1. 44 U.S. states enforce economic nexus laws, setting thresholds for remote seller tax collection based on sales or transactions.

2. 2018 Wayfair ruling reshaped sales tax collection by mandating remote sellers to comply with state-specific nexus thresholds.

3. Thresholds for economic nexus range from $100,000 to $500,000 in gross sales or 200 transactions annually, varying by state.

4. Businesses must register for sales tax permits in states where they meet nexus requirements to legally collect and remit taxes.

5. Non-compliance can lead to penalties, interest, and even revocation of business licenses.

When defined, the sales tax nexus is the link that helps determine when a business should collect and remit sales tax for transactions that happen in a state.

But, here’s the thing – what creates this link, though, isn’t actually the same across the board.

Primarily, it varies largely from one state to another. Moreover, the requirements for creating a sales tax nexus can differ, such as meeting particular sales or transaction thresholds or having a physical presence, such as a store or warehouse.

Due to this massive variety, businesses must be cognizant of their tax obligations in different jurisdictions, especially those that sell online or across state lines.

This is just half the story. There’s more to this topic that you should know about.

Let’s talk about this in detail.

What is Sales Tax Nexus?

Sales tax nexus is basically the relationship between the seller and the state that obligates the seller to register, collect, and remit sales tax in that specific state.

In other words, your business can form a sales tax nexus when it has a certain connection with a state.

This “nexus” with the state can be achieved by engaging in particular business activities, including keeping a physical presence or reaching a set sales volume.

Nevertheless, it is true that the specifics of a nexus can differ, but states conventionally agree that an economic connection or a physical presence is enough to fulfill this link.

Now, let’s look at the activities that can trigger sales tax nexus:

- Operating a store, office, warehouse, or home office within a state.

- Having a pool of workers, salespersons, or contractors within the state.

- Operating or merely owning storage facilities or warehouses within the state.

- Having an inventory in the state, including Amazon FBA warehouses, alongside similar third-party centers.

- Collaborating with a state-based third-party affiliate.

- Having temporary business operations functioning within a state, such as attending craft fairs or trade displays.

With the constant rise of e-commerce and the simplicity of reaching customers around the world, you need to be aware of what is nexus sales tax in the United States. In fact, as people say, it is no longer about where your business is, but more about where the sales are taking place.

But what does this mean for your business? In layman’s language, knowing your obligations can help you avoid the risk of penalties and guarantee smooth operations across your business. That brings us to the next question, why is it even important? Let’s have a detailed look at why nexus for sales tax is important.

Importance of Understanding Sales Tax Nexus

1. Reducing the chances of penalties

Failure to comply with sales tax nexus rules and regulations can result in substantial penalties and back taxes. In fact, these costs can quickly consume your profits and put an unnecessary strain on your business.

Moreover, non-compliance can further add to the damage of your business’s reputation in the market. Read more about financial audits.

2. Massive help in financial planning and budgeting

If you know your sales tax nexus thoroughly, there is a high chance that you can accurately evaluate and budget for sales tax collection and remittance later in the day.

Why is it beneficial?

Well, this can ensure that you have enough funds to meet your tax liabilities exactly on time. But, let’s say, you somehow ignored it. In that case, it can result in unanticipated tax bills breaking down your cash flow and planning.

3. Helps in strategic decision-making processes

Having in-depth knowledge about the nexus implications can allow you to make wise decisions about how to expand your market reach.

Nonetheless, it can also help you streamline several other major things, such as targeting new customers in various states and creating a dedicated distribution strategy.

4. Helps you maintain a positive image

Complying with sales tax laws is a great way to show that you value ethical behavior and conscientious business practices.

On the flip side, any form of failure to comply can harm your reputation and cast doubt on your company’s moral character.

There are several more reasons why you should have a clear grip on concepts like sales tax nexus and economic tax nexus. Till now, these are the areas that have kept your business afloat around the globe.

Changes in Sales Tax Nexus Laws

Since sales tax laws are always undergoing some amount of change, some states saw a substantial change in these, in 2025.

There have been several variations, including how goods and services will be taxed, modifications to economic nexus thresholds, and last but not least, updates to some of the sales tax rates.

For those closely eyeing the changes, here we are, with a value-packed list specifying all changes you must be aware of. So, without further ado, let’s get straight into it:

1. Specific legislative modifications: Louisiana and South Dakota have recently streamlined the nexus for smaller sellers. They have achieved so by eliminating the 200 transactions needed. In fact, several states have also started reassessing the taxation of digital services. Nonetheless, Michigan is one state which has started taxing some cloud computing services.

2. Marketplace facilitator challenges: Even though laws pertaining to marketplace facilitators are gradually becoming more common, there is still uncertainty because of different definitions and inadequate guidance in industries including the sharing economy. On top of that, expanded tax collection responsibilities are among the many concerns as well.

