1. Financial forecasting software usage is projected to grow significantly due to increased demand for predictive analytics and AI-driven decision-making in finance.

2. Companies using financial forecasting tools report up to 50% time savings in planning and budgeting processes.

3. Automated forecasting reduces errors in financial projections by over 30% compared to manual methods.

4. Organizations with advanced forecasting capabilities experience up to 10% higher revenue growth than those relying on traditional methods.

5. The global financial forecasting software market is expected to grow at a CAGR of 8.2% from 2025 to 2030, reflecting increasing adoption across industries.

Running a business is all about anticipating what’s round the corner and being prepared for it.

There are several things that fall outside of your control, impacting the market in ways you cannot always easily predict.

For instance, just take a look at how numerous new innovations, technologies, and regulations change the way how industries operate. So, you must forever be on the lookout for new trends, demand opportunities and avenues for growth and expansion. This is where financial forecasting software comes in handy.

The purpose of this blog is to explore best financial forecasting software in detail. But, before that, we must understand what financial forecasting is and why is it important for small businesses.

What is Financial Forecasting?

In layman’s language, financial forecasting is when you make necessary predictions about how your business is going to perform in the future to help support decisions integral to the company. It involves answering some very imperative questions:

- How has the business performed in the past?

- What is happening in the business now?

- Are there potential vulnerabilities to be worried about?

This is just a handful of the many questions it can involve answering. Now, the way many perform financial forecasting can differ on the basis of what you need the forecast for and the type of business you have.

For instance, a short-term financial forecast can often focus on understanding the immediate needs in cash flow to make sure that the business has enough resources to meet its obligations. On the other hand, let’s say some are aiming for a long-term forecast. Now, that can be a catalyst in strategic planning, major investment decisions among stakeholders, or to secure a funding round.

To put it simply, financial forecasting is more like a GPS that people use to guide themselves in the right direction, often understanding whether they are on the correct path financially.

Importance of Financial Forecasting for Small Businesses

Financial forecasting is important for a list of reasons as it means you are strategically planning the success of your small business. Here are some major points to remember:

- Informed decision making: Financial forecasting is a way to understand the future health of your business. With this information, small business owners can make wiser decisions, including but not limited to investments, budget allocations, and monitoring areas or resources that may need cost cutting. Many also turn to analytics and reporting platforms like agencyanalytics to consolidate performance data and gain a clearer view of financial trends.

- Allocation of resources: This is one of the most necessary principles in a small business, as it helps allocate resources where they are most required. When you analyze future income and expenses, you can easily avoid wasting resources by prioritizing spending on projects with the highest potential for return.

- Funding and investment: Financial forecasts are highly necessary in events where you are, as a small business owner, looking for investments and loans. In other words, it can offer investors, lenders, and other stakeholders a transparent picture of whether the company can make profits in the future and if it has a potential for growth. Thus, through this method, many businesses can secure funding or investment.

- Comprehensive risk management: Financial forecasting is known among people to help identify financial bottlenecks ahead of time before they become severe. As a result, businesses can formulate strategies to lower the risk of downturns or economic shortages by planning ahead, diversifying their sources of income or increasing their cash reserves.

- Cash flow management: When you have efficient financial forecasting in place, it helps you identify whether the business has enough cash flow to cover its commitments, such as paying employees, staff members, suppliers, businesses operations, utilities, and bills. What does it do for you? It helps maintain liquidity and stability in your business.

Get your business’s financial statements audited for free from our certified accountants.

