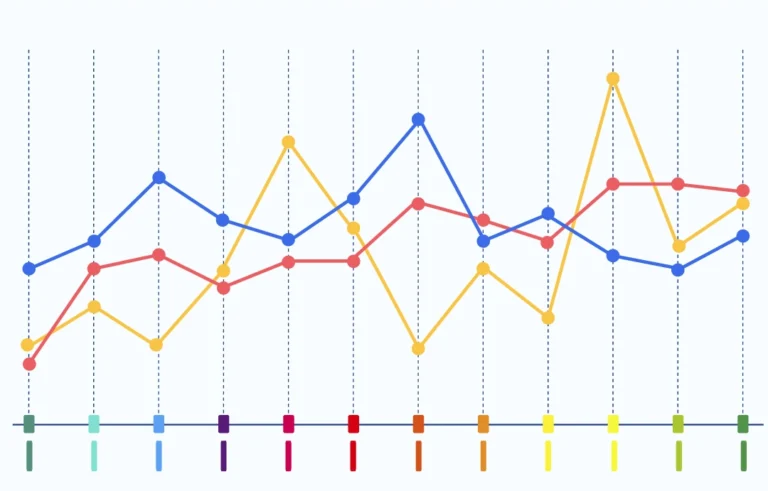

1. 80% of businesses fail to create accurate financial forecasts, which leads to poor decision-making and missed opportunities.

2. Scenario-based forecasting can improve decision-making by preparing businesses for various potential outcomes.

3. 67% of businesses find cash flow forecasting essential for sustainable growth.

4. Using historical data for forecasting increases accuracy by up to 40%.

5. A flexible forecasting model allows businesses to adapt to changes in the market or industry.

There’s no doubt that executives and business owners have been using forecasts quite frequently in all decision-making processes.

Efficient forecasting helps tackle several obstacles, especially by giving a crystal clear approach to demand patterns, economic changes, and competitive actions.

But, you need to understand that it is all about data, and, sometimes, data may not be as readily available.

That’s why choosing the right financial forecasting model depends on a number of things. From data availability to cost-effectiveness and desired accuracy – it is based on several factors. Having said that, this makes it incredibly important to choose a financial forecasting model that caters to your requirements, from start to finish.

But, how do you determine which one is the best?

More so, what are the types that you can choose from anyway? That’s what we are here to answer.

Understanding Financial Forecasting

Have you seen machinery and technological equipment constantly changing form, especially from ground up? That’s what we are stepping into, everyday. A future with no certainty. For example, COVID-19. We barely predicted its prevalence, yet when it happened, it did create a major economic slowdown due to the sudden churn of the crisis.

This is where we need financial forecasting. It helps to know what to expect in the future and have a backup plan ready to respond.

Financial forecasting is the financial projection conducted to support any decision-making process associated with understanding the future performance of a business.

This process generally includes the analysis of a business in its past years and ongoing trends, alongside other internal assessments.

Read more about 9 accounting trends to follow.

However, it’s important to note something here. Some parts of financial forecasting may vary based on the type and motive of the forecast itself, as discussed right in the next part. So, go on and read ahead.

Types of Financial Forecasting Models

There are several types of financial forecasting models and it depends on your business which one is the best fit. But, before getting into that, let’s look at the types it has. Here is a brief rundown of each type and what they mean in general:

1. Qualitative Forecasting Models

The qualitative forecasting model basically relies on subjective judgments and opinions, instead of any historical data. These are used at times when data is hardly found.

For example, you wouldn’t be able to get the right data, or any data at all, for a product that is newly launched in the market. In this case, human judgment and ratings are the best course of action to convert qualitative information into quantitative possibilities. Let’s look at the three very common types of qualitative forecasting models it houses under its name:

- a) Delphi Method- This is the process of surveying a panel of experts and specialists anonymously on a certain topic of interest. Following that, the results retrieved are then summarized and given back to the panel for any further polish. Until the board finally reaches a consensus, this method is constantly repeated.

