1. 75% of businesses face delayed payments, which affect cash flow.

2. Companies relying on manual AR entries risk errors, leading to 45% of delays in payments.

3. Automating accounts receivable can increase collection rates by 15-20%.

4. Businesses using automated AR systems see a 30% reduction in processing costs.

Accounts receivable is an important aspect of a company’s financial health, as it represents the money owed to the business by its customers.

The accounts receivable journal entry process can be complex, with different types of transactions requiring specific treatment.

But how does a business keep these records updated and indexed?

This is exactly where journal entries come into the frame.

An Accounts Receivable journal entry describes and records the sale of goods or services that are made on credit. This, in turn, results in a rise in the accounts receivable balance.

This entry is indispensable for documenting the transaction in the company’s accounting system and ensuring that the financial statements reflect the state of its finances meticulously.

But, what is its purpose, and what components does it house?

Purpose of Journal Entries in Accounting

The purpose of an Accounts Receivable Journal Entry can extend far to:

1. Assessing customer creditworthiness

2. Keeping a close eye on pending balances

3. Collection of the due payments from consumers

In other words, the major purpose of a journal entry is to have a proper tab (either physically or digitally) about every business transaction. Now, let’s say that one transaction goes to impact several accounts, the journal entry will detail that data as well. They support the tracking of all activities associated with accounts receivable, from the first revenue recognition to the last cash receipt.

Understanding Accounts Receivable Journal Entries

Many treat journal entries as the building blocks of accounting. This is primarily because it frequently serves as a chronological log of every financial transaction that takes place within an organization. As you may know, every entry records transaction details, including but not limited to the date, accounts impacted, and involved amount, among many others. It helps to ensure that eerie little nitty-gritty is properly accounted for and accurately presented in the company’s books.

In simple words, we specifically examine how companies document transactions involving the sale of goods or services on credit when it comes to accounts receivable journal entries. It is undeniable that these entries are highly necessary because they display sales that are yet to be paid in cash. Thus, it gives a sneak peek into the amounts due from the customer’s end to the business.

In detail, this is one of the key areas of a business because it affects both the cash flow and the general financial well-being of the business. Now that you know what journal entries in accounts receivable are, let’s look at their components and how they function together.

Components of an Accounts Receivable Journal Entry

If you want to understand accounts receivable journal entries in detail, then you must learn about their components and how they work in unison. But, here’s the twist, the components of an accounts receivable journal entry will differ based on the transaction that is documented.

However, there are certain common components that you may see more often than others. Let’s look at it from a closer view to help you understand better:

1. Date: This gives an overview of when the transaction takes place.

2. Accounts:

- a) Debit: In order to exhibit the rise in the amount a customer owes, this typically entails debiting the Accounts Receivable (AR) account.

- b) Credit: This basically entails crediting the Sales Revenue account in order to identify the total revenue gains through the sale.

3. Amount: Now, this is the transaction amount that is to be recorded.

4. Optional Description: This is just a crisp and concise explanation of the given transaction that can be pretty advantageous as a future reference

Want help with accounts receivable journal entry components?

Consult our expert accountants.

Now, let’s look at some other components that you may be seeing as well, on the basis of certain scenarios.

- Sales discounts: In case there is an additional discount offered for early payment, then that would be debited to Sales Discounts and later credited to Accounts Receivable.

- Provision for Doubtful Accounts: Whenever a company sells a product or service on credit, there is always a chance that a customer will not pay their fair share of the bill. In order to combat this extra risk, businesses often create an “allowance for doubtful accounts” which is a special account type that is considered a “contra asset” since it helps to lower the asset’s value, especially accounts receivable. Read more about credit risk management here.

- Cash or other assets: In case a consumer goes to make a payment, the Cash account (or any other related asset account) is debited. While, on the other side, the Accounts Receivable is credited.

Now that you know the components required, let’s now understand the types of journal entries!

