1. Sales tax compliance outsourcing can reduce tax errors by up to 30%, helping businesses avoid penalties and audits through accurate filing and regulatory adherence.

2. Automating sales tax compliance via outsourcing saves approximately 50–60% of the time compared to in-house handling, freeing up resources for strategic business activities.

3. Sales tax outsourcing services cover multiple jurisdictions, ensuring compliance with over 11,000 U.S. tax codes and reducing the risk of local compliance failures.

Are you feeling weighed down by the complexities of sales tax compliance?

Is the mountain of paperwork and audits stealing your time running a business?

Frankly, you’re not the only one facing these challenges. There are several businesses that find it challenging to tackle their sales tax obligations.

That, in turn, leads to expensive mistakes and hefty penalties. However, there’s an easy solution most people need to remember: Sales tax compliance outsourcing.

Most businesses use this model to delegate the responsibility of sales tax processes to a third-party service provider.

This can include anything between filing tax returns, evaluating sales tax rates, and managing audits, among others. But, why exactly do businesses need it and how does it work?

What is Sales Tax Compliance Outsourcing?

In simple terms, sales tax compliance outsourcing is about businesses hiring third-party companies to manage their sales tax reporting and payments.

Now, you might be a little curious about what exactly sales tax is. Well, it is a tax which is applicable on sale of goods and services. In general, it is a tax that is added to the price of what you’re selling and the amount usually varies based on the location where the sale takes place.

Typically, when businesses want to outsource sales tax compliance, they are hiring professionals who are well-versed with these regulations and have a better understanding than any internal team member. This saves resources, money, and time for businesses, while substantially minimizing the risk of making expensive errors.

Why is Sales Tax Compliance Outsourcing Important for Businesses?

Sales tax compliance outsourcing can be extremely significant for businesses for more than one reason.

For many businesses, keeping up with consistently changing sales tax regulations around different jurisdictions often becomes tricky and time-consuming. You can simply ease this process by outsourcing it to a team of experts who understand varying regulations around different locations.

But, why is it important, you may ask? The reason is pretty simple. Let’s understand it through an example.

For instance, consider a bookstore that operates from more than one location. Every region has its own sales tax regulation. As a result, the bookstore has to stay updated with different tax rates and their respective submission deadlines in the area they are based in. Thus, if the bookstore decides to contact a third-party company specializing in this area, it can take off the burden of understanding every tax law applicable in the regions it operates in.

Hence, they usually choose sales tax compliance outsourcing to focus on what they do best: selling endless books to consumers. This takes the hassle of tax reporting off their busy plate but still lets them stay compliant.

5 Challenges Faced in In-house Sales Tax Compliance

As we said earlier, it’s difficult for small businesses with limited resources to keep track of ever-changing sales tax laws on a regular basis. Furthermore, there are some other challenges that they face with in-house sales tax compliance. They are:

1. Complex sales tax laws and regulations

When you try to swim through different sales tax laws and regulations, it can become an uphill (or upstream!) task. Every state (sometimes, even a city in that state) has its own rules and regulations mandated for businesses. As a result, it is challenging for businesses to understand and track whether they have complied with every applicable tax law across the different areas of their chains.

2. Difficulty in Keeping Track of Multiple Tax Rates and Jurisdictions

For businesses that have been operating from different areas, keeping up with changing tax rates and laws can be tricky to understand, and often scary as well. In other words, they always need to stay updated with the constantly changing rates and rules as per different jurisdictions. Usually, this makes it challenging for the team to keep a close eye on every changing rule in different regions.

Stuck with Sales tax compliance problems?

Get instant resolution from our tax experts!

3. Time-consuming Process

You need to drill hours and put a lot of effort in order to manage sales tax compliance. From evaluating the correct tax amounts to filing returns – the process can usually stretch a lot more than anticipated, and also consume a significant amount of business resources that could have been used in other important areas.

4. Requires Adequate Qualified Resources

Speaking of resources, we usually mean those professionals who are incredibly well-versed in tax laws and accounting practices. Understandably, recruiting and onboarding them can pose a significant challenge as it requires a substantial investment in training and resource management.