- b) Expert Opinion Method- As the name suggests, this method is more about soliciting the opinions experts have in a given field. This is typically the easiest way to obtain a forecast. But, here’s the thing, it is important to consider the expertise and biases the experts may have in this case.

c) Market Research Method- As the name indicates, this method is extremely prevalent and is used by companies to understand how well their products or services have been received by consumers. In many cases, this is either done internally or through the help of a certain agency. In the market research method, it generally involves focus groups, surveys, or something as common as blind testing, where a customer is asked to try a product without having any knowledge about its existence. The company further uses this feedback to decide what they should change or keep.

Confused about which forecasting model will work for you?

Why not ask our CFO advisor for free!

2. Quantitative Forecasting Models

Quantitative forecasting models are very different from the qualitative forecasting model. That is because, in this case, the method is more data-oriented where it uses mathematical equations or statistical procedures to predict how finances are going to perform in the future. While qualitative methods generally rely on expert opinions, this method typically uses historical data. Here are its three common models:

- a) Time Series Analysis- This method helps to assess historical data over a timeframe to understand patterns and trends that are going on. As a result, after an exhaustive analysis, these patterns are used to forecast the future values. Therefore, it is considered as an effective method in scenarios where data is available for an extended period of time.

- b) Regression Analysis- This analysis basically inspects the relationship between two or more variables. You can use regression models to forecast the dependent variable based on changes in the independent variable by knowing how one variable (the independent variable) affects another (the dependent variable). How is this any helpful, you may ask? Well, it is incredibly helpful in predicting factors such as marketing budget influencing sales. Read more about planning and budgeting using accounting software like NetSuite

- c) Moving Averages- When you hear the word “moving”, what’s the first thing that comes to your mind? This method, as its name suggests, uses the average of a specific number of recent data points to smooth out any fluctuations in the data. This is especially beneficial for recognizing several underlying trends, formulating forecasts on the basis of them later on. Now, it comes in different variations that allocate numerous weights to past data points, such as simple moving averages and weighted moving averages.

3. Hybrid Forecasting Models

Hybrid forecasting models are known to mix the powers of both qualitative and quantitative approaches. This helps to build a stronger and more adaptable forecasting strategy.

- a) Combination of qualitative and quantitative approaches- These models use historical data, along with subjective insights. While qualitative methods are basically known for recognizing active future events, quantitative models offer you a framework to help assess its financial influence.

- b) Scenario Analysis- This method is more inclined towards giving rise to different hypothetical situations that may occur in the near future based on certain qualitative information. These are the scenarios that take into account several possible industry changes, economic upheaval or trends, and potential new regulations. After that, quantitative models are used to have a clear understanding of the financial performance of your business in each of the situations. This can be a massive help, especially for businesses that are trying to have a wider range of possibilities.

c) Monte Carlo Simulation- This method is best known for using statistical simulation to monitor any potential risk or jeopardy that may be associated with any future forecast. With it, you can just draft a probability distribution of any relevant outcome contingent on several simulations with varied inputs based on qualitative information and historical data.

Now that you know the types, it is time to jump on something more relevant to this section. That is, having an understanding of your business requirements. Without any more delay, let’s get into it.

Assessing your Business Needs

Let’s now look at the key steps to assess your business’s needs for financial forecasting. Here’s a rundown:

1. Identifying the purpose and objectives of financial forecasting:

The very first step is outlining your goals for your financial forecasts in detail. Do you want to plan for growth, control cash flow, obtain funding, or prepare for possible changes in the market? Either way, there can be several purposes behind it. Let’s look at some of the common purposes:

- Strategic planning: Forecasts typically help guide choices about upcoming capital expenditures, new product development, market penetration, and general company orientation.

- Resource allocation and budgeting: When you have proper forecasts, you can set realistic budgetary needs and allocate them to expenses, inventory, and staffing.

- Fund securing: As you may know, investors and analysts usually need financial forecasts to understand how viable a business is.

2. Evaluating the nature of your business and industry:

Predictability is never the same for two businesses. That’s why you need to consider a few factors, including:

- Business stage: There’s absolutely no doubt that startups and early-stage businesses do have their share of uncertainties. For established businesses, though, this does not hold true. That is because established businesses usually have more steady historical data. Read more about credit risk management.