3. Tax simplification measures and efforts: The one major reason why tax compliance can seem more like a headache is because of the home rule states. Moreover, home rule states give individual home rule cities the authority to set their own tax bases and manage their own sales taxes. However, Colorado and Louisiana are among a couple of states that are making major strides toward easier tax compliance.

4. New tax types and sales tax holidays: In addition to existing fees, such as Colorado’s retail delivery fee, businesses now have to cope up with a number of new taxes and sales tax holidays that are meant to encourage investment in areas like emergency preparedness and education.

That’s it, these are some of the major updates that businesses and individuals must be aware of in 2025.

Stay up to date with latest sales tax compliance tips.

Talk to our sales tax support group.

Types of Sales Tax Nexus and How they Apply?

Sales tax nexus specifies the circumstances under which a company’s transactions in a state or locality require it to collect sales tax. There are several kinds of sales tax nexus that can trigger this requirement, such as:

1. Physical presence nexus

This is the requirement that comes into effect when a business has a tangible operation to look at, such as a distribution center, warehouse, storefront, or an office within the bounds of the state.

Furthermore, this kind of nexus is actually a conventional norm for sales tax collection that is established by numerous court cases. For instance, a physical nexus for a business is when they have a physical location, inventory, contractors, or employees in the state.

2. Economic nexus

Economic nexus is basically formed when a business has a considerable economic operation in the state or jurisdiction, even if it does not have a physical footprint in that location. In fact, this is a type of nexus that occurs when the economic activity of a business in a specific state touches a certain magnitude.

Furthermore, states are known to set thresholds for sales volume and exceeding it obligates your business to manage sales tax laws. The South Dakota vs. The Wayfair Supreme Court ruling further necessitated businesses, both in and out of the state, to collect sales tax on transactions that go to cross 200 or sales that exceed $100,000 within the state.

3. Affiliate nexus

Affiliate nexus is basically established when a business has formed a relationship with another business that has a physical existence in a state. When does this happen, you may ask? This is very usual when a business has a subsidiary or an affiliate in a state that is closely associated with the business. For example, it can be a common owner or branding.

This type of nexus is based on business links to another company with physical operations in the state, such as shared ownership or branding. When such affiliations exist, the company must comply with sales tax collection if the partner company is in the state.

4. Click-through nexus

This kind of nexus or relationship can be established in a state when a business has a “nexus” with a third-party seller or a referral agent. This usually takes place when a company decides to pay a third party a commission or referral fee for sales generated by their website or marketing initiatives.

Moreover, you should also be aware that click-through nexus laws usually mandate that if a third party has a physical presence in the state, the business must collect and remit sales tax.

Sales Tax Nexus by State

Now that you know what sales tax nexus is, it’s time to understand it with respect to the some states around the US. Without further ado, let’s get into it:

1. California sales tax nexus

In California, the specific criteria in order to establish sales tax nexus can be described by various thresholds. Besides, should a company have one or more fixed locations of operation within the state, a physical presence nexus is formed.

Moreover, you should know that an economic nexus is established in case a business’s sales or the value of tangible personal property sold surpasses $500,000 in the preceding or current calendar year. Furthermore, a nexus is present if the marketplace provider is known to operate physically in the state for an online marketplace.

Last but not least, a business is considered to have a payroll compensation nexus if its payrolls in California for the current or previous calendar year exceed $69,015 as a whole. In addition, each of the thresholds actually goes to trigger tax obligations that businesses in California must abide by.

2. Alabama sales tax nexus

The threshold for the state of Alabama is $250,000 per year based on the preceding calendar year’s sales. As per the state law here, the sellers who exceed the sales threshold must register for the Alabama sales tax permit, remit sales tax to the state, and also charge sales tax on the items shipped to Alabama.

3. Arizona sales tax nexus

In Arizona, the basic criteria to establish a sales tax nexus can be classified into three types. Well, first, a physical presence nexus is designated in case there is a tangible presence in the state. Now, it can be anything from an office to an inventory. In simple words, this means that if your business has a physical address in the state of Arizona, then you are obligated to collect sales tax.

Besides, an economic nexus is generally triggered when the gross revenue of a business touches $100,000. In simple words, if your total sales exceed this specific amount, you need to comply with the sales tax regulations. Moreover, a nexus with marketplaces is for sellers found on platforms such as Amazon. If you make 200 sales, or say, your gross revenue hits $100,000, then you simply need to be mindful of the sales tax collection and remittance rules.

Unsure about your state’s sales tax nexus?

Consult with our sales tax experts for free.

4. Ohio sales tax nexus

In Ohio, too, the nexus sales tax is clearly defined for 2025. A business often establishes a physical presence nexus when it maintains an inventory or similar tangible property in the state. Moreover, it can also have employees, contractors, or representatives working in Ohio, too.

In fact, the threshold for touching an economic nexus is $100,000 in gross receipts from the sale of tangible personal property shipped in Ohio, or when it partakes in 200 or more extra transactions. The same criteria applies for nexus with marketplaces.