6 Financial Forecasting Software Small Businesses Should Explore in 2025

There are endless tools in the market but here are a few financial forecasting software that you need to check out in 2025 if you are pushing your business towards a gradual growth track! Without further ado, let’s dive in and know what can suit you best:

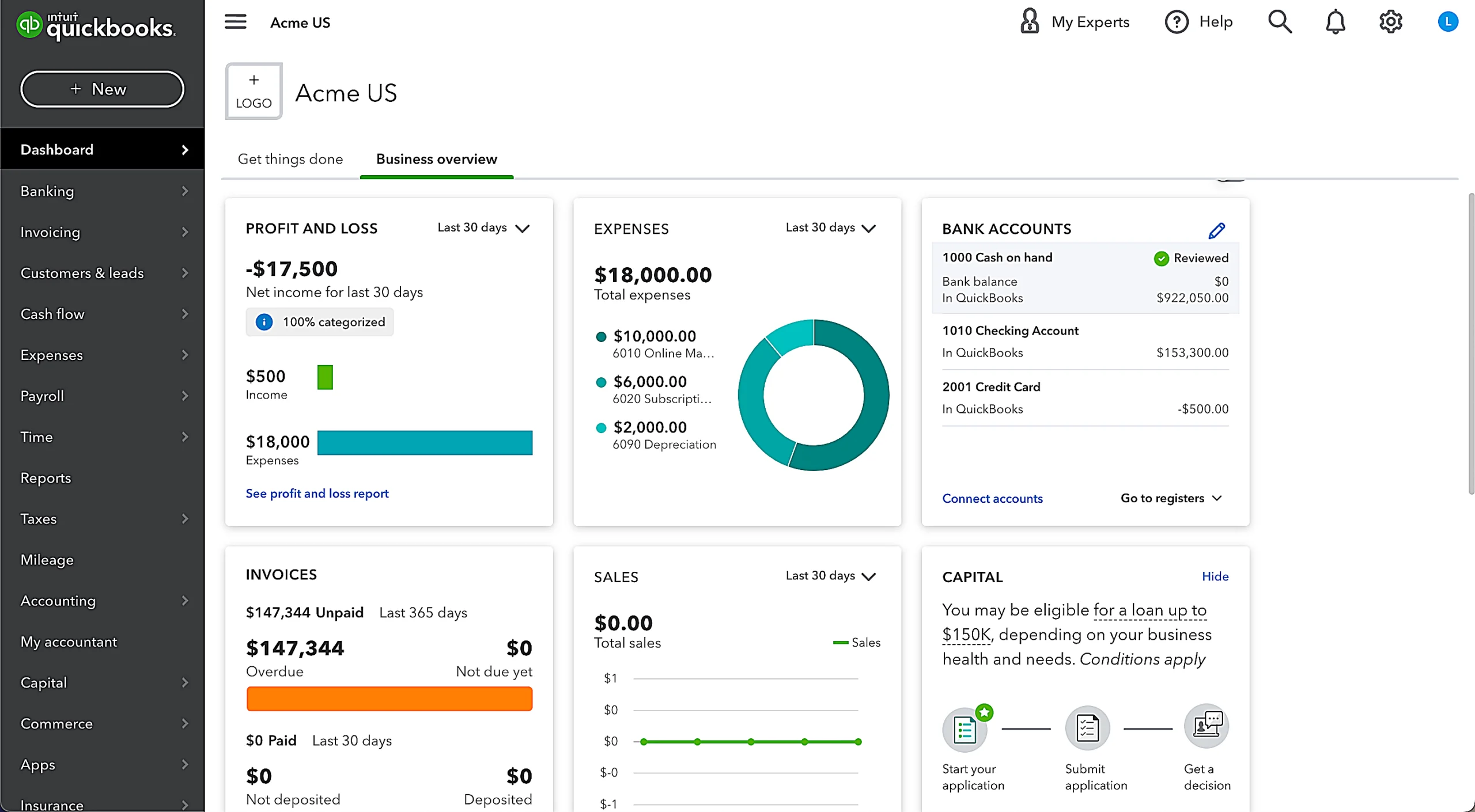

QuickBooks Online

QuickBooks Online houses several features that can help to manage finances, including but not limited to expense tracking, invoice generation, bank feeds for inventory tracking and tax management, and multi-currency support, among many more.

