1. COGS represents direct costs of producing goods, including raw materials and labor, and excludes indirect expenses like distribution or marketing.

2. Accurate COGS calculation is essential for understanding gross profit and ensuring proper financial reporting compliance.

3. Businesses can improve decision-making and profitability by optimizing inventory and production based on precise COGS figures.

4. Mismanagement of COGS can lead to over or underpricing, affecting overall business competitiveness and market positioning.

5. Leveraging automation tools like NetSuite can streamline COGS calculation and enhance accuracy, reducing errors and saving time.

Calculating the COGS is a pretty basic step in your company’s financial statements, specifically the income statement.

This calculation helps businesses determine the right prices for their products, find growth opportunities, and manage their taxes effectively.

Not just that, when it comes to filing tax returns, accurately determining the Cost of Goods Sold is important, because it allows businesses to claim the right deductions and minimize their tax liability.

By effectively calculating the COGS, business owners can make informed decisions about pricing, discover ways to expand their operations and handle their tax responsibilities efficiently.

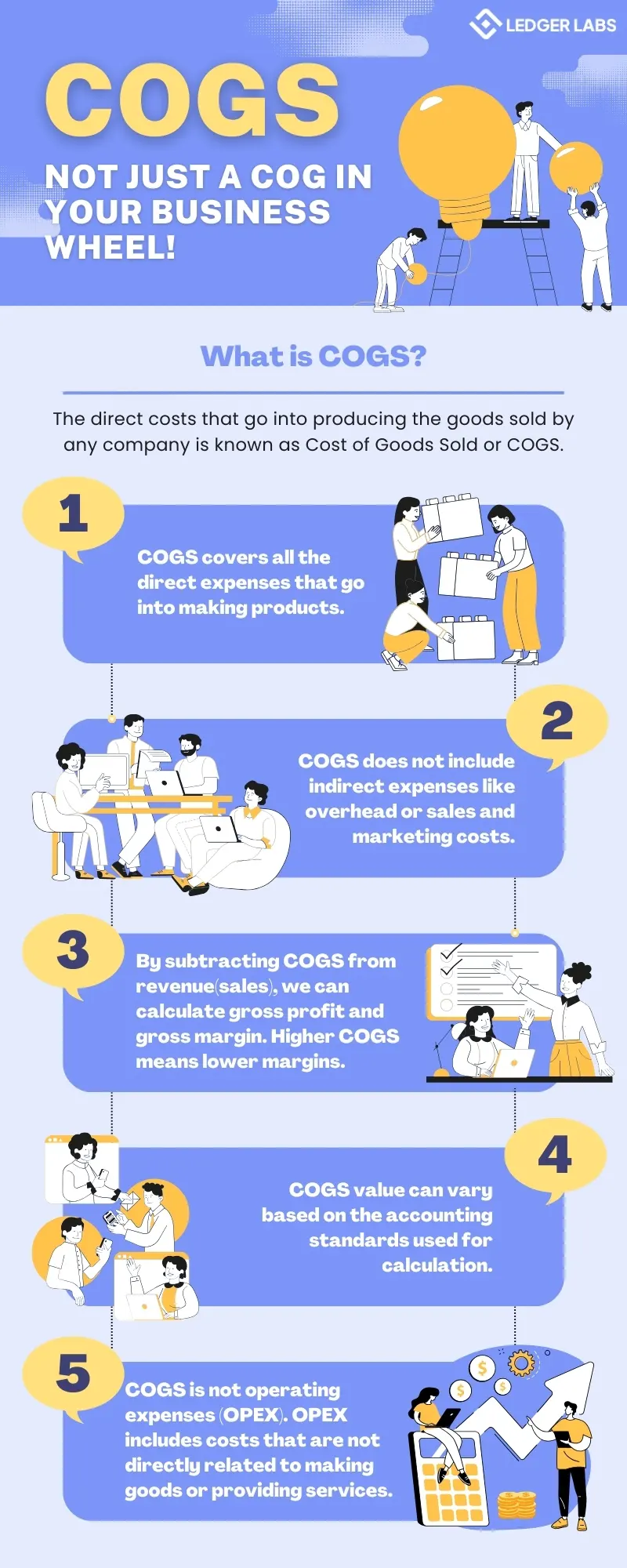

What is the Cost of Goods Sold (COGS)?

The cost of goods sold refers to the specific expenses your organization incurs for the inventory it sells within a certain period.

This includes all the costs directly related to the goods or services sold, such as purchasing or producing the inventory.

However, it doesn’t include any indirect or fixed costs like overhead expenses or marketing costs.