- Industry dynamics: Fast-paced industries, such as technology, come with frequent disruptions. That makes it important for them to house more versatile forecasting approaches that can withstand changing market states. On the other hand, established sectors like utilities might have more predictable seasonal patterns, making more conventional forecasting models possible.

- Complexity of the product or service: Complicated products or services may need more advanced forecasting models due to their lengthy development cycles.

3. Determining the level of detail and accuracy required for forecasts

This is where you have to determine the granularity and accuracy in your forecasts. While some businesses just need comprehensive, yet short-term forecasts to run their daily operations, a few others need long-term forecasts to understand what holds in the future. Likewise, take into account the data at your disposal. Why? Because more precise forecasts call for additional information and resources, at all times.

Considerations for Choosing the Right Model

There are a few things to keep in mind when you are choosing the right model for your business. Here are some of the considerations you need to know about:

- a) Data Availability and Quality- Question yourself, “What sort of data do we have?” Always make sure you have adequate, high-quality data. In case the data you house is precise and abundant, you may have more room to choose a detailed model. What if you don’t? In that case, go for a simpler approach.

- b) Forecasting Horizon- The first thing that you need to do is understand how far ahead you may need to forecast. What exactly are you looking at right now? Is it just a couple of months, a year, or multiple years down the lane? Short-term forecasts are usually easier to tackle, while long-term forecasts often need more detailed, sophisticated models.

- c) Complexity and Resources- Always check for how sophisticated the model is along with the resources you have. Complex models indeed provide more comprehensive results, but at the same time, they also need more time and experience. Many cannot afford to have that. Always make sure that you have the right knowledge and time to tackle the model you go for.

Want professional help with your business forecasting?

Consult our expert accountants.

- d) Flexibility and Adaptability- Go for a model that can change as your business progresses or the market changes. You need a model that can update seamlessly, especially if your business is rather fast-paced and unsteady.

- e) Risk and Uncertainty Management- Have you ever thought about the risks and uncertainties present in your business? If not, then do it right away. Select a model that can cater to these uncertainties and address these risks.

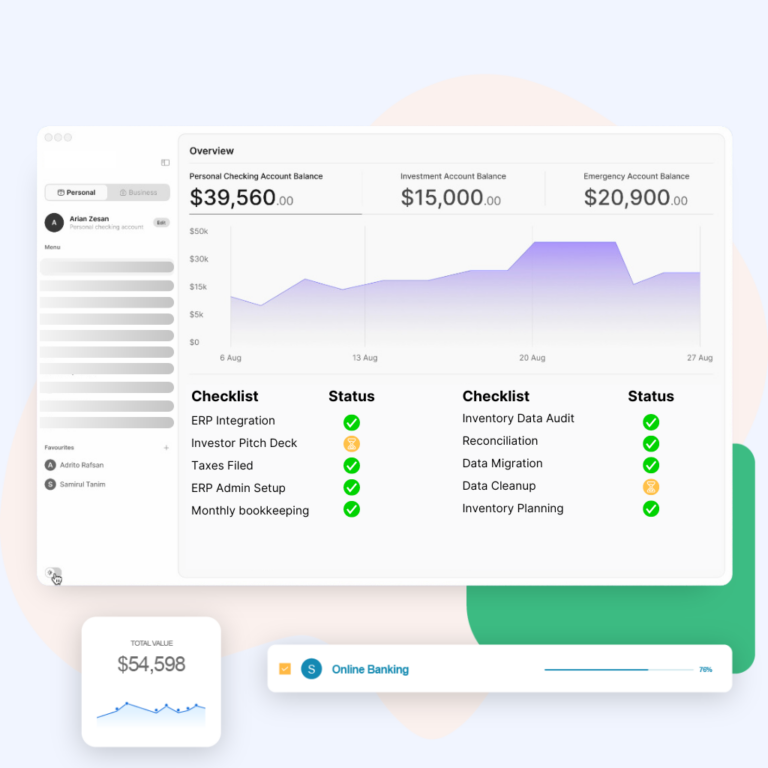

Implementing the Chosen Financial Forecasting Model

Once you know the right financial forecasting model, you need to implement it right. Here’s how you can do it:

- Gathering and preparing data for analysis: Gather all the financial data you would need for the forecast. It can be anything between sales to expenses, and everything in between. Now, it’s time to clean the data to make sure it has no discrepancies.

