1. Property management accounting ensures precise tracking of income and expenses, supporting profitability analysis and tax compliance.

2. Budgeting is crucial for estimating future maintenance costs, repair needs, and operational expenses.

3. Common reports like income statements and balance sheets provide insights into property performance and financial health.

4. Regular audits help identify discrepancies in property finances, ensuring accurate accounting records.

There’s no doubt you have put your heart and soul into building a stream of income through your rental properties.

But, here’s the truth – Without a proper and effective accounting system in place, you are probably flying blind.

From all the payments that you receive each month, imagine keeping clear tabs on them all the time.

That being said, it is unquestionably efficient to have a clear picture of the earnings each individual property produces.

In other words, one of the primary responsibilities of a property manager is to make sure they are managing their income, expenses, and assets effectively.

Looking at it today, property accounting is not just any requirement, as people call it.

It is what helps you understand your investment’s real potential and ensure long-term, steady profitability.

But, that’s not even half the story.

When you report the income and expenses of each property, the IRS (Internal Revenue Service) will have their eyes open – looking for holes in the report. That’s where you need to make sure everything is in the right spot. With good property management accounting, you can have a closer look at your expenses and maximize tax deductions.

But, here’s the question, what is property management accounting?

Let’s talk about it in detail.

What is Property Management Accounting?

Property management accounting is the meticulous financial management and tracking of all the cash that comes in and goes out of a property.

When we talk of expenses, it could potentially cover minimal costs to significant expenditures, including routine upkeep, renovations, landscaping, maintenance, and any other statutory fees.

On the other hand, when we consider the income end, it is basically the rent collected from tenants.

Moreover, there are certain tasks to be fulfilled in property management accounting. These tasks can be anything from making and processing invoices, preparing and submitting financial statements to the reconciliation of the balance sheet.

If you do it properly, property management accounting comes with a list of benefits you probably cannot guess in one go. In simple words, when you keep an accurate and updated record of your expenses, you can leverage it for several tax purposes. For example, it is incredibly beneficial to claim deductions.

That being said, a transparent view of your portfolio’s profitability can always help you make sound and wise decisions nonetheless – especially when you set rent amounts, purchase a new property, or upgrade the existing ones.

In the long run, this strategy can positively influence the financial well-being of your real estate investments.

Importance of Accounting in Property Management for Real Estate

As you know, fortunes can be lost as easily as they are made with just one investment. This is where careful and accurate accounting practices become important. It is basically the foundation on which your investments are built on. In other words, good accounting in property management ensures you safeguard your profits, while maximizing them in real-time.

With it, you can have proper visibility across your revenue, expenditures, and overall profitability of each property. In fact, good accounting practices can help maximize tax deductions as well. In simple words, when you track and subtract operating expenses (including but not limited to repairs, general upkeep, depreciation, and utilities), you can lessen your taxable income and harvest the profits over time.

That brings us to the question, why do we need it so badly? What makes it so integral to the process? Well, here’s your answer in detail.

Read more: Cash Flow Real Estate: Formula to Success

Why do we need Accounting for Property Management?

This is actually a very good question. For those unfamiliar, here’s a rundown of why we need accounting for property management:

Gain deeper visibility into financial operations

Property management accounting can help greatly in the tracking and recording of financial transactions in the most accurate form. From cash flow analysis and financial performance evaluation to budgeting and forecasting – you need it for almost everything. This granular visibility helps managers understand the cash inflow and outflow more in detail to assess the financial health of the property.

Pinpoint opportunities for cost optimization

With accounting for property management, you can identify certain areas where costs can be cut down. In other words, this offers you a comprehensive breakdown of expenses and exhibits a detailed comparative analysis you can leverage down the line. In fact, managers often use this to understand patterns in spending spread across numerous properties and pinpoint areas that hint at inefficiency.

Facilitate timely settlement of business obligations

With it, you can always be on the right side of the bed. In layman’s terms, automated systems make sure that every single financial obligation is settled properly and on time. These financial obligations can include the collection of rent and accounts payable, which mainly consist of tenant rents and supplier bills. This system is greatly beneficial in terms of preventing late payments, maintaining a steady cash flow, and fostering healthy business relationships.

Maximize use of available business assets

Property accounting helps make sure that all assets are being used to their maximum potential. It does so by providing thorough and comprehensive financial reporting and budgeting. In fact, smart resource allocation and budgeting maximize the use of company assets as they avoid unnecessary spending and allocate money to areas that yield the highest returns. So go ahead, do it.

There you go. These are some of the reasons (out of several others) that make accounting for property management integral.

Have more questions about Property Management Accounting?

Consult with our in-house experts!

Types of Accounts in Property Management

If you are managing a property, you must have three major types of accounts. They are:

- Rent income accounts: These accounts help to track every single rental income that comes from the tenant side. Always make sure to monitor the main source of revenue to record rent payments properly.

- Expense accounts: These are the types of accounts that help to record all the expenses related to maintaining the properties firsthand. This can include anything, including utilities, property management fees, general upkeep, and maintenance, along with any additional operational costs that surface in between.

