1. The U.S. tax preparation market is projected to reach $14.8 billion by 2025, showcasing the growing demand for professional tax preparers and services in the industry.

2. Over 62% of Americans used tax preparers in 2023, reflecting the complexity of tax regulations and a preference for expert guidance among individuals and businesses.

3. Certified tax preparers typically charge $150–$450 per return, with charges varying by location, complexity, and additional services such as audits or consultations.

4. The IRS requires the annual filing of 12-15 million complex returns involving businesses or specialized deductions, offering a lucrative niche for skilled tax preparers.

There are many who love the process of doing their own taxes, while a few others love seeing how meticulously a tax preparer does their job. Either way, this goes to show how many are enthusiastic about the subject, as a whole. In case you really are, might we say, you must have a natural knack for tax preparation.

This is a profession that is currently in high demand and offers numerous standalone flexibilities of its own. In fact, opting for this field naturally also means that you can work from anywhere as a tax preparer, virtual and completely remote.

In fact, when you are a tax preparer, you can make a fair share of an impact on people’s financial lives as you will help them navigate difficult tax circumstances. So, whether you are looking for a fresh career perspective or are wondering if you should make a planned switch to become a tax preparer or tax accountant – now is the time to do it. But, here’s the truth, you will have to know a lot of nitty-gritty details before actually making that decision.

That’s what brings your tax preparers near me here. To guide and inform you about what you can expect when you choose a course as in demand as tax preparation. So, here we go!

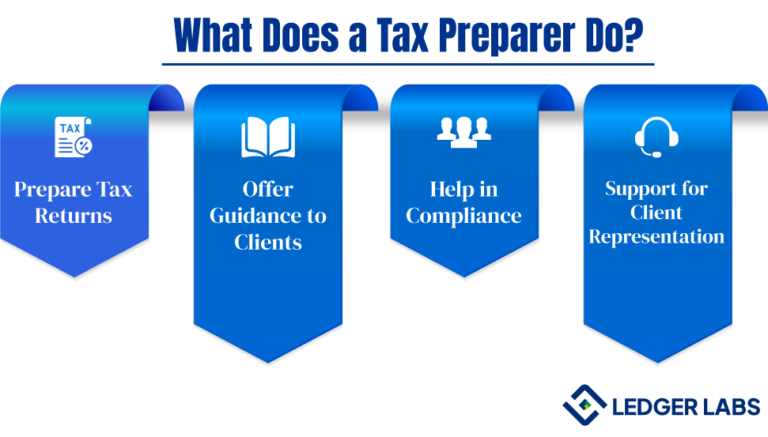

What Does a Tax Preparer Do?

A tax preparer is basically an experienced and highly skilled professional who helps individuals and businesses with their tax returns, end-to-end, without them having to do anything.

Here is a closer glimpse at what they do:

- Prepare tax returns: One of their primary responsibilities is to collect financial information, complete all the necessary forms, and make sure your tax returns reach the Internal Revenue Service (IRS) on time and accurately.

- Offer guidance to clients: They are also best known for offering strategic and unbreakable tax-saving strategies, deductions, and credits in order to optimize tax liabilities.

- Help in compliance: One of the many things that a tax preparer does is make sure your returns fully comply with the current laws and regulations.

- Support for client representation: The best thing that a certified tax preparer does is represent you during any IRS financial audit. This helps to resolve tax-related issues faster and more efficiently.

That being said, this is just the tip of the iceberg. There are several other responsibilities that fall under the duties of a tax preparer. Nevertheless, the very role of a tax preparer is to safeguard the best interests of their clients. As a result, they make sure you get the well-deserved peace of mind and intended accuracy in your taxes.

Read More: Trusted Startup Accounting Services

Types of Tax Preparers

There are several types of tax preparers, all of whom have different roles and responsibilities. Let’s have a look at each one of them:

Enrolled Agents (EAs)

Enrolled agents are tax professionals who are authorized to represent taxpayers before the IRS. In order to obtain this status, they typically have to go through a comprehensive and exhaustive IRS exam or gain it with their experience as former IRS employees. Moreover, this credential requires the individual to adhere to ethical standards as well as 72 hours of continuing education every three years. The best part? EAs get unlimited practice rights. That means they can tackle all types of tax matters and also represent taxpayers before the IRS.

