1. SaaS accounting software market is growing, with projections to reach $232 billion in 2024, highlighting its increasing adoption among small businesses for scalability and financial transparency.

2. Key benefits of SaaS accounting tools include real-time collaboration, multi-user access, robust data security, and seamless integration with other systems, ensuring enhanced operational efficiency and financial management.

3. Cloud-based accounting platforms like NetSuite, QuickBooks Online, and Sage Intacct empower businesses with anytime, anywhere access to financial data, supporting dynamic and flexible business operations.

4. Small businesses transitioning to SaaS solutions can mitigate risks, improve decision-making, and achieve better financial visibility through robust analytics and integration features.

The market is filled with SaaS accounting software.

But, every business has different needs for their accounting requirements.

Most essentially, you need to understand what your business has, how it performs, and what software can make tracking finances better.

We have curated for you a detailed, easy, and the only guide you will ever need to understand which SaaS accounting software best fits your business!

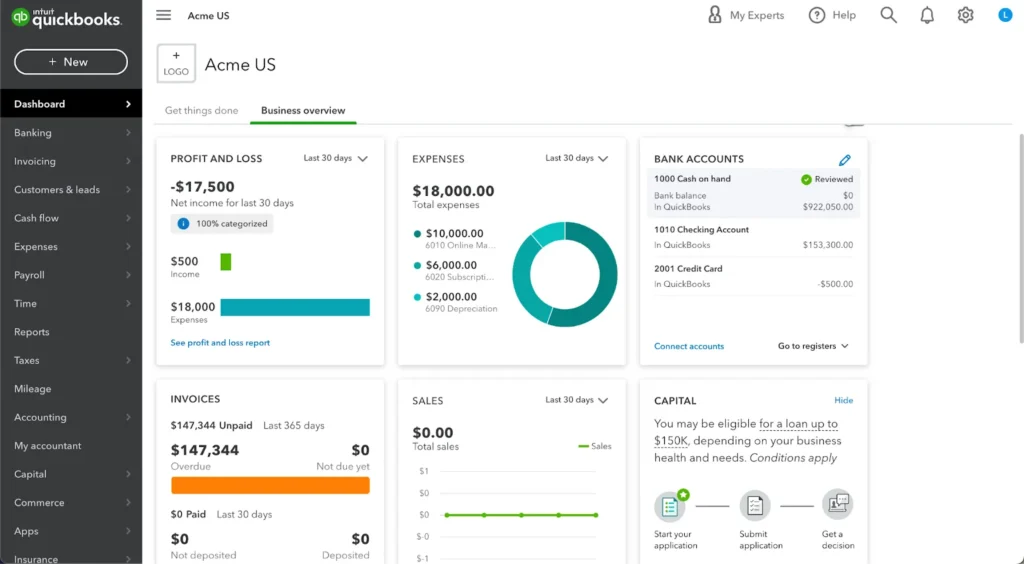

1. QuickBooks Online

QuickBooks Online is a favorite among many small and medium-sized businesses.

The best part about QuickBooks is its user-friendly interface, making it an excellent fit for anyone looking to manage their finances efficiently for the long term.

From the very moment you log in, QuickBooks Online will welcome you head-on with simple, clear, and effortless navigation.

Above all, one of its greatest edges is its ease of use, especially for people who are not accounting specialists.

The best part?

You can access it from absolutely anywhere. That means business owners and employees have full flexibility to control it remotely.

Not to mention, it has countless features you can tap into next time you visit the website.

Key Features:

- Interactive and Simple to Use: Just as you sign in you’ll notice Quickbooks Online has a clean, easy, and intuitive dashboard. It is one of the major advantages of this SaaS accounting software.

- Streamlined Invoicing: One of the many reasons why this is a favorite for many is because it offers quick invoice customization for your brand needs and also sets up automatic reminders for your consumers. This is a significant way to ensure timely payments.

