1. The revenue recognition principle mandates that revenue is reported in the accounting period when it is earned, regardless of when cash is received. This ensures financial accuracy.

2. Accrual accounting underpins the revenue recognition principle, contrasting with cash-basis accounting, where revenue is recorded only when cash is exchanged.

3. Businesses comply with the principle by recognizing revenue upon product delivery or service provision, critical for maintaining investor confidence and regulatory standards.

Making a good chunk of money in a business that took years to establish always calls for celebration.

But has your business really “earned” that revenue yet?

As a matter of fact, the topic of “revenue recognition” has been a popular discussion since Accounting Standards Codification (ASC) 606 was introduced in 2014 by the Financial Accounting Standards Board (FASB).

It is a key accounting rule that can help understand when your company should formally record its income.

Now, you can ask, “How am I going to know when to evaluate my earnings?” Well, this rule, while somewhere similar, is a little different from earning revenue and calling it your “earning” instantly. In other words, this rule says that “revenue is not actually counted when the cash is received, but when the primary work to earn that money is completed.”

For example, you can consider the same when a product has been sold or a service has been provided. The goal here is to ensure that your financial statements accurately exhibit the performance of your business by aligning the income with the time you actually earned it. But, there are a lot of other questions that come to the surface when we talk about revenue recognition. So, without beating around the bush any longer, let’s tune in and learn all about this term in depth.

What is Revenue Recognition?

Revenue basically sits at the top to show how well your business is doing. At times, businesses may just want to stretch the meaning of revenue, especially because they have not yet received the cash in hand right after the job is completed.

Let’s consider, for instance, attorneys who bill their customers on a per hour basis. Hour after hour, they finally send out their invoices once the job is accomplished on a good note. This is where you would come across the term “Revenue Recognition”, an important term of accrual accounting.

Revenue recognition is a principle that comes under “Generally Accepted Accounting Principles”, also known as “GAAP”. In simple words, it gives shape to certain criteria about when the revenue must be recorded and how it is going to be accounted for. At first glance, revenue is recognized when a major event has occurred, including when you deliver a product or provide a service to a customer, and its revenue amount can be evaluated by the respective company.

If we have to go by its definition, revenue recognition says that revenue must be showcased in an income statement when it is both realized and earned, which is not always the case when cash comes in. But, what does “realized” mean in this context?

When we say the revenue has been “realized”, it simply means that the customer has successfully received the service or product but won’t pay until later. This is a way to showcase and capture your business’s health accurately, representing its performance without jumping to conclusions about the cash it has still not received but is expecting to.

That being said, this approach is both neat and reliable, as it keeps everybody on the same page about the company’s well-being. But, what makes it so essential? Continue reading to learn more about it.

Why is Revenue Recognition Important?

That’s indeed a really good question to ask absolutely any business owner. There are a couple of reasons why revenue recognition is considered highly indispensable. Let’s look at why:

- Accuracy in Financial Reporting: One of the primary reasons why revenue recognition is important is because it guarantees the integrity of a business’s financial statements. As we mentioned, revenue is recognized when it has been earned, not typically when the cash is gained. This gives a more robust, transparent, and truthful overview of a company’s financial health. In case it is inaccurate, investors and creditors can be misled about how well the company is performing.

- Standardization and Comparability: As we know, accounting standards, such as ASC 606 and International Financial Reporting Standard 15 (IFRS 15, have laid out their framework to ensure consistent revenue recognition. This helps all investors, analysts, and creditors compare the financial statements of different businesses that fall under the same industry.

GAAP Revenue Recognition Principles

The Financial Accounting Standards Board (FASB), which is broadly known to set the standards for the U.S. GAAP, houses five principles to recognize revenue. Let’s have a brief look at them.

- Identify the customer contract

- Identify the obligations in the customer contract

- Determine the transaction price

- Allocate the transaction price according to the performance obligations in the contract

- Recognize revenue when the performance obligations are met

Having said that, you also need to know the requirements of revenue recognition. The more knowledge you have about all of this, the better your business’s financial health. So, without wasting any more time, let’s get into it.

Have questions regarding revenue recognition

Consult our expert accountants!

What are Revenue Recognition Requirements?

The revenue recognition principle, which is closely bound by double-entry accounting, has many key rules to abide by. Here are some of them:

- Agreement with the customer: If we have to define it in simple words, this means that there is a mutual agreement or understanding between you and your customer about all the payment terms.

