Any business unable to securely process customer transactions is missing out on a significant portion of sales.

To solve the problem, you need a robust payment processing solution.

One of the best ways to do so is by equipping your business with a merchant service provider.

An e-commerce merchant account allows you to collect digital payments on your store. But that’s not all.

Your merchant account should also be able to make payment processing quicker, give you an accurate inventory analysis, and pave the way for more growth.

But how exactly do you choose the right e-commerce merchant account?

Let’s talk about that in detail.

- A merchant account will allow you to accept digital, credit, and debit card payments on your e-commerce store.

- When you’re choosing a merchant service provider, your budget, customer support, scalability, and PCI compliance are some of the important considerations.

- An ideal merchant provider efficiently navigates diverse payment options and has the bandwidth for growth.

- A merchant service provider will process your payments through POS integration and automated transactions.

Modern Businesses Require Modern Ecommerce Merchant Accounts

In today’s time, every online store needs to accept online payments.

And for that, you need a merchant account.

The market share of e-commerce merchant accounts is 30.7 million in the US, helping businesses process payments through different payment options.

Consider it as a gateway between the merchant and the bank that processes the payments.

Quite simply, every merchant account is a contract between a retailer and a credit card processing company.

This allows you to offer quick and secure payment options.

How Do Merchant Accounts Work?

The role of a merchant account provider begins once a customer purchases anything from your online store.

The customer will add the item to their cart and choose their preferred payment method.

Now let’s say they choose to make their payment through a credit card.

Next, they will provide the credit card details and ensure successful payment from their bank account to your merchant account.

Then, the funds are transferred from your merchant account to your business account – subtracting the platform fees.

This process can take 24 hours to complete. The right service providers prioritize the security of the transferred funds.

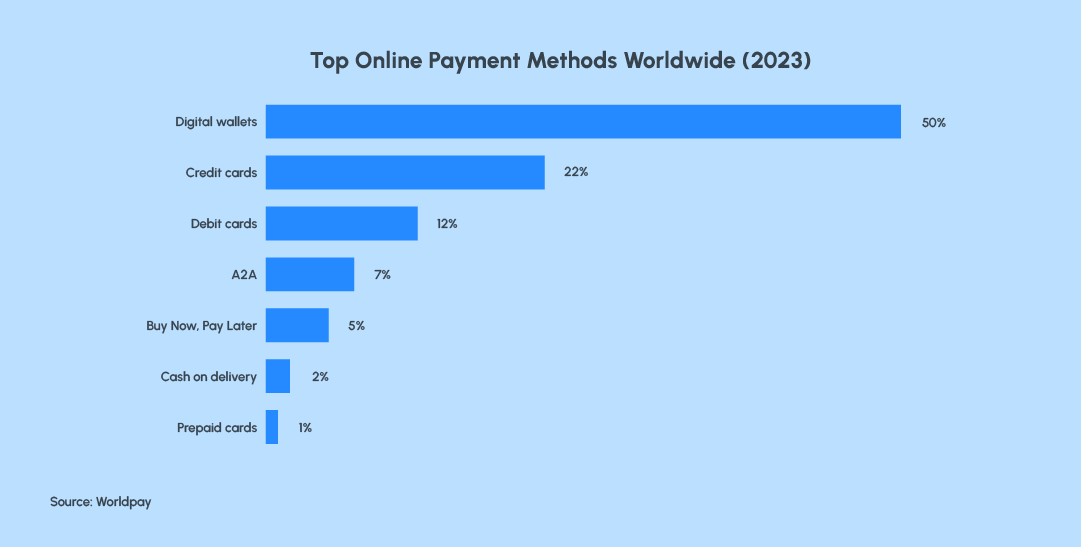

Due to rapid digitalization, the nature of online payments has become pretty diverse, further highlighting the importance of merchant accounts.

Today, 45% of customers use credit cards as their primary payment option. but Bitcoin and other online currencies are also becoming popular modes of payment.

If I had to simplify, I’d say, customers are looking for convenience.

They want diverse payment options to make their purchasing experience better. And a merchant account would do that for you.

5 Ways Merchant Accounts Help Your Online Business

One of the best ways to generate more sales is to offer a multitude of payment options to your customers.

Over 74% of B2B customers prefer e-commerce sites simply because of better payment options.

And this is how merchant accounts seize the opportunity, catering to customer needs by providing diverse and secure payment options.