5. Potential Hefty Costs

For several businesses, having an in-house sales tax compliance team can turn out to be extremely expensive. Moreover, the costs include not just the wages associated with each member but a major investment in software and technology required for correct tax calculation and reporting. Businesses that are gradually on the rise and have recently started operating from more than one location cannot usually bear the high costs associated with the entire procedure.

4 Benefits of outsourcing sales tax compliance

As opposed to hiring sales experts in-house, outsourcing sales tax compliance to a third-party provider has multiple advantages. Here are a few of the many benefits:

- 1. Expertise and knowledge of tax professionals:- Outsourcing sales tax compliance helps businesses track down different tax regulations with the immediate help of experts. When they opt to outsource this area to a professional, companies tend to remain compliant, gradually reducing the risks of any errors that could lead to substantial fines or penalties. Typically, their up-to-date knowledge of different tax laws and jurisdictions across various regions help businesses stay ahead of the curve and keep sight of potential pitfalls.

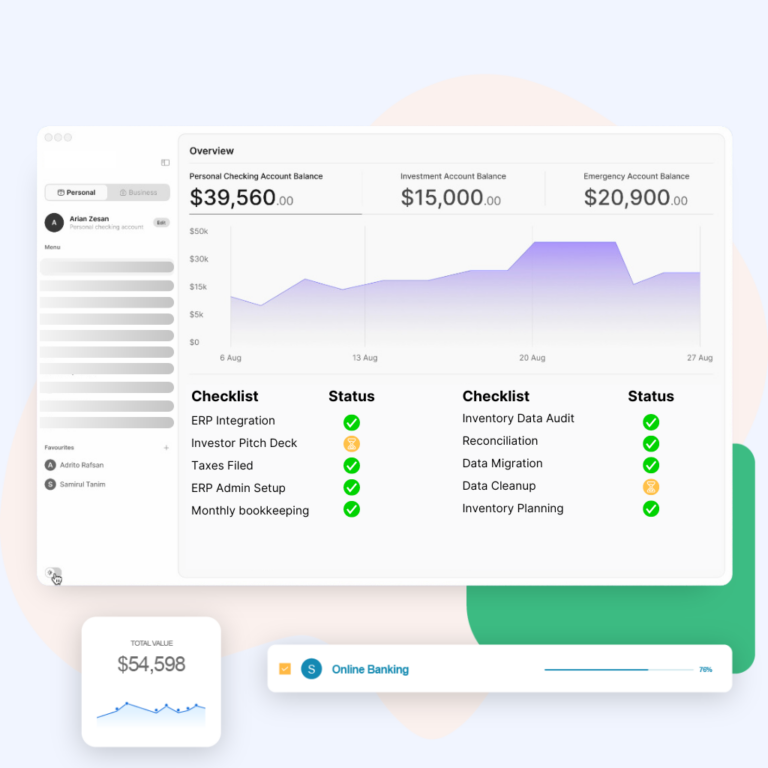

- 2. Time and cost savings for businesses:- This is among the most important reasons for outsourcing. In simple words, if you leave sales tax compliance with in-house specialists, you’ll lose out on resources big time. This entails hiring, onboarding, training, and constant support of relevant software like NetSuite ERP that typically causes businesses to lose money (and time too).

When enterprises start outsourcing, they’re actually eliminating overhead costs and helping to redirect their internal resources toward other business areas that are on priority. As a result, this usually leads to better efficiency and boosted profitability.

- 3. Reduced risk of errors and penalties:- One tiny error, and you’ll land with a significant pile of penalties. With outsourcing, you can reduce the risk of mistakes and hefty fines. Primarily due to its complex nature, sales tax compliance can lead to various errors you might need to learn more about. Consequently, this is one of the many reasons sales tax management outsourcing is integral for any business. When you outsource, you’re typically giving responsibility to those who know how to handle things like sales tax nexus, use taxes, excise taxes and more. This significantly reduces the likelihood of penalties.

- 4. Prevention of Audits:- One of the less discussed aspects yet an imperative part of sales tax compliance outsourcing is its potential to minimize audits. Tax authorities consider non-compliance (even if there’s just one) a huge red flag in many cases.

To be more specific, outsourcing firms always ensure accuracy in calculations. Moreover, they have a hard and fast rule to ensure compliance with tax regulations. This, in turn, reduces the chances of triggering an audit.

How sales tax compliance outsourcing works?

