- CA : 1001 Wilshire Blvd, Los Angeles, CA 90017

- NY: 1178 Broadway, 3rd Floor #3067, New York, NY 10001

Whether you’re managing properties, closing deals, or overseeing development projects, your accounting shouldn’t be falling behind.

That’s why we manage your rent roll tracking, construction cost accounting, and other parts of your real estate business. We’re professional real estate accountants who will help you scale your portfolio without financial blind spots.

Happy Clients

Years in industry

Strong team

We help you understand what drives your cashflow fluctuations, how you can control & Whats the future looks like with that cashflow.

Get a correct understanding of various costs underlying the project and the associated revenue with timelines.

Get Deductions & Tax compliant bookkeeping with various fed & complex state laws across the united states.

Never miss the deadlines to collect rent & providing the owners with the breakup of revenues and expenses.

Understand various costs associated with property related transactions and optimize your profit with indepth profitability calculations.

Have the peace of mind with business finances being managed by a team of seasoned real estate accountants.

We’ve helped real estate agents clean up a wide range of accounting issues that were costing them time, money, and missed opportunities. This means that we have solved instances of inconsistent commission tracking, unrecorded expenses, and a lack of separation between personal and business finances.

Over the course of our services for businesses, we’ve fixed disorganized books, corrected tax misclassifications, and created clean income reports that agents can actually rely on during tax season or loan applications. Many real estate agents struggle with cash flow visibility, especially when income is irregular — we’ve built systems to forecast earnings, track deductions, and simplify quarterly tax planning. Whether it’s reconciling brokerage payouts, structuring LLC finances, or organizing books for scaling into a team, we make sure the financial side of the business runs as smoothly as the deals.

We begin by thoroughly assessing your financial records, identifying inefficiencies, and pinpointing areas for cost optimization. This allows us to recognize the areas of improvement and help you put together a robust accounting strategy. We dig into your books to find what’s missing, broken, or holding you back. Then, we lay out exactly what needs fixing - so you’re no longer guessing and finally have a clear path to clean, accurate finances.

As soon as we finalize a comprehensive plan of action for your books, the next step is to deploy this plan. We do this by ensuring we have proper internal and external control of data. Internally, we ensure that financial records are organized, reconciled, and regularly monitored. Externally, we implement secure data-sharing protocols and compliance measures to safeguard financial information.

Accounting is an evolving process, and we continuously refine financial strategies to enhance profitability. We ensure full compliance with tax regulations, conduct regular audits, and provide proactive recommendations to keep your business on the right track. And one of the best ways for us to do this is by building custom apps and workflows for your business - all powered by AI.

