1. 43% of small businesses don’t track their inventory, leading to poor stock visibility and operational inefficiencies.

2. 62% of businesses experience financial losses due to inaccurate inventory tracking and management.

3. 72% of businesses aim for real-time inventory tracking using automation and sensors to streamline supply chain operations.

4. Proper inventory valuation methods, like FIFO, LIFO, and Weighted Average, directly impact financial reporting and strategic decision-making for businesses.

How you record the stock in your inventory can be a game-changer for your business.

Accurate accounting for inventory helps you better analyze and strategize your e-commerce business.

Shipment delays, inaccurate inventory tracking, and improper inventory valuation can only add to your problems as a business owner.

So how can you avoid this?

And how can you properly account for inventory for your e-commerce business?

Let’s talk about that in detail.

Let’s Talk About Inventory Management… In Detail

Understanding the importance of e-commerce inventory management comes with the knowledge of the type of inventories there are.

Your business inventory includes the products you already have access to and are yet to be sold. So, if you have an online clothing business, the clothes hanging on the racks, waiting to be sold, are part of your inventory.

Most businesses purchase products from wholesalers and sell them through their online websites.

Emphasis should be placed on the fact that this is the product that you have on hand — not being transported or undergoing manufacturing.

This stock is with you until someone buys it from your website or any marketplace where you sell, like Etsy or Amazon.

Until you don’t own the product, it can’t be considered your inventory.

Of course, this information is available to you if you actively monitor your inventory.

Zippia says that about 43% of small businesses don’t track their inventory while 23% don’t even keep any stock to begin with.

If you believe that you can get this information from your suppliers, then you may be setting yourself up for blunders, and possibly loss.

About 62% of businesses undergo financial loss due to poor inventory tracking.

Depending on the inventory report provided by your suppliers can be a sign of laziness because their sheet may not match your balance sheet. For instance, you might find an inaccurate balance or accidentally repeat products that your business has already sold.

Now, this isn’t the only type of inventory that you may have. If you’ve got a factory where you produce the goods that are eventually sold on your website, tracking your inventory can be rather challenging.

This type of inventory moves through phases.

Let’s break it down:

- You’ve got raw materials — these are essential components that are put together to give your final product its shape. For instance, you have sheepskin leather that you clean and manufacture into a sheepskin leather jacket.

- On-going processing — this is the part when your raw materials are undergoing a process. Taking the above example forward, this is the part when you’ve cut the design of your leather jacket and are adding studs and zippers to transform sheepskin leather into a rugged motorcycle leather jacket.

Final goods — now your product is ready to be sold online. And ending the example we provided before, this is a complete product sitting on your inventory shelf, waiting to be sold.

How Often Should You Record Your Inventory?

When you initially start, you hope to find an accounting solution that will sync your sales data and automate the entire process.

Approximately 72% of businesses aim to bring real-time visibility to their supply chain operations with the incorporation of sensors and automation.

For example, businesses want to sell their product from their website and have their sales data instantly and automatically sent to their inventory and books.

Does such a tool exist? Yes.

Is it affordable? Well, it depends on your business needs.

Recommended: Best E-Commerce Accounting Software

Although various accounting software are available, they are often challenging to use and pricey.

Sometimes, they don’t sync correctly and result in wrong reporting.

To avoid such blunders, you should hire an accountant to keep the accuracy of reports in check.

It’s always best to subscribe to accounting software while also monitoring the record of your inventory regularly. Now that doesn’t imply daily tracking, rather, do track it monthly or every quarter.

How often you track your inventory should always depend on your business needs.

Whether you do it weekly or monthly, the process should be developed and implemented across your business units.

With the right numbers, you can develop a better understanding of your inventory, as this information makes your business operations more efficient.

And, as your business grows, you’ll have to reconsider the frequency and regularity of tracking your business inventory.

Excel or Accounting Software — What’s Right For Your Business?

You can track your business inventory with accounting software… or also with an Excel spreadsheet.

The method you opt for depends on your business size and its operations.

Excel spreadsheets are easy to use but can be limiting if your business is scaling. In this case, continuing with spreadsheets can easily be an e-commerce accounting mistake.

And if you’re at this stage, you will find yourself wanting to invest in an inventory software solution. Choosing the right software can save you from headaches and stress.

Ideally, you should opt for an inventory software that easily integrates with your accounting software.

The best way to proceed is by hiring a professional accountant to help you monitor and manage your inventory using effective software.

Understanding Inventory Valuation

Inventory valuation is a method that helps e-commerce businesses track the value of the stock that is sitting in their inventory. This information is essential when producing your company’s financial statements.

The data can help you extract the turnover ratio of your stock and can dictate your future buying decisions.

Let’s break it down into an example:

Let’s say you have an apparel business and you’re left with 150 ready-to-deliver leather jackets in your inventory at the end of a quarter. Now when you calculate this quarter’s financial statements, this information has to be reflected in your company’s balance sheet.

Furthermore, you should realize that you might have paid a different price for these products at the time of their purchase. That price could be lower or higher than it’s price now, due to inflation and other factors.

Identifying its original price and comparing it with the present one can make a lot of difference.