If you’re looking for a merchant service provider, make sure you understand how a merchant account can optimize your business transactions.

Here are the five ways they’ll help improve your merchant experience.

1. Easy payment processing

Post-pandemic, the popularity of online transactions increased significantly, leading to the estimation of 6.1 billion people choosing it as their primary payment method.

This makes it a crucial aspect of running an online business.

A merchant service provider helps you streamline online payments, securing the ones your customers make on your website and seamlessly transferring them to your bank account.

2. Manage Inventory Through POS

With a POS system, you can automate your sales tracking, process payments, and generate reports, to streamline your business operations effectively.

Most businesses have separate inventories for their online and offline stores.

Popular merchants help businesses manage their inventories through a POS system.

3. A Simplified System of Measuring Sales

The idea of every merchant account is to make the process convenient for your customers and yourself.

A merchant provider does that with the integration of an ecommerce accounting software.

Before you choose one, make sure it has the following features at least:

- An understandable dashboard

- A self-explanatory UI

- Allows you to track your transactions, issue refunds, and extract financial data.

- Is quicker in managing payments

- Has a proactive customer support

4. Avenue for More Revenue

Merchant accounts help you increase your revenue.

You can attract customers with different payment preferences by offering diverse payment options.

Most importantly, merchant accounts allow you to:

- Enhance your revenue stream by accepting multiple payment methods.

- Allows you to send customized invoices and create branded payment portals.

- Saves payment information for your customers’ future use.

All this ultimately builds your brand credibility and presents a professional perspective of your business to your customers.

5. High-Risk Solutions

By 2023, payment fraud across the e-commerce industry was calculated at $48 billion.

This highlights the need to secure your businesses with protection tools.

This is where the role of merchant providers is paramount.

They offer tailored solutions to high-risk businesses to tackle fraud and possible chargebacks.

The integration of a top security system allows you to mitigate high-stake risks from your business.

Also, some service providers have business equations with the banks. This makes the account approval process faster.

10 Non-Negotiables When Choosing the Best Merchant Service Provider

For starters, your ecommerce accountant should be helping you pick your ideal merchant account.

Choosing the right merchant service can be simplified by taking into account the following considerations:

1. Affordability

Signing up on an e-commerce merchant platform means choosing a pricing plan to your liking.

Most times, you will find various applicable fees applicable, which include:

Setup fee: The providers will set up your account and for that, they will charge you a one-time fee. The amount will depend on the bank account you use, your sales traction, and the software or device you use.

Maintenance Fees: If you use e-commerce software, you’re also liable to pay a maintenance fee. Think of it as a monthly or quarterly subscription for updating your processes and tools.

Transaction Fees: You may have noticed that sometimes the final payment is not what you expected. This is usually because of platform fees, credit card fees, and other cuts that come in the way before you receive the final amount. You call it the transaction fees. It is usually the percentage of an amount or a flat rate.

Statement Fees: Some merchants charge for maintaining your financial records, like for generating monthly statements and reports.

Chargeback Fees: It may occur if a customer demands a refund. This fee covers the administrative costs that may be incurred while handling such disputes.

2. PCI Compliance

Choose a certified merchant provider who undergoes regular security audits.

This makes your business PCI-compliant, making all transactional data secure.

The process has been finalized to help online businesses process payments through credit companies like Mastercard and Visa.

Level 1 PCI Compliance has the best reputation as it has mandated annual audits.

3. Chargeback Prevention Tools

Hire a merchant provider with access to chargeback prevention tools, preferably without additional fees.

Chargebacks happen when a customer disputes a refund. Most of the time, such demands are fraudulent.

For example, customers claim they never received the delivery or that it was broken.

So every time a customer makes such claims, you receive a penalty.

Too many penalties can suspend or block your account, making it important to hire a merchant provider with access to chargeback prevention tools.

You can use these tools to address such problems ahead of time by tracking IP addresses and evaluating past activities.

This way, you can take the necessary steps to navigate difficult customers.

4. A Mobile-Friendly Data Access

Online payments have to be processed in real time.

This requires you to take immediate action whether you want to approve a payment, decline a flagged payment, review sales history, or simply analyze sales patterns.

The merchant provider that you end up choosing should be available for almost all devices that you manage your store from.

5. Address Your Business Needs

Even though hundreds of exceptional e-commerce merchant providers are available, not all of them are the right fit for your business.

