Any business owner would tell you the woes of tax filing.

The process requires not just attention to detail but also an up-to-date understanding of local, state, and federal tax policies.

You would quite literally play down the process of tax filing by saying that it’s time-consuming.

Corporate tax filing is a complex process that is further complicated due to the frequent changes in law.

It isn’t something that you can just do by yourself as inaccurate filing results in costly penalties.

You need someone with extensive experience filing tax returns, preferably an agency specializing in corporate taxation.

This is why you probably need to outsource corporate tax filing as it helps you avoid costly financial mistakes.

In addition, you wouldn’t have to lift the entire burden of tax preparation yourself – especially if you already have to strategize and look after your core business operations.

Let’s explore the various aspects of corporate tax filing.

- Corporate tax filing is an important part of running your business.

- There is a 21% corporate tax rate in the US in 2025.

- When you file for corporate taxes, consider federal, state, and local taxes.

- You must file your corporate tax returns every year by the 15th of April.

Corporate tax filing – A quick overview

Before we begin, it is important to understand what corporate taxes really are.

In simple words, this financial information includes the earnings, losses, and investments of your business.

Giving a comprehensive overview of your tax liabilities helps your business maintain compliance and stay in the good books of the IRS.

You are obliged to file your tax returns using Form 1120 by the 15th of April every year.

While the federal corporate tax rates change quite often, currently it is 21% as mentioned in the Tax Cuts and Jobs Act.

Although it is best if you file for your corporate taxes by the fourth month of the year, you may get a 6-month extension period.

What is the corporate tax rate?

The federal corporate tax rate for 2025 is 21% which applies to your entire business’s income.

You can estimate the number by subtracting the total revenue from your expenses.

This expense could include administrative costs, COGs, asset depreciation, and operational and marketing expenses.

There’s a way you can reduce the total tax liability – by learning about different tax deductions and tax loopholes.

Of course, only a reliable and credible source can help you with this.

7 steps for filing corporate tax returns

1. Find out your corporation status

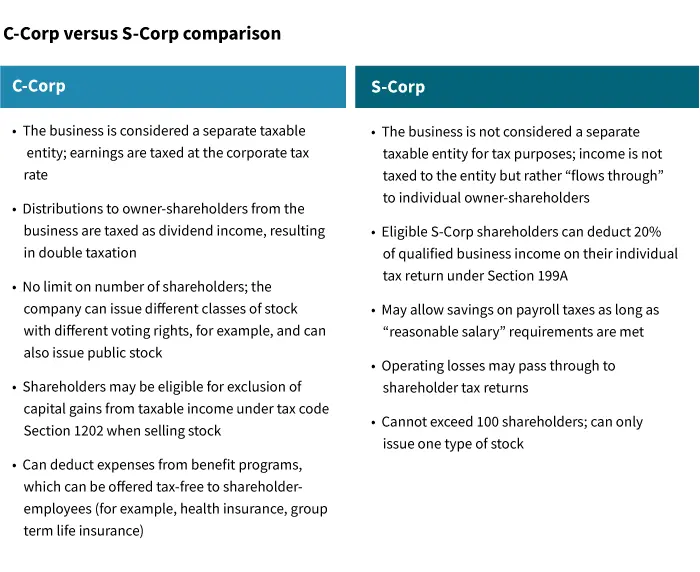

Are you an S corporation or a C corporation?

In the US, any company that is not an LLC (Limited Liability Corporation) is a C corporation.

The only difference that it makes is that with an S corporation, you can pass down your tax obligations to the owner’s income tax returns.

2. Evaluate your tax deductions

During the preparation, a major step is writing off the most common tax deductions.

IRS allows corporations to deduct expenses relevant to their core business operations, investments, employee salaries, benefits, and even insurance.

Therefore, find out different tax deductions related to your specific industry.

3. Time to pay taxes

Now it is time for you to estimate the total tax amount that you have to pay to the IRS.

If you are a C corporation, you’ll have to pay taxes four times a year, from state to federal tax authorities.

What gives S corporations a moment of relief is that they don’t have to pay corporate taxes.

As discussed, they are mandated to pay income tax on their personal wealth.

Some C corporations are asked to pay an estimated amount to not one but more states.

4. File federal tax returns

It is important for you to know which form you have to use to file your taxes.

For example, C corporations file for tax returns on Form 1120 while S corporations use Form 1120-S.

5. File for state tax returns

As mentioned above, C corporations have to look at different tax returns varying from state-level to federal and even international.

Once you’ve filed for federal corporate income, you are due state corporation tax.

Thus, see the flat tax rate of the state where your business conducts its operations.

Now things are changing in some states. Earlier, you had to file for both federal and state tax on the same day.

Now many states extend the deadline for a month, giving taxpayers a sigh of relief, and more time handling federal tax returns.

6. File local tax returns

Let’s sum it down to two things:

- Companies should always check in with the local authorities to find out their actual tax obligations. The tax amount varies from city to county and regional court of law.

- Most local tax returns are filed on the same day as state taxes, you must still confirm to avoid delays or early rush.

7. File International tax returns

This step is only for businesses with global ties.

Always discuss the international laws and obligations with the agency handling your taxes.

They can guide you through the process to ensure accuracy and timeliness.

Problems with poor tax planning

As your business grows, keeping track of your taxes will become more difficult.

In addition to this, you’ll find it challenging to juggle tax deadlines with your core business operations.

The problems could arise due to various reasons starting from rookie bookkeeping mistakes and unexpected delays.

Mistakes in the world of tax compliance come with a cost. They are known as penalties. Here are some of the reasons why you could potentially face penalties.

- Failure to report actual income

- Inability to meet deadlines

- Failing to file for a quarter tax return

- Overdeducting business expenses

- Underpaying tax returns

- Inaccurate tax estimations due to poor financial planning and record tracking

4 reasons you should outsource corporate tax filing to Ledger Labs

There are 4 main reasons why you should outsource your corporate tax filing to Ledger Labs.

Not only do we provide reliable services, but we also dedicate our experienced professionals to give you cost-effective solutions and tax services.

- You can delegate the entire responsibility of corporate tax filing to Ledger Labs. This means, we take care of your books, handle your accounts, and ensure your finances are in top form and ready and submitted before the deadline.

- By outsourcing corporate tax filing, you get our year-round services. You can give us a call or email us to get immediate and detailed responses.

- We have 12+ years of experience, helping businesses from different industries and sizes. We have the knowledge and the tools necessary to track accurate tax returns and tax deductions.

- We have the latest information. Our experts help you make the most of tax deductions so that you can save as much as possible from your hard-earned money.

The Bottom Line

Corporate tax filing is a complex financial obligation that every business must follow to avoid legal and compliance issues.

There are various corporate tax filings, including federal, state, and local.

By outsourcing your tax filing, you can get professionals to handle your tax preparation.

It ensures you file accurate tax returns as per the latest jurisdictions.

By getting Ledger Labs on board, you will not only manage your tax obligations but also boost your knowledge.

Book an appointment with us as we can help you evaluate your tax deductions to maximize corporate tax benefits.