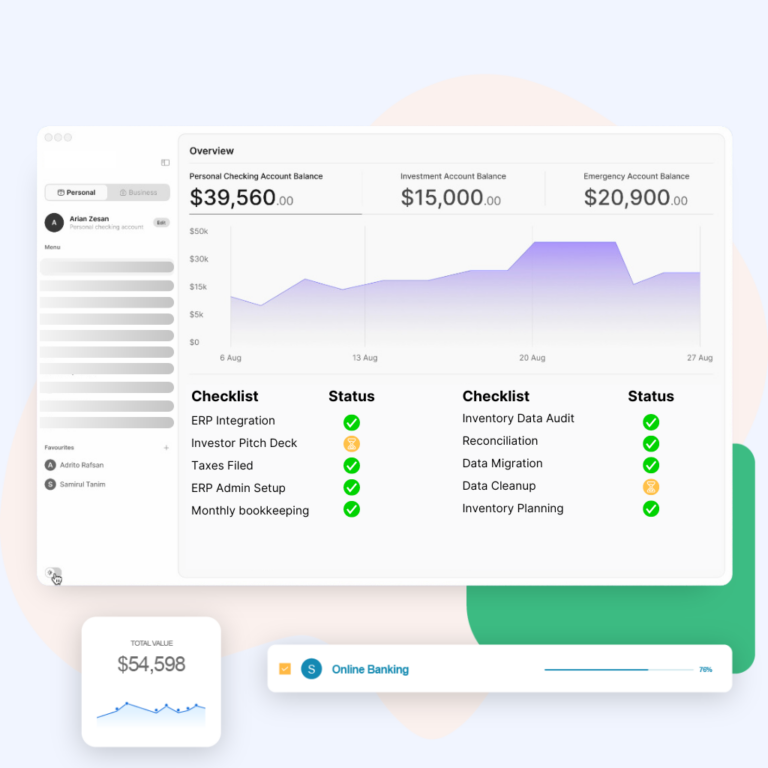

Our system provides up-to-date financial reports, allowing you to track performance, monitor key metrics, and make data-driven decisions. With detailed reports and regular insights, you gain complete control over your business finances and witness the financial health of your company improve. Our reporting system helps you identify trends, address potential issues proactively, and optimize cash flow management.

H iring an outsourced real estate accounting firm like Ledger Labs gives you more than clean books — it gives you control, clarity, and confidence in how your money moves. We handle the accounting complexities that come with commissions, property income, development costs, and tax exposure, so you can focus on growing your portfolio or closing more deals.

Our systems are built around the way real estate actually works — irregular income, multiple entities, deductible expenses, and long deal cycles. You get real-time reporting, cash flow visibility, and proactive tax planning without the overhead of hiring in-house. Whether you’re a solo agent, investor, or managing multiple properties, we build accounting frameworks that help you scale faster, avoid financial mistakes, and stay ready for whatever comes next.

We automate and organize your commission income across deals, brokerages, and agents — ensuring every dollar is tracked, reported, and allocated properly. No more chasing down missing payouts or second-guessing your books at tax time. We bring clarity to irregular income so you can focus on closing, not untangling spreadsheets.

We know how real estate professionals earn, spend, and get taxed — and we build systems that capture every deduction you're entitled to. From mileage and marketing to depreciation and pass-through income structures, our tax planning is built to reduce your liability without risking compliance.

Whether you're a solo agent, building a team, or managing multiple rental entities, our accounting systems grow with you. We set up clean reporting, cash flow forecasting, and entity separation from day one — so you’re always prepared to expand, raise capital, or file clean taxes, no matter how fast things move.

You can hustle deals all day, but if your accounting is messy, money slips through the cracks. In real estate, small errors compound — missed deductions, misclassified expenses, late filings, or bad cash flow planning. That’s not just bookkeeping noise. That’s lost profit.

So, when should you stop winging it and bring in a real accountant?

The answer: before your numbers start holding you back.

Outsourcing an accountant isn’t about offloading admin work — it’s about tightening financial control so you can make smarter moves. Here’s when it’s not just helpful — it’s necessary.

Real estate income rarely arrives on a neat monthly schedule. Commissions hit late. Rentals fluctuate. Flips take time. If your tax filings are based on rough estimates and last-minute number crunching, it’s a sign your finances aren’t being managed — they’re being guessed.

Whether you’re managing rentals, closing commissions, or structuring investment partnerships, complexity stacks fast. One LLC becomes three. One property becomes five. One flip becomes a pipeline. That’s when spreadsheets break and DIY accounting turns into a liability.

An outsourced real estate accountant can help you:

If your current system can’t handle escrow tracking, deal-specific income, or rental-level reporting, it’s time to upgrade. But software alone won’t save you. You need someone who can structure it properly, integrate it with your workflow, and keep it running clean.

A good outsourced accountant doesn’t just “know the software.” They know how to make it work for your business model.

If you’re losing hours each week to cleaning up receipts, organizing invoices, or figuring out why your cash flow report makes no sense — you’re doing the wrong job. Founders, agents, and investors should be focused on growth, not cleaning books.

If yes to any of those — it’s time.

Outsourcing your accounting isn’t about size — it’s about urgency, risk, and growth. If your financials are holding you back from scaling, slowing down deals, or creating confusion instead of clarity, it’s time to bring in help.

Real estate agents don’t need bloated ERP systems — but they do need software that tracks income, expenses, and taxes without chaos. The right tools save time, keep books audit-ready, and make tax season painless.