- Effortless Payroll Integration: There’s no doubt how challenging and tricky payroll management can be. This is where QuickBooks helps businesses big time. To solve this issue, it automates employee payments and tax filings. As a result, it can minimize a lot of manual work that goes into payroll management.

- Seamless Tracking of Expenses: In a few moves, you can automatically link your bank and credit card accounts to track all expenses. Compared to manual tracking, you can save twice as much time with this. That’s not even half the story. You can also categorize expenses properly, which is a major plus for the upcoming tax season.

- Efficient Tax Preparation: This is a huge addition, especially with the tax season lingering. Therefore, you can now organize all financial information into various tax categories (even link it with tax software).

Pricing:

The pricing plans are divided into four parts: Simple Start, Essentials, Plus, and Advanced.

The plan “Essentials” supports around three people. In general, it helps with inventory tracking and tackles project profitability reports. The plan starts at $25 per month. As we go into the details, the “Essentials” cover:

- Free guided setup

- Income and expenses

- Banking with 5.00% APY

- Bookkeeping automation

- Invoice and payments

- Tax deductions

- Enhanced reports

Pros:

- Seamless and Easy-to-Use: It is best known for its easy-to-use interface and seamless dashboard navigation.

- Cloud-Based: It allows on-the-go management because you can access it remotely from anywhere.

- Robust Security: It also takes protective measures to safeguard sensitive data.

Cons:

- Limited Customization (Reporting): Unlike other reporting tools, it offers limited customization options according to customer reviews.

- Cost: For several small businesses, the costs, especially in the higher ring, can feel a bit higher than others.

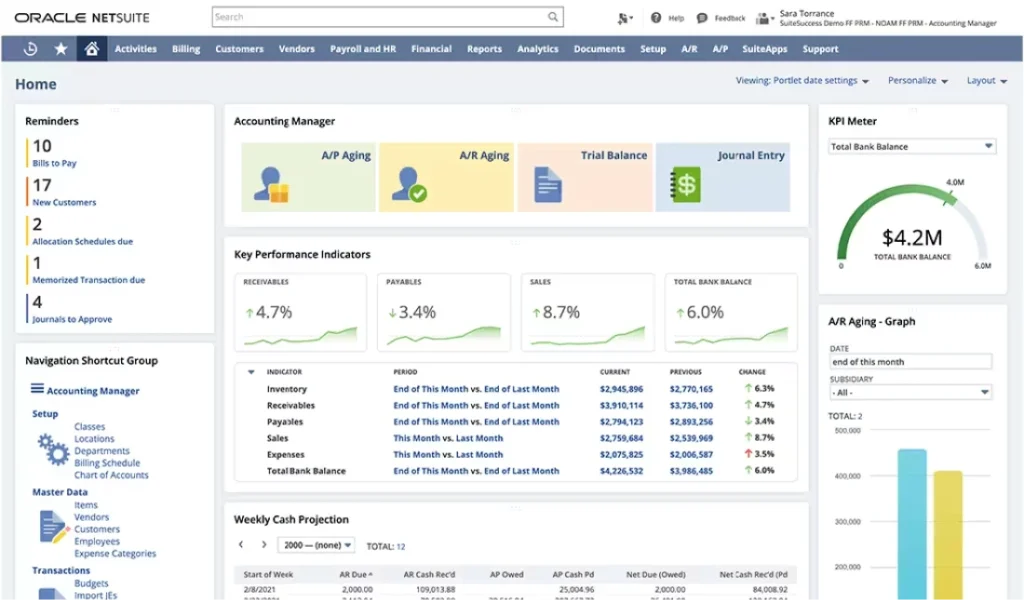

2. NetSuite ERP

NetSuite ERP is a popular, versatile, and leading cloud-based enterprise resource planning (ERP) software. More often than not, it is largely preferred by large businesses and fast-growing enterprises.

NetSuite ERP, widely known among people for its vast functionality, scalability, and real-time data processing, can give you a unified approach to addressing all important business processes in just one system.