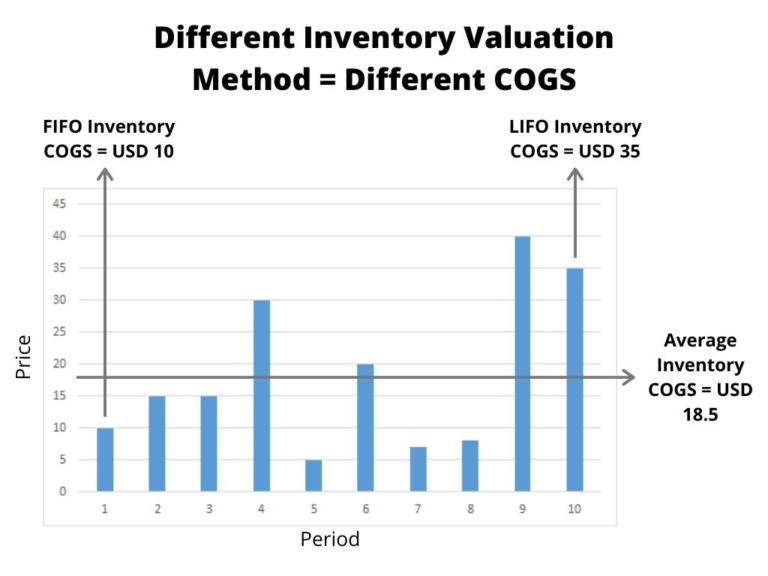

To extract this information, you have three valuation methods.

Types of Inventory Valuation

Three accounting practices help you determine inventory valuation.

1. FIFO — First in, First Out

In this method, you sell products by the arrangement of products listed. As soon as a product is sold, you assume it is the first one on the list.

2. LIFO — Last In, First Out

For this method, you make the opposite assumption. So when you sell a product, it’s assumed to be the last one from the inventory list.

3. WAC — Weighted Average Cost

In this method, you assume the average cost of the product. This cost is calculated per unit and you can get that by dividing the entire cost by the total number of goods purchased.

So What’s The Right Valuation Method?

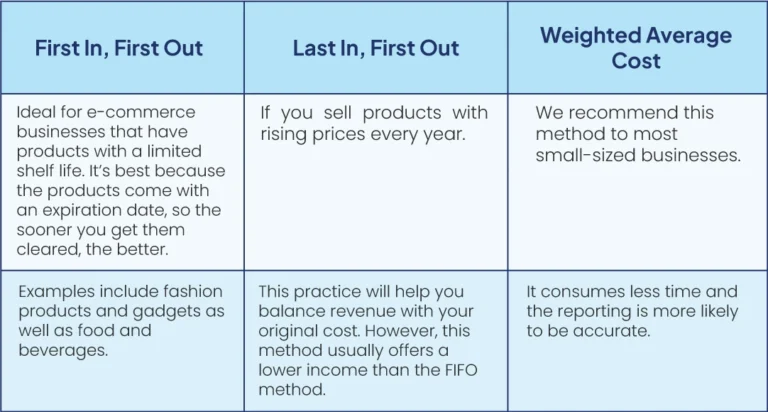

To determine the right valuation method, you have to consider the products or goods you are selling.

You must also remember the number of resources you have employed to manage and account for your business inventory.

While small to medium enterprises should ideally opt for weighted average costs, it has its share of pros and cons. Let’s consider the pros and cons of all three methods.

Performing Inventory Audits

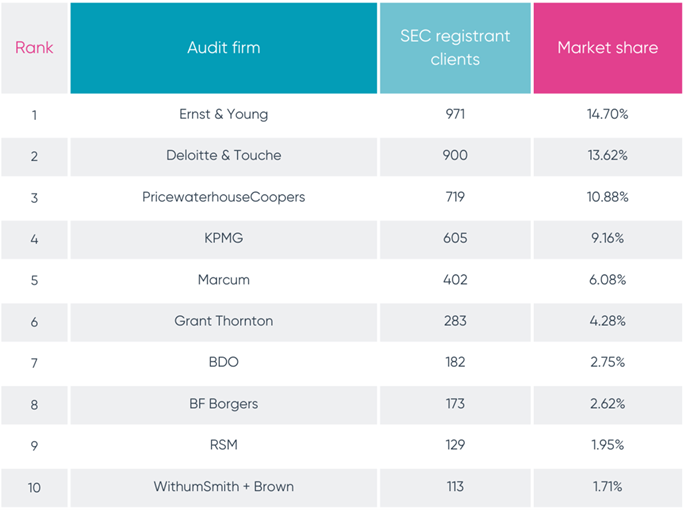

In 2024, about 6,607 Securities and Exchange Commission registrants hired an audit firm to provide them with a thorough analysis of their inventories.

So, what exactly is an inventory audit?

Inventory audits mean counting all the inventory that your business has on hand.

It’s an exhausting process but equally rewarding.

It’s best to conduct this audit every quarter but an annual audit will suffice.

Most importantly, the purpose is also clear – to keep your inventory and balance sheet clear and precise. You should always have knowledge of your numbers as they will shape your business decisions.

As an e-commerce business owner, you might not always get the time to physically count all the stock in your inventory and then report it on your balance sheet. Therefore, choose to delegate or outsource.

You will be surprised to see how this one step can make your business operations more efficient and profits higher.

Let’s start working on improving the financial health of your company.

The Bottom Line

79% of businesses have reported that efficiency in supply chain management helps them increase their revenue.

This number should reflect how you handle the accounting of your business inventory.

Ledger Labs has effectively helped businesses manage the accounting of their inventories for over 12 years.

With our expertise in AI and a deep understanding of e-commerce accounting tools that your business generally uses, we help businesses optimize their financial growth and profitability.