Look for software that offers:

Top options include:

Ledger Labs understands how real estate really works — inconsistent income, complex deals, multiple entities, and constant movement.

We don’t just manage books; we build accounting systems that track commissions, rental income, construction costs, and tax exposure in real time.

Despite your role in the world of real estate, we give you clean financials, smart forecasting, and full clarity on cash flow and profitability. Our reporting isn’t built for spreadsheets — it’s built for decisions.

With Ledger Labs, your numbers stay sharp, your risks stay low, and your business stays ready to scale without financial blind spots slowing you down.

| Feature | Ledger Labs' Real Estate Accounting Services | Other Services |

|---|---|---|

| Property-Level Financial Reporting | Detailed income and expense tracking by property, project, or portfolio | Generalized reporting with no asset-level performance insight |

| Commission and Deal Income Tracking | Clean tracking of variable commissions, split payments, and referral income | Manual spreadsheets with inconsistent records across brokerages or deals |

| Lease and Rent Roll Management | Accurate tracking of lease terms, rent schedules, and receivables across tenants | Disconnected rent records leading to missed payments or invoicing gaps |

| Construction and Development Cost Accounting | Budgeting and tracking costs for new builds, renovations, or phased projects | Unstructured cost records and overages with no visibility into overruns |

| Cash Flow Forecasting by Property or Deal | Cash flow models tied to payment schedules, loan service, and occupancy timelines | Generic cash flow tools with no real estate-specific forecasting logic |

| Real Estate-Specific Tax Planning | Built-in strategies for depreciation, 1031 exchanges, and passive income structuring | Standard tax prep with no optimization for real estate holding entities |

| Multi-Entity & Partnership Accounting | Clean separation of income, expenses, and equity across LLCs, JV deals, and syndicates | Blended records and unclear ownership tracking across multiple entities |

| Ongoing Strategic Financial Guidance | Support with scaling, capital planning, and exit preparation for portfolios | Limited to basic compliance with no long-term financial insight |

Find out what our customers are saying about our products.

Since working with Ledger labs, our bookkeeping and Controller processes have been streamlined. The routine accounting tasks are managed on a predictable schedule, and checklists are used to ensure that all required documents are processed within the proper deadlines. We have improved the accuracy and timeliness of our financial statements and other crucial

Patrik Nichols CFOWe have a unique business, and almost all the accounting firms we have engaged so far have been unable to get a hold of our business. But Ledger Labs really took the bull by its horn. They understood our business better than us & created a very customized process & systems to streamline our accounting department. We now have detailed step-by-step process documentation, checklists & schedule of reports.

Amanda Fludd CEOLedger Labs found $18K in missed deductions that our old accountant completely missed—same books, same receipts, totally different results. That’s when I knew we were finally working with pros. Since then, they’ve helped us restructure expenses and make tax planning part of the daily flow, not just something we scramble on last minute.

Michael Smith CFOGary—yes, the founder—took the time to really understand our business and where we were struggling. Within a few weeks, our books were clean, our cash flow was clear, and we were spending way less time managing it all. You can tell he genuinely cares, and that energy runs through the whole team

Nicole Allen Founder & CEOOur multidimensional experience and wide exposure have been channelized beautifully in these articles!

Selecting an Odoo implementation partner is more than a tech…

Odoo migration is not about software. It is about control.…

Freelancers can set up Odoo, but when your business grows,…

From saving thousands to scaling fast — these stories highlight how we help businesses grow smarter with real financial strategy and execution.

Helping busy founders and busy owners streamline their accounting & bookkeeping with services designed from and for the perspective of business owners.

We publish fresh and power-packed insights every week on multiple platforms. Subscribe to our newsletter and get latest updates!

Copyright © 2025 Ledger Labs, Inc. | Powered by Ledger Labs, Inc.

| Thank you for Signing Up |

My main problem always has been to know my accurate profits & this is precisely what Ledger Labs helped me with. They went through my entire supply chain costs, my monthly operational expenses, and COGS and got me the correct costing of my goods and the cost of running the business. Now I know how much I need to sell & at what price I should sell it to be profitable.

Ariel Robinson CEO & Founder