In general, sales tax compliance outsourcing works in a way where businesses hire a different company altogether (a.k.a, a third-party provider) who helps to deal with sales tax reporting and payments.

In such cases, the third-party providers are best at what they do and know how to keep up with various regulations. More specifically, this is how it works:

- Selection of a suitable outsourcing provider:- It usually starts with identifying who the right outsourcing provider is. This is where you need to conduct thorough research, compare several offerings, and prioritize experts with a proven track record.

- Assessment of business needs and requirements:- Once you know who you are partnering with, it’s time to start a collaborative assessment of your business requirements. This entails a comprehensive overview of your sales volume, existing tax procedures, and geographic footprint.

- Implementation and integration of systems and processes:- Have you followed the last step meticulously? Now, it’s time to streamline your operations with all your integrated systems. In this section, you need to start implementing and integrating all the systems. Your sales tax compliance provider will help configure technological solutions to further automate tax evaluations, integrate safe data exchange, and operate on streamlined filing systems.

Looking for experienced sales tax compliance partner?

Your search ends at Ledger Labs!

Common misconceptions about sales tax compliance outsourcing

While it’s true that sales tax compliance outsourcing offers a wide range of benefits, there’s no denying that it also comes with several misconceptions as well. Let’s shed light on some of the most common misconceptions:

- Loss of control over tax processes:- As time passes, many businesses start to believe that they are actually surrendering their control after choosing to outsource. But that is far from the truth. Outsourcing, in reality, does not mean sacrificing control.

Some reputable third-party providers, like Ledger Labs, offer nothing less than exceptional and transparent approaches, keeping you posted on any occurrence. In this way, you have a full say on all your providers’ decisions.

- Higher costs compared to in-house compliance:- In-house compliance indeed looks more cost-effective at the first glance. But, more often than not, it’s not what it looks like. While it does seem cost-effective initially, consider all the hidden costs associated with in-house compliance.

From dedicated recruitment, staff training, employee benefits and software licenses to keeping track of all laws across different regions – it gradually becomes more challenging for businesses. On the flip side, outsourcing gives you a predictable payment structure with no extra effort spent on training and development right from day one.

- Security and confidentiality concerns:- Providers who have a vast track record typically prioritize data security and client confidentiality at all costs. More specifically, it is in their nature to adhere to strict market standards and undergo two or three layers of encryption to ensure data integrity.

Besides, you can also boost your security by choosing a third-party partner who offers data encryption and adheres to data protection laws like CCPA and others.

5 Tips for Choosing the Right Sales Tax Compliance Outsourcing Partner

If you wish to see your business thrive and avoid potential pitfalls, you need to choose the right sales tax compliance outsourcing partner. But, how can you do that without slipping? Read ahead because we have 5 major tips that guarantee you the best provider:

- Proven reputation:- Choose a provider with a robust market reputation, and a proven success rate. Besides, it’s also essential to look for providers who have relevant certifications and accreditations. In some instances, this includes the Sales Tax Institute (STI) Certified Sales Tax Consultant (CSTC) designation. Furthermore, you can also hunt down various online reviews and ask for references from past clients.

- Experience in the industry:- Choosing a provider with the right expertise and in-depth experience can help you in the long run. That’s because they have a deep understanding of the challenges businesses face.

- Flexibility and scalability of services:- Additionally, you need to choose a provider who can understand and change their strategy as per your business needs. Also, ensure the provider can offer customized solutions for different industry regulations.

- Availability and use of technology and automation solutions:- You should always choose a provider that offers real-time access to different sales tax tools and software like QuickBooks Online, Avalara, Zoho Books and more.

- Responsive and responsible staff:- Make sure you choose a provider who has a dedicated team familiar with the needs of your type of business. Besides, they should also be regularly available for different types of inquiries and support you might require.

Summing up

There’s absolutely no denying that you need sales tax compliance outsourcing, primarily because you wouldn’t know about the many sales tax laws applicable in different regions.

What makes it so important? Well, it is one of those decisions that has the potential to impact your business’ compliance status, financial well-being, and overall efficiency. And, frankly, who wouldn’t want a healthy business?

Connect with the accounting and bookkeeping experts at Ledger Labs and get your most pressing questions answered. Book a meeting now!