1. Outsourcing to an e-commerce accountant offers specialized expertise in handling complex accounting tasks, ensuring better accuracy, compliance, and efficiency for growing businesses.

2. An outsourced accountant can streamline operations, save time, and reduce the cost of maintaining an in-house accounting team, particularly for small and medium-sized enterprises.

3. Ecommerce businesses benefit from tailored solutions that address industry-specific challenges, such as multi-channel inventory management and complex tax calculations.

4. By outsourcing, businesses can focus on growth while leaving intricate financial matters, such as cash flow management, to experts.

The last decade has witnessed significant growth in online businesses.

This, by extension, has led to a growth in the need for professional accountants and e-commerce bookkeeping professionals.

E-commerce entrepreneurs choose to outsource their accounting needs for various reasons, which majorly include:

- Reducing business costs.

- Meeting their core business needs.

- Outsourcing for tax compliance.

So before you outsource your accounting requirements, what factors should you consider first?

Well, we have a detailed list.

Benefits of Outsourcing Your E-commerce Accounting Needs

If your e-commerce business is expanding, one of the first things I’d recommend is to streamline your accounting first.

In the past, it might have been easier to do basic bookkeeping yourself with little to no help.

But, as you scale your business, you might struggle to do its accounting without neglecting your core business.

Let’s help you get a fresh perspective so that you can decide whether outsourcing e-commerce accounting is right for you or not.

Saves Time

Outsourcing e-commerce accounting can help you save a notable amount of time, which you can use to focus on your core business processes.

- Integration of accounting software and tools: You can benefit from reliable automated accounting software. It can record and monitor all your business transactions.

And you get access to this software without spending any extra money. An accounting system will sync with your bank account. It will transfer and extract accurate data, giving you real-time reports and summaries. - Get real-time data: Most accounting software run by professionals who understand the software in and out provides real-time information on your financial data. Your financial reports will provide accurate data and real-time visibility. You can track your inventory, calculate COGs, or calculate quarterly and annual revenue. This gives you clarity and the ability to make instant but informed decisions.

- Accurate financial reporting: A professional accountant can guide you on your company’s financial position. They’ll highlight red flags and help you navigate the e-commerce landscape with expert knowledge and insights.

Access updated financial reports. Use them to make informed decisions for future investments and cost reductions.

Financial Transparency and Cost Reduction

Outsourcing e-commerce accounting means you also get to save a lot of money. Here’s how that happens:

- Avoid costly sanctions and penalties: You can avoid paying hefty fines and costly limitations by meeting tax deadlines.

- Cost Reduction: Hiring a full-time accountant is expensive. Their basic salary package has to be attractive. Equipment, training, and employee incentives are other costs required to retain full-time employees.

- Financial Planning: Manage your cash flow and make financially informed decisions by outsourcing.

Reduces Tax Burdens

An area business owners don’t think about until the last minute is that of tax preparation.

By outsourcing e-commerce accounting, you can not only file your taxes on time but also find ways of tax optimization for your business.

A professional handles all the aspects of tax filing and meets the deadlines. They guide you through various tax reduction policies to reduce costs for a healthier bottom line.

This allows you to focus on running your core business operations.

Should you Outsource your E-commerce Accounting Needs?

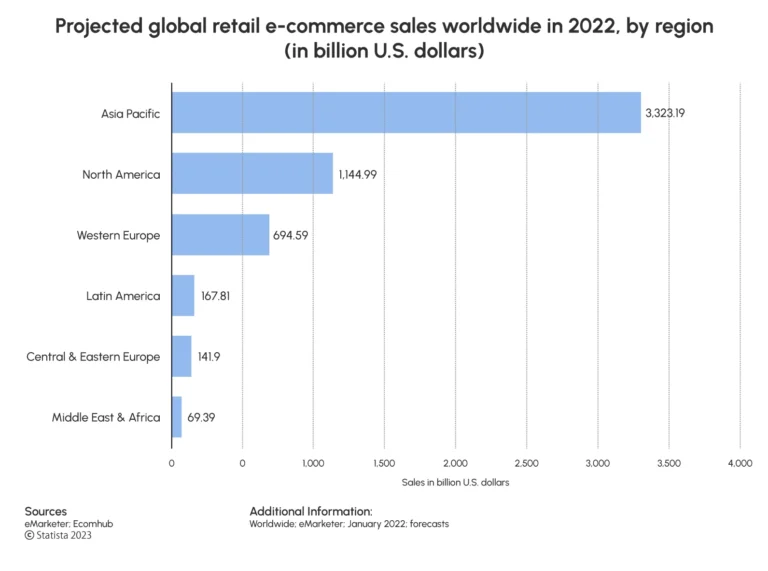

North America has the second-largest global retail sales. Seeing these numbers might motivate you to start your own online business.

