1. A well-maintained accounts receivable system can increase cash flow by 30% in businesses.

2. Automated invoicing can reduce late payments by 20%.

3. Implementing collection strategies can cut bad debt by 10% annually.

4. Regular accounts receivable audits can improve collection rates by 15%.

5. Using payment reminders boosts on-time payments by 12%.

Accounts receivable clean-up might seem alien and complex, but it is essential to your business’s finances.

This is one of the approaches that prevent the risks associated with cash flow interruptions and rising bad debts.

In the middle of high-priority accounts that demand your constant attention, keeping a small collection of low balances from expanding is incredibly important.

If you neglect it, you might have to experience a situation requiring far too much time and resources to rectify. This makes accounts receivable clean-up the lifeblood of seamless financial operations.

But what exactly is it, and why is it even necessary?

Let’s talk about this in detail.

Accounts receivable clean up – why is it needed?

In corporate accounting, it’s pretty usual for an excess of past-due invoices to get overlooked. In general, this essentially happens due to factors like staff changes, the introduction of new accounting systems, or additional operational challenges.

This is why conducting a deep clean-up or auditing your accounts receivable (AR) is best for your company. In return, this proactive approach helps to stop a minimal number of overdue invoices from escalating into a massive pile that might need to be sent to collections or written off.

Now, why exactly is it needed? Well, your company needs to be aware of those who owe you money and for how long. The idea is much more than just tracking down various payments. More essentially, it is about fostering a healthy cash flow within the business. But how to go about it? We’ll explain.

1. Checking the current state of accounts receivable (AR)

No action can be taken without establishing a baseline potential. So, the first step should be reviewing the current state of your ARs. This has two steps:

- Reviewing outstanding invoices and unpaid balances: To begin you must review all outstanding unpaid balances and invoices. Nonetheless, this step includes a comprehensive examination of every invoice to get further information of its age, the reason for non-payment, and the customer’s payment history.

- Identifying common issues and challenges: One of the major areas of this process is recognizing all common issues and challenges that result in delayed payments. It can usually be anything between incorrect amounts to misleading payment terms that might have left clients baffled about their obligations.

In addition, customer miscommunication is one of the largest factors that lead to delayed responses as well.

There are several other factors that can build a bottleneck in your cash flow. That is why understanding each of them is vital for creating an efficient clean-up approach.

2. Developing an AR clean up strategy

Once you have checked the current state of ARs, you know the pain points that you should address. Now is the time to create an AR clean up strategy.

1. Setting clear goals and objectives: Are you tracking AR performance metrics to make sure the processes are operating properly? In other words, you need to establish specific and equally measurable goals for a strategic AR clean-up. This can largely comprise minimizing the approximate Days Sales Outstanding (a.k.a DSO) or decreasing the invoice percentage over 90 days due.

2. Prioritizing invoices and customers for clean up: After you clearly understand your goals, prioritize which invoices and customers need instant attention. Accordingly, it can be based on several factors, including but not limited to:

- Invoice age: The older the invoice, the more attention it requires.

- Customer importance: Clients with whom you have had a long-term relationship with might prefer a different approach than usual.

- Payment history: Customers who usually have a significant history of late payments might need more specific follow-up procedures than others.

- Invoice value: Invoices with a high value may have a more significant impact on your cash flow.

- Risk on non-payment: The more the risk associated with an invoice, the quicker the action should be taken.

- Analyze the root cause: Now, you need to understand why an invoice is unpaid to date. This is where conducting a root cause analysis becomes highly important to understand the underlying causes for delayed payments.

Therefore, the reasons could be anything between billing errors, inefficient AR processes, and disputes over goods or services.

Want help with AR strategy?

Ask our Expert Accountants!

3. Implementing effective collection strategies

Creating the strategy is just half the work. The other half is seeing that it gets implemented. This has following two aspects:

- Communicating with customers about overdue payments: Formulate a strategic communication blueprint that readily reminds customers of their outstanding payments. If you want to resolve an issue like this faster, you need to take a better step and tailor your communication directed at them. As a result, this can resolve underlying issues quicker and more effectively.

- Offering discounts or payment plans to encourage prompt payment: For people who are under the radar of financial strain, offer them discounts, payment plans, or just encourage prompt payment. This is one of the many methods that can be specifically effective in 2025, given the dynamic financial circumstances of customers. In this case, you can encourage customers to pay up with early discounts and settle prior to the due date. Now, these discounts may or may not be significant. More often than not, even a smaller chunk can be a huge motivator.

In many cases, you can also adopt flexible payment plans and present them to customers before the due date is closer. As a result, it can allow them to pay in installments for a specific timeline. It is extremely important to track metrics like the reduction in DSO, the percentage of customers availing discounts, and the recovery rate from those tied with a payment plan.

