If you run a clothing brand, your margins live and die by the numbers.

The math behind fashion is brutal because it encompasses inventory management, cash flow gaps, and SKU-level profitability.

And if your books aren’t bullet‑proof, you’re flying blind.

The U.S. clothing industry is a $365 billion powerhouse currently.

Yet, behind every trendsetting collection and viral fashion drop lies a complex web of financial management.

Accurate accounting for the clothing industry is essential in such a fast-paced industry. It’s a strategic necessity for survival and growth in a market where profit margins average between 4% and 13%, and inventory turnover rates can significantly impact a brand’s cash flow.

This comprehensive guide unpacks the statistical realities and best practices for accounting in the clothing industry, tailored explicitly for U.S. businesses navigating a fiercely competitive landscape.

The financial state of the U.S. clothing industry

- The US clothing market averages a net profit margin, ranging from 4% to 13%.

- For many clothing businesses, inventory is the single largest asset, often representing up to 40% of total assets on the balance sheet.

- This isn’t surprising when you consider that the average apparel retailer in the U.S. turns over its inventory between 3.5 and 6.5 times per year, according to the National Retail Federation.

The rise of e-commerce has brought both opportunities and challenges.

Also Read: E-commerce Accounting: The only guide you need

In 2024, 38% of all U.S. apparel sales occurred online, and with that shift came a significant increase in return rates, averaging 24% for online purchases.

Returns are not just a logistical headache; they have a direct impact on revenue recognition, inventory management, and cash flow. If not correctly tracked and accounted for, returns can distort financial statements and lead to poor business decisions.

Omnichannel retail has become the norm.

A customer might browse online, try on products in-store, and ultimately make a purchase through a mobile app or at a pop-up event.

For accountants, this complexity necessitates seamless integration between physical and digital systems, ensuring that every transaction is accurately captured and processed in real-time.

1. The clothing business isn’t simple

Clothing looks simple on the surface. But in reality, most fashion businesses run on tight margins and high complexity.

You’re not just selling clothes, you’re managing a fluid inventory, unpredictable returns, multiple sales channels, and time-sensitive trends.

Here’s where things get messy fast:

- Styles shift constantly – what sold in Q1 may be dead stock in Q2

- Most online fashion brands operate on 2-4 sales channels at once: DTC, marketplaces, wholesale, pop-ups

- Discounts, promos, and bundles complicate revenue recognition

If you’re not tracking every dollar properly, your books will seemingly lie to you. You’ll think a product is profitable when it’s not. Or worse, you’ll run out of cash during your peak season.

Founders often get caught in three common traps:

- They overestimate margins: They forget to include shipping, returns, packaging, and merchant fees in their cost calculations.

- They let inventory pile up: Instead of adjusting buying based on actual sell-through rates, they continue to reorder based on gut instinct.

- They treat accounting as “admin work”: The truth is, it’s not just compliance. It’s operational intelligence. Accounting should be your decision engine.

And if you’re working with a generalist CPA who doesn’t get eComm or inventory-heavy businesses, they’re probably giving you clean books that hide dirty problems.

To be fair, most of the time, clothing brands don’t fail because of bad designs. They fail because they don’t know what’s actually making money and what’s quietly draining it.

2. What needs to be tracked, precisely

Let’s start with the most misunderstood line item: COGS.

Most founders think of Cost of Goods Sold as the invoice from their manufacturer. But that’s just the beginning. True COGS in apparel include raw materials, shipping, freight insurance, customs, packaging, fulfillment, and platform fees.

Even the 2.9% Shopify takes from every sale belongs here.

If you’re leaving those out or treating them as separate “expenses”, your margins are inflated and your forecasts are likely inaccurate.

The situation worsens when multiple sales channels are involved.

- Selling directly on Shopify has different economics than wholesale or through Amazon.

- DTC typically yields higher margins, but also higher returns and advertising spend.

- Wholesale ties up inventory valuation longer and often comes with chargebacks, co-op marketing fees, or post-sale allowances.

- Marketplaces gouge you on fees and take control of the customer experience.

If your accounting system doesn’t break these out, then you’re flying blind. A blended margin tells you nothing.

Returns are another black hole. Apparel returns are among the worst in retail.

Many brands don’t record return data in sync with the original sale, which distorts revenue recognition. Even fewer track the real cost of those returns, including repackaging, restocking, or markdowns if the item isn’t resale-ready.

It’s not enough to “keep track” of your numbers. You have to track the right numbers, in the right way, at the right time.

That’s what separates businesses that scale from those that spin in circles — looking profitable but bleeding cash under the surface.

3. Paying attention to inventory accounting

Inventory is not just stock. It’s cash that’s locked up in fabric and sizes that may or may not move.