- Delivery or completion: The revenue is recorded when the good or service has been fully completed or has reached the customer. This just goes to confirm that you have completed your side of the job.

- Finalized cost: The client must agree to the cost of your services or goods before you recognize the revenue.

- Advance payments: When you receive the payment for a service ahead of time, gradually begin recognizing revenue as the service is rendered.

- Collectible payments: In all cases, make sure you are analyzing and checking in detail whether the client can pay the credit you are offering. Plus, only recognize the revenue if you are totally sure that the billed amount will undeniably be collected from the customer. Having said that, you must wait to acknowledge it until after the money has been received.

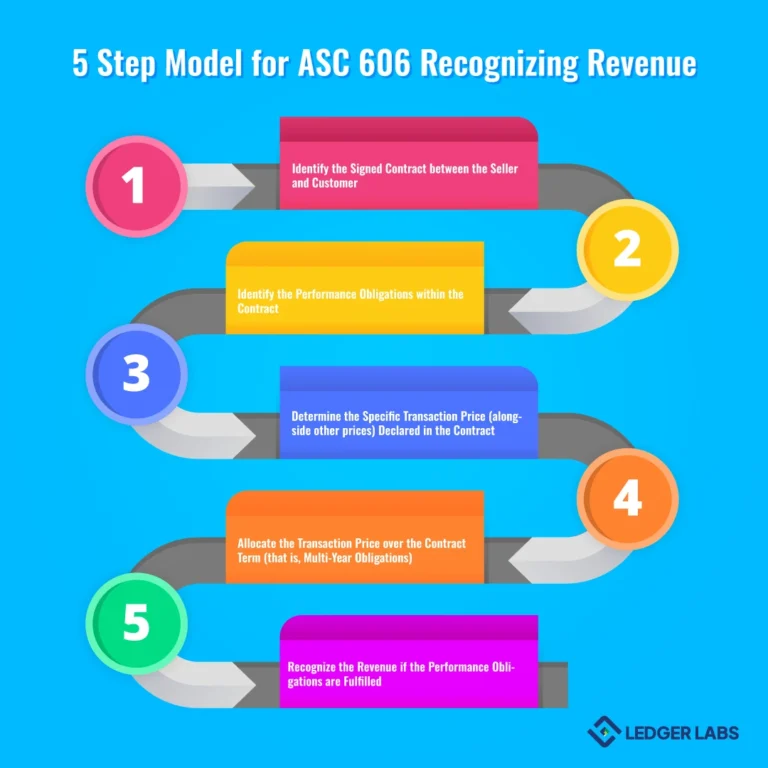

Five-Step Model for ASC 606 Recognizing Revenue

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), on the 28th of May, 2014, introduced the ASC 606 revenue recognition. In layman’s terms, this new standard depicts how a company should manage its revenue from customer contracts, clearly showing a consistent and transparent method for recognizing revenue alike.

Back in the day, the guidance on revenue recognition actually differed from one industry to another. That, undoubtedly, led to a tangle of rules around the room. However, the newly introduced one changed everything. It replaced the whole chitter-chatter about the industry-specific guidelines and now follows a universal approach instead of being limited to only a couple of industries whatsoever. But, if you want to comply with this new standard, your business should follow these five steps, like a ritual:

Identify the Signed Contract between the Seller and Customer

In this stage, you need to shed light on the terms of the agreement. This can include payment terms, the delivery of services or goods, and the outcome of not meeting the obligations. Additionally, contracts can be of any form, such as in writing (formal) or as a verbal agreement (informal).

Identify the Performance Obligations within the Contract

By the time you get to step two, make sure you specify clearly what exactly the services or products are under the established contract.

Determine the Specific Transaction Price (alongside other prices) Declared in the Contract

Only understanding the payment terms in any contract is not enough. We mean to say that, in this step, have a clear estimate of the total price, such as return policies, extra charges, money-back guarantees, or discounts that may impact the cost.

Allocate the Transaction Price over the Contract Term (that is, Multi-Year Obligations)

By the time you are here, start assigning a specific part of the total price to every single obligation in the drafted contract.

Recognize the Revenue if the Performance Obligations are Fulfilled

In this stage, only record the revenue when the promised products or services have been successfully delivered. It marks the end of the transaction.

That’s it. Now, you are fully aware of the five-step model to recognize revenue. But, it’s always a good idea to present written information through examples. So, let’s not wait any longer and get straight to the point.

