If you are a first-timer and you don’t know how to file self-employment taxes, this guide is for you.

Whether you run a business or work part-time or full-time as a freelancer, tax season will bombard you with several forms of income.

Some of them include Form W-2, Schedule SE, Form 1040, etc.

And you’d have to make sense of it all.

Now with a business to run, you already have a lot on your plate.

This (mostly) doesn’t leave you with time to read and prepare for your taxes all the time. But by hiring an affordable service for tax filing, you can take off that burden.

Let’s explore what self-employment taxes are and how you can file them the right way.

- Self-employment tax requires you to provide an estimate of your total income after subtracting total business costs.

- You will use Form W-2 to show Social Security and Medicare tax.

- Calculate your total net income, collect all financial information, and evaluate all tax deductions to file for your tax returns.

- Form 1040, Schedule SE, and Schedule K are all necessary forms for all self-employed individuals.

What is self-employment tax?

The true meaning of independent working becomes prominent when it comes to filing your taxes.

When you are employed with a traditional employer, they are responsible for paying half your taxes.

This is done on the W-2 Form in which they apply for your Medicare and Social Security taxes.

While your employer pays 7.65% of your net income, you pay the rest of it.

But the entire narrative shifts once you become your own boss.

When you start working for yourself, you get an additional Medicare and Social Security tax on your income tax. This takes your tax liability to 15.3% per annum.

But it doesn’t have to sound so challenging, You can get a 50% tax deduction on the self-employment tax you pay – reducing an enormous amount of weight off your shoulders.

Should you be filing self-employment taxes?

It’s important to figure out whether or not self-employed taxes apply to you.

And for that, you must identify what the term self-employed means.

- Self-employed individuals work as independent contractors or have sole proprietorships.

- They are also individuals who have companies in partnerships with other individual workers.

- You can also identify yourself as a self-employed individual if you are a freelance photographer, writer, or designer.

- You’ll be identified as a self-employed individual if you are also a driver linked with car services such as Lyft and Uber.

Now you may wonder whether there is an earning bracket that would box you in the self-employed category.

Well, yes, there is.

If you are a part-time or full-time worker earning up to $400 or more as part of your self-employment income, and that is the income once you take out earnings from your expenses, then the IRS makes you responsible for filing self-employment taxes.

Although you get the W-9 form for filing self-employment tax returns, you may also receive additional forms, like the 1099-NEC for nonemployee compensation or the 1099-K in case you made money through any online apps.

The IRS is extremely particular about the accuracy of these reports so it is best to file and report your tax returns correctly.

Self-employment tax forms: An analysis

It may confuse which form you have to report your earnings on.

So here’s a simplified version of where you must file your tax returns.

To make it easier for you, I’ve divided it according to the type of your business entity.

- Single-Member LLC: Report your earnings on Form 1040 OR Schedule C. You can also use Schedule SE to establish the amount you owe should your business make $400 or more in a business year.

- Non-LLC or Sole Proprietorship: File your individual tax returns on Schedule E. Then, you will use Schedule E to fill the return on Schedule SE.

Here’s an example.

You have a partnership and you file for Form 1065, providing your partner with a Schedule K-1 to file their returns.

Now this partner will use the information from Schedule K-1 to fill out Schedule SE.

At the same time, if you own an S corporation, you don’t have to file for SE tax on your earnings.

Accurate filing of self-employed tax (in 4 steps)

It may seem intimidating to be filing your self-employment taxes for the first time but it doesn’t have to be.

All you have to do is clarify how much you earn by taking out business expenses from that amount.

Here’s what the IRS expects you to do.

1. Calculate your net income

First, you must put all the necessary tax forms in front of you. This includes:

These forms will help you determine your entire nonemployee compensation. Should you miss any information, you simply add up all income generated from all sources.

2. Gather your financial statements

Now it’s time to collect all the proof.

You will gather all the necessary financial statements, invoices, bills, and any receipts that could help your business costs through the year.

Evidence is necessary to write off that money from your total earnings.

You can look at it as business deductibles, such as fuel used for travel or internet bills and office supplies.

Make sure you only add expenses relevant to your business – they should not be your expenses.

3. Evaluate your tax deductions

It is important to know whether there are any additional tax deductions that you may benefit from.