- Building and validating the forecasting model: Make use of prepared data to create your forecasting model. On the basis of the model, this may entail formula setup, software configuration, or statistical analysis. After it has been built, you must validate the model. How? Well, by comparing its forecasts against the existing data to match precision.

- Incorporating feedback and adjustments: Always make sure that you are presenting that data to priority team members for immediate feedback following the initial validation. Why should you do that? There might be parts that you would most likely miss but they won’t. Leverage this feedback to make necessary changes, as and when needed.

- Communicating the forecast results to stakeholders: This is the last step and usually the most fundamental one. Make sure you present the forecast result to your business stakeholders in a very readable, clear, and informative manner. Plus, communicate how forecasts can affect individual areas of the business. Finally, be sure to go over every possible course of action based on the forecast’s results.

Best Practices for Financial Forecasting

Now that you know every step of financial forecasting models, let’s see and adopt the best practices associated with them.

- Regularly review and update forecasts: Financial forecasting is not a “set it and forget about it” thing. Make sure that you are reviewing and updating it to reflect any new business changes or shifts in strategy. This might be done annually, quarterly, or in fact, monthly – as and when deemed fit.

- Monitor actual performance against forecasted figures: Are you closely checking whether the actual financial results match your forecasts? If not, you are risking major gaps in strategy. Make it a practice to compare your real financial results against the forecasts. This can help you gauge why and where exactly the variances have taken place. Use any of these 6 financial forecasting software for small businesses.

- Incorporate feedback and insights into future forecasts: To make better forecasts in the future, incorporate the knowledge gathered from previous forecasts and actual results. You can also encourage different departments in the business to leave feedback on the same.

- Continuously improve forecasting processes and models: Financial forecasting models are never just a one-time task. They are continuous in nature. Always adopt breakthroughs in technology or data sources that can contribute to an efficient forecast.

Common Challenges and Solutions of Financial Forecasting

Financial forecasting is definitely very powerful in itself, but it does come with its own challenges. Here’s a rundown of what we mean:

- Choosing and Implementing the Right Model- The first challenge is always choosing the right model. This is where you need to weigh your aim, industry, and available data. In certain cases, you can choose the hybrid model as it brings awesome flexibility. Oftentimes, data integration can also become significantly tricky. It is during these times that strong data management systems can capture vital factors without making the process any more complex.

- Overcoming Data Limitations and Uncertainty- Limited historical data can definitely be a giant problem, especially if you are running a startup. If you want to improve your data, then it’s best to add market research, competitor analysis, and industry benchmarks to it. Plus, you can also leverage scenario analysis as it poses as a big help to explore multiple potential impacts and out-of-the-box possibilities.

In Wrapping up

Financial forecasting is more like a map that guides businesses in the right direction. It shows whether their decisions are in sync with the patterns and trends going on in the industry. In simple words, it helps business analysts, investors, leaders, and lenders make wise decisions about a company’s future.

Without proper forecasts, there would be a pile of guesswork, with team members scrambling to find out what’s going to happen next. On that note, it’s true that predictions will not always be 100% accurate, but with proper forecasting models, you will at least know what to expect.

Using this data helps businesses make decisions about how to invest and expand. While, analysts use it to predict the company’s future gains. Just like them, several stakeholders use this information to gauge a lot of other things. This makes financial forecasting as important as any other business decision.

The truth is, forecasting’s main objective is to facilitate planning for the unknown rather than to make predictions about the future.

That’s about it. If you have more questions, The Ledger Labs is here to help. Get in touch with accounting and bookkeeping professionals in the US who have 12+ years of experience in this field to know more.