Features

- Seamless CRM: NetSuite ERP covers everything between lead management, customer service, and email marketing, among many others.

- Order Management: It also helps big time in creating and managing sales orders, quotes, fulfillment, returns, and RMA.

- Global Business Management: In addition to all its features, it also offers multi-language structures, and multi-currency options, making it convenient for global businesses.

Pricing:

NetSuite pricing is basically tailored based on specific needs and modules chosen. But, in general, we can say that it costs $2,500 per month for a small to mid-sized ecommerce business.

Pros:

- Comprehensive functionality: It is an all inclusive system for every core business requirement you may have.

- Cloud-based accessibility: You can access it from anywhere, anytime, and stay in the loop with all current updates.

- Scalability: NetSuite ERP actually grows simultaneously with your business.

Cons:

- High price: NetSuite has a substantial payment system. The initial investment and constant subscription fees may add up to a lump sum over time.

- Implementation complexity: To be implemented successfully, it takes a lot of ground level preparation and vast knowledge.

- Learning curve: The system can be scary and tricky to first time users and for people less accustomed with ERP systems.

- Pricey Advanced Customer Support: NetSuite customer support is invaluable when it comes to resolutions but it can definitely burn a hole in your pocket.

Want help with NetSuite ERP?

Connect with our NetSuite experts.

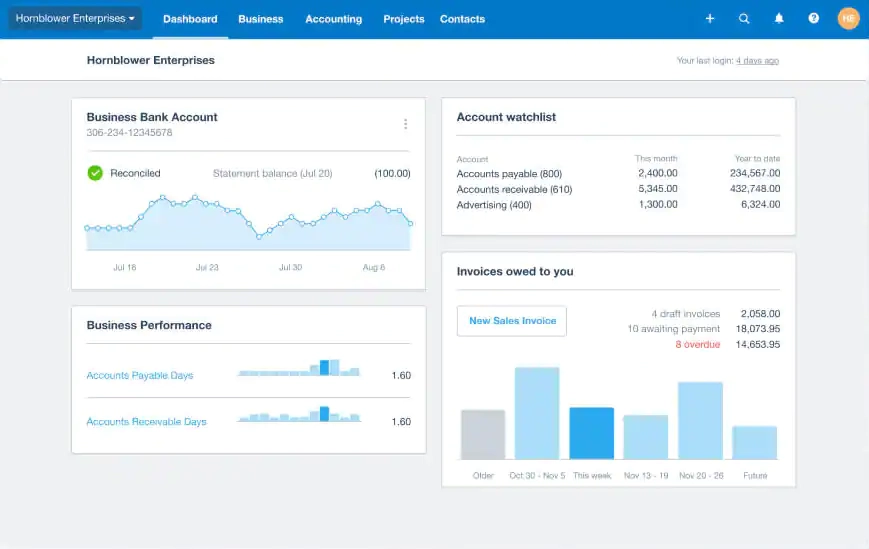

3. Xero

Xero has all the necessary components you would need in a double-entry accounting system. This includes anything between sales, billing and expenses, inventory management, payroll, and purchases. Moreover, it is one of the best options you can have to generate comprehensive reports since it gives you a detailed rundown of your business through advanced analytics.

Additionally, it leverages AI to streamline processes and link with other financial websites. There are several features it offers. Let’s list them below.

Key Features:

- User-friendly interface: Just like several others, Xero has a very user-friendly interface, too. It is simple, straightforward, and easy to use. In fact, the dashboard offers direct insights into the financial status, including but not limited to outstanding invoices, bank balances, total cash flow, among others – right at a glance.

- Invoice and Billing: Xero is best known for simplifying invoicing processes. It makes creating, sending, and the very making of invoices easy.

- Third-party Integrations: You can integrate various third-party applications, including a CRM, inventory management, etc.

- Real-time Financial Reporting: Besides all other features, Xero can give you real-time insights about cash flow and financial statements.