5. Texas sales tax nexus

Let us take a closer look at the Texas sales tax nexus:

- You need to collect state and local taxes if your e-commerce store has generated more than $500,000 in Texas sales during the last 12 months.

- If you have representatives or a physical location in Texas, then it also mandates tax collection.

- Marketplace operators who enable transactions exceeding $500,000 in Texas revenue are also subject to tax collection.

6. Florida sales tax nexus

When taxable goods are delivered to customers within the state, marketplace providers and out-of-state retailers with no physical presence in Florida must collect sales tax, as long as their sales surpass $100,000 in the prior year.

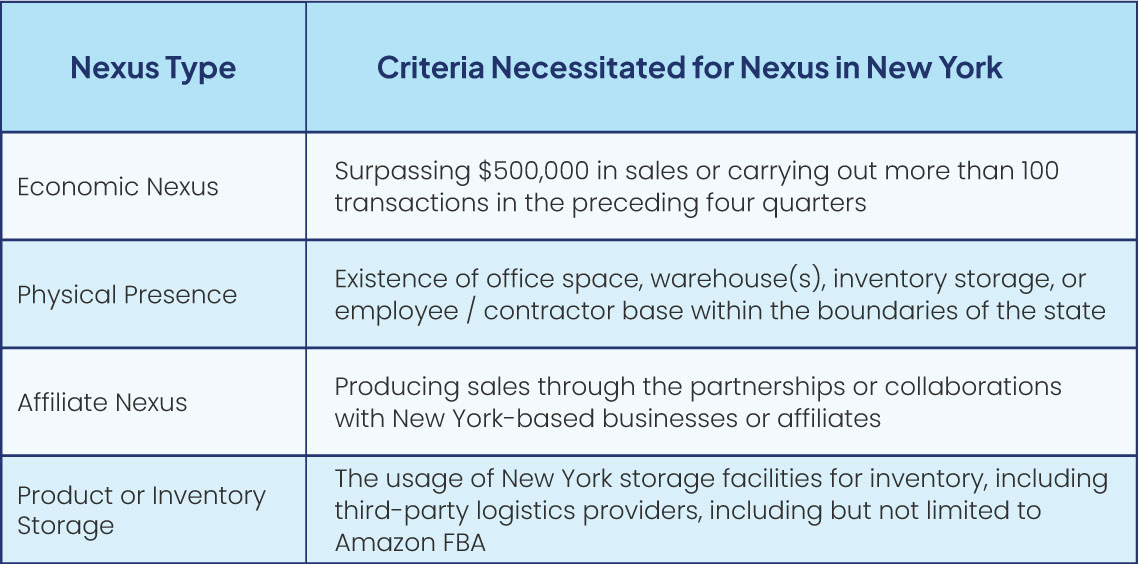

7. New York sales tax nexus

Here is a detailed overview of the New York (NY) sales tax nexus:

Strategies for Managing Sales Tax Nexus in 2025

When you are managing the sales tax nexus, it is highly indispensable to have a strategic approach in order to guarantee compliance and the gradual reduction of administrative burden from the business. That brings us to the strategies for managing the sales tax nexus in 2025. Let’s get straight into it:

1. Utilizing sales tax software or automated solutions

The first, and typically one of the most important areas to focus on, is getting trustworthy sales tax software or automation tools to help manage sales tax collection, evaluation, and remittance effectively.

In return, these tools can automatically keep a close track of your sales operations happening across various states. Moreover, this can also give you a clear picture of where exactly you have an established nexus.

Want help with sales tax automation?

Get free consultation with our tax experts.

2. Conducting regular nexus reviews

This is where you should review and monitor your business operations on a regular basis in each state to spot any changes that could possibly impact your nexus status. Now, this can be absolutely anything. Starting from a close monitoring of your sales volume, to keeping track of the economic thresholds. These are ways to analyze and adjust your compliance strategies before there are any complications.

3. Seeking professional advice and assistance

There is absolutely no doubt that tax laws are forever changing and have a complicated nature. That is one of the primary reasons why having a word with tax professionals or legal advisors specializing in state and local tax (SALT) problems can help you get detailed insights about the sales tax nexus.

In wrapping up

Often, for many “nexus” may seem like a very enigmatic and unfamiliar topic of discussion.

But it is one of the most commonly used terms in businesses who have a presence around various states. Truth be told, businesses must be aware of terms like these to ensure continued compliance with the laws different states have mandated over time.

As you know, not every state has the same rule. What New Jersey has might not be anywhere close to what Montana or Florida mandates for its businesses. This makes the term, “sales tax nexus”, a very important fragment that businesses and individuals, likewise, have to be more vigilant about.

Still uncertain about the sales tax nexus your state has issued in 2025? We have the right answers for you. Get in touch with our accounting and bookkeeping specialists who have more than 12 years of experience to guide you to the right path. Reach out today and get all solutions to your questions!