For instance, if your business offers an affiliate program and pays commission for customer referrals, find the provider with affiliate management tools.

Right from effective tax planning to accurate financial projections, every business is different and requires specific features to foster growth and efficiency. Make sure you choose a provider who understands your business needs.

6. Diverse Payment Options

If you want to increase your revenue, accepting payments from top credit card companies is not sufficient.

Customers will also prefer P2P payments or decentralized options too.

Then comes the option of accepting multiple currencies. Not capitalizing means you’re sidelining the revenue that can be generated through worldwide shipment.

The best merchant provider will accept different currencies and offer alternate payment options.

This is a core business need for online stores with a global reach.

7. Compatible With Your Ecommerce platform

An all-inclusive hosting solution only works for you if it can integrate into your e-commerce platform or website.

For example, Shopify can plug into most online stores but WooCommerce is limited.

So before you choose a provider, confirm their compatibility with your website or online store.

8. Instant Customer Support

Online payments are common but their processing is complicated, so you might face problems from time to time.

For example, you can wake up one day to unexplainable charges, or sometimes the payment might get delayed.

Whatever may be the issue, the best solution is to hire a provider with an excellent 24-hour service.

The best ones understand your business and are committed to enhancing your payment processing experience at an affordable price.

9. Next-Day Funding Option

Find a provider who offers the next-day or same-day payment processing facility.

This way when a payment is made to your merchant account, it is transferred to your bank account within the same day or maximum by the next business day.

Many merchant providers offer same-day deposits, settling payments in batches.

This improves business efficiency and avoids discrepancies.

10. Bandwidth For Growth

Every business strives for growth. Regardless of the size of your business, always look for merchant providers who understand your growing needs and support your ambitions.

Go for merchants with tiered subscriptions for businesses of different sizes.

This way you can ensure they have the bandwidth to meet your changing needs.

Choosing The Best Ecommerce Merchant Accounts

By choosing the right merchant, you can optimize your business operations and navigate the increasing demands of the digital marketplace.

The best merchant provider transforms your business by streamlining payments and increasing customer satisfaction through diverse payment models.

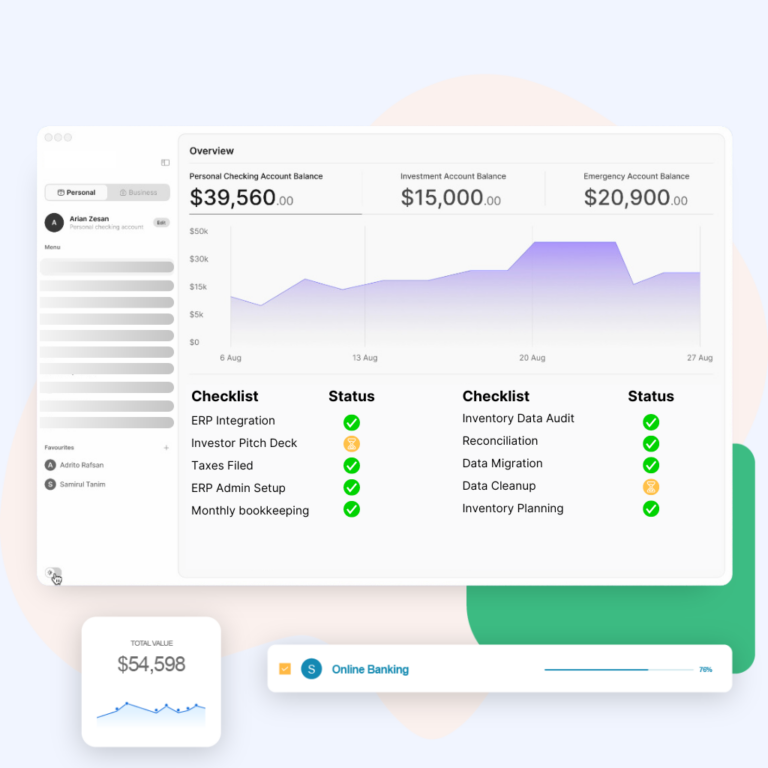

This is where Ledger Labs comes in.

We have built a strong foundation over 12 years in this field, helping businesses establish solid payment systems and manage their finances.

Leverage our expertise as we’re well-equipped to handle your accounting and payment needs.

Book an appointment today to explore how we can help you.