Certified Public Accountants (CPAs)

CPAs are one of the most esteemed tax preparers, thanks to their comprehensive tax and financial knowledge. However, it is often true that not all CPAs specialize in taxes. However, several business owners actually rely on them for various tax preparation requirements due to the fact that they manage all their accounting needs. CPAs are required to pass a rigorous exam that covers a variety of topics, including taxes.

Tax Attorneys

Tax attorneys are ideally suited for various complicated tax situations. They need to have a law degree and state bar admission. That is especially the case for taxpayers filing in more than one jurisdiction. In fact, they are best known for providing dedicated and specialized knowledge in tax matters, along with representing clients in the tax court. This is typically helpful in cases of legal issues. But, at the same time, you will need to remember that their services can occasionally end up being a little more expensive and might be more than what you would need for straightforward tax returns.

Self-Prepared

Well, as the name suggests, this is a plain and simple option where you need to prepare and file your own taxes. In case you are audited, you will need to represent yourself. Otherwise, if you think it is becoming quite unmanageable, it is best to contact an EA, CPA, or an attorney for better assistance.

Unenrolled Preparers

You can get tax assistance from friends or relatives who are not enrolled preparers. But, in California, they are not allowed to charge for it. In the event of an audit, you would have to defend yourself or look for assistance from a CPA, attorney, or EA.

California Tax Education Council Registered Tax Preparers (CRTPs)

Professional tax preparers in California are required to be either CRTPs, CPAs, EAs, or attorneys. CRTPs typically complete 60 hours of tax education from a CTEC-approved provider, along with holding a $5,000 tax preparer bond. That being said, this helps to make sure that they meet state-specific requirements while having top-quality knowledge and ethical standards.

Limited representation rights

Heard of the “Annual Filing Season Program”? This is basically a voluntary initiative thought out and taken by the IRS for tax return preparers who are not EAs, CPAs, or attorneys. This helps encourage preparers to continue their education and be extra prepared for the tax season. Every year, participants are required to complete a minimum number of hours of continuing education. In exchange, the IRS provides them with a record of completion for the Annual Filing Season Program, recognizing their work and dedication to professional growth. However, only participants in the Annual Filing Season Program have been granted a limited practice right as of December 31, 2015.

Having said that, how do you become a certified tax preparer? Let’s have a look at the next section to find out.

How to Become a Tax Preparer?

Did you just ask, “How to become a tax preparer?” We have an answer for you. If you are interested in pursuing a career in tax preparation and see yourself in the shoes of a tax preparer sometime soon, you need to follow certain steps. Here’s a glimpse of it all:

1. Complete your education

The first is, as usual, to start with a high school diploma or GED. This is where you would consider courses that focus on math or business. While it’s true that a college degree may not always be as important, it is just more helpful in the long run. Plus, it would be a good decision to pursue a relevant field, let’s say tax accounting, in case you want to take on higher education.

2. Get the proper training

There are several training schools and community colleges that offer students tax preparation courses. That also means you can receive on-the-job training or even earn accreditation via organizations, such as the Accreditation Council for Accountancy and Taxation (ACAT) or the National Association of Tax Professionals. Typical training topics include state tax codes, tax forms, and taxpayer filing status.

3. Receive valid ID numbers through the IRS

If you want to become a tax preparer, you will need a Preparer Tax Identification Number (PTIN) from the IRS. For more details about the application and the fees required, you need to be up-to-date with the IRS website. This is where you would need to apply online and also undergo a screening process. In fact, when you have a PTIN, you can easily file basic returns. Additionally, if you have any plans to run a business, it is best to obtain an Electronic Filing Identification Number (EFIN) for e-filing tax returns. Planning for this route usually also means that you need to go through an additional background check by the IRS.

4. Obtain a Tax Preparation License in Your State

Well, there are certain states that actually require you to go through some additional steps in order to become a tax preparer. For example, the residents of Connecticut, Nevada, Oregon, California, New York, and Maryland actually need you to provide a state license. Different states have different requirements. For instance, California mandates 20 hours of continuing education annually. To guarantee compliance, review the particular requirements set out by your state.

