Solutions

- Parallel Accounting System Setup: Built an entirely new, clean accounting system from scratch to bypass unreliable historical data.

- Forensic Audit: Dedicated over 1,000 hours to reconstruct five years of financials, collecting data from 20+ banks and 100+ business partners.

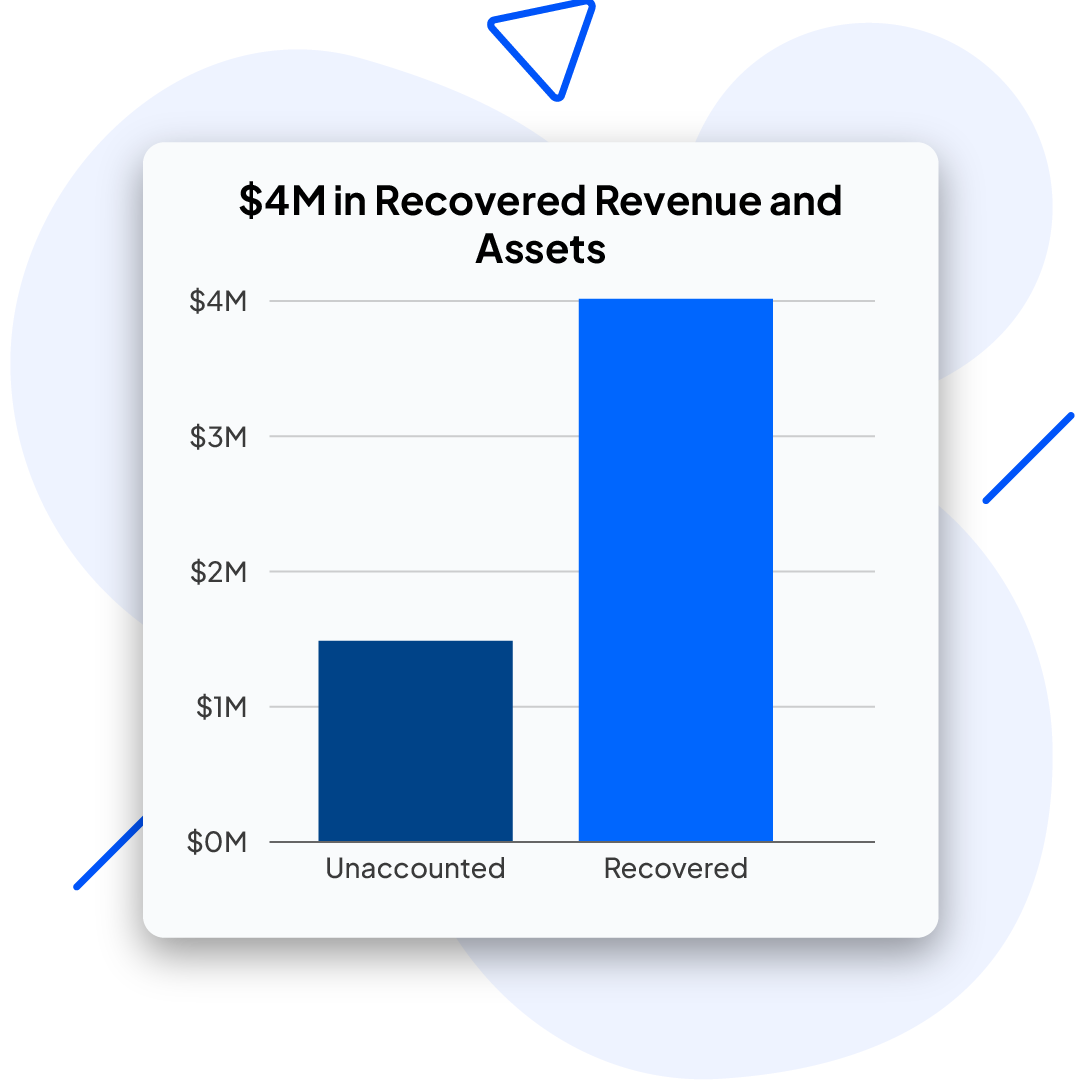

- Stringent Reconciliation Process: Identified $4 million in missing revenue, deposits, and assets through in-depth audits and verification.

