Today, businesses are impacted by the recent announcement from Bench Accounting about the shutdown of the service. Although the services resumed following the acquisition of Bench, many finance leaders are still exploring alternative solutions due to the sudden change.

There has been a rampant movement of accounts and clients ever since the announcement was made.

This post will help you to make an informed decision whether to stay parked with Bench or move to a newer alternative.

- Uncertainties like company acquisitions and getting locked out of important bookkeeping software could happen at any time. You need to have professionals who will be able to aid the situation right then and there and have the ability to migrate your accounts to a new platform within a day.

- No matter how easy accounting software may seem, you can’t do it all by yourself as a business owner. You need experts who understand bookkeeping in and out and don’t solely rely on software – even in case of emergencies.

- Your accounting and finances need an offline backup almost every day that will allow you to access and migrate them even if your traditional accounting software locks you out for some reason.

The story behind Bench’s acquisition?

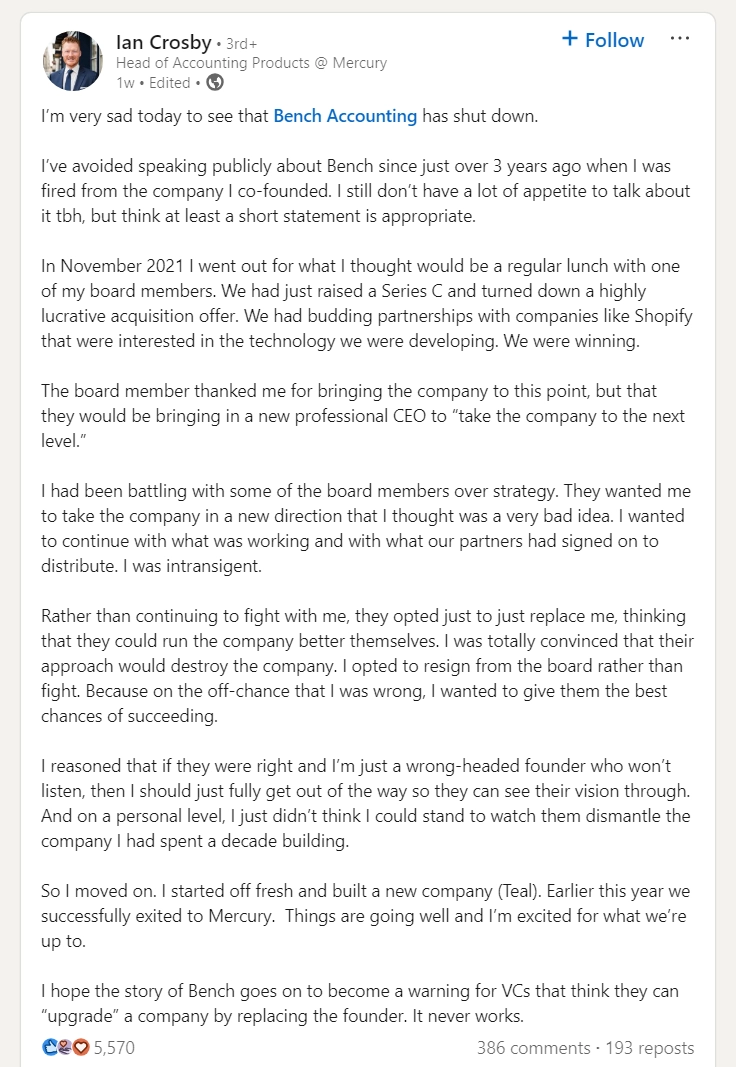

The VC-backed bookkeeping platform, Bench Accounting has caused a widespread movement of accounts for its customers after abruptly announcing its shutdown on Friday, December 27, 2024.

This has caused thousands of customers to get locked out of their accounts. The Vancouver-based start-up‘s notice of closure has led to businesses that use its software scrambling for solutions, right as year-end and tax season emerges.

As the following Monday approached, payroll and onboarding tech company, Employer.com announced the acquisition of Bench in its last-minute deal, and customer login was restored.

But the looming question remains, what about customers’ trust?

Should Bench’s quality of service be of concern now?

The Bench acquisition came unannounced – which of course, brings up questions of safety and trust among customers.