Do You Need a License to Prepare Tax Returns?

When you are just starting your chapter as a tax preparer, you need to earn the Preparer Tax Identification Number (PTIN) from the IRS. While it is true that it is more like a federal requirement, it actually does not fall under the umbrella of a “license” per se. That said, if someone wants to become a preparer, they generally don’t need a specific license. In addition, in case you want to gain representation rights before the IRS, it is required that you are an Enrolled Agent (EA), Certified Public Accountant (CPA), or a tax attorney.

But, here’s the thing, there are seven states that need additional credentials that are close to the PTIN process. Here’s a rundown:

Moreover, you should know that several states exempt CPAs, along with other credentialed professionals, from these certain requirements. Make sure you are aware of the state laws in the area you intend to work in. Always be extra cautious!

How Long Does It Take to Become a Tax Preparer?

That’s a good question. Well, to answer it, you can start preparing your taxes as soon as you acquire your PTIN and EFIN from the IRS. However, the goal of becoming a better and more progressive tax preparer will take a little longer.

Gaining the Initial Experience

In general, to get the hang of things, it usually takes two tax seasons. Regardless of whether you want to start at a firm or want to practice solo, the usual career chart looks almost like this:

- The first year: The start is usually to focus on learning and data entry.

- The second year: During the second year, you will gain more autonomy and have better confidence to handle tax returns.

- The third year: In the third year, you will develop and nurture the skills to work independently as a full-fledged tax preparer.

Becoming a Professional

Following the initial learning phase, it typically takes almost five whole years to understand, grasp, and fully comprehend the nuances of tax preparation services. During this period, you will gradually build up the necessary expertise required to set you apart in the industry.

In fact, this is where you will handle several complex tax situations, offer various tax services, and provide advice to your clients that can help them. In addition to guaranteeing compliance and maximizing tax outcomes, this experience also enables you to fathom the various tax caps that may apply to various client situations. So, if you are wondering, “How to become a tax professional?”, this should be your go-to answer!

How to Get a PTIN?

That’s one of the most asked questions. So, here’s a simple, step-by-step procedure.

Step 1: Create an IRS e-Services Account

The first step, as you can guess, is setting up an e-Services account on the IRS website.

Step 2: Complete and Submit Your Application

Now, the next step is to submit your application to become an authorized IRS e-file provider. Just a heads-up, this whole process can take up to 45 days. Therefore, make sure to provide all the necessary details from your end. These include:

- Identification details about your company

- Information about every Responsible Official and Principal

- E-file provider option (for instance, Electronic Return Originator for preparers)

In case you are a certified professional, including but not limited to an attorney or CPA, make sure to include your current professional status. For others, you will need to mail in a fingerprint card that you can obtain through the IRS or your local police services. Post that, you can mail it to the IRS.

Step 3: Pass a Suitability Check

In the third step, the IRS is going to conduct a sustainability check. It basically includes:

- Credit check

- Tax compliance check

- Criminal background check

- Check for prior non-compliance with IRS e-file rules

Once you are all approved, get ready to receive an acceptance letter with your EFIN.

Bottom Line and Key Takeaways

So, there you have it. Becoming a tax preparer is a highly rewarding career that allows you to help individuals and businesses understand their taxes better. The good news? You do not need a very fancy degree or several years of experience to get started.

In fact, if you have some basic tax education, such as taking a course or enrolling in a program at your local community college, then we are sure you will be well on your way. Can you imagine being able to work remotely, and connect virtually with your loved ones or clients during the tax season? Or, imagine yourself as part of a renowned company where your position is to advise small businesses about their tax obligations, deductions, and credits.

That all sounds perfect already. But, if you want to accomplish it, start now. The market for skilled tax preparers is expanding, and the opportunities are actually limitless today. So, why not take the leap and become a successful IRS tax preparer? You never know, maybe you will look forward to April 15th!

If you have any more questions, our accounting and bookkeeping experts are just one consultation away. Our team will make sure you don’t leave without the answers you are looking for. So, book your consultation today!