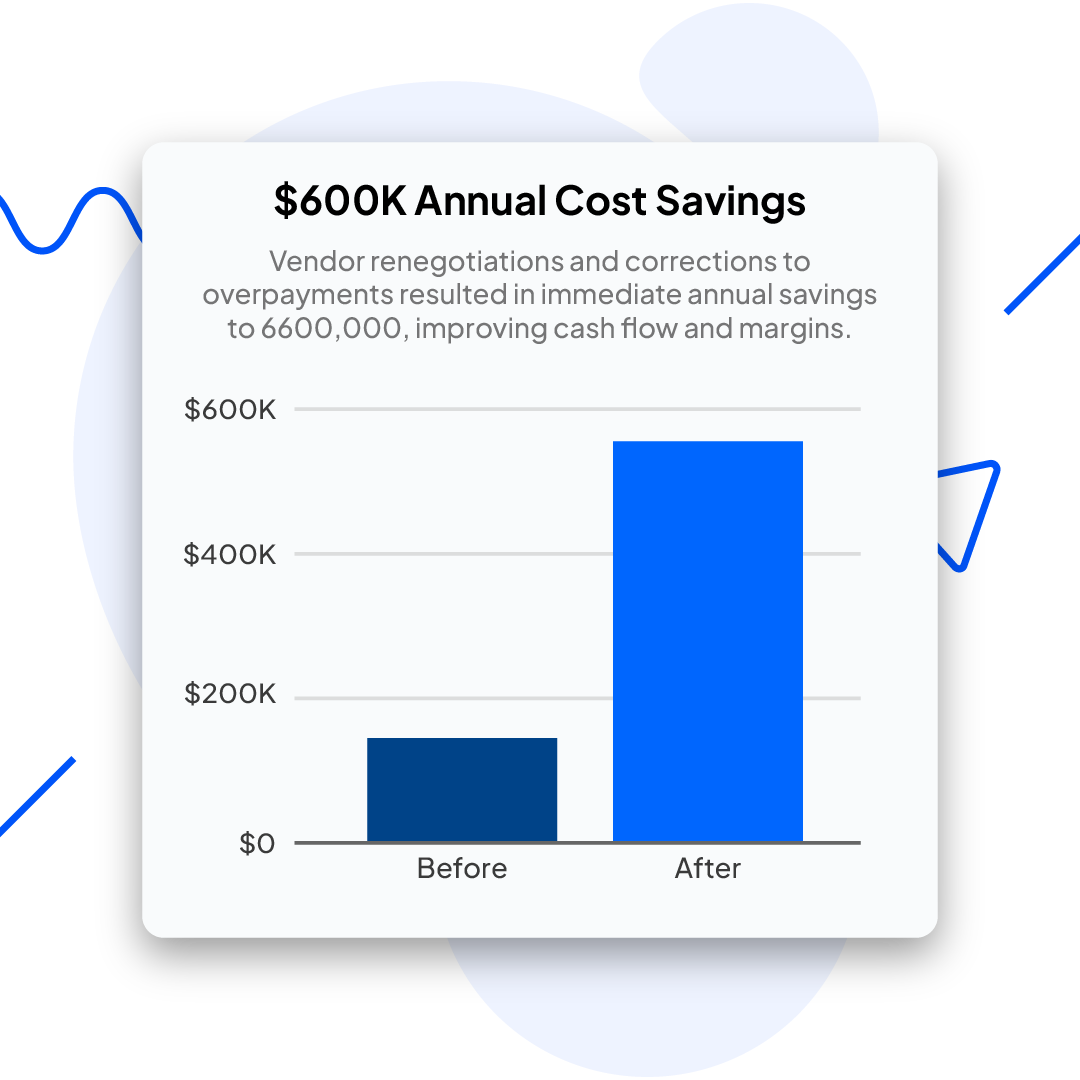

- Vendor Contract Review: Renegotiated terms with over 50 vendors after uncovering systematic overpayments, locking in cost savings.