Pricing:

Xero has three primary plans, namely, Starter, Standard, and the Premium plan. Among them, the Standard plan starts at $46 per month, with various optional features beginning at $4.

Pros:

- Collaborative Platform: The best add-on of Xero is that it offers easy collaboration with fellow accountants and staff members, leading to better financial management.

- Strong Reporting and Analytics: With Xero, you can access comprehensive reporting and analytics, getting an overall insight into how your business is performing.

- Strong Security: Like many others, Xero offers robust security measures, helping protect sensitive information.

Cons:

- Performance Problem with Large Data Sets: Many users have occasionally mentioned slower performance when dealing with massive transactions (or other complicated accounting scenarios).

- Limitations in Payroll Feature: In some instances, the payroll feature might not be as strong as standalone payroll services. This can force you to use extra software.

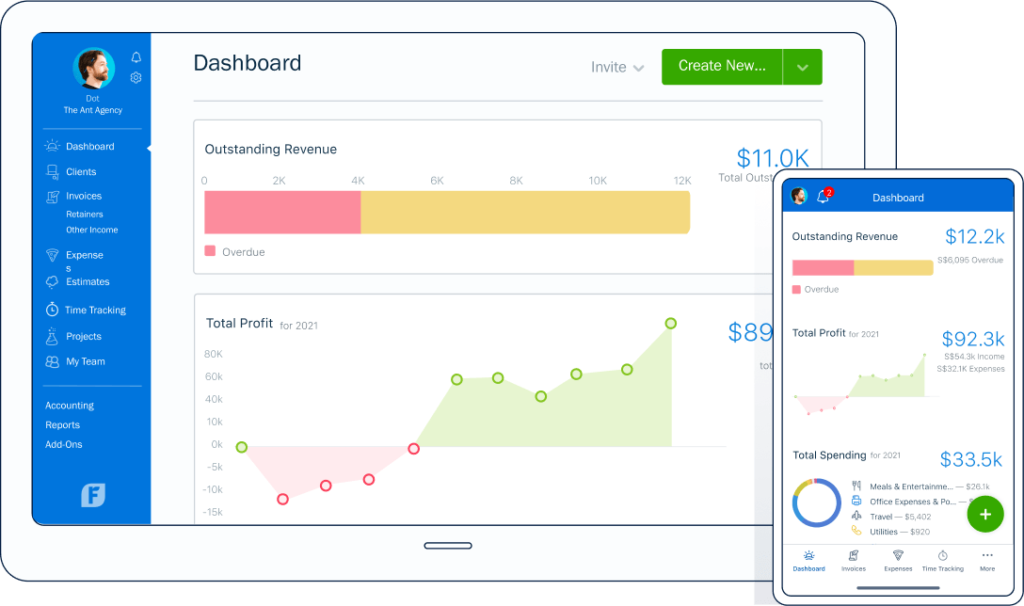

4. FreshBooks

There’s more to FreshBook than just good looks. It is mainly a full-featured, double-entry accounting system that can give you an excellent user experience. For many of these reasons, it has been an Editor’s Choice winner too! It is incredibly intuitive for first-time, novice accountants.

Features:

- Effortless Invoicing: With FreshBooks, the process of invoice making becomes a breeze. What’s more? The invoices look professional, seamless, and ready to go. In addition, the platform also supports customization in order to reflect brand identity.

- Time Tracking: This feature is best for service-based businesses and freelancers. Moreover, this allows you to log the billable hours on to your invoice (which is quite an important feature if you’re an independent contractor).

- Seamless Reports: This is one of the highlight features of FreshBooks. It provides you comprehensive, insightful financial reports, including Profit and Loss Statements. It allows you to have a sneak peek into how well your business is doing financially.

- Project Management: This feature is one of the most important areas of FreshBooks, and usually the most captivating. It can help you integrate project management tools, enabling collaboration with team members, track project progress, and even share vital files.

Pricing:

FreshBooks has 3 plan structures, Lite, Plus, and Premium.