- Security deposit accounts: As the name indicates, these are “special” accounts that are used to keep the security deposits collected from tenants. In other words, these funds are often used to cover unfulfilled damages or, sometimes, unpaid rent after the tenant leaves the property.

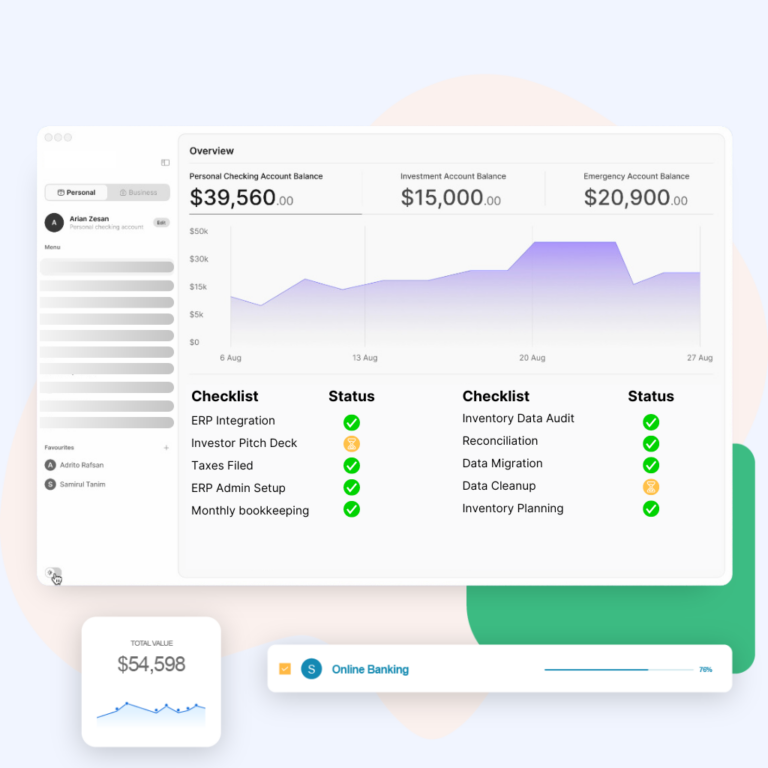

Financial Statements for Property Management

- Income statement: Often also known as a “profit and loss statement”, this statement gives a synopsis of the revenue, costs, and expenses accumulated during a certain period of time. This basically exhibits the net profit or loss. Plus, this is highly integral as it helps to assess the operational success of property management. A free profit and loss template can simplify this process..

- Balance sheet: This financial statement gives us a detailed picture of the assets, liabilities, and equity of an organization over a certain period of time. This is especially helpful for property managers as it gives them a rundown of the financial health of the business.

- Cash flow statement: A cash flow statement, as the name suggests, is a type of statement that helps to understand and track the flow of cash in and out of a business. In terms of property management, it showcases how well the business is managing its cash.

Property Management Financial Terms

Before we get to anything else, it’s important to understand the financial terms associated with it. So here we go.

- Accounting period: This is the specific time frame measured for financial statements. The accounting period is usually calculated monthly, quarterly, or yearly.

- Accounts payable: This is what your property owes to creditors. For example, utilities, vendors, and suppliers, among others.

- Accounts receivable: This is the cash your property is owed.

- Accrual accounting: This is just a process wherein revenue and expenses are recorded right when they have been gained or incurred. It is regardless of whether the cash is actually exchanged or not.

- Allocation: It is the process of dividing up and assigning funds among various periods or general ledger accounts.

- Asset: These are basically the objects or things your business or client owns that have monetary value.

- Bookkeeping: Also called business accounting, this helps to record several business transactions.

- Bank reconciliation: This is simply where you get to compare and cross-check your financial records or accounting books to see if they match your banks.

- Cash accounting: This is a type of accounting method where the revenue and expenses are only recorded during the exchange of money.

- Depreciation: This is basically the loss of value of a particular asset over the course of time.

- Equity: This is, as the name suggests, the very ownership of an asset.

- Chargeback or expense recovery: This is when the property gathers an expense but its cost is to be paid by the tenant.

- Expense: This is the cost that you have to bear for operating your business. It can include payroll, advertising, and contractor fees, among others.

- Credit and Debit: Credit shows whether money is coming into the property

(equity and income). On the other hand, debit is a way to show whether the money is flowing out of the company (expenses). - Fixed cost: This is basically the amount that does not change over time. One example of this is rent.

- General ledger (G/L): A General Ledger is a comprehensive record of all the business transactions you have.

- Generally accepted accounting principles (GAAP): This is the universal accounting standard as set and established by the Financial Accounting Standards Board.

- Revenue: As known, this is basically the income your property generates.

- Liability: This is the amount that your business owes to a third party.

- Overhead: These are the costs needed to run your business outside the actual service.

Set up of Property Management Accounting System

If you want to establish accounting software for property management, then here are your steps to do it.