In simple terms, the actual cost of the inventory was sold without considering other general expenses. Sometimes, it’s also called the cost of services or the cost of sales.

Formula for Cost of Goods Sold (COGS)

Calculating the cost of goods sold involves a slightly indirect approach.

Instead of simply adding up expenses, it is determined by comparing the costs of the inventory at the beginning and end of a specific period and then considering the cost of inventory acquired and sold during that time.

In simple terms, the formula focuses on the timeframe rather than just the expenses.

Short Formula of COGS

In normal circumstances, a small or medium size business or shop can use this formula as the business involves clear transactions for each item. It involves fewer layers and might be appropriate for businesses with small transactions.

COGS = Opening Stock + Purchases + Direct Expenses - Closing Stock. Now, let’s understand the components of COGS:

1. Opening Stock (Beginning inventory): This refers to the inventory your company had at the start of the previous period (mostly, accounting year), whether it was a quarter, month, year, or any specific time frame.

2. Purchases: These are the total costs of everything your company bought or acquired during the current accounting period.

3. Direct expenses: These are expenses related directly to the manufacture, purchase of goods, and bringing them to the point of sale. These include carriage inwards, freight inwards, wages, factory lighting, water and fuel, etc.

4. Closing Stock (Ending inventory): This is the inventory left at the end of that specific period (accounting year) after accounting for the goods sold or used up.

We will help you understand this better with an example:

Suppose a retail store begins the year with a certain amount of inventory. The inventory has a retail value of 60,000 USD, but it costs the store owners 30,000 USD to acquire it.

Throughout the year, the owners purchase an additional 100,000 USD worth of inventory with a retail value of 2,25,000 USD. By the end of the year, they are left with inventory worth 40,000 USD, which they acquired for 20,000 USD.

To assess how well the store performed in terms of profitability for the year, the owners can use COGS (Cost of Goods Sold). COGS helps determine the total cost of inventory sold during the year, which is crucial in understanding overall profitability.

Let’s calculate the COGS using the given numbers:

Opening Stock: 30,000

Purchases: 100,000

Closing Stock: 20,000

COGS = 30,000 + 100,000 - 20,000 = 110,000 Therefore, the store’s total cost of goods sold for the year amounts to 110,000 USD. To determine the gross margin for the period (gross sales minus COGS), we subtract the COGS from the total sales:

Gross Margin = 60,000 + 225,000 - 40,000 – 110,000 = 1,35,000 So, the store’s gross margin for the year would be 1,35,000 USD. Understanding these figures helps the owners assess the store’s performance and profitability.

Extended COGS Formula

Now, the above short formula may become more complex if you are involved in manufacturing your products. In that case, the beginning inventory would be the cost of creating that inventory, purchases would represent the direct cost of manufacturing more goods during the period, and the ending inventory would represent the direct cost of the unsold goods.

Take a look at the detailed and free cost of goods sold sample table below to reach at COGS:

COGS Sheet Terms Explained

Here’s a ready reckoner you may want to refer to while you’re determining your Cost of Goods Sold.

1. Cost of Material meaning

Simply put, material costs are the direct costs of manufacturing a specific product or providing a specific service. These interchangeable terms all describe the cost of integral materials in a product or service. They are also known as raw material costs or direct material costs.

2. Cost of Labor meaning

The total labor cost or labor cost is the total expenditure borne by employers for staffing. Employee compensation (including wages, cash and in-kind salaries, and employer’s social security contributions) makes up the total labor cost.

3. Direct Expenses meaning

Direct expenses are any costs associated with a product that are not direct material costs or direct labour costs. In general, these items are of a lumpsum nature and are not common for the products. Direct expenses examples include:

- Utility costs such as fuel, power, water, steam, and so on

- Royalty based on production.

- Fees for technical assistance or know-how (related to Project Managers)

- Depreciation on moulds, patterns, patents, and so on.

- Job charges

- Hire charges for tools and equipment

- Charges for designing a specific product, etc.

4. Production or Works or Factory Overheads meaning

These are indirect costs associated with the manufacturing or production process of goods or services. These costs are not directly attributable to a specific product or service but are incurred as part of the overall production process. Production overhead examples are:

- i) Consumables and spare parts

- ii) Depreciation of plant and machinery, factory construction, and so on

- iii) Production asset lease rent

- iv) Repair and maintenance of plant and machinery, factory building, etc.

- v) Employee indirect costs associated with production activities

- vi) Cost of drawing and design department

- vii) Plant and machinery insurance, factory construction, raw material and work in progress stock, and so on.