QuickBooks has a very intuitive, easy, and engaging UI interface that comes with a clean, readable dashboard. Moreover, what most people love about it is the quick invoice customization and automatic reminders for consumers. In fact, with this amazing financial forecasting software for small businesses, payroll management becomes a breeze, among several other facilities that make life easier for business owners.

Supporting plans

QuickBooks Online provides you the freedom to choose between four plans catering to different business needs, which include Simple Start, Essentials, Plus, and Advanced. The Plus plan generally starts at $45 per month with a free trial for 30 days.

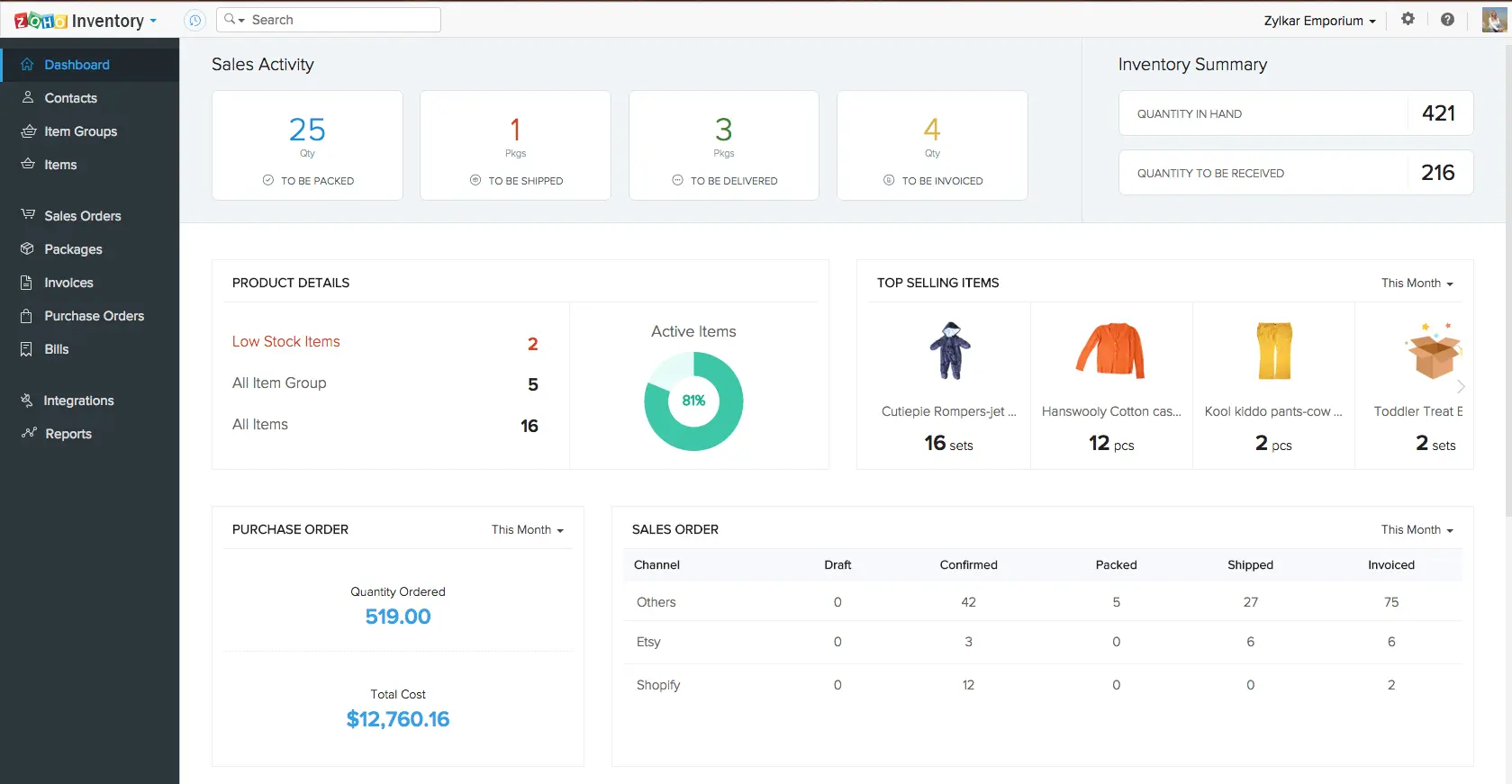

Zoho Books

Zoho Books offers small businesses numerous features that make financial management easier than it was. From customizable invoice templates and online payments to comprehensive inventory management and vendor credits, there is absolutely no doubt that this is one of the prime pieces of software for financial forecasting.

