Payroll should be boring.

That’s not a joke.

If your payroll system is exciting and involves a lot of irregular activity, it probably means something’s broken. It probably means that calculations are off, compliance is being missed, or employees are waiting for their paychecks. For finance and HR teams, reliability is the highest standard.

And yet, most payroll workflows are patched together. One tool handles timesheets. Another does tax filing. Data is passed around manually.

And in such cases, errors creep in silently. By the time someone catches it, you’re already dealing with fines or frustrated staff.

That’s where Odoo Payroll automation becomes a powerful solution, but only if you configure the right features.

This guide walks through 8 must-have capabilities inside (or adjacent to) the Odoo Payroll app.

Let’s break them down.

- Salary rules must support variable pay, allowances, and deductions.

- Tax automation is essential for U.S. compliance and audit defense.

- Time tracking must connect directly to payslips.

- Journal entries should post cleanly to the general ledger.

- PTO, contracts, and self-service reduce HR workload long term.

1. Real-Time Salary Structure Rules

Payroll isn’t one-size-fits-all, especially in companies with multiple departments, roles, or jurisdictions.

You need flexible logic that adjusts to role-based allowances, overtime rules, and benefits without requiring a developer every time something changes.

Odoo’s salary structure engine lets you:

- Define role-specific pay rules (e.g., hourly, salaried, commission-based)

- Layer in allowances (HRA, travel, phone, etc.)

- Automate deductions (tax, social security, benefits contributions)

- Create conditional logic (e.g., extra pay if over X hours, or if a performance bonus is triggered)

Other payroll platforms like Gusto and ADP Workforce Now also offer layered pay rules, but Odoo’s open model gives you the ability to extend or modify them across roles and countries, especially valuable for businesses with international or hybrid workforces.

The real power comes from the fact that Odoo’s salary structures connect directly with contracts and attendance.

When an employee clocks in extra hours or reaches a bonus threshold, their payslip reflects it automatically.

2. Automated Tax and Compliance Calculations

Getting paid the wrong amount is bad. But getting tax wrong is worse.

You’re not just facing upset employees, you’re inviting IRS penalties, audits, and legal risks.

Odoo Payroll supports U.S.-specific tax structures when paired with localization modules or third-party connectors (e.g., for Form W‑2s, 1099s, and state-level deductions). While the out-of-the-box configuration is limited, its real advantage lies in its customization for multi-state compliance or companies using external tax engines.

Compare that with platforms like Rippling, which automatically calculates local, state, and federal taxes and files them on your behalf.

Rippling even updates rates in real-time. Odoo can’t do that natively, but when configured correctly with APIs or tax modules (e.g., Avalara integration), it can be brought up to that level.

The bottom line: your Odoo Payroll setup must include:

- Tax rate tables updated monthly or dynamically

- Jurisdiction-specific deduction mappings

- Clear audit trails for every payslip and adjustment

- Auto-generation of statutory documents (W-2, W-9, 1099, etc.)

Without this, you’re not running payroll, you’re gambling with compliance.

3. Integrated Time Tracking and Overtime Calculation

If you’re running hourly teams or mixed contracts, accurate time capture is non-negotiable. Every missed hour or untracked shift turns into payroll disputes—or worse, unpaid labor violations.

Odoo allows seamless integration with its Timesheets and Attendance modules, giving you:

- Clock-in/out logs tied directly to employee IDs

- Project-based time tracking (for cost attribution)

- Overtime flagging once thresholds are passed

- Workflow rules for supervisor approval or auto-pay triggers

Let’s say an employee logs 52 hours in a week. Odoo’s rule engine can automatically calculate overtime pay (e.g., 1.5x rate after 40 hours) and add that to the payslip, no spreadsheet needed.

This functionality mirrors tools like QuickBooks Time (formerly TSheets) or Deputy, both known for precise scheduling and wage rule enforcement. The key difference? With Odoo, it all stays within one ecosystem—fewer integrations, fewer data mismatches.

