1. Proper property accounting can reduce costs by identifying inefficiencies and offering detailed expense analyses, enhancing financial decision-making.

2. Automated systems in property accounting ensure timely rent collections, invoice payments, and consistent cash flow, reducing administrative workloads and errors.

3. Key financial statements like income statements, balance sheets, and cash flow statements are critical for evaluating property management performance and overall business health.

4. Regular bank reconciliations and transaction monitoring are vital for fraud prevention and maintaining financial accuracy.

5. Effective property accounting includes rent roll management and automation of rent collection, ensuring smooth tenant management and lease renewals.

In the latter half of 2020, 89.1% of U.S. residents rented their homes.

While this statistic is quite high – the question is, how many of them have a clear idea about real estate accounting?

Well, owning property is an “investment”. It’s overwhelming and exciting in itself. But, after you have purchased your first rental property, an important question comes to mind: How can you keep track of the money coming in and going out?

There are several types of transactions beyond just “rental income”. Some of the pretty common ones are:

- Mortgage payments

- Property taxes

- General upkeep costs

- Repair costs

As you can see, the names are too many to count. It’s normal to lose track once and for all. b It is a method that helps you record every financial transaction. Real estate accounting can help you track rental revenues, taxes, maintenance, and mortgage interests – without you having to keep a close tab.

So, how do you track it? More so, what are its principles and elements? Let’s have a look!

What is Real Estate Accounting?

Real estate accounting is a collection of monthly and yearly financial tasks a business needs to do if they want their business to operate without any hiccups. This type of accounting practices accentuate the income properties can yield, along with other tax-related concerns, including any vital real estate agent tax deductions. Understanding accounting trends can help real estate businesses stay competitive and optimize their financial management.

Just like any other accounting practice, real estate accounting helps track income and expenses to showcase an accurate representation of its financial well-being. This is actually key information, if you did not know. That’s because this information can help with your tax payments and simultaneously prepare business owners for any potential financial audits.

But, why is it even important?

Importance of Proper Accounting Practices in Real Estate

Precise accounting practices in this industry are highly integral, and the reasons are numerous:

- Tax compliance: Real estate comes with significant tax implications. This can include deductions, depreciation, and capital gains. With proper accounting, you can make sure that all transactions are recorded and reported with ultimate precision.

- Investment strategy: Good accounting practices can help investors understand and assess the performance of their properties. Most people don’t realize it, but this is actually very imperative. With this analysis, you can make better decisions about buying, selling, or holding properties, according to market conditions and profitability.

- Risk management: When your financial statements and records are impeccable, you can automatically identify potential risks and manage them head-on. For example, you will have a better insight into varying market trends, vacancy rates, unanticipated repairs, or gigantic maintenance requirements.

These are just a few of the many reasons why proper accounting is important. The hack is to be vigilant, prepared, and as heedful as possible. Frankly, with proper accounting for real estate, you will be just that.

What to Track in Real Estate Accounting?

When it comes to real estate accounting, there are actually three primary areas to look at:

Income

This is basically an umbrella term for the money that comes into the business. Some of the major income streams in this case are:

- Commission income: These are the fees you earn from facilitating real estate transactions.

- Rental income: This is the monthly or biweekly payment your tenants make to keep using your properties for residential purposes.

- Additional sources: This is the payment for property management services or real estate profits.

Expenses

With income, you will always have expenses. These are the costs that help your business keep operating and growing. Some of the common expenses are:

- Operating costs: This can include anything between utilities, repairs, general upkeep, maintenance, and property taxes.

- Marketing costs: You often need to advertise your property before it gets a good name. This is where your money goes into.

- Other deductible costs: This can be anything between office supplies, dues, and subscriptions, among others.

Assets and Liabilities

As the name suggests, this is typically a rundown of what your business owns (assets) and owes (liabilities). Some examples of it are:

- Real estate properties: This is the land, buildings, or houses you have invested in.

- Equipment and supplies: This is a liability. It includes computers, vehicles, or furniture used in the business.

- Accounts payable: In simple words, accounts payable is the sum that you owe to suppliers and vendors.

- Accounts receivable: As opposed to payable, accounts receivable is the sum that you are owed for the property you have provided.

- Mortgages or loans: This can be any borrowed lump sum that you took to purchase properties.

If you own a property or are a real estate investor, you need to maintain good records of your income, expenses, assets, and liabilities. Only then can you have a full, comprehensive picture of how your business is actually doing.

Need to know more about real estate accounting?

Get in touch with our in-house experts for a comprehensive solution.

Why do Real Estate Agents Need Accounting?

