1. 34% of businesses face delivery delays due to selling unavailable inventory.

2. 43% of small businesses in the US don’t track inventory; proper tracking reduces costs by 10%.

3. Cash-based accounting misses accounts payable/receivable; accrual accounting improves revenue forecasting and expense reduction.

4. 16% of small businesses fail due to cash flow issues and lack of capital.

5. Segregating personal and business finances avoids tax penalties and financial confusion.

Sticking to old-school accounting methods for your e-commerce business barely cuts it now.

Guidant Financial reports that 16% of small businesses fail because of a lack of capital and poor cash flow.

In fact, most businesses could have to pay heavy prices due to small accounting errors.

I have already posted a thread about accounting errors on LinkedIn.

So how can you avoid most mistakes?

And how can you save your e-commerce business money?

Let’s talk about that in detail.

7 Common E-Commerce Accounting Mistakes and Their Solutions

With an annual growth rate of 8.99%, the US e-commerce market is expected to grow to US $1,881 billion by 2029.

Since the introduction of the Internet, a good number of e-commerce businesses have established quite a foothold in the online shopping industry.

But that doesn’t mean e-commerce businesses haven’t failed either.

Because of inadequate inventory management, cash flow problems, and lack of strategic planning, a lot of e-commerce businesses have also never quite bloomed they way they could have.

So how can your business prevent itself from making such mistakes?

Well, you start by learning about them first.

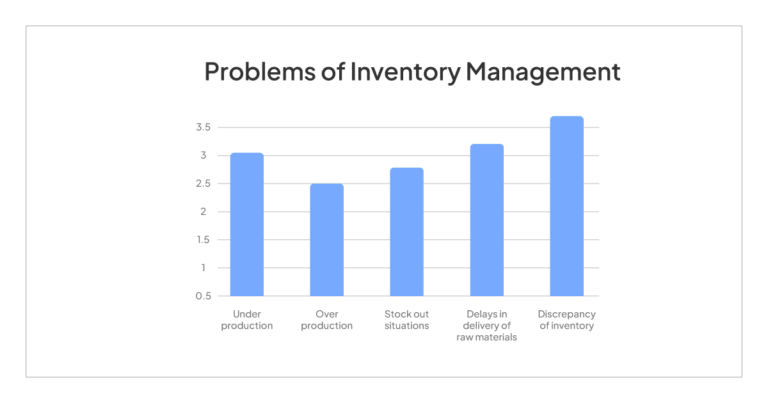

Mistake #1: Mismanaging Inventory Levels & Wrong COGs Estimations

A major cause of concern for most e-commerce businesses is the management of inventories.

The lack of information results in a waste of time and money.

About 34% of businesses suffer from delayed deliveries because they sell products that are unavailable in their inventory.

You can efficiently plan your inventories and form informed decisions with the right numbers in your hands.

A proper track of inventory management allows you to understand:

- How much stock is left

- How much of it is required for a certain period of time, and

- How much of it is simply sitting on the shelves, waiting to go out

Over 43% of small businesses in the US don’t track their inventories at all, and some of them that do, approach it manually.

Tracking your inventory reflects your bottom line as well as your profit and loss statements. It can reduce your inventory cost by 10%.

Furthermore, it helps you predict and streamline your cash flow far more efficiently; something you need to be mindful of because how most businesses also fail due to poor cash flow management.

One of the best e-commerce accounting practices is to integrate an accounting system with your inventory management software.

For example, Amazon uses several Multi-Channel fulfillment to sync its inventory management system across platforms. From an inventory management dashboard to an Inventory Performance Index, Amazon has various tools that help sellers effectively manage their inventory.

Speaking of inventory tracking, not keeping tabs on that can lead to inaccuracies in the calculation of the Cost of Goods Sold (or COGs)

The cost of goods sold for an online business is a complicated concept because there are so many things that you need to consider.

While some costs are pretty straightforward to figure out, some indirect costs are unpredictable and even difficult to track sometimes.

For example, there are basic expenses like the raw materials and the cost of packaging.

But what about indirect costs which are challenging to jot down and spread across the different segments of your business?

These costs include corporate tax, delivery charges, and much more.

You need a proper accountant for that – or at least, somebody who knows how to use accounting software.

Mistake #2: Inconsistent Data Due to Oversimplification

Businesses frequently add their sales and payment data in inaccurate categories.

Usually, this mistake occurs when they are setting up their accounting software.

Liabilities, equity, and assets are the most common categories, each having sub-divisions, like sales information, shipment fees, etc.

For example, gift cards and credited amounts are not to be simplified into one category.

It’s always advisable to double-check how your financial data is being integrated into the accounting system. Automation increases efficiency, but sometimes, it can create confusion, leading to inconsistencies.

Mistake #3: Employing A Cash-Based Accounting System Instead Of An Accrual Accounting System

You can record your business finances in two different ways — cash or accrual.

While cash-basis accounting is simpler and used by most small businesses, it has its limitations. For example, it doesn’t track the money you owe others (AP) or the money others owe you (AR).

An accrual accounting system is comparatively complex but it comes with a bunch of advantages as well.

- It provides visibility of your financial health

- It increases your revenue

- It improves forecasting

- It reduces your expenses

Many businesses look for simpler and quicker ways to track and record their money, and this mindset can restrict your revenue and financial understanding.