4. Payslip Batches with Mass Processing

When you’ve got a growing headcount, payslips by hand won’t cut it. You need batch processing that is fast, accurate, and traceable.

Odoo Payroll gives you the ability to:

- Generate multiple payslips in one click (by department, team, or contract type)

- Apply batch-specific adjustments (e.g., bonuses, deductions)

- Validate and post entries to the accounting ledger directly

- Export or email payslips to employees automatically

Platforms like Paychex and Zoho Payroll also support mass runs, but what makes Odoo powerful is its link to accounting.

As soon as you finalize payroll, all journal entries are auto-posted, mapped by cost center, department, or job role. That reduces manual entry and makes reconciliation tighter.

You also get full visibility on who’s been paid, when, and how—critical for finance leaders managing cash flow and liability reporting.

5. Contract Management and Lifecycle Tracking

This is where most payroll systems fall short; they focus only on pay, not on why someone is paid what they’re paid.

Odoo tracks employee contracts as part of the HR module. That means:

- Start/end dates, probation windows, and renewals

- Contract types (permanent, fixed-term, freelance)

- Salary structure linkage (each contract defines its own rules)

- Historic changes (for audit trails and retroactive adjustments)

So when someone changes roles, locations, or pay scale, the system captures the change at the contract level, not just the payslip. This protects both HR and finance from backdated confusion.

