1. Gross profit is calculated as:

Revenue – Cost of Goods Sold (COGS). This reveals how efficiently a company produces and sells its goods.

2. COGS includes direct costs such as raw materials, labor, and manufacturing expenses. Understanding and managing COGS can significantly boost profitability.

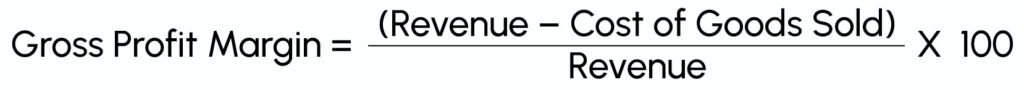

3. Gross Profit Margin is an essential metric calculated as:

(Gross Profit / Revenue) × 100. A higher margin indicates better operational efficiency.

4. Gross profit is critical for setting accurate pricing, controlling production costs, and ensuring financial sustainability in the long term.

Gross profit is a simple yet strong tool that helps companies understand whether they are profitable enough for the core activities they do.

This calculation is incredibly important to measure.

It gives a detailed overview of how much money a business retains after covering expenses immediately related to production.

Let’s dive in and understand how something as simple as Gross Profit can reveal so much about the performance of your business.

What is gross profit?

Gross profit is a pivotal financial metric that all business owners should be aware of.

Technically speaking, gross profit is a company’s profit after deducting operating expenses, like selling, general, and administrative (SG&A) expenses.

Often, gross profit is also called sales profit or gross income. If you’re wondering how it’s calculated, it is simply done by subtracting the cost of goods sold (COGS) from the company’s net revenue.

Understandably, this concept can sometimes be tricky to assimilate in one go. So, let’s consider an example. Imagine this: an organization sells products that cost $1,20,000, while the production cost is around $65,000.

Thus, the gross profit would be $55,000. Gross profit is simply an indicator of “profitability” that the company made.

Gross Profit Formula

Here’s the gross profit formula:

Gross Profit = Revenue – Cost of Goods Sold

Now, let’s consider the gross profit formula in a different light to make the concept even more precise.

Consider this hypothetical case, a small business, ATU Electronics, markets and sells different gadgets. One of the most popular items on their list is a Bluetooth headset that sells better than others.

Total sales revenue of the headset = $22,000

Total COGS for the headset (including manufacturing, materials, and labor costs) = $13,000

Now, for calculating the gross profit, we can use the given formula for gross profit:

Gross Profit = Total Sales Revenue – Cost of Goods Sold (COGS)

Thus, when you replace the values:

Gross Profit = $22,000 – $13,000 = $9,000

Hence, the gross profit of the headset is $9,000. This typically means that after clearing the direct costs of producing the headset, the business has a remaining total of $9,000 to cover additional expenses such as salary and marketing.

This example perfectly represents a view of the profitability of a specific product or service in a business.

Gross Profit Margin

The gross profit margin is primarily used to show how successful an organization is in generating revenue, while keeping their expenses pretty low.

The gross profit margin formula, is a metric that shows the percentage of revenue a company obtains after deducting the COGS.

When the gross profit margin is high, it clearly indicates that a company is more efficient in producing its services or goods.

Gross Profit Margin Example

As an instance of gross profit margin, let’s consider a bakery. Keep in mind that this is a product-based business. Assuming that this bakery is most famous for its tailored cakes for different events, there are various figures the business notes down.

Here is a detailed breakdown:

- A custom cake costs = $120

- Costs it bears = $30 (ingredients as well as labor)

- Gross profit generated= $90

When illustrated through formula, the gross profit margin shows $90 / $120 x 100 = 75%. Hence, the figures suggest a margin of 75%.

Therefore, 75% means that for every dollar the cake sells for, the business provides 75 cents in the form of gross profit (deducting direct costs of producing the cake in whole). But, what does this actually mean? Well, the high margin effective production costs, indicating good profitability.

How to calculate gross profit?

As mentioned earlier, gross profit can be evaluated by deducting the cost of goods sold (COGS) from the total revenue.

That is, Gross Profit = Total Sales Revenue – Cost of Goods Sold (COGS)

When broken down, there are more details you need to uncover.

Cost of Goods Sold (COGS)

The cost of goods sold is primarily the direct costs and expenses incorporated in manufacturing or delivering the services and goods. In simple words, COGS is the direct costs required to build the product or service. However, the list does not include things like the marketing budget and your staff’s wages. Examples:

- Materials you are buying to build the product

- The wages you pay to those making the product

- Costs included in shipping

- The time spent to serve the customer

- The utilities you pay for in production

And, what about Total Sales Revenue?

Revenue is what you earn when you sell your services or products. It’s more like the total sales income before paying any kind of bill. Keep in mind that this does not include additional costs like interest or taxes.

What is a good gross profit margin?

A good gross profit margin is usually 50% or more. In simple terms, many businesses consider a gross profit margin ratio between 50% to 70% healthy. However, anything less than or equal to 30% is likely to be dangerous for businesses with higher gross costs. Additionally, the goal is 20% if it’s a new business setup.

Gross profit vs net profit: What’s the difference?

Profits don’t just come in size. While profits mean the total of your financial growth, gross and net profits are still incredibly different.

Gross profit is the amount your business obtained over a particular timeline, subtracting the cost of goods sold or COGS. Gross profit also implies how effectively a business manufactures and sells its service or product.

On the contrary, net profit is actually the total revenue, but subtracting the cost of goods sold (COGS), other operating costs (administrative costs), and taxes or interests that fall into operating expenses. This is also symbolic of the business’s overall profitability and potential cash flow.

While gross profits are a sneak peek into how efficient the production is, net profits give the overall view of how well the business’s financial performance is. The latter is a metric to measure whether the business is financially performing well in the market.

As a business owner, understanding both gross profits and net profits can help big time in making sound decisions about your company. These decisions have a significant influence on your business. But, why is that? These decisions give you more than just a financial checkup of your business. It opens doors to many more opportunities, like attracting investors and making better decisions.

Wrapping up

Calculating your gross profit is more than just a routine checkup of your business. It’s a term that suggests how healthy your business is, and how efficient your operations are against production costs.

Nonetheless, this metric gives more than one analysis.

While it does provide a clear image of cost management and prices – it also offers investors and stakeholders an analysis of how profitable your company is.

Frequently Asked Questions

1. How to get gross profit percentage?

The gross profit ratio, also often called the gross profit margin, is a very important metric that companies use to measure their profitability. Here, you need to evaluate the gross profit by deducting the cost of goods sold from the total revenue stream. Following this, you have to divide the gross profit by the total revenue and multiply it by 100. In whole figures, it looks like this: Gross Profit Percentage = (Gross Profit / Total Revenue) x 100.

2. What is gross profit ratio formula?

Here’s the gross profit ratio formula for better understanding:

Gross Profit Ratio = (Revenue – COGS) / Revenue.

Similar to the gross profit percentage, this is shown in decimals.

3. What is the operating profit ratio?

The formula for operating profit ratio is: Operating Profit Ratio = Operating Profit / Total Revenue. The primary motive behind this ratio is that it measures the efficiency of a business’s management by representing the proportion of revenue it retains after deducting their operating expenses. However, the measure is taken before considering taxes and interests.