Examples of Revenue Recognition

Every subject is understood better with examples. So, we have one for you regarding revenue recognition examples. Let’s consider businesses that provide a service, or we can call them as “service providers.”

Now, let’s assume there’s a company called TXN Ltd. It is basically a marketing firm which offers people digital marketing solutions, especially to startups and growing businesses. Now, let’s consider that TXN Ltd. goes to offer a service that is worth $18,000 to one of its clients around February. In this case, the client will not pay for the services until June.

The revenue recognition for a service-based work, such as consulting, occurs exactly during the time of consulting (herein, the revenue is realized and earned), despite the fact that the client will not pay until later in June. In simple words, this means that the business must recognize the revenue in the month of February itself, despite the cash for the service received only until June.

That’s about it. This sums up the revenue recognition principle of one industry out of many others. Just know that every single industry is different, which is why what you read in this example might not be applicable to some other company that caters to an industry not similar to this one.

To know about Capital Expenditure vs Revenue Expenditure Read here

Different Types of Revenue Recognition

Here are the common methods (or types) of revenue recognition:

Sales-based method

This is where you record the revenue once the product or service has reached the respective customer, despite whether the form of payment was credit or cash.

Installment method

As the name suggests, in this method, revenue is recorded once each installment payment from the client is received. This is how the ongoing project is compensated (i.e., the delivery of the good or service).

Completed-contract method

This is one of those methods that is not normally used or practiced. In this case, the revenue is recognized once the entire contract, along with the performance obligations, are fully satisfied.

Percentage of completion method

Applicable to multi-year contracts, the Percentage of Completion Method tracks revenue based on the portion of the performance obligation that has been fulfilled.

Cost recoverability method

This is where you get to record the revenue once every bit of the costs associated with the completion of the performance obligation, along with the transaction, are satisfied. In other words, the payment you will collect from the customer must surpass the cost of the service provided.

Closing Thoughts and Key Takeaways

Benjamin Franklin once mentioned, “An investment in knowledge pays the best interest.” That said, we believe, it is vital for you to understand the nuts and bolts of revenue recognition as it is an investment that leads to reliable and comparable financial statements in the market.

Moving forward – eight years after FASB first introduced the fresh and new revenue recognition rules, most businesses have seen at least a fair amount of impact. Interestingly, for a few businesses though, these new rules fully distorted their earnings and revenue over the initial days.

Focusing on today, the revenue recognition principle is a concept you need to know about at all costs. It is the mere foundation that shows investors, stakeholders, and the market at large all about how a company is doing financially and operation-wise. Is it going well or has it seen a major upheaval in recent days? As you can see from the question itself, this term is highly vital and means a lot to numerous people.

If you still have any underlying questions or want to know more about this term or others, you know who to talk to.

The Ledger Labs is here to help. Get in touch with our accounting and bookkeeping experts now.

Frequently Asked Questions

Ques. Which IFRS is revenue recognition?

Ans. Revenue recognition is basically the IFRS 15.

Ques. Is revenue recognition a GAAP?

Ans. Yes, that’s right. Revenue recognition is, in fact, a GAAP.

Ques. How do you calculate revenue recognition?

Ans. It is easy! Here are the five steps that you would need.

- Identify the Contract with Customer

- Identify Performance Obligation(s)

- Evaluate the Transaction Price

- Assign Transaction to Performance Obligation(s)

- Recognize Revenue as Performance Obligation(s) is Satisfied

Ques. Do all Businesses Need to Follow Revenue Recognition Principles?

Ans. All the public companies around the U.S. need to follow GAAP principles for revenue recognition. But, it is worth noting that for other companies, the requirements may or may not differ on the basis of the jurisdiction. In addition, small businesses typically do not need to follow GAAP accounting unless they have a plan in mind to go public in the coming days.

Ques. How does ASC 606 Standard Impact Different Industries?

Ans. There’s no doubt that one rule impacts different industries in different ways. For instance, let’s consider the retail industry. This type of industry may have not seen any major trouble on its way when it started to adopt the new standard. That is because their way of business is simply selling products and then recognizing the revenue post the delivery of the item, despite the method of payment. This fits well and neatly with the new standard.

On the other hand, there’s the SaaS industry. In the SaaS revenue recognition, wherein businesses basically depend mostly on their recurring sales from licenses and subscriptions, most probably had a hard time adjusting to the abrupt change brought by the effect.