- viii) Depreciation on jigs, fixtures, tooling, and so on.

- ix) Cost of service departments, such as tool room, engineering and maintenance, and pollution control.

- x) Salaries for production planning, technical supervision, factory administration, and so on.

- xi) Idle time cost and all normal losses. Exceptional losses are transferred to P&L account.

- xii) Store management expenses

- xiii) Factory security expenses

- xiv) Labor welfare costs

- xv) Canteen costs

5. Quality Cost meaning

As the term suggests, the quality control cost is the amount of money spent on quality control activities to ensure that the quality standard is met. These expenses must include salaries and wages for employees engaged in quality control activities, as well as other related expenses. They must inspect the received material, the quality of the work in progress, and the finished product.

6. Research and Development Cost meaning

The cost of research and development for the development and improvement of the process or the existing product is included in the cost of production. Basically, this cost is allocated based on the product life cycle.

7. Administrative Overheads meaning

Administrative overhead must be evaluated in relation to production and other activities, such as factory offices and works manager offices. Administrative costs associated with production activities must be included in the cost of production.

Further, administrative overheads related to non-manufacturing activities, such as marketing, project management, corporate office expenses, and so on. Administrative expenses examples are:

- Salaries of administrative and accounting personnel

- General office expenses such as rent, lighting rates and taxes

- Telephone, stationery and so on

- Bank charges

- Audit fees, legal expenses and so on.

8. Work in Progress meaning

Work in progress (WIP) describes partially finished goods that are still in the manufacturing process. These items may be undergoing transformation in the manufacturing process right now, or they may be queued in front of a production workstation.

Work-in-progress items do not include raw materials or finished goods. Work in progress typically includes the full amount of raw materials required for a product, as this is added at the start of production, as well as the cost of additional processing as each unit progresses through the various manufacturing steps.

9. Finished Goods meaning

Finished goods are items that have completed all stages of the manufacturing process and are ready for sale. The production process on such goods has been completed.

At times some costs may land in a grey area and you may get confused about how to calculate Cost of Goods Sold. We, at Ledger Labs, are here to help.

Why Calculating the Correct Cost of Goods Sold is Important?

COGS is crucial in financial statements because it helps calculate your gross profit. Gross profit tells us how well a company is doing in terms of managing its labor and supplies during the production process.

Furthermore, by subtracting the COGS from the revenues, we can see the company’s actual profit after considering the direct costs of making the products or providing services. It gives us insights into how effectively the company utilizes its resources and generates profit.

Since the Cost of Goods Sold (COGS) is an essential business expense, it is recorded as a business cost on income statements. Knowledge of the COGS helps analysts, investors, and managers estimate a company’s overall financial performance.

If the COGS increases, it will lead to a decrease in the net income. While this may have tax benefits, the business will have less profit available for its shareholders. Therefore, businesses strive to keep their COGS as low as possible to maximize their net profits.

1. Determining the right price

Knowing your Cost of Goods Sold (COGS) helps you determine the appropriate product cost without driving away your customers. Hence, by setting the right price, you can cover your business’s operating expenses and still make a good profit.

Further, understanding your COGS enables you to assess when it may be necessary to adjust your product prices—whether that means reducing or increasing them. A clear understanding of your COGS puts you in a strong position to make informed pricing decisions and stay competitive.

2. Tax management

Your Cost of Goods Sold (COGS) directly impacts your taxes. It’s important to understand that the COGS you incur when selling your products or services can be deducted from your taxable income. COGS usually appears as the second line item on your income statement when you file your taxes. Accurate reporting of your COGS is crucial to avoid legal issues or disputes.

If your business has high COGS, it means you will have a lower net income, resulting in paying lesser taxes. However, this can also indicate that your business may need to generate more profits. It serves as a warning sign that you must find a balance between your business’s profitability and operational costs. You can ensure your business remains financially healthy and sustainable by implementing effective systems and strategies.

3. Business growth

Consistently using your Cost of Goods Sold (COGS) involves analyzing your collected historical data to identify seasonal trends. Thus, by studying past changes in your COGS, you can discover new opportunities that can boost your business’s growth.

For example, if your COGS tends to be higher during the winter season, you can explore diversifying your business by offering products in demand during that time. This helps reduce the risk of losses and increases your chances of success.

Furthermore, by adapting your business to align with seasonal trends, you can capitalize on the opportunities and drive the growth of your business.

4. Analyzing profits

By utilizing your Cost of Goods Sold (COGS), you can calculate various ratios that provide valuable insights into your business’s overall health. This allows you to make correct decisions, especially those that are likely to have a positive impact on your business.

