1. Activity-Based Costing (ABC) improves cost accuracy by allocating overhead costs based on specific activities.

2. ABC identifies cost drivers, allowing businesses to track expenses more precisely for each product or service.

3. Helps organizations eliminate waste and improve efficiency by identifying non-value-added activities.

4. ABC aids in more accurate pricing decisions, leading to improved profitability and cost control.

If you are a business owner, you will know how challenging it is to find the “sweet spot” – a price tag that can attract customers while still making you a good amount of profit.

So, how do you determine the cost of each product?

Let’s say you are hosting a big party in your hometown and want to understand the cost per guest. Had you done it traditionally, you would have to take the total expenses (decorations, food, balloons, etc) and divide it by the number of people coming. But, this approach is missing out on a lot of things!

With Activity-based costing (ABC), you identify everything – such as going shopping and bringing all supplies, cooking different dishes, etc. Each of these “activities” comes with its own costs. How? Well, what about the cost associated with going to a store to make a purchase? Did you not spend money on public transport, maybe?

Similarly, you need to account for the indirect expenses that come along with the direct costs of manufacturing the products or offering services. These indirect costs can be utilities, employee salaries, and rent, among several others. Rather than just arbitrarily allocating overheads, activity based costing ABC method gives you a better understanding of what expenses are connected to each of your products.

But, how does it work? Tune in and read ahead to know more!

What is Activity-Based Costing System?

Activity-based costing (ABC) is a costing method that helps businesses assign overhead and indirect costs to their goods, services, or additional cost objects depending on the activities and resources needed to manufacture, market, sell, and deliver them.

In traditional systems, the overhead costs are typically assigned to products through very large-scale, arbitrary allocation methods.

This can include machine hours and direct labor costs, among others. But, several overhead costs, such as maintenance, quality control, and material management, are not necessarily fueled by labor or machine hours.

In this entire procedure, activity-based costing has a different take after all.

The first thing it does is recognize major activities going on in manufacturing a product or delivering a certain service. Now, when we say “activities”, it could mean absolutely anything, including the purchase of raw materials, machine equipment, assembly, testing, and packaging, etc.

After that, it allocates costs for each activity, depending on the resource it has consumed till now. For instance, ordering costs are allocated to ordering activity, and so on.

Following that, it starts estimating the activity cost drivers. These are factors through which the activity’s prices differ. In the final step, it starts allocating activity costs to goods or services, depending on how much activity they deplete using specific activity cost drivers. But, these are the basics. So, let’s have a closer glimpse at how it all works, in detail.

How Activity-based Costing (ABC) Works?

Activity-based costing (ABC) method is commonly seen to be used in the manufacturing industry. They mainly use it to enhance their accuracy of cost data. The primary part of it all boils down to the impressive results it brings. It leads to an almost precise cost figure and fuels better categorization of the costs taken up by a company during the manufacturing process.

This method can be seen on multiple occasions, nonetheless. Starting from target costing, setting service prices, and product costing to the analysis of product line profitability and customer profitability – this method is literally seen everywhere you lay eyes on.

Now, what’s the goal? It is to help businesses have a better grasp on their costs to set improved pricing strategies.

Coming back to the process and how all of it works, here’s a rundown you need to check out in no time:

- Recognize and track all activities necessary for the making of the product.

- Further, segregate these activities into cost pools. This involves all the costs related to a certain activity, such as manufacturing. Finally, evaluate the total overhead for every cost pool.

- Allocate cost drivers to all the cost pool activity as known. It can be anything from hours worked or the number of units processed.

- Jump on to division now. Find out the cost driver rate by dividing the total overhead present in every cost pool by the number of cost drivers.

- Now onto the trickier part. Start evaluating the total overhead per cost driver following a division of the total overhead of each cost pool by the total cost drivers.

- This is the final step. Here, you need to multiply the cost driver rate by the number of cost drivers in order to figure out the overhead and indirect costs associated with every activity.

As you can see, this method is more structured and goes down meticulously, keeping everything in mind. For the most part, it helps to assign costs appropriately on the basis of the actual activities that go to generate them.

What is Activity-based Costing Formula?

The formula of activity-based costing system is: Activity-based Costing = Cost Pool Total / Cost Driver

Among several costing methods you will see in the manufacturing and production sector, the one that is bound to cross your eyes is the activity-based costing system.

It can be calculated by allocating all the indirect costs that have been incurred to the tracked types of costs at large. But, you may have this one question in mind. What do the terms, cost pool total and cost driver, literally mean? Here’s a general breakdown of both:

- Cost pool total: In simple words, this term indicates the total costs gathered in a certain activity cost pool. Generally speaking, an activity cost pool is just a collection of indirect and overhead costs mainly associated with a particular activity in a business.

- Cost drivers: A cost driver is basically a factor that impacts or causes the costs in a certain activity cost pool to differ in nature. Some of the common names you have heard in this case include the number of units, machine hours, and labor hours, among others.

