The impact and contribution of regular bookkeeping is indisputable as it allows you to stay within a predetermined budget and achieve targeted financial goals.

Bookkeeping helps you budget your finances more efficiently as opposed to taking a chunk of your revenue and time.

When running a business, you need as much financial insight as possible for informed decision-making, like knowing how much money you can invest in a project and whether or not you have the resources to hire and retain a new employee.

And that is where the role of bookkeeping gets highlighted the most.

Here’s a detailed guide on bookkeeping on a budget.

- 60% of business owners take on their accounting and bookkeeping responsibilities.

- 21% of business owners don’t know enough about bookkeeping.

- Tracking your financial transactions and preparing personalized reports is part of bookkeeping.

- Bookkeeping helps you budget and make informed financial decisions.

Bookkeeping for small businesses and important statistics you should know

Bookkeeping is one of the most important aspects of running a business and a challenge every small business owner experiences.

It is considered a challenge as it consumes hours from your day that can be spent strategizing and running core business operations.

Some of the responsibilities of a bookkeeper include:

- Tracking and recording financial transactions

- Preparing financial statements

- Accurate data entry and bank reconciliation

- Handling account payables and receivables

While it is recommended that you do your bookkeeping in the initial stages of your business to keep your business cost as minimal as possible, there comes a point where delegation becomes essential.

This is the pivotal shift where you must prioritize your time and decide where to put your energy the most.

Do you want to spend most of your time tracking every financial transaction and manually monitoring the cash flow or do you want to evaluate all financial data and derive decisions based on it?

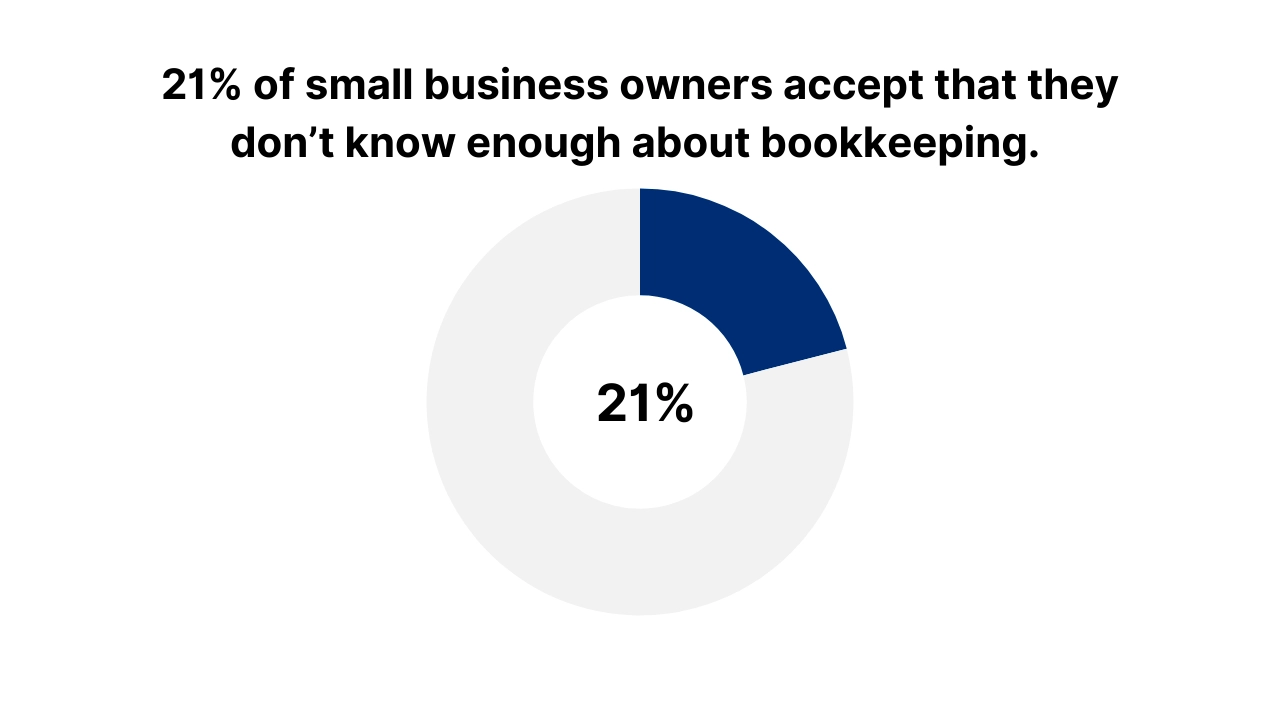

Let’s look at some important numbers to put things into perspective.

- 21% of small business owners accept that they don’t know enough about bookkeeping.

- 60% of business owners take on the bookkeeping responsibilities. While this hands-on approach is great, it can easily be outsourced or automated with bookkeeping software.

- 75% of accounting operations can be automated with the incorporation of software. It makes financial management more efficient and less prone to errors.

- 72% of accounting and bookkeeping practices report an increase in revenue, a necessary growth to sustain your business in a competitive market.

Bookkeeping: Basic vs. advanced bookkeeping

There is both basic and advanced bookkeeping that a business owner should know about.

Let’s explore the basic responsibilities of a bookkeeper first.

1. Record and categorize financial transactions

The bookkeeper records all financial transactions on time.

All cash inflows and outflows are recorded accurately and as per the latest accounting principles.

Record-keeping is essential in maintaining the financial health of your business.

2. Bank reconciliation and accuracy

Bookkeepers maintain your bank account, ensuring financial accuracy.

