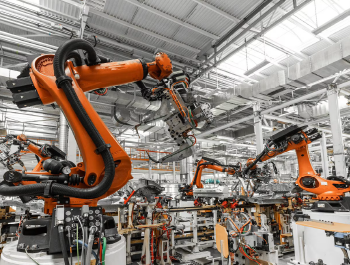

Hiring an accountant isn’t just about keeping your books clean. Between fluctuating material costs, labor complexities, inventory shifts, and margin pressure, manufacturing businesses face financial challenges that go far beyond basic bookkeeping.

So, when should you actually bring in an accountant? The short answer: before the financial mess starts costing you serious money.

Here’s a breakdown of key moments when hiring an accountant isn’t just helpful — it’s necessary:

1. When You Can’t Clearly Track Production Costs

If you don’t have a reliable system for tracking how much each product costs to make — including materials, labor, and overhead — your pricing decisions are based on guesswork. That guesswork erodes margins over time.

An accountant helps you:

- Build accurate cost of goods sold (COGS) structures

- Set up job costing or process costing systems

- Allocate overhead properly across products or locations

2. When Your Inventory Numbers Don’t Match Reality

Inaccurate inventory is one of the most common issues we see in manufacturing. If your books say you have 3,000 units and your floor shows 2,400 — you’ve already got a problem.

An accountant helps you:

- Set up real-time inventory accounting

- Reconcile stock levels with financials

- Catch shrinkage, waste, or misallocations early

3. When You’re Growing — Fast

Growth adds pressure on every part of your operation. More customers. More materials. More employees. More mistakes — unless your financial systems can scale with the business.

Signs you need accounting support:

- New product lines or SKUs launching

- Adding new vendors, warehouses, or sales channels

- Expanding into new states or countries (bringing tax and compliance complexity)

An accountant ensures your financial infrastructure doesn’t collapse under rapid operational expansion.

4. When Your Cash Flow Feels Out of Control

It’s common to sell a lot, ship a lot — and still struggle to pay bills. That’s often because cash flow isn’t being tracked properly, or payment cycles are misaligned.

An accountant helps you:

- Forecast cash flow based on production cycles

- Spot upcoming cash gaps before they hit

- Align payment terms with supply chain and client cycles

5. When You’re Getting Ready for a Loan, Audit, or Exit

If you’re planning to apply for financing, prepare for an audit, or even sell your business, your financials need to be accurate, defensible, and cleanly structured.

You’ll need:

- Properly categorized and reconciled financial statements

- Detailed depreciation and fixed asset tracking

- Clean, auditable books that withstand lender or buyer scrutiny

Don’t wait until the bank or buyer finds your financial inconsistencies for you.

You don’t need to wait until there’s a crisis to bring in an accountant. The earlier you build strong financial systems, the less costly your mistakes — and the more confidently you can grow.

If your manufacturing business is starting to scale, facing margin pressure, or just tired of financial confusion, it’s time to hire someone who can bring order to the numbers. At Ledger Labs, that’s what we do — not just by closing books, but by building accounting systems that support how manufacturers actually operate.

My main problem always has been to know my accurate profits & this is precisely what Ledger Labs helped me with. They went through my entire supply chain costs, my monthly operational expenses, and COGS and got me the correct costing of my goods and the cost of running the business. Now I know how much I need to sell & at what price I should sell it to be profitable.

Ariel Robinson CEO & Founder