This entire concept can seem tricky to understand at first glance. That’s what makes an example even better in this case, to understand what this means from A to Z. So, without further ado, let’s look at an example of this topic of discussion.

Have questions regarding activity based costing

Consult our expert accountants!

Activity-based Costing Example

To understand this concept better, let’s consider that you have installed almost 4,000 machines that come with a total overhead of $10,000.

Therefore, we can say that,

→ Overhead = $10,000

→ Cost driver = 4,000

Now, we do have an idea about the formula.

Thus, Cost driver rate = cost pool overhead / cost driver

As you know, your cost driver rate = $10,000 / 4,000 = $2.50

It is also apparent that you have just assigned 250 of these machines to manufacture a new product, and you definitely need to evaluate the production costs to check if all that you are doing will be profitable or not.

Now, as you may know already,

→ Overhead costs for the new product = Activity cost drivers x cost driver rate

Replacing it with numbers, we get:

→ Overhead costs for the new product = 250 x $2.50 = $625

Hence, overhead costs for the new product = $625

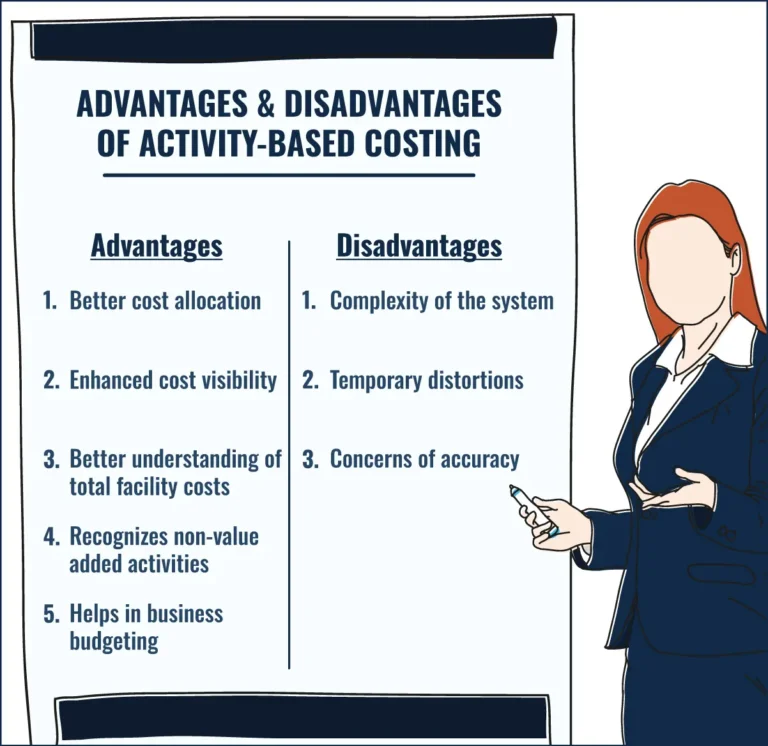

Advantages of Activity-based Costing

Activity-based costing does beat the traditional methodologies we have been following for quite some time. So, here are some advantages of activity based costing that you may want to know:

1. Better cost allocation

Activity-based costing (ABC) has been known for some time to offer a better, and more accurate process of allocating overhead and indirect costs to goods, services, along with other cost objects. In fact, it does trace costs to the activities which drive resource consumption. It is a better approach than using broad arbitrary allocation methods.

2. Enhanced cost visibility

ABC is best known to accentuate the cost drivers and particular activities which actually consume resources. This comprehensive and simple to visualize cost data helps managers big time by showcasing the real costs and profitability of the goods, services, processes, and customers.

3. Better understanding of total facility costs

Undeniably, businesses can get the full details of the overhead costs at their production facilities via an Activity-based costing system. How is this helpful? Well, when businesses are well equipped with this broad spectrum knowledge, they can easily compare production costs across several facilities. When businesses have this data right at their fingertips, it becomes far too easy to make wise decisions on strategies that could help the company save a solid chunk of money.

4. Recognizes non-value-added activities

ABC requires an activity analysis in order to identify activities that, in the eyes of the customer, do not add value. This is highly beneficial for any business at all. If you ask why, then the reason is plain and simple. It has enabled managers to concentrate on minimizing or strictly removing any and every non-value-added activity.

5. Helps in business budgeting

You can always create a more enhanced, power-packed budget and plan for your business when you have a clear understanding of your costs. In this case, with ABC, you can easily track where exactly your money is going and side-by-side get a clear picture of which products are most profitable. Not to mention, with ABC, it becomes 2X easier to compare costs of manufacturing products and determine whether they are producing adequate profit. This, in turn, can help you make necessary adjustments as and when required.

But, there’s no way a system so powerful comes without its own demerits. So, let’s have a closer look at the disadvantages you may have to face with this system.