But there are so many aspects of running an e-commerce business that people often neglect.

For example, it’s not going to survive only with an idea. You need proper accounting support, especially if you have long-term plans.

Outsourcing e-commerce accounting is the best decision you can make for your business.

But before outsourcing, you have to see where your business is heading and if you can find the right provider.

Ask yourself the six most important questions.

1. Is It The Right Time to Outsource?

It’s a common practice for small business owners to manage their bookkeeping.

About 34% of business owners handle bookkeeping themselves. Either because they can’t afford to hire an internal accountant or because they have hired inexperienced accountants as they could only afford them.

In the initial stages of any business, assuming too many roles might work. But, there will come a time when you might start feeling overwhelmed.

This will be a crucial turning point as you’ll be faced with a choice — to continue managing your books and risk errors or outsource your accounting to professionals.

Regardless, if you can’t endure this pressure any further, you might ask yourself: Is this the right time to outsource?

Recommended: Common e-commerce accounting mistakes

2. Will They Be Dedicated Enough To Grow With You?

Finding a partner that can handle the pressure that comes with growth is challenging. And without a proper infrastructure and talent, your business can crumble and fail.

- Ask yourself if they are aligned with your goals and the standard of practices you’ve set for your business.

- Or are you just another client for them?

- Do you trust them with your account?

- Do they have the capacity to handle the pressure that comes with scaling your business?

As your business expands, the cash flow and revenue streams will grow with it. Do you think they can find a provider who can handle this quantity of data?

You must know how dedicated they are before you outsource your accounting.

3. How Should I Choose The Best Provider For My Business?

Outsourcing your accounting comes with risk.

It’s important to understand the synchronization between you and your potential e-commerce accountants.

This includes:

- Meeting the people who will work with you

- Their potential to solve problems

- Finalizing your meeting frequency

- Analyzing what KPIs you’ll be seeing

Look for providers that have evidence of working in the same industry as you and enough social proof.

Ask them for references.

Transparency shows how comfortable they are with questions.

They must make your accounting more efficient. The practices they implement, the information they possess, and the tools they use should be up to date and latest.

4. What Safety Protocols Do They Follow?

Outsourcing your accounting means you have to share confidential information. So, before you do that, ask yourself if you trust them implicitly to handle such sensitive data.

- Do you think they have the right systems to protect your data?

- Are you aware of the type of cybersecurity software they use?

- Are you 100% certain that your data will be secured?

- Do they have any contingency plans should there be any threat?

Make sure you know where they store all of your information. Trusting someone with your company data is risky, so are you satisfied to go ahead and outsource?

It’s in your best interest to review their systems and security protocols.

5. Is This A Cost-Effective Solution?

Think of the long-term plan. Hiring a full-time employee can cost you more than outsourcing.

Many business owners prefer hiring inexperienced candidates to save costs and stay within budget.

But, if you think about it, hiring and training your employees is expensive. Hiring a candidate not fit for the role can impact the quality of your work.

Ask yourself if you will benefit from monthly subscription fees or an expensive full-time resource.

By outsourcing, you can file your taxes, handle payroll, manage your finances, and track day-to-day bookkeeping at a much lower cost.

On the other hand, hiring a full-time accountant means paying their monthly salary, training them, offering them benefits, and paying for expensive equipment.

Evaluate which option is more feasible for you.

Even though both options have their own set of features, your decision majorly depends on the location, time, and requirements of your business.

6. Does The Provider Ensure A Background In E-Commerce?

Every accounting service provider is different and has a certain scope for every industry. Some have experience with small businesses. Others have only worked with one industry.

The best case scenario is to find an accounting service with prior experience collaborating with companies the same size as yours.

So, before outsourcing, ask yourself: Do you think they are equipped with knowledge specific to your business and industry?

Do you consider them credible? Do they possess an understanding of the laws applicable to the e-commerce industry, business entity, and size?

With prior experience and knowledge, they can guide you through the taxation process. They can instruct you on how to apply for certain licenses and certifications, even the ones you weren’t aware of.

The Bottom Line

Outsourcing your e-commerce accountancy is one of the best ideas to bring in professional expertise to your business.

Whether the purpose is to reduce cost or get the best talent, outsourcing an accountant can fill all these gaps for you.

And I can majorly help you do that with my team at Ledger Labs.

With 12+ years of experience, I have helped businesses secure their finances and streamline their accounting operations efficiently. No matter how complicated their books seem.

Book a consultation now and streamline your e-commerce business accounting starting from today with our bookkeeping professionals in the US.