If you are a real estate agent, you need to keep tabs on your finances for several reasons. Let’s look at some of them:

Legal and Tax Compliance

In real estate, every minute detail can be complex at first glance. It includes complex transactions and numerous legal or tax requirements. When you do proper accounting, you ensure compliance with certain regulations, such as:

- Keeping track of commission income and expenses for tax filing

- Managing rental income and expenses according to tax laws

- Preventing penalties for poor expense deductions or underreporting income

Financial Management and Decision-making

Good accounting always provides a clear, comprehensible outlook of your finances. Moreover, it gives you the ability to make smart decisions, such as:

- Overseeing cash flow by tracking accounts receivable and payable

- Assessing the type of marketing efforts that generate the best returns

- Determining whether or not it will be important to hire new members

- Pinpointing your most and least profitable revenue streams

Measuring Profitability and Growth

When you have a proper accounting system in place, you can monitor the real profitability above the top-line revenue. Well, in simple words, this lets you:

- Monitor your earnings after your expenses

- Spot trends after estimating year-over-year profits

- Recognize suitable areas for cost cutting

- Set tangible, realistic goals for boosting your net income

Attracting Investors and Securing Financing

In case you need capital for growth and expansion, lenders and investors would want to see a robust financial record that exhibits:

- Healthy growth in revenue, assets, and overall financial performance

- Precise and controlled expense management and cost controls

- Transparent profit reporting and capability to service any debt

- Dedication and commitment to running a fully professional business

Now that you are aware of why real estate agents would require accounting, let’s understand its principles.

Principles of Real Estate Accounting

There are several principles of real estate accounting that you should know about, they are:

- Cost principle: This is basically the acquisition cost of the property. It includes both the purchase price, as well as other expenses associated with the acquisition, including transaction fees, legalities, and additional direct costs.

- Revenue recognition: There’s no doubt that real estate companies need to comply with certain guidelines about when to recognize “revenue”. The revenue that comes from property sales can be recognized when the sale is made. Moreover, it happens when all the major risks and rewards have been transferred solely to the buyer. On the other hand, there’s rental income. In this case, the revenue can be recognized over time, as you earn the amount over the period of the lease.

- Matching principle: As the name suggests, your expenses must be matched to the revenues they help to yield. For instance, the repair costs and property management expenses must be recorded during the same period when you are recognizing the rental income.

- Full disclosure: Your financial statements should provide all the necessary information in order to make it easier for users to decide wisely. It can include absolutely anything, from methods of property valuation, depreciation, to the management of realized and unrealized gains or losses.

- Conservatism: This is one of those principles that talk about exercising caution when reporting financial information. In layman’s terms, this simply means that all the potential expenses and liabilities need to be promptly acknowledged. But, on the flip side, you must report revenue only when it is certain.

- Materiality: Financial reports are required to reveal all “material” facts. In simple words, a fact is considered material if its omission or misrepresentation could severely impact the user’s ability to make informed financial decisions based on the financial statements.

- Historical costs: Unless there are specific circumstances where impairment needs to be taken into consideration, real estate is typically recorded on the balance sheet at its original cost without being adjusted for changes in market value.

- Economic entity assumption: As you may know, real estate accounting must be kept away from any personal finances, particularly in the case of real estate companies.

- Depreciation: Real estate accounting enables property depreciation over the course of its useful life. This, further, helps to offer a systematic allocation of the building’s cost (except the land, of course) across its useful life.

Elements of Real Estate Accounting

In real estate accounting, there are five elements that give you a comprehensive sneak peek into the financial health of your properties. So, without further ado, let’s have a look:

1. Assets

Assets are the reserves an individual or entity owns. In other terms, these are funds that can be easily converted into cash.

2. Liabilities

A person’s or business’s liabilities are the debts or financial commitments they have taken on. These are further segregated into two different categories: Current liabilities and fixed liabilities. Current liabilities are the debts that are payable within a year, while fixed liabilities represent the obligations that can be paid beyond one year.

3. Equity

Equity basically shows the net worth or ownership value of an entity after deducting what it owes (liabilities) from what it owns (assets).

4. Income

This is actually the amount an individual or party receives for the services they have provided or the work they have accomplished.

5. Expenses

As the name indicates, expenses are any amount that has been consumed due to daily business activities and operations to keep things running smoothly.

Accounting Best Practices for Real Estate Agents

Are you a real estate agent? If you answered yes, then you need to keep these tips in mind.

Maintaining accurate and up-to-date records

If you are a real estate agent or real estate accountant, it is incredibly important that you keep impeccable records of every transaction, income, expense, and client data. This is a very good way to stay organized and meticulous. On a side note, it also helps you stay compliant with tax laws and regulations. Always make sure that you record all the earned commissions, listing fees, and marketing expenditures down the line. Not to mention, do not forget to keep detailed client information for later use.

Separating business and personal finances

Make sure your personal finances are kept separate from your business finances. It is an incredibly important practice that simplifies the entire tax filing process. Moreover, it also helps you track the profitability of your business better. In this case, it’s best that you open a dedicated business bank account, along with a separate credit card that fully caters to your real estate transactions. If you ever combine your business finances with your personal ones, there’s a higher chance of confusion and potential pitfalls.