The Plus plan starts at a price of $7.50 per month. The add-on prices start at $11 per month (per user). If you choose “advanced payments”, the price for the same starts at $20 per month.

It offers several features, including:

- You can send unlimited invoices (limit until 50 clients)

- Create customer retainers and recurring invoices

- Send as many proposals and estimates as possible

- Get paid with credit cards and bank transfers (ACH)

- Automatically capture receipt data

- Develop accounting and financial reports.

Pros:

- Robust Mobile Functionalities: FreshBooks offers full flexibility to control finances on the go with mobile applications for Android and iOS.

- Excellent Customer Support: The best thing about FreshBooks is that it offers responsive customer service on the get go. In addition, you can find plenty of online resources for enhanced user support.

- Integrated Project Management: On top of many other features it offers, integrated project management is a favorite to many. This platform includes necessary tools required for project management.

Cons:

- Limited Advanced Features: Unlike its competitors, FreshBooks usually lacks advanced features that several large business models require for complicated accounting scenarios.

- Cost: It is true that it offers a free trial initially. However, the ongoing subscription can gradually add up, especially for the businesses that have multiple user profiles.

- Limited Customization in Reporting: As opposed to other softwares, many users find that the customization feature is incredibly limited.

- Inventory Management: It’s not the best software for businesses with vast inventory management.

Stuck with invoice management? Read this informative blog on What are the Most Common Platforms to Create Business Invoices?

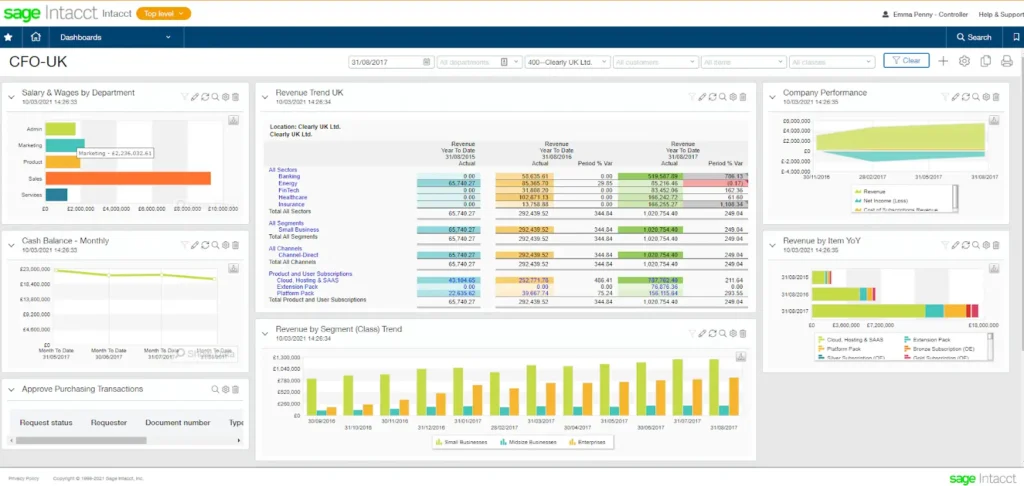

5. Sage Intacct

Sage Intacct is the perfect choice for those looking for a powerful and versatile accounting system that can tackle tricky finances and generate in-depth reports. In simple words, this software is made to grow with whatever needs you have on your mind. As a result, it makes financial management easy to handle.

Features:

- Advanced Functionality: With Sage Intacct, you now have access to multi-entity management, project accounting, global consolidation, and more. This is especially important for businesses that have complicated accounting needs.

- Customization and Integration: Sage is highly customizable and can integrate seamlessly with other business systems, including but not limited to CRM, payroll, etc.

- Real-time Reporting: Apart from all its other benefits, Sage is best known for its real-time financial and operational insights through highly customizable reports. This makes decision making easier.

Pricing:

For Sage Intacct, you have to request pricing by filling out a form. Once filled and sent, a representative will be appointed to brief you on all pricing details based on your immediate needs and requests.

