While minor ups and downs are a regular part of our being, how your business deals with economic fluctuations makes it stand out.

The one good thing about recession is that it comes with signs.

For example, your sales would decrease by the day and your operating expenses would increase unexpectedly.

These signs indicate the need to prepare and implement strategies to reduce the impact of the recession on your business.

There are effective bookkeeping and accounting techniques that keep your business costs low, minimizing the negative impact on your company’s bottom line.

Let’s explore how accounting and bookkeeping help you during a recession.

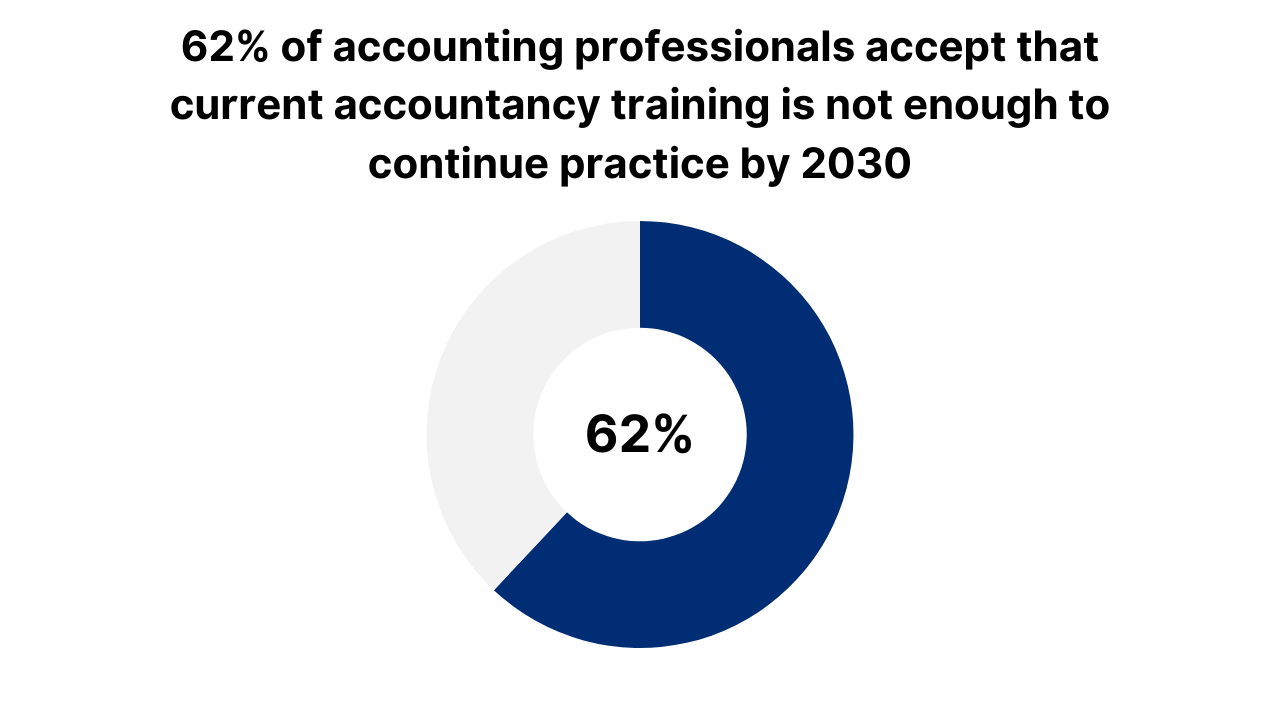

- 62% of accounting professionals accept that their current accounting programs aren’t enough for them to continue practice in 2030.

- Opt for cost-saving solutions, improve cash flow management, and put a pause on most company benefits to cut down bookkeeping costs.

- Consider the reevaluation of your fixed and variable expenses.

- Outsource your financial needs to a reliable and affordable service.