Types of Journal Entries

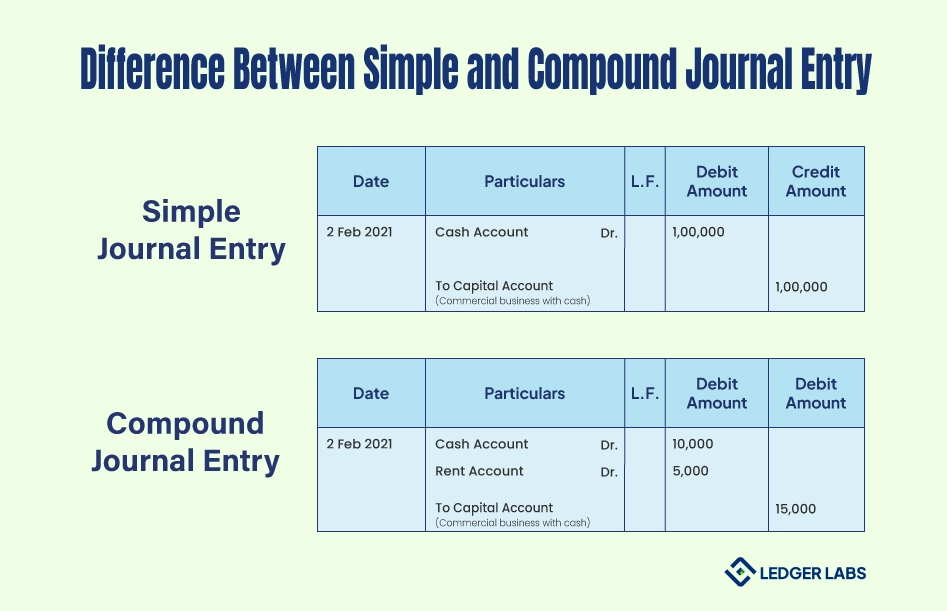

In double-entry accounting, businesses can choose either simple or compound journal entries on the basis of how complex a transaction is. Let’s look at them in detail:

Simple Journal Entry

This is basically an accounts receivable journal entry type that entails that a business might issue refunds, make necessary purchases, or even transfer funds between given accounts. Moreover, one of the primary features of simple journal entry is that businesses mainly document debit in one account, and credit in another. In other words, it means that these entries only impact two accounts.

Compound Journal Entry

Compound journal entries can be a savior at times when transactions become really difficult, involving several account changes. A company can often use compound journal entries to record payroll payments and deductions. In some cases, many use compound journal entries to input multiple line items into a supplier invoice that involves numerous company expenses. To be precise, these entries have the power to impact two or more accounts, either on the credit or debit side.

Types of Accounts Receivable Transactions

Accounts receivable transactions basically cover numerous scenarios which exhibit the dealings of the company with its customers. Let’s have a look at them in detail and their associated journal entries:

Sales on Credit

A business doesn’t receive cash immediately right after a sale has been made. More precisely, it actually identifies the revenue at the moment and then goes to record the amount owed by the customer as the accounts receivable (AR). Know more about credit memo here.

Let’s consider an example of journal entry for a sale on credit:

- Debit Accounts Receivable (it raises the balance, representing that the company is owed an amount)

- Credit Sales Revenue (basically shows the income from the same)

Cash Receipts from Customers

This is the transaction that takes place when a customer is paying their balance off, eventually lowering the accounts receivable and multiplying the cash on hand of the company.

Let’s consider an example of journal entry for cash receipts:

a) Debit Cash (helps raise the balance, which indicates a growth in company’s can on hand)

b) Credits Accounts Receivable (starts to lower the balance because the debt of the customer is now settled)

Discounts and Allowances

This is basically a reduction allowed to customers. However, keep in mind that this can impact the overall sales revenue and the balance in accounts receivable.

Let’s consider an example of journal entry for discounts and allowances:

a) Debit Sales Discounts (helps to keep tab on the discount amount, thus lowering the revenue)

b) Credit Accounts Receivable (due to the discount, there is a reduction in the amount that is owed by the consumer here)

Bad Debt Write-offs

An enterprise may occasionally decide that some debts will never be paid. These are essentially named off as “bad debts”.

Let’s consider an example of journal entry for bad debts write-offs:

a) Debit Allowance for Doubtful Accounts (as previously said, this is a contra asset account that actually soaks up the impact of the write-off)

b) Credit Accounts Receivable (helps in reducing the balance, knowing that said amount will not be collected)

Fairly, every transaction listed here is imperative when you consider managing and recording the financial operations of a company as associated with sales on credit. This, consequently, guarantees proper financial reporting and analysis.

Unsure about journal entries?

Ask our accounting experts for free guidance.