4. Resolving discrepancies and disputes

While implementing collection strategies, you may hit roadblocks and need to resolve certain issues. Again, there are two aspects to this:

- Investigating and resolving any billing errors or disputes: Avoid any and every dispute that may arise during the process. That is because disputes can take up much of your time and result in increasing errors. Always investigate and resolve disputes or mistakes in billing that can result in massive payment delays.

- Maintaining open lines of communication with customers to address concerns: Your job is to stay open to all forms of communication that come from consumers. In simple terms, always try to keep an available communication channel with customers who may have large piles of concerns or problems, hampering their ability to pay before the clock ticks off.

5. Streamlining the accounts receivable process

Once you are done with resolving issues, now is the time to smoothen the workflows.

- Implementing automated invoicing and payment systems: Manual processes consume a lot of time and resources, usually ending up with huge amounts of errors. As a solution to this issue, you need to adopt automated invoicing and payment systems that can massively minimize errors, save you time, and also enable quicker processing of payments.

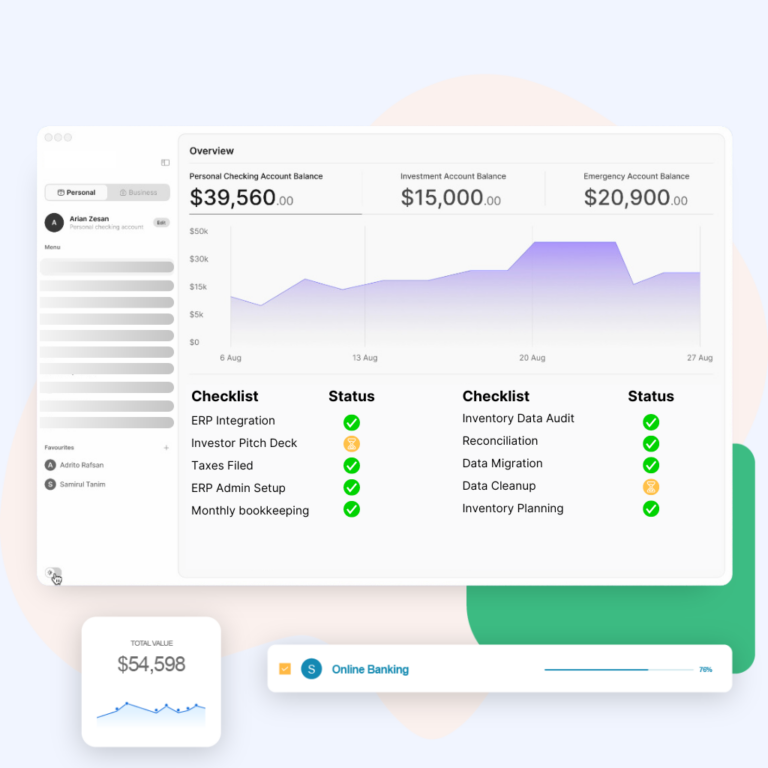

- Utilizing technology and software to track and manage accounts receivable: Real time insights can keep your head above the water. In order to have real time insights, you can use technology and customized software that help to track and tackle accounts receivable. In this way, you can gain a better insight into all the analytics and use it to make sound decisions over time.

See how technology can help you track AR better

Get expert help

6. Monitoring and maintaining clean accounts receivable

You’ve got all things going fine. Now is the time to keep up the good work. Like literally!

1. Regularly reviewing and reconciling accounts receivable balances: Always be open to conducting regular reviews and AR reconciliations. This is especially done so that there are no underlying loopholes that need to be addressed immediately, or can create potential pitfalls in no time.

2. Implementing preventive measures to avoid future issues: Ask yourself, are you taking the proper measures to prevent future problems? If not, then start already. If you’re not sure how to, then implement these major preventive measures:

- Have a clear credit policy: Describe clear credit terms and conditions. This comprises transparent payment due dates, credit limits, and late payment fees.

- Perform timely payment checks: Are you conducting regular credit checks on new customers to analyze their risk of default? If not, start now. This, in turn, can prevent rising bad debt and safeguard your business for the long term.

- Offer multiple payment modes: Start offering several payment methods to people. As a result, it can cater to the diverse choices customers might have. This can make it even simpler for customers to pay their invoices on time (sometimes, before the due date even comes closer).

- Have a robust collection plan: By 2025, you should have a clear, consistent, and effective collection blueprint to address overdue accounts.

Summing Up

In times when the economy and competition are growing side by side, efficiently cleaning up and increasing collections from AR is becoming more essential to have a strong cash flow.

It’s all about ensuring your business is doing financially well. Very frankly, the only way to do so is by achieving financial stability.

If you’re wondering how to do that, it is simple.

Always have a smart, innovative, and clearly emphasized strategy that can help you see your goals, and never get sidetracked.

Have more questions? Get in touch with our certified accountants with 12+ years of experience, and get instant answers.