7 ways to use AI in e-commerce

Ever wondered how your e-commerce business can also benefit from…

Experience

Happy Clients

Hours

Strong Team

Still deciding whether to sell your business or merge with another entity? Take monumental decisions like such with our Exit Strategy and M&A Support services.

Perfected to guide you through the tiresome process of merging and acquisitions, our team handles processes with expertise, ensuring you achieve the best possible outcomes!

Get access to comprehensive, customized latest mergers and acquisitions support that adds significant value at every step.

Well evaluated and executed strategies to help businesses plan their M&A goals

Well evaluated and executed strategies to help businesses plan their M&A goals

Our team comprises seasoned professionals with extensive experience in exit planning and M&A transactions. We bring deep industry knowledge and strategic insight to every engagement.

We understand that every business is unique. Our solutions are tailored to meet your specific needs and goals.

We handle all transactions with the utmost confidentiality, ensuring your business interests are protected throughout the process.

Our focus is on delivering results that enhance your business value and facilitate a smooth exit or merger process. We aim to maximize your ROI and ensure your long-term success.

Book a free 30-minute consultation with Gary Jain, Co-founder of Ledger Labs — a seasoned accountant with 12+ years of experience helping small and mid-sized US businesses boost growth, streamline finances, and plan for the future.

Always Included:

Never Included:

Fill out the form and we’ll send you a link to schedule your free session.

An exit strategy is a plan for a business owner to sell their company or shares, aiming to maximize value and ensure a smooth transition. It involves identifying potential buyers, preparing the business for sale, and strategizing the timing and terms of the exit.

A precise business valuation provides a solid foundation for negotiations, ensuring you get a fair price for your business. It helps you understand your company's worth and justifies the asking price to potential buyers.

We assess the cultural fit between merging entities by evaluating management styles, corporate values, and employee engagement practices. This helps ensure a smooth integration and long-term success post-merger.

Early planning helps set strategic business goals, maximize ROI, make the business attractive to investors, and ensure a smooth transition during ownership changes. It also allows time to address any potential issues that could affect the sale.

The duration of the M&A process can vary depending on the complexity of the transaction, the readiness of the business for sale, and market conditions. On average, it can take several months to over a year from initial planning to closing the deal.

Find out what our customers are saying about our products.

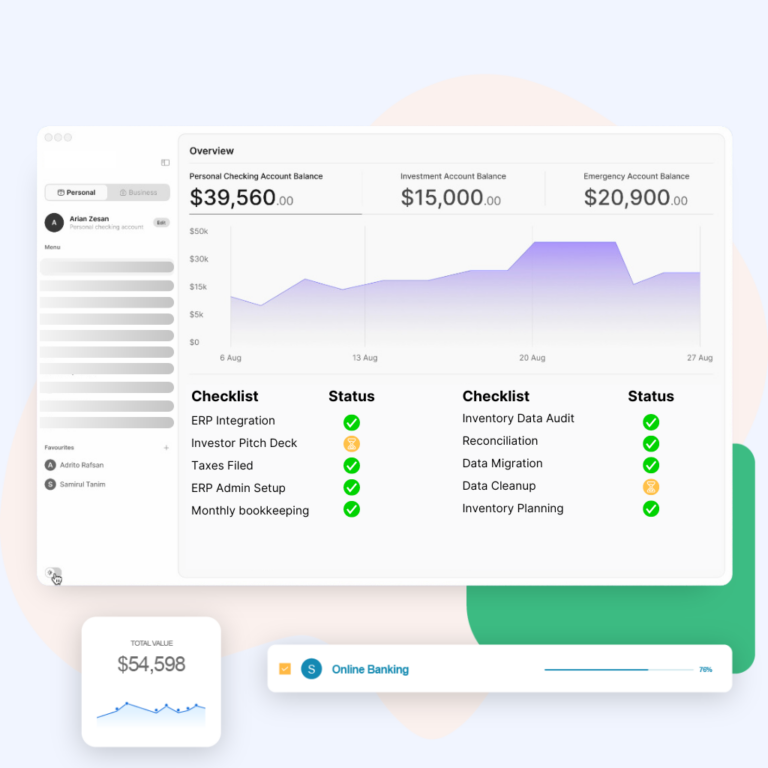

Since working with Ledger labs, our bookkeeping and Controller processes have been streamlined. The routine accounting tasks are managed on a predictable schedule, and checklists are used to ensure that all required documents are processed within the proper deadlines. We have improved the accuracy and timeliness of our financial statements and other crucial

Patrik Nichols CFOWe have a unique business, and almost all the accounting firms we have engaged so far have been unable to get a hold of our business. But Ledger Labs really took the bull by its horn. They understood our business better than us & created a very customized process & systems to streamline our accounting department. We now have detailed step-by-step process documentation, checklists & schedule of reports.

Amanda Fludd CEOLedger Labs found $18K in missed deductions that our old accountant completely missed—same books, same receipts, totally different results. That’s when I knew we were finally working with pros. Since then, they’ve helped us restructure expenses and make tax planning part of the daily flow, not just something we scramble on last minute.

Michael Smith CFOGary—yes, the founder—took the time to really understand our business and where we were struggling. Within a few weeks, our books were clean, our cash flow was clear, and we were spending way less time managing it all. You can tell he genuinely cares, and that energy runs through the whole team

Nicole Allen Founder & CEOOur years of experience and exposure to various businesses are summarized in these articles!

Ever wondered how your e-commerce business can also benefit from…

If you run an e-commerce business, you need tools for…

AI allows businesses to analyze customer’s browsing and purchasing behavior…

From saving thousands to scaling fast — these stories highlight how we help businesses grow smarter with real financial strategy and execution.

Helping busy founders and busy owners streamline their accounting & bookkeeping with services designed from and for the perspective of business owners.

We publish fresh and power-packed insights every week on multiple platforms. Subscribe to our newsletter and get latest updates!

Copyright © 2025 Ledger Labs, Inc. | Powered by Ledger Labs, Inc.

| Thank you for Signing Up |

My main problem always has been to know my accurate profits & this is precisely what Ledger Labs helped me with. They went through my entire supply chain costs, my monthly operational expenses, and COGS and got me the correct costing of my goods and the cost of running the business. Now I know how much I need to sell & at what price I should sell it to be profitable.

Ariel Robinson CEO & Founder