And if your accounting doesn’t track it right, it becomes a black hole on your balance sheet.

Let’s start with dead stock – the stuff that didn’t sell.

Apparel is brutally seasonal. What’s hot in May becomes irrelevant in July. And if you don’t write off that inventory(or at least markdown the value on your books), you’re inflating your assets and showing phantom profitability.

Then there’s WIP – work in progress.

If you manufacture, especially overseas, you’ll often have large batches in various stages: fabric bought, items cut, some stitched, some packed.

Most brands ignore this in their accounting. That’s a mistake. Those goods aren’t “expenses” yet, but they’re also not sellable. They live in limbo, and if they’re not appropriately recorded, your cash flow reports will lie.

The fix to this situation isn’t complicated. You need a perpetual inventory system, one that updates in real time, not at the end of the quarter. You need to reconcile it frequently. Your balance sheet should always reflect what’s actually on hand, what’s in transit, and what’s aging out. Having the right accounting software for your business is going to go a long way.

Here’s what healthy inventory accounting tracks clearly:

- Stock by SKU, size, and location

- Sell-through rate (how fast items are moving)

- Inventory aging (how long stock has been sitting)

- WIP and committed inventory (not yet sellable but already paid for)

Most of the successful fashion brands we’ve worked with at Ledger Labs weren’t better designers. They just knew their numbers, down to the SKU, the size, and the shelf life.

4. Taxes in the clothing industry

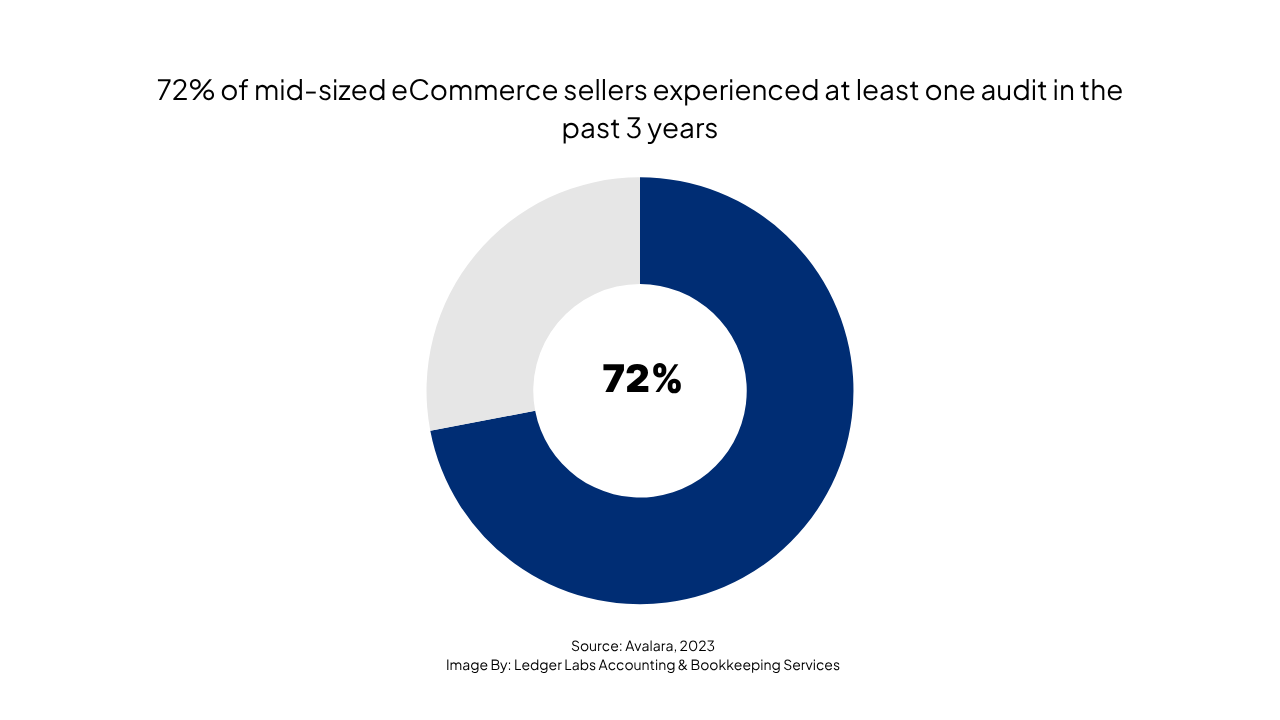

A 2023 Avalara survey found that 72% of mid-sized eCommerce sellers experienced at least one audit in the past 3 years, often triggered by economic nexus violations or misreported tax categories.

Unlike federal income tax, sales tax is governed at the state level, and apparel sits in a gray area in many of them.