In addition, it also supports automated bank feeds, reconciliation, shareable and customizable reports. What’s more interesting? This financial forecasting software is deemed one of the best for its multiple project management specialties, timesheet tracking feature, multi-currency transactions for each contact, and role-based access – making it a one-stop for all needs.

Supporting plans

Zoho Books supports several plans that help small businesses choose the one that best fits their situation and needs. It houses 6 plans in total, namely, the free, standard, professional, premium, elite, and ultimate. Plus, it also offers a 14-day trial period to help you get a detailed overview of the website from inside the closet. Among the many, as a small business owner, if you do not have a long list of needs, the Professional ($40 per year) or the Premium ($60 per year) would do the job just fine.

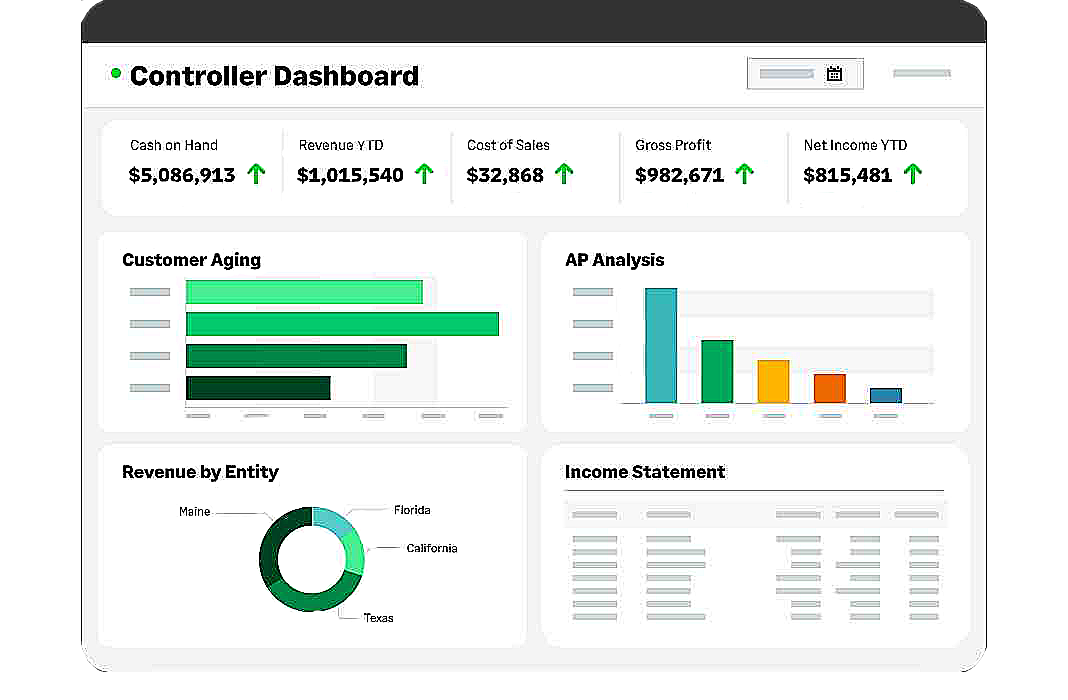

Sage Intacct

Sage Intacct gives you a bundle of advanced accounting features that can help automate and streamline some of the major financial processes, such as, multi-entity consolidation, inventory control, project accounting, and revenue recognition, along with a lot many additional features to use.