Examples of Accounts Receivable Journal Entries

Let’s now look at some examples related to Accounts Receivable Journal Entries to showcase various scenarios. This will help you understand better. So, let’s go and get a better picture of accounts receivable journal entry examples!

Example Case 1: Sale of Goods on Credit

Let’s consider the sold goods are worth $2,000 to customer A on credit. They have a net due in about 30 days.

In this case, the journal entry would look like:

a) Debit: Accounts Receivable – $2,000

b) Credit: Sales Revenue – $2,000

Example Case 2: Customer Pays a Partial Amount

Let’s assume that Customer B pays off $860 towards their already outstanding balance worth of $1,000.

Thus, the journal entry in this case will be recorded as:

a) Debit: Cash – $860

b) Credit: Accounts Receivable – $860

Example Case 3: Sales Discount

Assuming a 2% discount paid within a timeframe of 10 days, an entity sold goods that cost $500 to customer C on credit. Now, customer C gets to pay within a discount period.

In this case, we can consider the journal entry as the following:

a) Debit: Cash – $490 (500 x 0.98)

b) Debit: Sales Discounts – $10 (500 x 0.02)

c) Credit: Accounts Receivable – $500

Example Case 4: Bad Debt Write-off

Let’s consider a hypothetical situation where there were numerous attempts made to collect, yet it was eventually determined that a whole $570 receivable from a given customer D cannot be collected.

For this scenario, we can consider the following journal entry:

a) Debt: Bad Debt Expense – $570

b) Credit: Allowance for Doubtful Accounts – $570

These are just a handful of examples you should know about. However, always remember that the particular details of the journal entry will differ on the basis of your accounting practices and business nature.

Best Practices for Managing Accounts Receivable Journal Entries

Examples of journal entries is important, but so is having full knowledge about its best practices. Let’s say you know almost everything about what Accounts Receivable Journal Entries are, but do you know what’s the best way to implement it or how to manage it well?

That’s what we will answer about. Without any further delay, let’s dive into the best practices you should be mindful about:

1. Maintain accurate records and documents

When you are accurate, you are safe. That’s the mantra. In simple words, you have to make sure that all the sales on credit have been perfectly recorded, with every nitty-gritty, such as the date, amount, and information of the customer. It’s not just useful in financial analysis but extends far beyond that. In other words, it also helps to track customer payments and manage cash flow in a more enhanced way.

2. Reconciling Accounts Receivable Regularly

Always be regular with the reconciliation of accounts receivable. In layman’s language, you can make sure that your accounting records and actual cash receipts match by regularly reconciling your accounts receivable. This can be a major help when you are trying to identify discrepancies head on, including but not limited to undocumented payments or invoice irregularities. In turn, you can address them for timely rectification and preserve the accuracy of financial statements

3. Monitoring Aging Schedules

Now, this is a very important tool that helps assess the status of accounts receivable. Moreover, it helps classify outstanding receivables after closely looking at their due dates, gradually recognizing the ones that fall under the category of overdue accounts. That’s part of the reason why we advise you to regularly review the aging schedule, as it helps take proactive measures and analyze the risk of bad debt.

4. Implementing Internal Controls

There’s absolutely no doubt that efficient internal controls can be lifesavers when you want to protect against looming errors and fraud. This can include a lot many things:

a) Duty segregation (this is where you ensure that there is no one person who has control over every little area of a transaction)

b) Given authorization of a transaction

c) Periodic analysis and detailed reviews of accounts receivable balances

When you implement robust, unbreakable controls, it further helps you to maintain the integrity of your financial information, also consequently helping you guarantee the authority of financial reporting.

To sum up

Have you ever given any thought to how a company’s success and well-being are affected by accounts receivable journal entries?

Well, even if you have not, it is almost time you did.

Imagine you are selling quite a lot of things collectively, but then, you lose the memory of who owes you what amount.

Sounds disastrous, isn’t it?

That’s exactly what makes accounting accounts receivable journal entries carry weight.

To make sure that every anticipated dollar actually gets to reach the business, they help companies track the amount they are owed in real-time.

That being said, you can already imagine how important journal entries are because they help you keep your books organized and cash flow uninterrupted.

Still have questions? Reach out to our accounting and bookkeeping experts and get direct guidance and assistance about accounts receivable journal entries (and so much more).