Pros:

- Scalability: Sage Intacct was built specifically to handle the expansion of businesses. Moreover, it is also capable of handling high transaction volumes and demanding financial needs.

- User-friendly Interface: Do you think Sage’s advanced functionalities can limit its user-friendliness? Absolutely not. The interface is intuitive, simple to understand, and highly user-friendly. It is ideal for both experienced accountants and new users.

- Strong Customer Support: Get strong customer support through a massive user community, a vast online resource library, and multiple training programs.

Cons:

- Learning Curve: The features can be quite difficult to understand, in some instances. This especially holds true for those new to accounting. Typically, it will require a massive learning curve just to cut to the chase, and understand the platform better.

- Cost: As opposed to other software, Sage can be far more expensive. As a result, it often prevents smaller businesses or startups from using it.

- Complex Setup: There are many who dislike the vast setup Sage Intacct requires from ground level. extensive customization options, the initial setup process can be complex and may require additional time or external assistance.

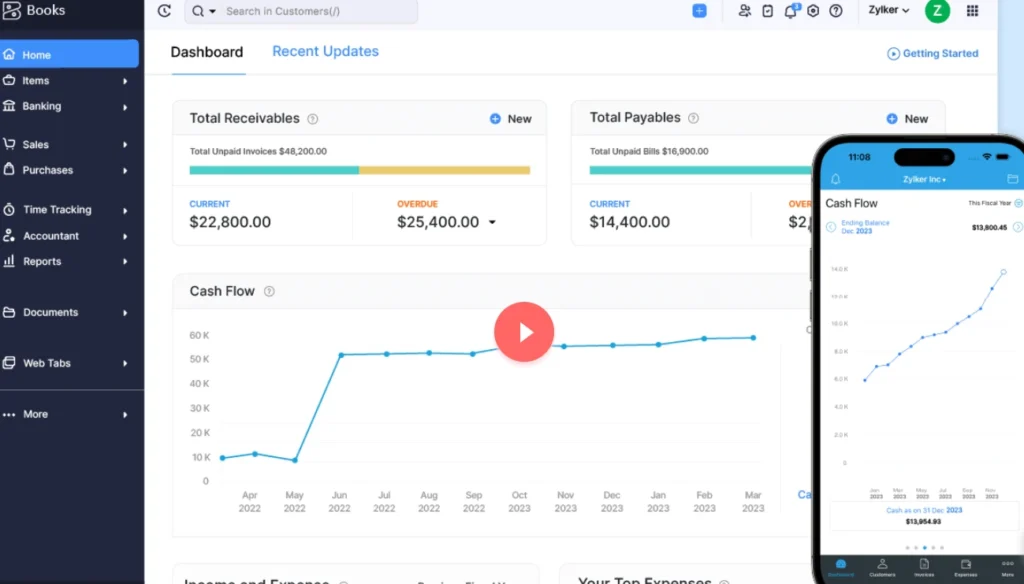

6. ZOHO Books

ZOHO Books has been a very popular choice among many. Frankly, the choice stems from its versatility and simplicity. This especially holds true for small to mid-sized businesses that are looking for an all-inclusive cloud-based accounting solution for better financial management.

Furthermore, ZOHO Books is just another part of ZOHO applications (the larger suite). The best part? It, too, offers multiple features and has integration capabilities.

Features:

- Seamless Automation: With Zoho Books, you can now automate all the routine, manual tasks such as, auto-charge capabilities, recurring invoices, and monthly/quarterly reminders of payments from consumers, among many others. This saves a lot of time that would otherwise go into tracking all business operations.

- Multi-currency Support: For businesses that deal primarily with international transactions, Zoho Books enables multiple currencies to make the process simpler.

- Integration: This software offers seamless integration with other ZOHO applications and several third-party systems.

Pricing:

The prices for Zoho Books are divided between Standard, Professional, and Premium.