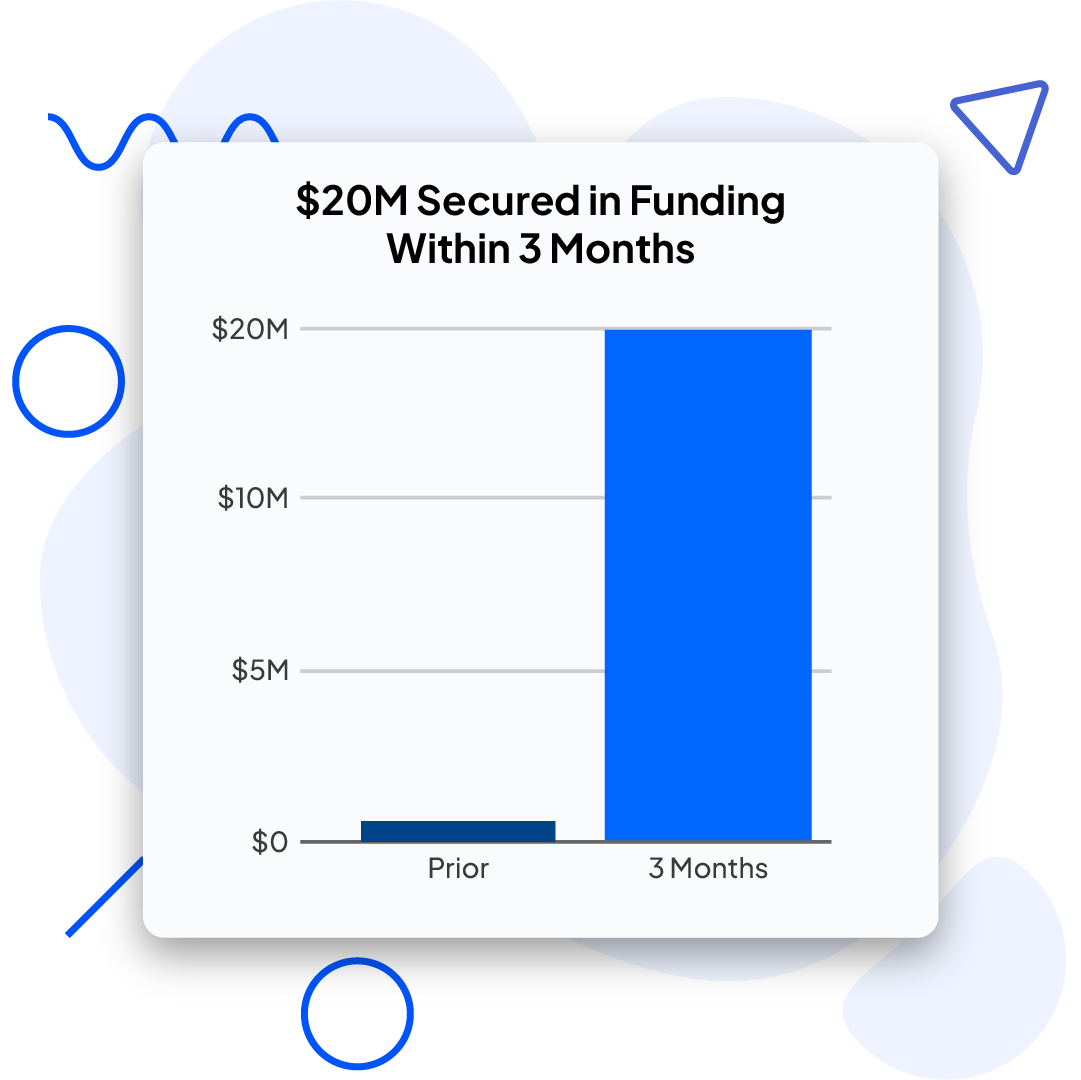

- Sustainable Financial Framework: Created compliant and auditable financial records that met investor and audit standards.