1. Retained earnings reflect cumulative net income. They accumulate profits since day one, excluding dividends paid, offering insights into financial health, growth potential, and reinvestment capacity.

2. Calculation formula: Retained earnings = Beginning retained earnings + Net income – Dividends.

3. Negative retained earnings occur when losses or dividends surpass profits, signaling sustained losses, excessive shareholder payouts, or adjustments, potentially impacting a firm’s financial stability.

By the end of the year, if you go through a balance sheet, you can see a familiar term popping up more than one time, it’s called “Retained Earnings”.

If you’re a business manager, investor, or analyst – you’ll know that this isn’t just a number.

On the whole, retained earnings is a highly vital figure that gives insight about how a company is doing, and whether it currently has a good financial standing.

In this blog, we’ll answer every question you ever had regarding how to calculate retained earnings on a balance sheet.

Let’s get started.

How retained earnings show business performance?

Retained earnings are one of the most integral indicators of a company’s sustained profitability and capability to produce shareholder value.

When there is a steady rise in retained earnings, it often implies that the organization is consistently earning profits, and might use them to reinvest in the business.

Therefore, this suggests the desire to grow and develop in the long run.

This is especially viewed in a favorable light by investors and lenders because it shows that the company is well off to fund itself for growth and operation.

However, a drop in retained earnings or negative retained earnings can be an omen for the company.

Hence, it might mean that the company is not making enough profits, operating at a loss, or distributing a substantial amount of profits in dividends without much reinvestment back to the business.

But, it’s necessary to consider a broader concept.

Let’s say, for instance, a company that chose to invest heavily in expansion might see a temporary plunge in retained earnings.

But, does it mean they took the wrong step? More often than not, the answer is no.

In contrast, this could result in greater profits over the long run.

What is a Balance Sheet?

In simple words, it is a financial statement that gives a comprehensive snapshot of the financial position of a company over a specific time period. A balance sheet typically reflects what a company owes and owns at a certain time. It gives a brief view of its financial health. It is a very vital tool that analyzes the company’s financial standing at a certain timeline.

A balance sheet typically has two ends:

- Assets: These are the tangible or intangible items that help to add value to the business.

- Liabilities and equity: In this case, liabilities are what the business owes to others, while the latter represents what the owners own.

If you look closely at a balance sheet, it usually exhibits two major accounting equations:

Components of retained earnings in the balance sheet

The primary formula to calculate retained earnings is based on three components:

1. Beginning Retained Earnings

This is the component that defines the retained earnings balance right at the start of the financial period. In general, this is carried over from the previous period’s balance sheet.

2. Accumulated Net Income

This is just another incredibly vital component you need to be aware of. It exhibits the total net income (or, loss) the company has experienced during the current period. Consequently, net income shows the profit a company has made after all expenses and taxes are paid. Moreover, it can be said that it is added to the beginning retained earnings.

3. Dividends Issued

This is actually the figure that shows the aggregate amount of dividends a company has distributed to its shareholders over a specific financial period. You can typically get this information in the cash flow statement of a company or simple explanatory notes that come with financial statements.

How to calculate retained earnings on a balance sheet?

Retained earnings on a balance sheet typically display the amount of net income remaining after an organization distributes dividends among shareholders.

Here’s how you can calculate retained earnings on a balance sheet:

- Beginning Retained Earnings: Take out the retained earnings figure from the end of the previous financial period. You can simply find this information on your company’s last balance sheet.

- Add the Net Income (or, just Deduct Net Loss): Take out the net income (or the loss) from your current period’s income statement. Assuming it’s a profit, add it to the beginning retained earnings. But you need to subtract, in case it’s a loss.

- Subtract Dividends Paid: In case the organization has already distributed the dividends to its shareholders during the period, you only need to deduct it from the amount received in step 2.

Therefore, here’s the formula used to calculate retained earnings:

Retained Earnings = Beginning Retained Earnings + Net Income/Loss – Dividends Paid The figure you receive gives a brief sneak peek into how much profit the company has retained for using in the near future, rather than distributing it to shareholders. In simple terms, it shows the collective profits that the company has kept aside to reinvest in its operations and growth.

Now’s the time!