This is when you can use a professional tax expert who is aware of all the loopholes and ways you can save the maximum from your earnings.

So far you may be wondering that self-employed individuals are only eligible for business cost deduction. But that’s not true.

You can also contribute to an IRA or SIMPLE IRA to reduce the tax amount.

And the same applies to individuals with spouses or other dependents.

4. File necessary tax forms

If you are using accounting software to file your tax returns, you’d have to simply use Form 1040.

However, if you’re not optimizing the experience of tax filing, here are additional forms that you may have to use to file your returns.

- Schedule C to show the profit or loss from your business.

- Schedule SE to file your Self-Employment Tax returns.

This form is used to determine your tax liability, keeping into consideration the profit or loss you earned on your business, and information you’ve already provided on Schedule SE.

- Schedule 1 to show you profit and loss with the purpose of claiming tax deductions.

Ledger Labs services to file self-employment taxes

Filing self-employment tax returns is not difficult but it can be for individuals either doing it for the first time or business owners who don’t have much time on their hands to focus on this extensive paperwork.

This is why it’s best to hire a tax professional and outsource your tax preparation and tax filing.

Ledger Labs, with a solid 12+ years of experience working with businesses of all sizes and industries.

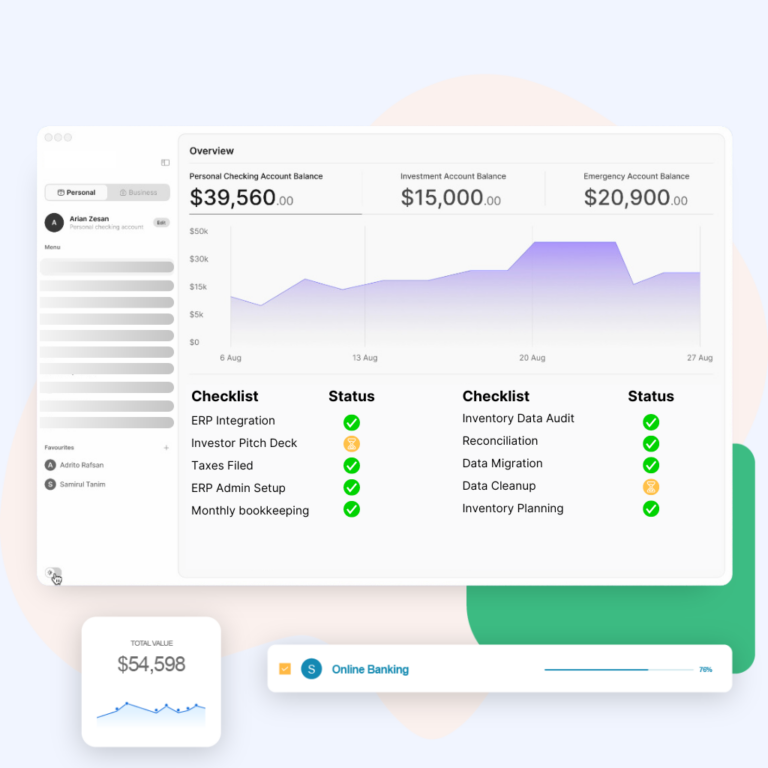

1. A comprehensive bank of resources

We provide complete tax preparation and year-round services.

So you can give us a call or write an email – we make sure there’s no communication gap between you and our services.

2. Available round the year

We provide complete tax preparation and year-round services.

So you can give us a call or write an email – we make sure there’s no communication gap between you and our services.

3. Full tax responsibility

Whether it is the preparation of tax filing or evaluating tax deductions, you can count on us.

4. Increase tax knowledge

It can be hard for you to take time offend learn about every aspect of tax compliance, especially when you already have your core business activities to look after.

By getting us on board, you will be able to understand how to make the most of your tax deductions and reduce your costs.

The Bottom Line

Self-employment tax is not limited to your annual income, it includes your Medicare and Social Security Tax.

Knowing how you can make the most of your tax deductions can not only maximize your savings but also help you fill gaps in your tax preparation.

It’s best to outsource tax filing of self-employed businesses to Ledger Labs.

We provide extensive tax support and are simply a call away.

Book a consultation with us to figure out how we can make self-employed tax filing easier for you.