- CA : 1001 Wilshire Blvd, Los Angeles, CA 90017

- NY: 1178 Broadway, 3rd Floor #3067, New York, NY 10001

Experience

Happy Clients

Hours

Strong Team

Kick start your brand’s accounting journey with our 12 years of niche expertise in retail businesses. Manage and execute the best financial moves with our 360 financial solutions.

With over 12 years of experience serving retail businesses, we understand the unique challenges you face. That’s why we’ve developed specialized processes and leverage advanced accounting software to streamline your financial management.

With over 12 years of experience, we've crafted thousands of processes and procedures to simplify routine accounting tasks for you.

We record and report every cent going in and out of your business.

Book a free 30-minute consultation with Gary Jain, Co-founder of Ledger Labs — a seasoned accountant with 12+ years of experience helping small and mid-sized US businesses boost growth, streamline finances, and plan for the future.

Always Included:

Never Included:

Fill out the form and we’ll send you a link to schedule your free session.

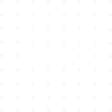

Our inventory management services are designed to optimize your retail operations. With our expertise and proven strategies, we ensure your business operates at its peak efficiency.

Stay ahead of tax deadlines effortlessly. Our expert tax consultants ensure you never miss deductions and remain compliant with up-to-date tax regulations.

Utilize valuation methods tailored to your retail operations, ensuring accurate assessments of your inventory's worth.

Efficiently file your corporate taxes on time with meticulous attention to detail, leaving no aspect overlooked.

Maximize your tax savings with comprehensive credits, including research and development incentives, tailored to both federal and state requirements.

Streamline your business structure setup and expedite licensing and registration processes to avoid delays.

Let us handle your quarterly and annual state and federal compliance requirements, ensuring peace of mind and regulatory adherence.

Navigate the complexities of sales tax effortlessly. We assess your business's nexus and manage registrations and filings as needed.

Never miss tax deadlines again. Get all legitimate tax deductions and stay updated with tax compliance by connecting with our expert tax consultants.

Borem ipsum dolor sit amet consectetur adipiscing elita

Our years of experience and exposure to various businesses are summarized in these articles!

Retail accounting refers to the specialized practice of managing financial transactions, inventory, and sales data for retail businesses. It is important as it helps retailers maintain accurate financial records, track inventory levels, manage cash flow, and ensure compliance with tax regulations, ultimately leading to better business decisions and profitability.

Retail accounting software offers numerous benefits, including real-time financial reporting, streamlined inventory management, automated transaction processing, and improved accuracy in financial data. It also helps in tracking sales, managing expenses, and integrating with other business systems to provide a comprehensive view of the retail business's financial health.

Accounting software for retail businesses is tailored to address the unique needs of the retail sector. It typically includes features such as inventory management, point-of-sale (POS) integration, sales tracking, customer management, and reporting specific to retail operations. General accounting software may not provide these specialized functions, making it less effective for retail businesses.

When choosing retail store accounting software, look for features such as inventory management, POS integration, real-time reporting, multi-store management, ease of use, scalability, and support for multiple payment methods. Additionally, ensure the software can handle your specific business requirements, such as sales tax calculations, discounts, and promotions.

Yes, retail accounting software can significantly aid in tax compliance by automating the calculation and reporting of sales tax, generating tax reports, and ensuring accurate financial records. It reduces the risk of errors and helps retailers stay compliant with tax regulations, avoiding penalties and fines.

Accounting software for retail can improve business operations by providing real-time insights into financial performance, streamlining inventory management, automating routine tasks, and enhancing decision-making. It helps in identifying trends, managing cash flow, reducing operational costs, and ultimately increasing profitability and efficiency in your retail business.

Helping busy founders and busy owners streamline their accounting & bookkeeping with services designed from and for the perspective of business owners.

We publish fresh and power-packed insights every week on multiple platforms. Subscribe to our newsletter and get latest updates!

Copyright © 2025 Ledger Labs, Inc. | Powered by Ledger Labs, Inc.

| Thank you for Signing Up |