- CA : 1001 Wilshire Blvd, Los Angeles, CA 90017

- NY: 1178 Broadway, 3rd Floor #3067, New York, NY 10001

- CA : 1001 Wilshire Blvd, Los Angeles, CA 90017

- NY: 1178 Broadway, 3rd Floor #3067, New York, NY 10001

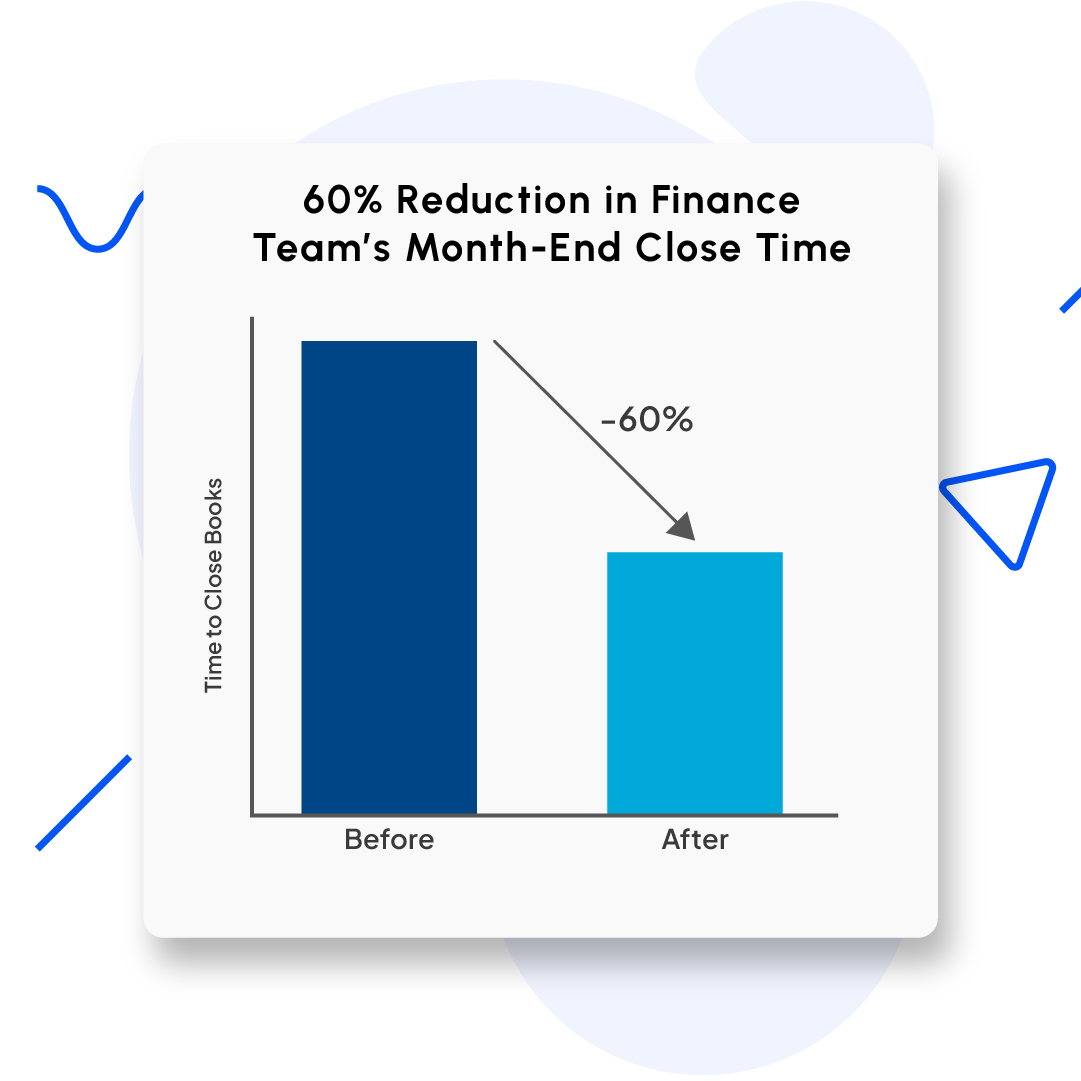

An engineering product sales company struggled with inefficiencies in order processing and inventory management. By implementing automation tools integrated with their existing ERP system, we streamlined repetitive tasks, reduced manual errors, and improved real-time data visibility. This transformation led to a 40% faster order fulfillment rate, improved customer satisfaction, and freed up staff to focus on high-value activities, driving scalable and efficient growth.