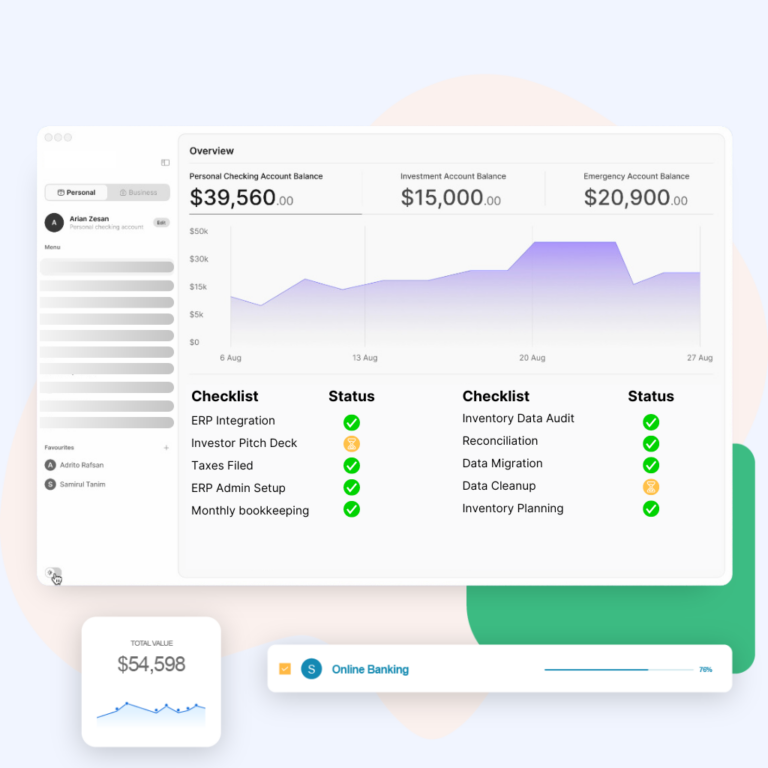

Using accounting software and tools

You can also use accounting software and tools if you want to make financial management processes even more streamlined and mitigate the active risk of mistakes. In accounting real estate, mistakes can be very common. So to say, popular options such as QuickBooks, FreshBooks, and Zoho can be great if you want to automate manual tasks, such as expense tracking, invoicing, and financial reporting.

Establishing internal controls and procedures

If you want to keep maintaining accurate financial records, you need to have internal controls and procedures. This can be anything between bank statement reconciliation and the execution of approval methods for expenses. In addition, make sure you have set policies to manage client funds, including security deposits, to guarantee proper compliance and management.

Are you looking for bookkeeping for real estate agents?

Get in touch with the right team.

Common Real Estate Accounting Mistakes

Let’s be real, the more you are associated with real estate, the more chances you have to make a silly mistake in its accounting needs. So, to avoid that fully, here’s a simple rundown that shows the common mistakes in property accounting.

- Commingling funds: The first and often the most common mistake of all time is mixing your personal finances with your business ones. Well, it can potentially lead to a number of hiccups along the way, make it even more difficult to track the real financial performance of your properties, and of course, complicate tax filing processes.

- Failing to track expenses properly: It is undeniably integral to record the expenses of real estate operations. In case you somehow overlook it, it can lead to a skewed picture of your finances and also show you missed opportunities for tax deductions. This can largely impact your profitability.

- Neglecting to reconcile accounts: It is undoubtedly important to keep your financial records immaculate and accurate. To do so, by the way, you need to reconcile your bank statements with your books regularly. If you fail to do it, there might be severe discrepancies down the line, going fully unnoticed. This can shuffle the accounting of steady cash flow in real estate.

- Overlooking depreciation and amortization: There have been several cases where real estate investors have failed to take into account the depreciation of properties and amortization of loans. This oversight may result in an unnecessarily high taxable income by affecting financial statements and tax obligations.

- Not maintaining proper documentation: This is one of the key things to remember. You need to keep comprehensive records, including but not limited to receipts, bank statements, communications, and contracts. Inadequate documentation could make it difficult for you to defend against audits or validate transactions. Worst case scenario, it could result in fines, penalties, or other dire consequences.

Final Thoughts and Key Takeaways

Keeping tabs on every penny in real estate can often feel challenging.

Between tracking expenses, income, assets, and liabilities – it is extremely easy to feel anxious and overwhelmed.

But, here’s the thing, accounting in this domain is the only pillar you need to streamline everything. Accounting is the backbone of absolutely any business because it helps to tackle and optimize all financial resources.

The truth is that many real estate investors often miss out and do not incorporate real estate accounting into their business – signing up for endless losses over the years. Every year, the real estate market witnesses the making and losing of enormous sums of money.

However, only a knowledge-driven real estate investor with good accounting insights has a borderline chance of success compared to those who do not. For this reason, knowing the fundamentals of real estate accounting and its significance to the company is just as critical. Well, you still have a chance at success, and this guide is your answer to it. Dig in, get organized, and watch as your profits start coming in. Your wealth-oriented future will thank you.

Still confused? Get the right help when you still can. The Ledger Labs has real estate accounting experts with more than 12 years of experience. Have a question? They potentially have the answer you are looking for. So, without delay, get in touch today.