How bookkeeping helps businesses during a recession

According to a Sage survey, 62% of accounting professionals accept that current accountancy training is not enough to continue practice by 2030.

The word recession can make anyone panic. It affects every industry, from the housing market to the oil and gas industry and even the corporate day jobs.

It makes every business owner feel anxious and unsettled. You may wonder if your business is ready for a recession.

Would it manage to survive the ripple effects of a deteriorating economy?

And most importantly, would your business be still in demand?

Preparing for a recession can help you keep your business afloat.

While nobody can expect the exact impact of a recession, a proper business plan and a system in place can help you survive.

And the most important tool in your kit is your bookkeeping and accountancy plan.

Look into your finances and evaluate your financial health. Maintain regular books and prepare financial reports to analyze trends.

This step can help you predict and forecast the future status of your finances.

You can also use it to understand what works for your business and identify your weaknesses.

If you yourself have been handling finances, it’s time to outsource this responsibility.

Professional insight and support can never be undermined.

They have the necessary tools and expertise to handle the recession and safely take your business to the other end of the recession with as little disruption as possible.

5 effective ways to cut bookkeeping and other business costs during recession

While it may seem next to impossible, there are a few ways of cutting down business costs to get past the horrible recession.

Let’s explore 5 effective ways to cut down bookkeeping and accounting costs.

1. Seek cost-saving solutions

Most businesses suffer when the cost of goods increases. It leads to delayed payments and shortages, creating an inefficient workflow.

The best solution to combating inefficiencies is the use of cost-saving solutions.

For example, if you’ve been purchasing products from a specific brand, try to find an alternative option that guarantees the same quality but at a much lower price.

It may require you to look around and do an in-depth market research.

Here is the list of things that you can do to reduce costs:

- Find an affordable bookkeeping software

- Get phone plans at lower rates

- Embrace a remote working system to reduce electricity bills and cost of internet packages

- Switch to paperless programs like PandaDoc

- Replace full-time employees with outsourcing

- Replace paid marketing with word-of-mouth advertising and organic social media marketing

2. Improve cash flow management

Yes, budgeting and cost-cutting are crucial but so is payment efficiency.

Work on improving the speed of payments.

Conduct a workflow efficiency analysis to see if it highlights a longer lead time between invoice generation and receiving payments.

Let’s look at some of the steps you can take to increase business efficiency:

- Pitch and get new clients on board, clients with a more comfortable financial background

- Adjust payment receiving dates to align with the rest of the payment cycle

- Implemented penalties on late payments

- Decrease net terms on invoices and enforce faster payment turnaround

- Go to business credit cards with lower interest rates

- Maximize your billable hours

3. Substitute manual work with automation

We all know the impact automation has on any business. It helps you save time and money, reducing the chances of manual error.

It speeds up your workflow, increasing data accuracy and data consistency.

Try to integrate third-party applications that automate and combine different business processes very much like a NetSuite Tipalti integration.

Automation doesn’t mean you will replace your employees with robots. On the other hand, it means you will decrease their manual input.

Simple tasks like payment reminders, invoice generation, data migration, tax preparation, reports creation, and bookkeeping can be automated, requiring minimal or no manual input.

This will reduce employee workload and also the time it takes to complete a particular task.

They will instead have the “time” to focus on core business functions and strategizing.

4. Pause all company benefits

Recession comes with some incredibly tough decisions.

These decisions may influence your company culture but will help you come out of this testing period safely.

Consider pausing all employee benefits until your business is stable.

- This includes team lunches and on-site or off-site events.

- Put away any program that you had planned for employee entertainment.

- Change business plan tickets with the economy.

- Avoid taking out potential investors or clients to fancy 5-star dinners.

- This change is difficult but necessary.

5. Outsource financial services

While hiring a full-time accountant could be expensive, you must get a financial advisor on board to help you during this challenging time.

This is why find a financial service that offers a two or three-in-one solution.