What else? It plays a big part in helping organizations make data-oriented decisions with a note of forecasting, modern-day planning, and budgeting in mind. Moreover, it provides real-time data needed to guide your business toward growth

Supporting plans

You must fill out a form in order to request pricing for Sage Intacct. A representative will be assigned to brief you on all pricing details based on your immediate needs and requests after the form has been filled out and sent. Plus, Sage Intacct offers a 14 day trial to people as well.

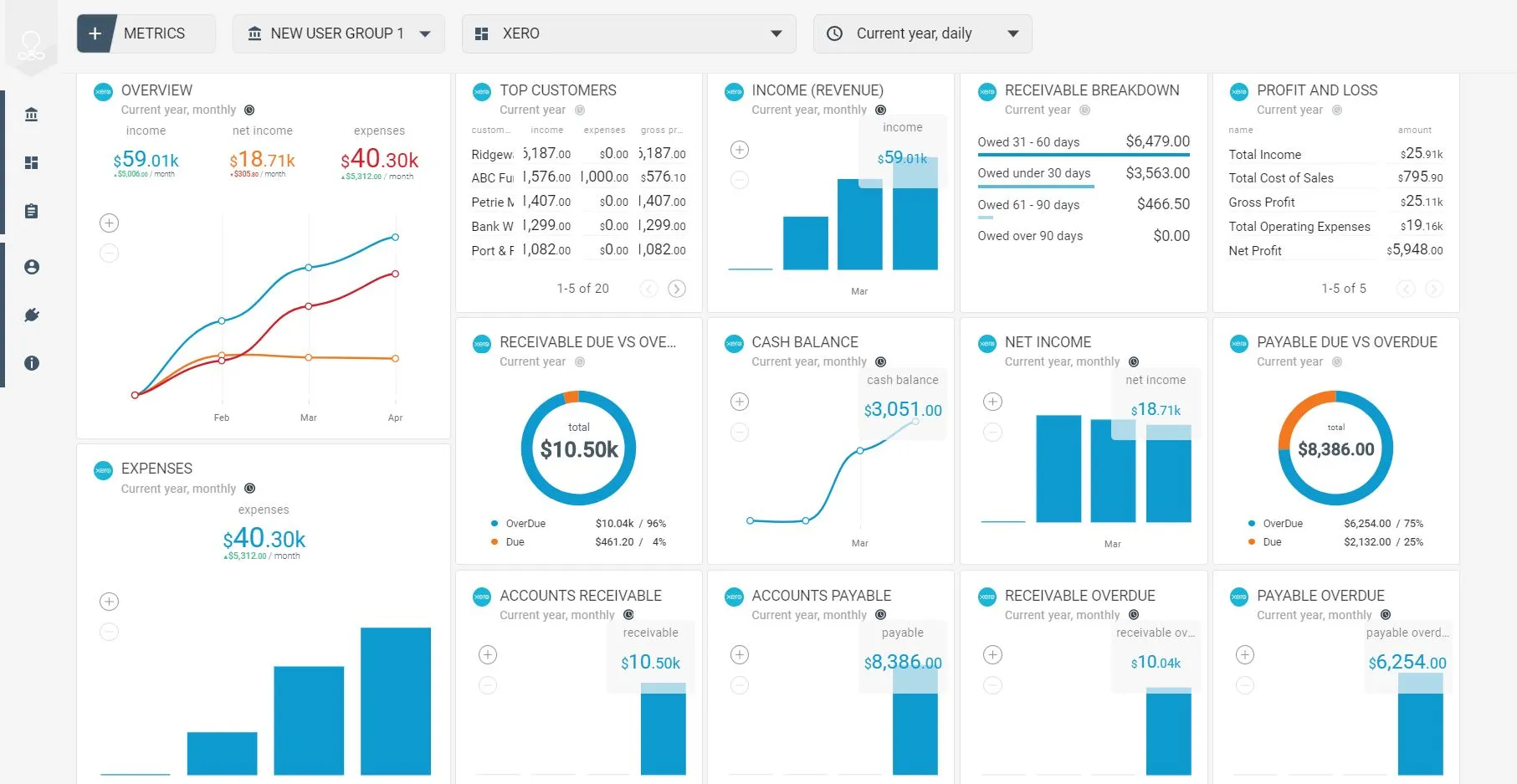

Xero

Xero is known for its clear, easy to use, and clean dashboard. It offers several important features that businesses need, including but not limited to payroll tracking, global bank connections, multi-currency support, purchase order creation, accounting dashboards, online invoicing, sales tax calculation, payroll integration with Gusto, and bank reconciliation, among many more.

From app integration and quotes to fixed asset management and customizable dashboards, there is nothing this financial forecasting software leaves out of the room. The best thing about it? It caters to a lot of business models, helps them ease the process of financial forecasting, and also supports W-9 + 1099 management.

Supporting plans

Xero supports three plans catered to major business models. In fact, many agree that the “early” plan is best for freelancers. Now to the point, Xero offers three plans, namely, Early, Growing, and Established. In the same, the “Growing” plan costs around $42 per month. However, it is advised to check the current price and match it with your requirements, as the prices of this tool can often vary in nature. So, go check here!