Consequently, the information derived from these calculations can help you determine if it’s necessary to reduce operational costs, assess your ability to repay debts, or even evaluate the viability of continuing your business operations.

Thus, by leveraging COGS and analyzing the resulting ratios, you better understand your business’s financial situation and can take appropriate actions to ensure its success and sustainability.

Explore: 4 Methods and Examples to Calculate Your COGS!

Cost of Revenue vs. COGS

Costs of revenue are expenses incurred for ongoing contract services. These expenses can include things like raw materials, direct labor, shipping costs, and commissions paid to sales employees.

However, these costs can only be classified as COGS if a physical product is sold. The IRS website even provides examples of “personal service businesses”, such as doctors, lawyers, carpenters, and painters, who do not calculate COGS on their income statements.

However, many service-based companies also have products to sell.

For instance, hotels provide services like transportation and lodging, but they also provide items like food, beverages, and more. These items are considered goods, and these companies maintain inventories of such goods. In these cases, they can include COGS in their income statements and claim them for tax purposes.

Operating Expenses vs. COGS

Both operating expenses and cost of goods sold (COGS) are expenses that companies have when running their business. However, these expenses are shown separately on the income statement. Unlike COGS, operating expenses (OPEX) are not directly related to goods or services.

One common type of operating expense is SG&A (selling, general, and administrative expenses). SG&A expenses include overhead expenses not directly linked to a specific product.

Some examples of operating expenses include:

- Rent and utilities

- Salaries and wages for non-production staff

- Marketing and advertising costs

- Insurance premiums

- Office supplies and equipment

- Professional services fees (e.g., legal or accounting services)

Which companies are exempted from calculating COGS?

As we said earlier, unlike businesses that sell physical goods, service companies typically do not have a cost of goods sold (COGS). In generally accepted accounting principles (GAAP), COGS is defined as the cost of inventory items sold within a certain period. Since service companies do not deal with tangible products, they do not have inventories and, therefore, no COGS.

Examples of service companies include accounting firms, law offices, real estate appraisers, business consultants, professional dancers, and many others.

Although these service-based industries have business expenses and incur costs to provide their services, they do not have COGS listed on their income statements. Instead, they have a category called “cost of services” or “cost of providing services”, which differs from COGS and does not qualify for a deduction.

Limitations of COGS

You would have realized by now that COGS is useful for businesses to track their direct costs and identify ways to save money. However, it has certain limitations.

COGS doesn’t show the cost of selling because it doesn’t include expenses like marketing. Additionally, since COGS doesn’t consider fixed costs, it doesn’t give an accurate picture of a company’s overall profitability.

Here are some other limitations of COGS:

- The actual COGS can vary greatly for each unit sold.

- COGS can change depending on the sales volume of each product line.

- COGS may fluctuate between periods, even if sales remain consistent, depending on the accounting method used.

- Managers need to pay close attention to understand their COGS.

- The impact of COGS on a company’s profitability is not always immediately clear.

- COGS can be changed or manipulated by accountants or managers who want to manipulate financial records. They can do this by:

- i) Assigning higher manufacturing overhead costs to inventory than what was spent.

- ii) Exaggerating discounts received.

- iii) Inflating the number of returns made to suppliers.

- iv) Adjusting the recorded amount of inventory at the end of a specific accounting period.

- v) Overestimating the value of the inventory on hand.

- vi) Neglecting to write off obsolete inventory.

Understandably, these actions can lead to inaccurate representations of a company’s financial situation. They even may be used to deceive others about the true state of the business.

Therefore, although COGS is an important metric, it must provide a complete picture of a company’s total business costs. While it’s often listed as the first item on an income or cash flow statement, there are other expenses that a company has to pay regardless of its sales.

To sum up

Calculating the cost of goods sold is important for businesses. It helps them understand how well they are doing financially, decide on fair product prices, and keep track of their inventory.

This article provides easy-to-follow steps and methods to help entrepreneurs and financial professionals accurately calculate the cost of goods sold. When businesses know the true cost of producing their goods, they can present their financial information correctly.

It’s also beneficial to regularly check and analyze ratios and metrics related to the cost of goods sold. This can give valuable information about how efficiently and profitable a company is operating. By learning about and applying the knowledge shared in this article, individuals can confidently handle the complexities of calculating the cost of goods sold. This empowers them to make smart business decisions and achieve long-lasting success.

For you, we’re offering a free Business Audit Consultation by our accounting and bookkeeping experts this month! Get your COGS questions (and even others) answered by scheduling a consultation session now.