For example, look for reliable services that include bookkeeping, accounting, and tax preparation services in one package.

The services should be available throughout the year and give you a dedicated team to handle all your financial needs.

Now instead of hiring, training, and supporting a dedicated entire team, you are simply outsourcing all responsibilities to a service provider.

They will manage your financial situation at a much lower cost.

5 tips to survive recession with bookkeeping and accounting

Here are 5 actionable tips to survive a recession with bookkeeping and accounting.

1. Reevaluate your fixed expenses

Fixed expenses are the ones that stay the same every month. Some of them are as follows:

- Rent

- Insurance

- Utilities (internet, phone, etc)

- Property tax

- Fixed interest rates

- Depreciation and amortization

You can’t do much about these expenses but you can tighten them a little.

First, the advantage of these expenses is that you know how much money your business makes every month and the minimum amount you need to make to continue.

Here’s what you need to do – plan and find a way to reduce your fixed expenses.

- Is there a cheaper internet package?

- Can you push the property tax deadline?

- Can you take loans with much lower interest rates than your current fixed-rate plan?

The idea is to build a new budget to reduce costs while ensuring they remain the same for the coming months.

2.Minimize variable expenses

Variable expenses are unpredictable costs that change every month.

They might increase or decrease depending on different factors, like the sales you make, the raw material you manufacture, or the hours you bill.

Here’s a list of some of the common variable costs:

- Commissions

- Shipping and restocking

- Pantry items

- Cost of raw materials

- Hourly wages

- Per-diem charges

The thing about variable costs is that they are harder to predict, making them harder to prepare for.

You can’t predict how many sales you’ll make in the next month. You also can’t plan how much money you’ll spend on restocking.

But despite their unpredictability, you can make things work by either cutting them down completely for an indefinite period of time or speaking to a vendor to reduce cost.

For example, instead of buying one or two items at a time, buy raw materials in bulk.

This gives you the chance to purchase at a discounted price.

Buying as much as you need is an effective philosophy but not when you’re trying to save pennies.

3. Check your insurance twice

It is in your best interest to contact your insurance provider.

Ask whether or not your commercial property experienced a loss of income during a recession. There are a few ways to qualify for this coverage.

- Business interruption: if you lose a business due to property damage, you can make a case for it.

- Interruption by Authority: Ask for coverage if your business is forced to close its doors and reduce its working hours or for any government orders.

4. Consider low-interest loans to settle debts

Covid-19 was a difficult time for business owners.

Fed had reduced the interest rate to 0% and cash reserves were down to 10%.

It made it easier for business owners to opt for low-interest loans.

Recession is generally the only time you can modify debt planning and decrease recurring interest payments.

The only requirement is that you pay on time.

It will ensure you pay what you owe, an amount that is extremely low and affordable, and are left with more cash flow at the end of each month.

5. Stay transparent with your vendors

It may be challenging but when the fate of your business is in question, talking to your vendors can work in your favor.

This awkward conversation will build a transparent relationship with your clients and vendors.

So if you skipped or delayed any payment, they will understand instead of building resentment and cutting off entirely.

Also, by talking to them, you can figure out how flexible they are and whether you need to switch vendors.

It is important to build a relationship where both of you can rely on each other and get past this challenging time together.

And this can only happen if you are transparent with each other.

The bottom line

Recession is a challenging time for businesses across the sectors.

While many strategies may work during this time, cutting down business costs is the most effective.

For instance, you can trim down your accounting and bookkeeping costs by increasing workflow efficiency through automation.

Subscribing to affordable accounting software and minimizing fixed and variable expenses are also practical methods.

But nothing beats outsourcing financial responsibility.

Outsource your bookkeeping and other financial requirements and get fully customized solutions for your business.

Ledger Labs has 12+ years of experience in the field of accounting and bookkeeping.

We’ve helped businesses across industries and different sizes with tailored bookkeeping solutions.

Book an appointment with us today to find out more.