Confused about the right financial forecasting software for your business?

Ask our expert accountants!

FreshBooks

FreshBooks has been the editor’s choice and there is so much more to it than its appealing, subtle looks. It is best known as a full-featured, double-entry accounting system that provides a remarkable user experience. Assuming that you are a novice accountant, many would suggest FreshBooks as your go-to. What’s more in store?

Well, FreshBooks offers a lengthy list of services as well, specifically catered to small businesses, including automated payment reminders, late fees, payment with credit cards and bank transfers (ACH), and multi-currency support. That’s not it. Many people say that it has also simplified expense tracking, project management, and payroll software integration – among so many additional features.

Furthermore, it offers comprehensive inventory management capabilities, strong reporting tools, and simple team and client collaboration. In fact, you can integrate it with important third-party applications and tools as well, making the process more streamlined and easygoing.

Supporting plans

Coming to the plans that FreshBook offers, it has three major ones, namely, Lite, Plus, and Premium. Several people go on to choose the “Plus” plan which costs $13.20 per month. However, if you have requirements that don’t fall under the umbrella of the current plans, you also have the freedom to talk to a specialist and understand a lot of other plans that may go with your business model. In the meantime, it is advised to keep a close eye on the prices as they are subject to change. Get a clear idea of the pricings on their pricing page.