The Premium typically costs $40 per month and covers:

- Track Project Expenses and invoices

- Project Tasks

- Currency adjustments

- Timesheet and Billing

- Sales Approval

- Stock tracking

- Retainer Invoices

- Recurring Bills

- Sales Orders

- Bills

- Payments Made

- Vendor Credits

- Purchase Orders, etc

Pros:

- Enhanced Customer Support: Zoho, like some of its competitors, is also best known for its reliable customer support. It includes email, a knowledge base, and even call support.

- Pricing: Because of its tiered pricing format, Zoho Books is known to be highly scalable for businesses that are currently expanding. In fact, it is also reasonably priced for smaller businesses. Besides, you also get a free trial to investigate its features before committing.

- Mobile Accessibility: It is accessible through both iOS and Android. That means, you can now manage your finances conveniently and on the go.

Cons:

- No Payroll Services: For this software, you will need access to a separate platform for payroll management. In return, this makes the whole process complex and expensive.

- Transaction Caps: In Zoho Books, certain plans have a monthly transaction cap. This is especially very inconvenient for businesses with high volumes of activity.

- Limited Customer Support: Typically, the support hours and availability for Zoho Books is limited, mostly on weekends.

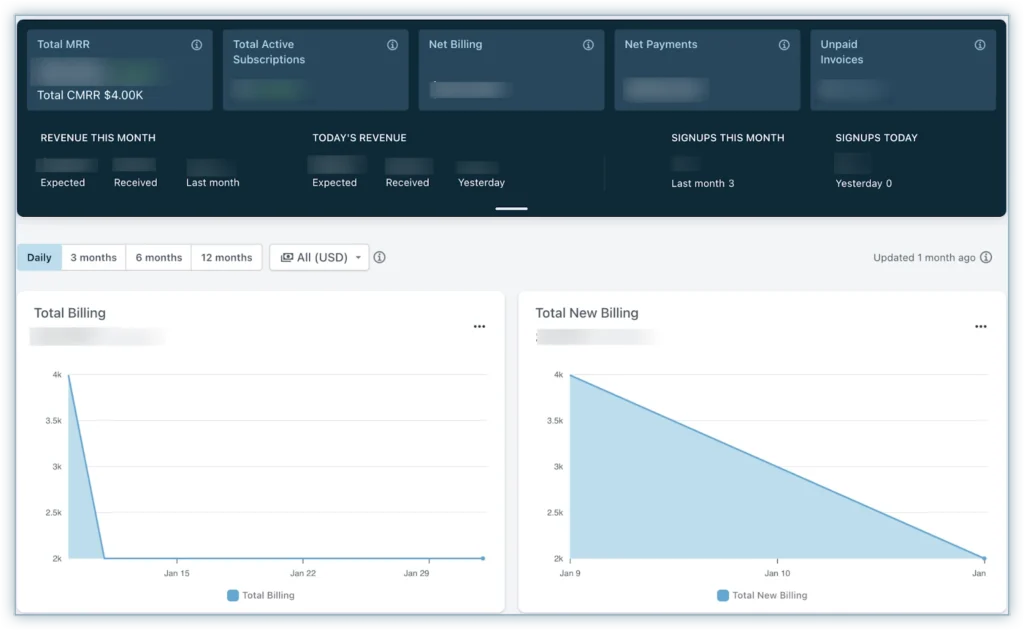

7. ChargeBee

ChargeBee is now a big name among many business models and the SaaS market, especially for corporations that function on a subscription model. A prevalent option for businesses of all sizes, Chargebee is best known for simplifying revenue and subscription billing processes. As a result, this makes it an ideal fit for startups as well as large business models.

Features:

- Subscription Billing: You can create and control several subscription plans with ChargeBee. It can include free trials, metered billing, and one-time charges, among many other additional options.

- Payment Processing: It also accepts payments from consumers all over the world through the integration of more than one payment gateway.

- Tax Management: It also helps to automatically evaluate and collect taxes based on the location of the customer.