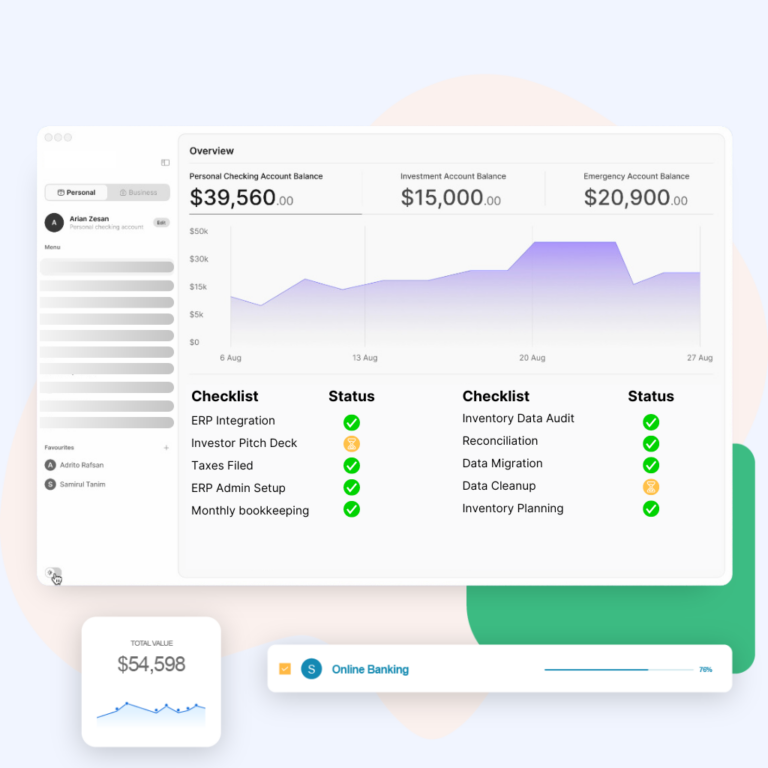

Want help with retained earnings calculation?

How to calculate retained earnings on a balance sheet example:

Let’s consider the following figures for a company:

- Beginning Retained Earnings: $50,000

- Net Income: $20,000

- Dividends Paid: $5,000

Therefore, when the formula is applied:

Retained Earnings = Beginning Retained Earnings + Net Income/Loss – Dividends Paid Replacing with the values:

Retained Earnings = $50,000 + $20,000 – $5000 = $65,000 Thus, the retained earnings totals up to $65,000. That means, the ending retained earnings on the balance sheet at the year’s end is going to be $65,000.

Calculated Retained Earnings Interpretation

In layman’s language, the calculated Retained Earnings define the net amount of profits your business has made and reinvested back to the company for future growth.

It’s important to keep two things in mind. A positive retained earnings represent that the business has retained a good amount of profits, signaling toward healthy business standing. A negative retained earnings, in contrast, may show that it has accumulated losses over a time period, leading to a big sign of worry.

What type of account is retained earnings?

The answer is Equity. Retained earnings are actually a type of equity. Thus, they are reported in the shareholders’ equity section on a balance sheet.

In wrapping up

In financial analysis, understanding retained earnings is one of the key areas you need to know about. It can be said that Retained Earnings is actually the bookmark for the next chapter of your business. It shows how well your business is doing, and how good it can do in the near future.

Put simply, it gives you a detailed overview of profits, losses, and the distribution of dividends to help understand your business’ current financial standpoint.

Have any unanswered questions about your business’ retained earnings? Check out our retained earnings blog for uses and case studies.

You could also connect with us and get direct answers from our expert accountants and bookkeepers at Ledger Labs with 12+ years of experience.

Frequently Asked Questions

1. Where do retained earnings go on a balance sheet?

You can find retained earnings on the equity section of your company’s balance sheet. In particular, you can find them listed under shareholder’s equity, representing the collective amount of profits that have been reinvested back into the business, instead of being distributed as dividends.

2. How to find addition to retained earnings?

This is where you need to check the company’s net income and the dividend amount divided during the period. If demonstrated in formula,

Addition to Retained Earnings = Net Income – Dividends Paid 3. What makes up retained earnings?

Retained earnings mainly consist of three major components,

- Beginning retained earnings.

- Net income or loss

- Dividends issued

4. How to find retained earnings without net income?

If you want to determine retained earnings without any immediate information on net income, then it’s best to use the change in retained earnings between the dates of two balance sheets. In simple words, you need to determine the common stock line item in your balance sheet.

Assuming that the two items on stockholder equity are common stock and retained earnings, just take the total stockholder equity and simply deduct the common stock line item from it. The answer (typically the difference between the two) is the retained earnings.