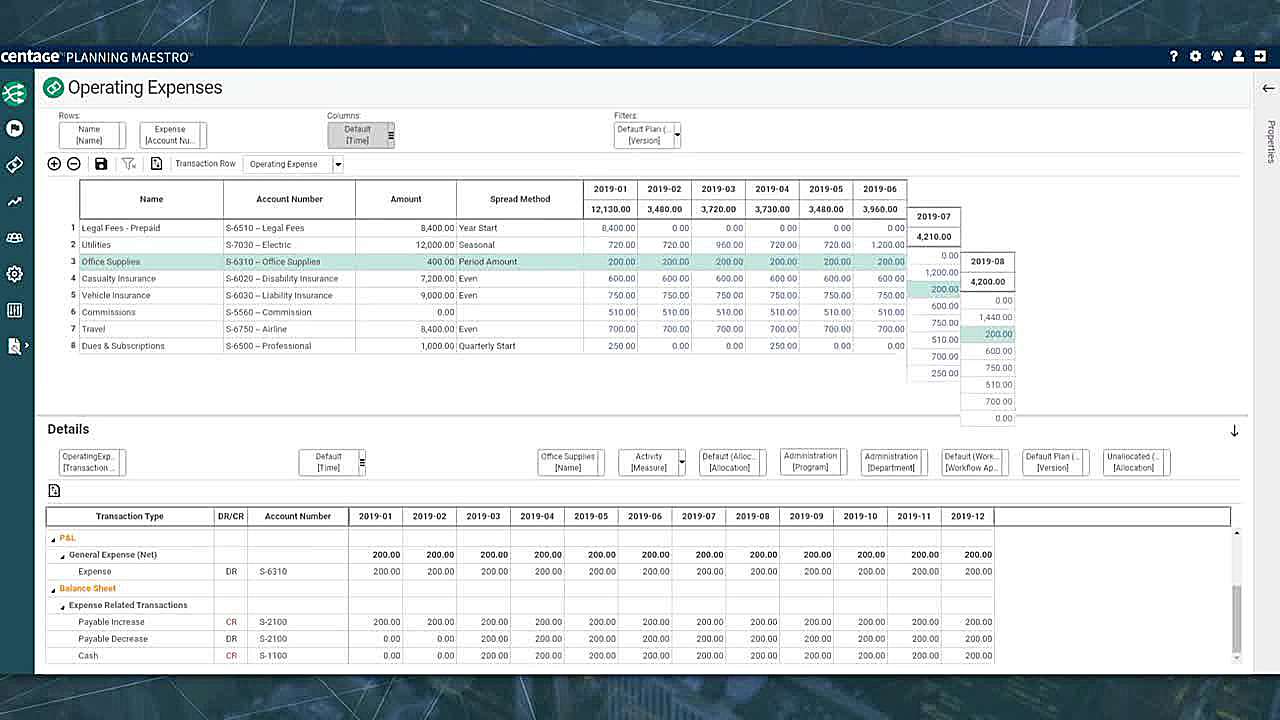

Planning Maestro

Planning Maestro, which was previously called “Budget Maestro”, is a cloud-based budgeting and forecasting application given birth by Centage. It is deemed best for small to midmarket organizations. The best thing about Planning Maestro is that it houses a sophisticated system built with financial intelligence for forecasting, budgeting, and performance reporting.

In fact, many know this software for its GL integration, quick setup principles, to-the-point planning and forecasting, and automated financial statements. Moreover, it also comes with a comprehensive and enhanced decision-making ability made feasible through advanced reporting and scenario analysis. What else? It also promotes team collaboration, unlike many in the market, and allows role-based access as well. This is especially helpful for various industries that require automated budgeting and financial forecasting.

Supporting plans

For Planning Maestro, you need to fill out a form and request a quote as per your needs. It is best to check the website and understand the necessary pieces of functionality you would need to address the requirements of your business. You will then be assigned a representative to work out a specific plan custom-made as per your requirements.

Choosing the Right Financial Forecasting Software for your Small Business

It is undeniable that when you choose something, you tend to weigh your needs and the external factors that may influence your requirements for the long term. The same goes for financial forecasting software. Effective forecasting needs a close attention to detail, where you analyze the current market trends, industry shifts, economic climates, and everything in between. The “best” financial forecasting software depends on what you need. So, ask yourself these questions before making a decision:

- What is the primary motive for using forecasting software? Are you looking to draft simple invoices and need monthly / quarterly reminders, or do you need something that offers everything from inventory management to multi-currency support? Your answer will lead you to the best tool.

- What level of financial knowledge and experience do you have? While some software are too complicated to tackle alone, a few others are really user-friendly, even for novice accountants.

- Do you already have data? Basically, do you need the software to integrate with your existing accounting system or third-party applications?

- What is your budget? There is no doubt that each forecasting software will vary in price range. While a free plan may not include inventory management, a premium plan may do. Weigh your budget and find a software that aligns with your needs and monetary scenario.

That’s about it. You cannot determine “best” through interfaces, but the requirements and functionalities you are trying to avail. Still have questions or need help understanding which software fits your business best? Get all solutions in just one place. Get in touch with our accounting and bookkeeping experts who have more than 12 years of experience and know what’s best for your business. Schedule a consultation now.