- CA : 1001 Wilshire Blvd, Los Angeles, CA 90017

- NY: 1178 Broadway, 3rd Floor #3067, New York, NY 10001

- CA : 1001 Wilshire Blvd, Los Angeles, CA 90017

- NY: 1178 Broadway, 3rd Floor #3067, New York, NY 10001

Margins were thin (~20%), and previous finance team advised raising prices. That dropped conversion and worsened cash flow.

Your team's expertise in strategic cost reduction transformed our financial performance, increasing our net profit margin. These changes have significantly enhanced our financial stability and long-term growth prospects.

Hannah Brown

CEO

The restructuring and outsourcing strategy bore immediate and tangible benefits

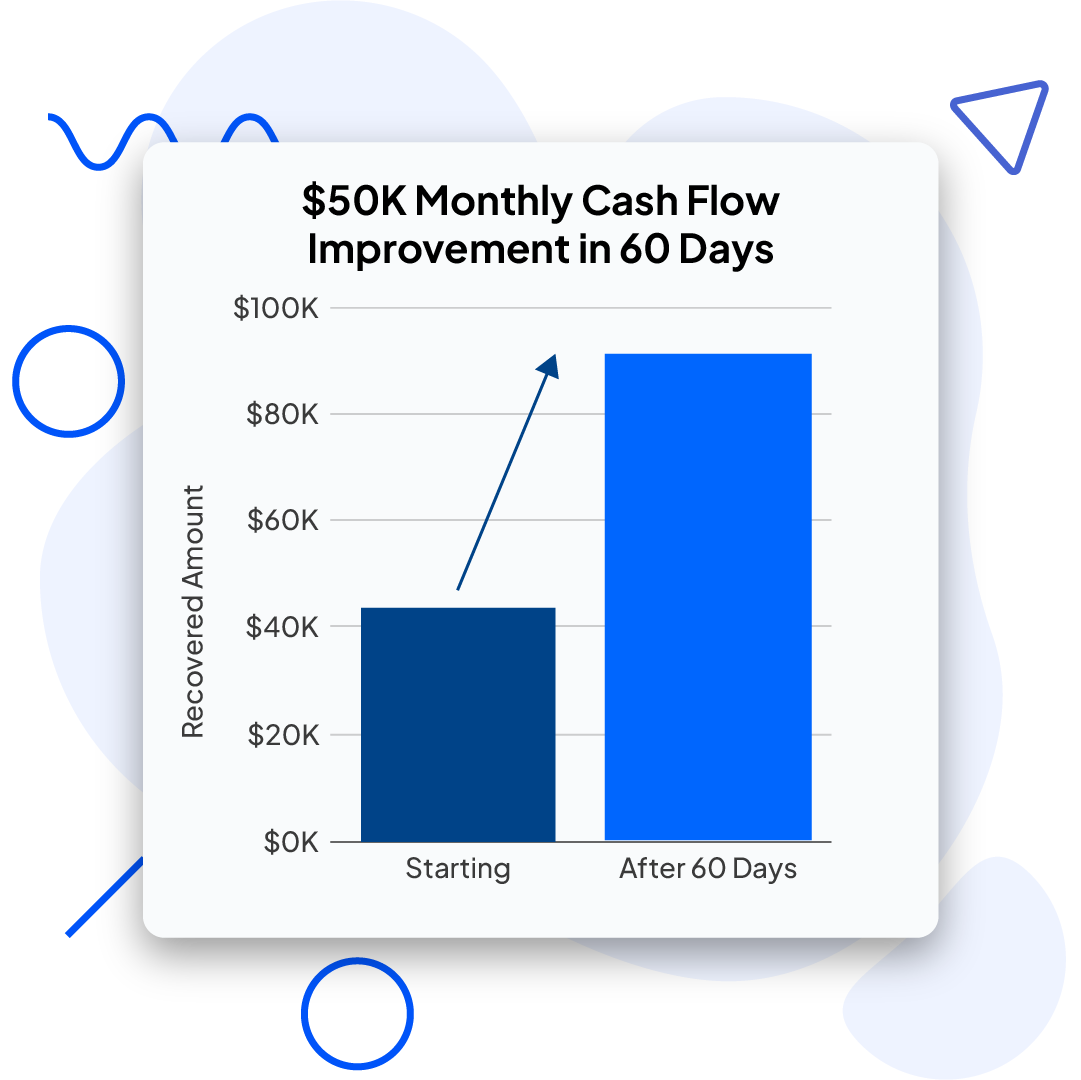

By shifting the focus from raising prices to improving inventory turnover, the business unlocked cash that had been stuck in unsold inventory. Automated reordering triggers ensured stock levels aligned with real-time sales data, reducing both overstock and stockouts. This optimization allowed the company to convert inventory into revenue more quickly, drastically improving liquidity. Within just two months, the freed-up working capital translated into a $50,000 boost in monthly cash flow—without increasing prices or cutting core expenses.

The implementation of ROAS (Return on Ad Spend) dashboards gave the marketing team clarity on which SKUs delivered the best bang for the buck. By redirecting ad budgets toward fast-moving, high-margin products, they achieved better conversions with less spend. This laser-focus on profitable SKUs eliminated wasteful ad spending on low-yield items. As a result, ROAS improved by 21%, indicating a significant gain in advertising efficiency and a more profitable customer acquisition process.

An SKU-level profitability analysis revealed that a few products were consistently underperforming and consuming valuable operational resources. After a careful review, the brand decided to discontinue three SKUs that were dragging down margins. This move not only eliminated the cost of storing and marketing unprofitable items but also freed up capacity for better-performing products. The decision delivered immediate financial relief—recovering approximately $18,000 annually in costs that would have otherwise gone unnoticed.

Previously, the team relied on delayed and disjointed reporting, which often led to poor inventory and pricing decisions. With the rollout of live dashboards tracking key performance indicators (KPIs) like sales velocity, ad performance, and inventory turnover, strategic decisions could now be made weekly instead of monthly or ad hoc. This shift to real-time, data-driven decision-making improved agility, allowed for faster response to market trends, and contributed directly to enhanced profitability.

| Thank you for Signing Up |