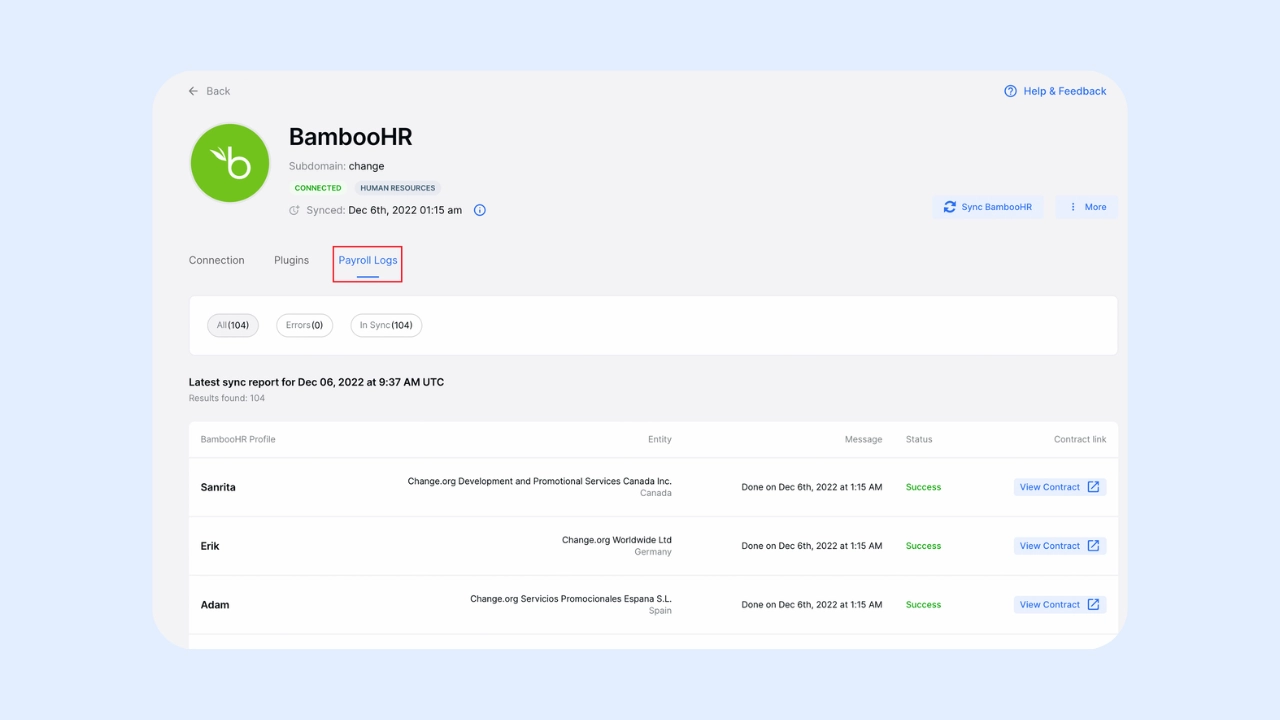

Most traditional platforms like BambooHR + a payroll plugin can’t handle this natively. They require third-party syncing. With Odoo, everything is linked—and that saves time every pay cycle.

6. Self-Service Portals for Employees

Your payroll team shouldn’t have to answer dozens of “Where’s my payslip?” emails every month. And your employees shouldn’t have to wait for basic information like tax documents, leave balances, or salary breakdowns.

That’s where Odoo’s employee portal makes a huge difference.

Each team member can:

- View and download payslips from any device

- Check leave balances and PTO accruals

- Update basic personal or banking info (with approval workflows)

- Access tax forms, bonus history, and contracts

Think of it as a payroll helpdesk that runs itself. And in practice, it reduces administrative load by over 30%, based on internal estimates from HR SaaS providers like Zenefits and Gusto, which emphasize similar features in their onboarding.

A well-set-up self-service system doesn’t just improve convenience, it also increases transparency and trust. Employees feel more in control. HR feels less overloaded. And sensitive payroll information stays centralized and secure.

7. Native Journal Entries and General Ledger Integration

This is where most third-party payroll tools fall flat: they calculate payroll correctly, but then dump the totals into accounting with vague labels like “Payroll Expense – May.”

Odoo treats payroll as a full accounting object, not just a monthly black box.

Here’s what you get:

- Auto-generated journal entries for each payslip (mapped to specific expense accounts)

- Cost splitting by department, project, or analytic tag

- Real-time impact on your general ledger, cash flow, and P&L

- Easy audit trail for every salary, deduction, and benefit paid

This integration eliminates one of the biggest sources of financial ambiguity: salary spend.

You no longer have to wait for your accountant to “reconcile payroll entries later”. They’re already built into your books.

Compare that to tools like ADP, which often require manual ledger imports, or Gusto, where the accounting sync can lag or misclassify entries. With Odoo, your accounting and HR systems don’t need to speak; they’re already speaking.

8. Leave and PTO Syncing with Payroll

Paid time off sounds simple until you try to calculate it.

An employee works 28 days, takes two sick leaves, plus 1 earned leave, but you forgot to deduct the balance or reflect it on the payslip. Multiply that by 50 employees, and your payroll math becomes a nightmare.

Odoo solves this by tightly linking leave management with payroll. Every approved leave request:

- Adjusts the available balance automatically

- Shows up in the payslip with the corresponding deduction or note

- Syncs with timesheet and attendance data for final calculations

- Gets approved through workflows that feed into the payroll run

Let’s say someone has 18 annual leave days left. They request 4 in the middle of the pay period. The system logs it, approves it, and auto-adjusts their salary if applicable, all without HR manually checking a calendar or spreadsheet.

This is standard in high-end HR systems like SAP SuccessFactors or Workday, but much harder to achieve in mid-market tools without custom development.

Odoo gives you this ability out of the box, especially when integrated with its Leaves and Time Off modules.

Conclusion

Most payroll systems just chase the deadline: calculate totals, deduct tax, hit send. But real payroll operations demand something deeper.

You need structured logic behind every number. You need full integration with time tracking, accounting, and HR. And you need flexibility that won’t collapse the moment someone changes departments or moves to a new state.

Odoo gives you that infrastructure, but only if you set it up with intent.

And if you want such a system built for your business too, what better way than to book a call with our Odoo accounting services at Ledger Labs?

We’re experienced Odoo ERP experts in the US, with over 13 years of experience and a track record of working with approximately 450 businesses. We also plan to help your business utilize Odoo effectively.