Should there be any inconsistencies, they rectify by correcting the mismanagement of financial records.

3. Produce financial statements

Bookkeepers are responsible for preparing financial statements, like income statements, balance sheets, and even cash flow statements.

It helps with decision-making and improving the financial health of your business.

In the initial stages of a business, basic bookkeeping is all that is required. However, as you scale and grow, the complexity of bookkeeping tasks increases.

For example, the following tasks get added to your financial management regime.

- Tracking account payables and receivables

- Monitoring financial records and their real-time updates

- Budget preparation

- Financial reporting and analytics

- Tax Preparation

- Automation through accounting software

5 reasons why your business needs bookkeeping services RIGHT NOW

You will start maintaining your books regularly once you understand their importance.

Here are 5 reasons your business requires bookkeeping services.

1. Budgeting becomes simpler

A lot of people think that bookkeeping means financial recording. But it’s much more than that.

Regular bookkeeping helps you create and stay within your budget, improving your costs and financial planning.

You know how much money you make, what your expenses are, and how much you are saving.

Now here’s what you need to know about budgeting.

A budget will serve as a roadmap for financial planning.

If you follow it effectively, you can identify areas for growth and make profitable decisions, something impossible should you base your decisions on guesswork.

Staying informed makes budgeting simpler, quicker, and more efficient.

2. It organizes your financial records

You are more likely to make mistakes when you handle your own bookkeeping.

As a business owner, you have a lot on your plate.

You are leading the strategic decisions, managing core business activities, looking into legal matters, and basically building an empire.

While it is not that complicated, bookkeeping is time-consuming, demanding every bit of your attention.

Thus, errors are bound to happen if you do it while distracted.

Now, one way to get a grip over your books is to keep them organized and that is only possible if you regularly bookkeep.

Honestly, if there’s one way to do bookkeeping correctly it is by not leaving it till the last minute.

3. It helps you effectively track your financial performance

You need accurate numbers to grow your business, making the role of bookkeeping mandatory.

It is almost impossible to analyze the financial health of your business or identify growth opportunities without accurate financial data.

To have the right information, you must regularly track your transactions and financial performance.

4. Your finances become more streamlined

Imagine the stress that comes with poor financial management.

You wouldn’t know how much you make nor would you have any idea about your expenses.

Lack of knowledge about your financial situation leads to major financial problems and even trouble with the IRS.

On the contrary, when your books are maintained regularly and your financial records are tidy, you sleep peacefully at night.

5. It helps with informed decision-making

I just mentioned how a lack of financial knowledge only adds to your stress.

Now here’s another way to look at it.

When you don’t know anything about your financial situation, like the money you make or the money you spend how are you going to make decisions?

By managing your books regularly, you have all the answers you need and a clear picture of your financial health to make decisions.

DIY vs outsourced vs in-house bookkeeping services

There are three different ways to do your bookkeeping. While the purpose of bookkeeping is the same, the cost of each method varies.

Here’s what you can expect from the three types of bookkeeping.

3 practical tips for bookkeeping on a budget

Bookkeeping is an important part of running a business. To ensure it remains affordable, here are 3 tips to follow:

1. Outsource to a bookkeeping service that understands your core business needs

Every business has a purpose which evolves with time.

In the early stages, you seek visibility and earn customers. But as you progress through, you want to implement ways to expand your business.

Hire a bookkeeping service that is on board with whatever vision you have for your business.

Are you only focused on hiring a service that understands only your current needs or do you want a service flexible enough to grow with your expanding needs?

Make sure you lay out your plans and goals for the future.

One way to see if they deem fit is to analyze the software and tools they use for bookkeeping.

Automation is necessary to increase productivity, create efficiencies, and improve overall workflow.

Having access to advanced tools will only support your business as the volume of data increases.

2. Choose a remote working model

I previously mentioned how hiring an in-house and full-time bookkeeper may be more costly than outsourcing.

Thus, make sure you save every penny you can without compromising your bookkeeping requirements.

Outsourcing your bookkeeping has become seamless with the integration of communication apps like Zoom and Google Meet.

The one advice that I would give you is to set your expectations and communication requirements straight from the get-go.

As for data management and accessibility, you can leverage NetSuite implementations.

Third-party integrations give you access to accurate and updated data.

3. Find out which accounting software they use

It is important to know what their thoughts are on accounting software.

When you outsource your bookkeeping to a dedicated resource, you must check in with them on the software they use to automate your financial transactions.

QuickBooks Online is the most popular accounting software that is also compatible and affordable. For agriculture-based businesses or small farms, using farm accounting software can provide more tailored insights into cash flow, inventory, and seasonal expenses.

But be mindful of the fact that there are other, more expensive, options available. And you want to ensure that your bookkeeping service is using the most affordable one.

The bottom line

Bookkeeping is the brickstone upon which your financial management is laid.

While it is time-consuming and demands attention to detail, its results are rewarding.

It is not feasible to outsource your bookkeeping during the early stages of your business but it becomes crucial once the wheels start moving.

Make sure you outsource your bookkeeping to a service provider that understands your core business needs.

It should ideally be remote and accustomed to using accounting software that is advanced but affordable.

This is where Ledger Labs can help you the most.

We have 12+ years of experience in the field, helping businesses with their bookkeeping, accounting, and tax management.

Having access to the latest tools and information on accounting principles, we ensure efficient management of your financial transactions.

So book a consultation appointment today to discuss this further!