In some states, basic clothing is tax-exempt.

In others, it depends on the price.

You need an effective e-commerce tax planning guide to get started.

In New York, for instance, clothing and footwear priced under $110 per item are exempt, provided they are sold to individuals for personal use (NY Department of Taxation).

If you’re bundling items, offering buy-one-get-one deals, or including accessories, the math becomes complicated quickly.

Now factor in economic nexus laws. Since the 2018 South Dakota v. Wayfair Supreme Court decision, you’re on the hook for sales tax in any state where you hit a certain revenue or transaction threshold, even if you don’t have a physical presence there. As of 2024, 46 states enforce economic nexus rules.

If you’re selling through Shopify or Amazon, here’s where it gets tricky: some platforms remit tax on your behalf, but only in certain states, and only if you’ve configured it correctly.

If you think this is “handled,” double-check. We’ve seen founders shocked by audit notices because their settings didn’t match their sales footprint.

Apparel founders also forget to account for:

- Duties and import taxes on overseas inventory, mainly if you manufacture in China, Vietnam, or India

- Freight and logistics costs are deductible, but only if properly categorized

- Promotions and discounts, which may reduce taxable revenue, depending on how they’re recorded

If your current accounting partner doesn’t ask about your sales by state, returns by location, or bundling strategies, they’re asleep at the wheel.

5. Reports That Really Matter

Data > everything else.

Most founders believe they need to file reports to comply with tax regulations. But that’s just the bare minimum. What they really need are reports that help them make decisions.

Real operators rely on numbers that tell them where the money’s going and whether they’re building a business or burning cash in style.

Here’s what should hit your inbox regularly:

- Weekly Cash Flow Report: Not a spreadsheet relic. A living view of what’s coming in, what’s going out, and what’s at risk.

- COGS by SKU and Channel: Margins lie when they’re averaged. You need to know exactly which products generate revenue, and whether that changes depending on whether you sell on Shopify, Amazon, or through wholesale.

- Sell-Through Rates: You’re not in the storage business. Inventory that sits too long costs you twice, first when you buy it, and again when you mark it down. A weekly sell-through rate exposes dead stock early.

- Inventory Aging Report: What’s fresh? What’s stagnant? What’s been sitting 90+ days? If your inventory system can’t answer that in 10 seconds, it’s time to upgrade.

Without these reports, you’re not running a business. You’re guessing. And in apparel, guessing is expensive.

6. Choosing the right accounting system

Your accounting system should tell you what’s happening in your business. Most don’t.

QuickBooks Online is where most founders start. And it’s fine, for a while.

But it also breaks when your complexity grows.

Tracking inventory across multiple warehouses? Managing wholesale terms? Handling returns across Shopify and Amazon? QBO can’t do it cleanly without bolt-ons that often don’t sync right.

Xero is sleeker. Better UX. Decent for early-stage brands with tight SKUs and low operational complexity. But again, no real inventory muscle, and integrations can get patchy when you scale past a few channels.

NetSuite? It’s powerful, but expensive. It’s not a plug-and-play tool. You need a team that knows how to implement it. But if you’re running serious volume, with manufacturing, wholesale, and multi-region inventory, this is the level you eventually graduate to.

So what matters when choosing your system?

- Can it sync with Shopify, Amazon, 3PLs, and payment gateways?

- Does it track COGS per SKU, not just by category?

- Can it handle returns and allowances properly?

- Does your bookkeeper actually understand how to use it?

You don’t need the biggest tool. You need the one that doesn’t hide reality behind clean charts and broken integrations. If your current setup forces you to “trust your gut” because the numbers don’t line up, it’s time to fix that.

Also Read: How to use Odoo for e-commerce?

Towards the end…

If you’ve made it this far, you’re not just running a clothing brand, you’re building one. You’ve seen how sloppy accounting isn’t just a back-office burden; it’s a liability.

Here’s the real deal:

- Your profits depend on accurate COGS calculation, down to the last freight fee and return allowance.

- Your cash flow depends on real-time inventory and WIP tracking, not quarterly guesswork.

- Your compliance depends on precise tax remittance by channel, state, and promotion, not hopeful assumptions.

- Your decisions depend on timely, transparent reports, not dashboards that gloss over reality.

Put those pieces together, and what you get is clarity. When your financial house is in order, growth isn’t a guess. It’s a repeatable outcome.

And that’s where Ledger Labs comes in. We’re not here to hand you templates or file your taxes.

We partner with brands like yours to re‑architect your accounting system.

If you’re ready to stop surviving on gut and start scaling on truth, we should talk. You can book an appointment with us and we will help your business build a solid accounting and bookkeeping foundation that survives all kinds of audits and difficult times.