As we move ahead with time, the sudden shutdown of Vancouver-based online bookkeeping service Bench.co continues to affect business owners.

The announcement of its immediate closure on December 27, 2024, has left small businesses scrambling for a suitable alternative. On top of that, its occurrence during a crucial financial period has left businesses in oblivion.

In this article, we will explore the inside details to understand the rise and fall of bench accounting services and the key factors that primarily contributed to its decline.

- Implementing a scalable infrastructure to ensure that the platform can handle growth without compromising on service quality.

- Prioritizing customer feedback allows us to adapt the offerings continuously to meet evolving business needs.

- Introducing a proactive customer-centric approach to ensure that the clients receive timely and accurate financial support.

Rise and fall of Bench accounting services

Bench was founded in 2012, wherein it secured over $100 million in funding

This included:

- A $73 million Series C round in 2021

- Previous investments from notable firms including Bain Capital, Inovia Capital, and Shopify

Bench Accounting initially rose to prominence by positioning itself as a pioneer in combining human expertise with technological automation for bookkeeping services.

Their innovative approach of personalizing services with technology attracted a significant customer base leading to its rapid growth.

However, the business was alsowith challenges as it scaled. Bench struggled to strike a balance in maintaining its dual identity as both a technology company and a service provider. The technology which was earlier its asset became a double-edged sword, as it grappled to maintain its human-powered bookkeeping services alongside technological automation.

This led to unsustainable operational costs. This exposed their operational inefficiencies which became evident in their hybrid model, to keep up with the increasing demands.

Factors that contributed to Bench's decline

It was discovered that there were several factors that contributed to the decline of Bench Accounting services, some of which include:

- Lack of scalability in their service model

- Failure to adapt to changing customer needs, in terms of customer experience and service quality

- The expanding user base was not met with apt infrastructure which could support the increasing workload which led to delays and errors.

- In terms of pricing, the company was pushing its customers to opt for annual contracts in recent weeks.

- The introduction of more agile and innovative services by Bench Accounting competitors such as QuickBooks, Maxim Liberty, Netsuite, Cognos, etc. caused the company to encounter profitability issues despite charging premium rates for its services.

Not only did these factors contribute towards eroding the Bench Accounting services market share but they also, revealed certain structural business model challenges. Let’s explore these inherent limitations that contributed to its shutdown :

1. Limited service scope :

It offered only cash-basis accounting, whereas growing businesses also required crucial accrual basis capabilities, which were missing. There was a lack of account payable and receivable tracking, which limited the visibility into business cash flow. There was an inability to handle inventory management, prepaid expenses, and unearned revenue.

2. Technological Restraints :

There was undue reliance on proprietary software, which locked customers into their ecosystem. Major accounting platforms like QuickBooks and Xero had no direct export capability. There was limited ability to migrate historical data, creating high customer switching costs.

3. Revenue Model Issues :

The base pricing for basic services at $299 monthly left little room for profitable scaling. There were also unsustainable operational costs due to their attempt to balance human bookkeeping with technological margins—additional accounting needs called for external solutions, which fragmented the customer experience.

4. Missing essential services :

There was limited ability to track billable expenses, and they could not provide profit center segregations and 1099 preparation capabilities.

The impact on its customers

From the customer’s standpoint they were left bumbling regarding many issues, some of which are:

- Businesses that have recently paid for the annual services are uncertain about refunds.

- Many companies are left without completed books for 2024.

- Due to the abrupt closure, customers must quickly come up with alternative bookkeeping solutions during the holiday period.

- There were concerns pertaining to accessing and transferring financial records.

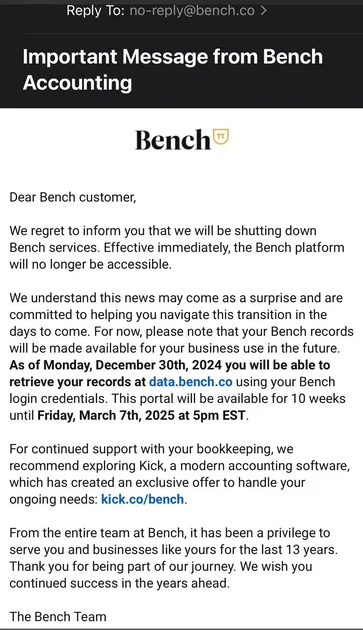

Now, there are some next steps for the affected parties and a few critical questions remain unanswered, as we talk further on this. Although Bench provides some guidance to its affected customers, the data will continue to remain accessible through March 7, 2025, and customers are advised to file their tax extensions to provide additional time for transitions.

Yet, some of the unanswered questions that remain are:

- Will customers receive refunds for prepaid services?

- How will the company handle incomplete 2024 bookkeeping?

- What support will be available for customers during the transition period?

It might be intriguing to note that as an immediate impact, Bench Accounting services has communicated through its mail wherein they have recommended Kick.co as their alternative service provider.

Insights and Lessons: Stability over scale in a post-Bench era

There are some important insights and lessons which are to be observed from the sudden closure of Bench , raises important considerations for both businesses and the broader fintech industry:

- The human element remains critical: Today’s customers want a combination of software and human support and Bench’s closure reinforces this lesson.

- Venture scaling vs.service quality: The pressure to scale rapidly while maintaining service quality creates fundamental tensions in the business model.

- Financial stability matters: Ironically, accounting firms are undermining the importance of sustainable business practices over rapid growth resulting in financial difficulties.

- The importance of having contingency plans for critical business services.

- The challenges of scaling service-based businesses in the tech sector.

- The potential risks of relying solely on venture-backed companies for essential business functions.

- The need for greater transparency in company operations and financial health.

So, why Ledger Labs next?

Ledger Labs is a premier accounting service offering bookkeeping, CFO advisory, tax compliance, ERP accounting, and controller services. We focus on helping businesses streamline their financial operations to ensure regulatory compliance and optimize strategic financial decisions.

We provide services across a variety of domains, including :

Accounting and Bookkeeping :

Controller & Audit services

CFO & Advisory Services

Tax setup, review, and filings

Inventory planning and merchandising

Technology consulting services and implementation

Financial planning services and fundraiser

Business exit strategy and M& A support

We excel in our approach because –

Fixed Fee with more value: While Bench Accounting also offers fixed fees, we go beyond the basics. Our pricing includes comprehensive services tailored to your specific business needs, ensuring no hidden costs and delivering maximum ROI.

Believe in being proactive: Bench focuses on maintaining your books but often misses proactive business insights. We analyze your financials in real-time, offering actionable insights to set clear business targets, prioritize investments, and optimize your resources for growth.

Responsive communication: In Bench, there has been a fragmented customer experience owing to additional accounting needs. We provide responsive, personalized support, so you are never left in unawareness and always have a financial expert available to guide you.

A dissection of Ledger Labs' features

We provide a holistic approach and focus on empowering your business with financial clarity, actionable insights, and strategic guidance to ensure growth with confidence and peace of mind.

While choosing any provider, it is important to prioritize finding a partner who combines human expertise, advanced technology, and a commitment to sustainable business practices.

Getting impacted by the Bench closure seems like a silver lining in the cloud – as it gives a chance to re-evaluate the needs and select a partner who can deliver not just services, but also long-term stability and support for the growth