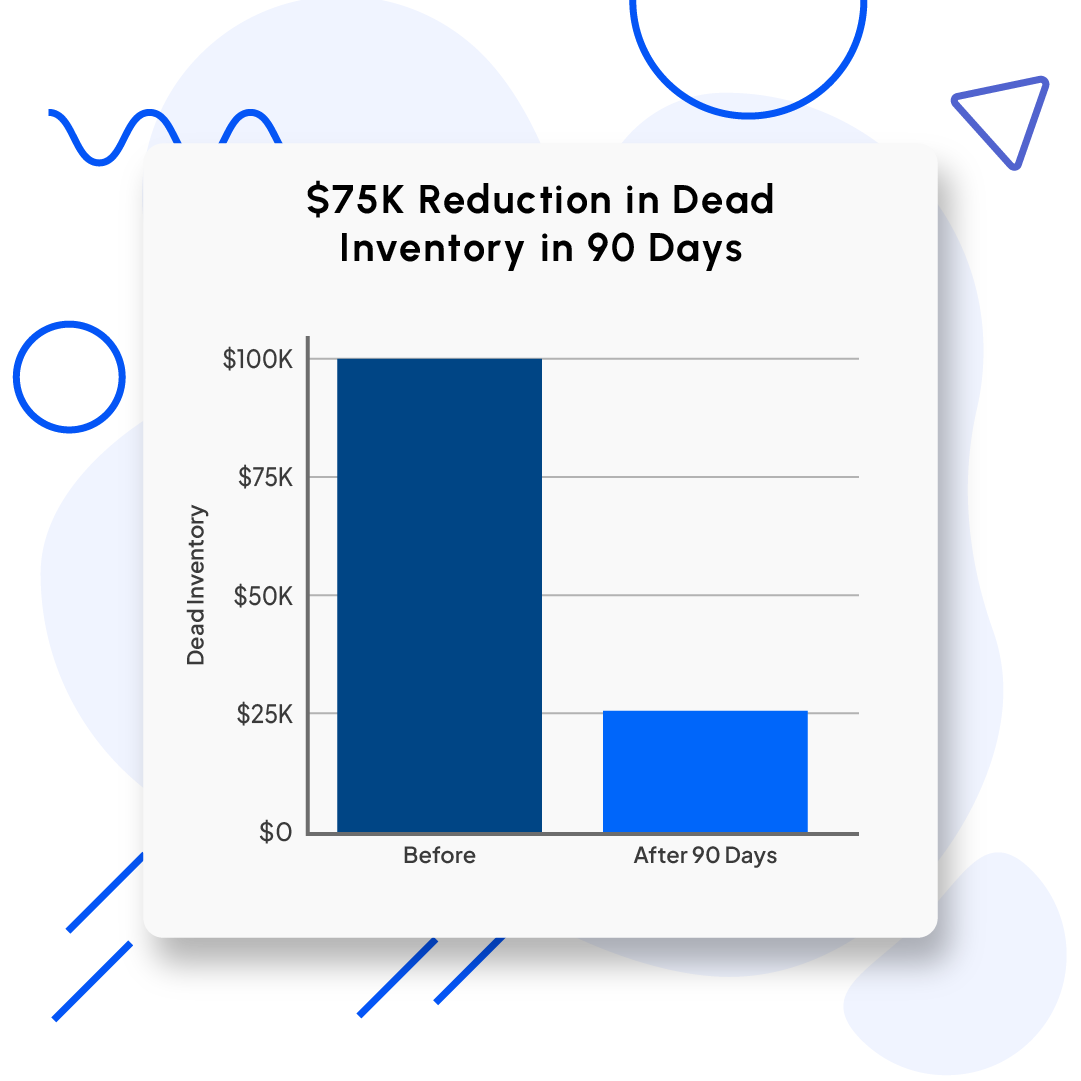

Always cash-strapped before big inventory purchases, despite good sales.

Thanks to their strategic guidance, we achieved sustainable growth by balancing selective hiring with cost-saving outsourcing, ensuring financial stability while maintaining our competitive edge in the global market.

Brad Taylor

Founder

The restructuring and outsourcing strategy bore immediate and tangible benefits

| Thank you for Signing Up |