While plans are to revive Bench’s existing platform and allow customers to regain access to their data (with an option to either port their information or continue using the service as is), most business owners would rather prefer a quick solution rather than waiting for who-know-how-long.

Amongst the chief concerns, some of the highlighted are the impacted workforce, concerns raised on the quality of services, and the platform reliability both during transition and in the long term.

Here is what, Bench former CEO and co-founder Ian Crosby released a statement on social media that further evaluates the question pertaining to the company’s direction over the past few years, following his abrupt dismissal.

What Should You Expect and Require from Your Future Accounting Provider?

Bench mostly offered basic “modified cash basis” books and basic (focused on filing, not tax optimization) corporate tax preparation, with limited support through a chat system.

Maybe that’s exactly what you need going forward, or maybe not.

This is an opportunity to take a step back and think about what your financial, accounting, and compliance needs are and will be over the next few years, and select a provider that will meet those needs.

In the introspect, there are three prominent segments which would looking for bookkeeping services:

- If you are a low-spend (< $5k / month) solopreneur-style business so that you can remember all of your expenses in your head, compliance-oriented books and basic tax filings without tax planning might be ok (there’s not enough bills to optimize). There is likely an ideal world out there where you find your bookkeeper and tax preparer that you trust, that will perform reasonable work, but not eat up a ton of your time, that is reasonably inexpensive.

- If you’re a larger business, work with a tax preparer who will do some tax planning and optimization with you, because it will pay for itself many times over. Work with a bookkeeper who’s going to provide you with the reporting and insights to know how to manage your spend, because it will pay for itself many times over.If this enables you to focus on higher-ROI activities, consider hiring someone to handle payroll, sales tax and vendor payments.

- If you’re a venture-backed company, you should be getting accrual-based financials classified monthly. That’s what your investors will be expecting, and it avoids where you are running around when you end up doing fundraising or M&A at short notice. If you are raising a Series A, you should also generally be working with a professional (a fractional CFO) on running the business against an operating model and budget.

What’s the alternative moving forward?

If you are a growing startup requiring strategic CFO support, you will find Ledger Labs as a strong contender to streamline your finances and empower confident decision-making.

Of course, it seems like an important plug to mention our service, but it’s important that we remind you that we’re not accounting software. Rather, we’re a decision-making team for your business that prepares for uncertainties like these and keeps you safe beforehand.

Your numbers and finances are the backbone of your business and you can’t afford to have lock-outs. You need a team that can do just fine even if Bench is completely removed from the picture.

We’re a team of experts that specialize in all types of accounting and bookkeeping services. We’ve dedicated teams for ERP integration and setup, e-commerce accounting, and handling other parts of your online business.

LedgerLabs is your unrivaled accounting partner, the best alternative for Bench accounting services, the only thing worth the money with a customer-oriented approach. Here’s why:

Simple Pricing Structure: A fixed Fee Model for predictable cash flows bids adieu to surprise bills, and concentrates on building your business.

Full-Service Accounting: Bench is primarily a bookkeeping service, but LedgerLabs is your all-things accounting. We provide a comprehensive range of services from bookkeeping, payroll, tax filing, and advisory seamlessly integrated into one place.

Robotically Rapid Response Times: We prioritize efficiency, ensuring you get well-articulated answers in no time. Because SLAs are defined, we never leave questions and concerns up in the air.

Innovative Integration: Bench focuses on automated solutions, but LedgerLabs integrates the latest technological developments with the touch of skilled professionals to give you customized strategies to achieve your ambitions.

Bring More Than Just Numbers to the Table: Ledger Labs provides actionable financial insights, offering you the data you need to make informed decisions and drive growth.

We get it – Managing and building an eCommerce business isn’t an easy task. It’s even more challenging when your traditional bookkeeping software shuts down without any warning. The priority is to make the transition one, that does not affect your eCommerce bookkeeping.

Moving to LedgerLabs is more than a solution, it brings you a powerful accounting Swiss knife, personalized support, and an organized approach. This not only allows for a smooth transition, but it also arms you with all the tools, insights, and expertise to maintain financial results over the long run. With LedgerLabs, you can confidently navigate this change and position your business for sustainable growth.