Pricing:

ChargeBee has three models: Starter, Performance, and Enterprise. The starter pack is free of charge, requiring just a sign up. The “Performance” model charges $599 per month. It covers:

- Advance and consolidated invoices

- Quotes

- User role management

- Priority phone support

- Multiple payment methods for every customer

- Chargeback automation

Pros:

- Increased Efficiency: You can now automate your subscription billing and payments. With this major feature, you can save a lot of time, resources, and money.

- Improved Customer Experience: Chargebee is best known among customers for making subscriptions and payments a lot more manageable.

- Decreased Customer Attrition: Chargebee can give you a better snapshot into the reasons behind customers canceling their subscriptions. It helps in reducing attrition.

Cons:

- Expensive for Smaller Businesses: The subscription fee can be a lot for early-stage startups or businesses that have low transaction volume.

- Fewer Unconventional Integrations: While ChargeBee does offer multiple integrations, some niche tools can still need complex integrations.

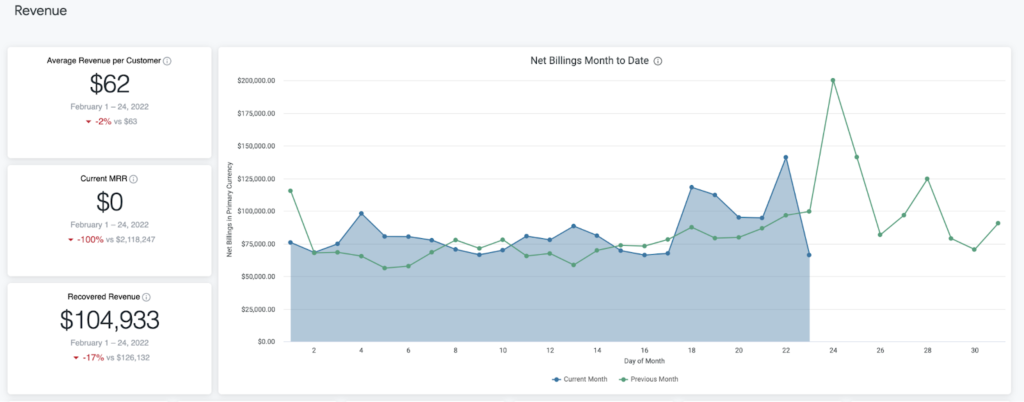

8. Recurly

Recurly is one of the most ideal solutions for businesses focusing more on subscription bill systems and revenue management. In addition, it also offers versatility, robust features, and tremendous efficiency.

Features:

- Advanced Subscription Billing: Recurly offers several tools to help you manage subscription billing scenarios. This can be anything between trials, discounts, and one-time charges.

- Revenue Optimization: Get access to features like automated invoice generation and dunning management. These are tailor-made to maximize revenue and reduce churn.

- Customizable Pricing Models: Get access to a vast range of pricing models and plans custom-made for your business type.

Pricing

There are different pricing models for different needs. To understand better, you will have to directly contact the team and get a quote as per your requirements.

Pros:

- Ease of Use: Recurly has a simple, user-friendly interface which helps people navigate better.

- Strong Payment Processing: Recurly supports numerous payment gateways for worldwide reach.

- Comprehensive Reporting: Recurly is also known around people for its insightful reports on customer churn, MRR, etc.

Cons:

- Reporting limitations: Although insightful, reports still need additional data manipulation tools that can help in complex analysis for advanced needs.

- Scalability concerns: Many users to date have reported major challenges in tackling high transaction volumes, primarily during peak periods.

In Wrapping Up

There are several SaaS Accounting Software strewn around in the market. However, it is totally up to you and your business to decide which model fits your situation the best. Before choosing, ask yourself, “What needs does my business have?”

It can be QuickBooks, Zoho Books, or Recurly – the choice largely depends on your business model, requirements, and future demands in accordance with the market.

Still have questions regarding which is best for your business?

Schedule a meeting with e-commerce accountants with 12+ years of experience and get hands-on solutions to your questions!