Understand Your Accounting Needs

The first step is to understand certain accounting requirements for your property management business. In this case, you have to consider several factors, including the number of properties managed, the types of properties, and the very specificity required to track the financial performance of the property.

Choose an Accounting Software

Every good property management accounting system starts with good software. In this phase, you need to choose software that fits your budget and needs. Not to mention, if you want to simplify operations, definitely look for features that assist property management, such as maintenance cost tracking, lease management, and tenant tracking.

Establish Individual Property Accounts

Make sure you establish separate and completely different accounts for each property in your portfolio in order to perfectly track income and expenses. This is especially helpful if you want to bifurcate the financial information for each property. Moreover, it makes it easier to understand the performance of every property in hand.

Have a Chart of Accounts

Always make sure you have a detailed, in-depth chart of accounts which consists of all the important income and expense categories. In this way, you can have an organized set of financial information and guarantee consistent transaction recording.

Implement Rent Roll Management

This is incredibly important. In this step, you need to set up a rent roll system which helps to maintain comprehensive records of all the tenants of your properties, along with rental prices and lease agreements. As a matter of fact, this is largely helpful if you want to have a clear view of your rental income and lease renewals.

Automate Rent Collection and Invoice Payments

You can always choose to automate systems to collect necessary rent payments and pay invoices. In other words, this mitigates the administrative workload, boosts management in cash flow, and also slashes down any errors in billings and payments.

Conduct Monthly Bank Reconciliations

Make sure you are regularly reconciling your bank statements with the accounting records. This is incredibly important, especially because you will want to find discrepancies, avoid fraud, and keep a close check on the accuracy of your financial data.

Produce Financial Reports

This is where you produce all the necessary financial reports, including your cash flow statements, profit and loss statements, and balance sheets. These reports are highly integral to determining the financial health of your properties.

Regularly Review and Analyze Financials

Make sure you are always reviewing, assessing, and analyzing your financial reports. This is where you recognize trends, pinpoint areas for reducing costs, and make sound decisions about how to optimize the profitability of your property management operations.

Best Practices for Property Management Accounting

Just as for every task, there are several best practices for property management accounting. Some of them are:

- Keeping detailed records of all transactions: Make sure you have impeccable records of all financial transactions. This consists of maintenance fees, rent payments, and management fees, alongside any other relevant revenue or expenses. Without a doubt, this helps in accurate financial reporting and streamlines year-end accounting tasks.

- Reconciling bank accounts regularly: As mentioned above, make sure you are conducting periodical bank reconciliations in order to cross-check the transactions recorded in your accounting records against the ones showcased on the bank statements. This is especially helpful when you want to catch discrepancies early on and make sure your finances are well-placed and accurate.

- Budgeting and forecasting for property expenses: Set up and maintain comprehensive budgets for every property you are managing. This is where you get to forecast any future expenses on the basis of historical data and predictable maintenance requirements. With this method, you can avoid any unanticipated pitfalls.

- Handling security deposits and tenant payments: Make sure your security deposits are safe and sound in a separate trust account. Plus, you also need to ensure that it follows state regulations as well. In addition, process tenant payments on time and accurately to make sure there is a good cash flow and even better tenant relationships.

- Having a rainy day fund: It is always easier to tackle unforeseen costs when you have a safety fund in place. Make sure you have a detailed conversation about the size of the reserve fund with rental owners. This is to stay ahead of any unanticipated challenges down the line.

These are just a handful of several other best practices to keep in mind when you want to solidify your property management accounting.

Common Challenges and Solutions

Moving forward, there have to be challenges associated with this term, given the fact that there is so much depth in it. So, let’s have a look at the challenges nonetheless.

Navigating complex regulations

Property management is largely governed by numerous local and state laws. With so many laws around, it becomes rather difficult to keep up. In these scenarios, make sure you get the right help from a professional who knows what they are doing.

Dealing with tenant disputes

If you rent a property, there will always be disputes with tenants about the rent, deposits, and repairs. Not to mention, this is where you would want to stay on the right side of the bed. That means, getting yourself a documented agreement when necessary to fully avoid the tussle.

Balancing multiple properties

When you juggle multiple properties at once, you may go down on resources. To help manage this head-on, use property management accounting software to automate manual tasks, such as financial reporting, maintenance expenses, and rent collection.

Final Thoughts and Key Takeaways

When you have a strong accounting system, it supports and safeguards your investments by properly tracking your revenue, expenses, and total profitability. Without this granular clarity, there can be endless mishaps in decisions that can quickly consume your returns.

But, that’s not it.

A well-oriented, decisive accounting system saves you innumerable hours of frustrations and paperwork.

This tax season and beyond, there will no longer be fighting out endless receipts or reconciling financial statements all because of sound property management accounting software.

That’s about it. If you have more questions, you know who to have a conversation with.

Ledger Labs is just one consultation away. Talk directly to our accounting and bookkeeping experts with more than 12+ years of experience and get answers to your lingering questions.