By prioritizing accrual accounting, you can track when the money goes out and when it is credited.

The e-commerce industry benefits from implementing an accrual accounting system. It helps you track not just the revenue that is received when cash is credited to your account, but also adds the cost incurred during the entire supply chain. For example, the cost of stock present in your inventory, waiting to be sold.

This system is especially effective for rapidly growing businesses.

Mistake #4: Mixing your Personal And Business Finances

Most first-time business owners make a common mistake – not segregating their personal and business finances. This can be limiting, especially when you start scaling your business.

When you mix your personal and business finances, you won’t be able to track how much money you already have and how much money you’re making. And come tax season, you’re setting yourself up for penalties and major tax consequences.

This problem can even discourage potential investors from investing in your business.

Of course, you can completely avoid mixing your personal and business finances by taking appropriate measures. Here’s how you do that:

- Maintain separate bank accounts and books.

- Avoid using your personal credit card to fill up inventories.

- File your taxes regularly.

- Hire a professional tax and finance advisor who will create the segregation for you.

Mistake #5: Overlooking Custom Fees And Other Costs

There are certain costs and fees that most new entrepreneurs fail to consider.

The lack of consideration leads to poor and inaccurate budgeting, and eventually unexpected or no profit at all.

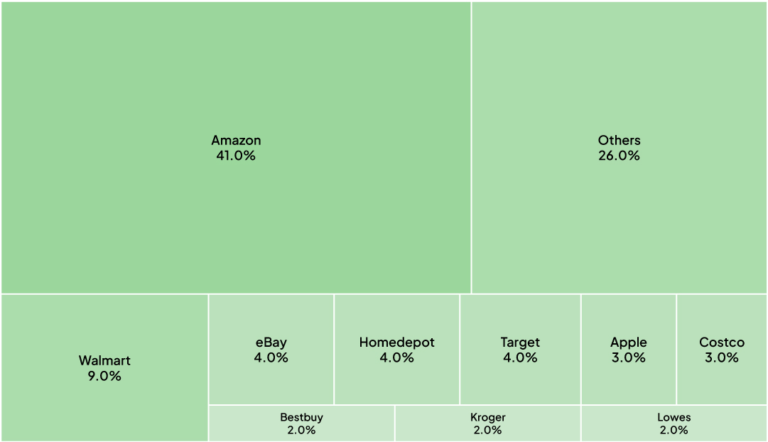

If you’re an e-commerce business that collaborates with a marketplace like Shopify and Amazon, make sure you add its fees to your overall cost.

For example, Etsy charges approximately 6.5% per transaction. This is a considerable bite out of your overall profit.

Overlooking shipping costs, import fees, custom requirements, delivery charges, and other supply chain costs can often hurt your financial profile, especially during taxation.

It’s best to subtract platform-specific and other relative expenses while predicting your total business revenue.

Mistake #6: Inconsistent Bookkeeping

Inconsistency is bad in every walk of e-commerce accounting.

But it has consequences if you are an e-commerce business owner.

Only 34% of small businesses hire a professional bookkeeper to manage their books while other businesses that are even smaller in size don’t give that importance to the task.

The biggest problem here is that businesses fail to recognize the significance of bookkeeping.

It’s not just data entry.

You have to monitor, calculate, and record all types of transactions — including your tax.

Many young entrepreneurs believe that they can set aside time from their already busy schedules to track and manage their books regularly but more often than not they fail to do it.

And that’s when they go wrong.

It’s humanly impossible to create and review your company’s financial statements regularly while also focusing on your actual business.

Also, you need to understand that inconsistent reporting and analysis leads to inaccuracies.

This is why it is absolutely essential that you hire a professional who regularly maintains your accounts. Maintain up-to-date data and identify trends in your sales and rising costs immediately — not weeks later when you get the time to look at your accounts.

Mistake #7: Last-minute filings

Filing your taxes could be a hectic process, who knows it better than I do?

Especially in e-commerce businesses where the cash flow is very fluid, it seems difficult to do your taxes on time.

On the contrary, failure to track cash flow regularly and neglecting smaller transactions ultimately lead to wrong estimations.

A lot of businesses fail to stay tax-compliant because of how they leave everything for the last minute.

Not only does it increase the chances of you making mistakes, but it also takes away the opportunities of optimizing your tax profile when you had the chance.

If all your paperwork is organized, filing for taxes will be manageable.

By preparing for tax season beforehand, you avoid paying for penalties and sanctions that can take a major bite out of your profit.

The Bottom Line

It doesn’t matter what industry your business is operating in, you’re likely to make mistakes that jeopardize the quality of your books and the financial health of your company.

Most of my clients also come up to me with similar frustrations, wondering why they have to spend so much time at the end of every month with their accountants, trying to understand the ins and outs of their business.

Don’t worry, you’re not alone.

No matter how complicated your books may seem, I can help you figure out a way to streamline your accounts. That’s what I do!

With 12+ years of accounting experience, our experts at Ledger Labs have the right tools to help e-commerce businesses effectively tackle accounting problems.

Book a consultation call with our e-commerce accountants and let’s start working on the financial health of your company.