Disadvantages of Activity-based Costing

As you know already, no powerful concept comes without its disadvantages. So, let’s look at some of the disadvantages of activity based costing:

1. Complexity of the system

The activity-based costing system, as many agree, is often felt to be more complex than traditional costing methods. With this system in hand, you cannot just be fulfilled with all the overhead costs together. Instead, you need to be as specific as possible.

Let’s say, for instance, you will have to know these data:

- How many staff hours are actually going into the drill to process the orders of each product?

- What part of the utility bills are generally used for specific activities?

That being said, if you want to implement this system – there is a lot of knowledge required by staff members who will have to gather, organize and manage this comprehensive data set. To top it off, your business also needs to develop an efficient and sustainable system in case you want it to be efficacious and steady. As you can see for yourself, the string of procedures involved in it can be a little over the budget of some businesses. Some small and medium enterprises (SMEs) often agree that setting up and maintaining ABC will not justify their Return on Investment (ROI).

2. Temporary distortions

In some cases, ABC cost allocations can potentially be distorted on certain occasions due to fluctuations in manufacturing volumes or changes in cost driver rate activities. Let’s consider an example to understand better. For instance, if the manufacturing volume abruptly declines on a significant level, the fixed costs assigned to all the units may dramatically increase (and vice versa). This can lead to overcosting or under-costing, as per the given scenario.

3. Concerns of accuracy

ABC is known to be detail-oriented, top-notch, and what not. That may be the case but it is not infallible. In reality, no costing method can actually give you a solid 100% accuracy at all times. In simple words, cost estimates are often known to be “educated guesses” instead of precise calculations, such as when assigning utility expenses to specific activities.

While not exactly a disadvantage, every system needs its system upgrades to keep up with the changing environment. Having said that, ABC is no different. It comes with its own upgrades and time-to-time update lists. On certain occasions, people may find the updates a little over their budget boundaries and may opt out.

Explore FREE Template of Activity-based Costing

Get access to a free template of activity-based costing and save yourself time making one from scratch.

Requirements for Activity-based Costing (ABC)

Activity-based costing (ABC), also often known by many as activity based accounting, is a cost accounting system that considers activities, at large, as the elemental cost objects.

Nevertheless, activities are basically “tasks” or “events” that come with certain goals, including but not limited to product design, machine setups, machine operations, and distribution. If you have read through this blog post, you will know that these activities always consume overhead resources.

In ABC, activities are often known to be cost drivers, also typically called activity drivers or allocation bases. As we have discussed right before, cost drivers are the factors that impact the activity’s cost, including maintenance requests, machine setups, purchase orders, and production orders, among others.

Just so you know, there are two types of activity measures:

- Transaction drivers (number of times an activity takes place)

- Duration drivers (time consumed to complete an activity)

This process is nothing similar to the traditional costing systems which use broad volume-based measures, such as direct labor, to assign overhead costs. Instead, it categorizes activities into five levels which are not bound within the production volume.

The levels that we are talking about, include:

- Batch-level activities

- Unit-level activities

- Customer-level activities

- Organization-sustaining activities

- Product-level activities

These are the five levels that make sure you get more accurate, comprehensive data every time.

Final Thoughts and Key Takeaways

If you run a business, you would always want to be in the light about where your money is spent. Traditional costing methods just don’t cut it anymore. They are incredibly broad and far too generalized to have a good grasp on where your money is going. The chance of missing any key piece only adds to the issue.

With ABC, people have less guesswork to worry about. Every dollar spent is rather clearly accounted for. Nonetheless, when you drill down the specific activities that drive costs, you get a transparent, comprehensive, and clear view of your operations. In fact, you can see for yourself the products, services, and customers that are actually profitable, following the overhead that has been accounted for. Not to mention, ABC is known to capture every little number – be it setup times, quality inspections, orders, or anything else.

Yes, it does take some time to implement. But, once done, there’s literally no looking back. Having that level of granular details can be life-changing as it gives you an overview of where to make adjustments.

But, if you still have any questions, you know who to consult. Get in touch with our accounting experts who have over 12 years of experience in this field – making them specialists with answers to all your questions. So, do not wait until tomorrow and book a consultation now.

Top FAQs on Activity-based Costing (ABC)

Ques. Why ABC costing is more accurate?

Ans. The reason why ABC costing is more accurate is because it allocates overhead depending on the activities that are responsible for driving the overhead costs.

Ques. What is an activity cost pool?

Ans. This is, in simple words, an aggregate of all the fixed and variable individual costs that are related to a business task. Some of its examples are purchase ordering, maintenance, machine set-up, and more.

Ques. What do you mean when you say “activities” in activity-based costing?

Ans. As the name suggests, “activities” are the things that you should do in order to manufacture or produce the product. It can be anything from a job, event, or just a set of work that comes with a particular objective and consumes resources.