The mere thought of balancing books might give you the jitters. And rightly so! Mistakes in this area can lead to costly errors, or worse, could jeopardize your entire business.

That’s enough to make anyone break out in a cold sweat.

But not anymore! This guide is here to help you.

eCommerce accounting is keeping track of your business’s money matters but with some special rules for online stores.

Many businesses run into trouble because they don’t understand these special rules. Our guide is here to help you avoid that.

This guide will help you understand all of this in a simple way. So, let’s get started so that you know the ins and outs of your online business’s money matters!

- eCommerce accounting has immaculate benefits and can unlock growth opportunities.

- Bookkeepers and accountants should pair together to undertake eCommerce accounting compliances.

- Auditing, ratio calculations, reconciliation, etc., are the core of analyzing the actual financial soundness.

- Timely and systematic financial analysis offers the ultimate answer to what is lacking in your business.

- Varied tax liabilities demand simplification, calculation to the cent, and accurate filing.

Benefits of Regular Accounting & Bookkeeping for Small Businesses

Regular bookkeeping for a small business helps keep track of money coming in and going out. It ensures bill payments are on time, shows the amount of profit, and helps avoid any money surprises. It’s like keeping a clear money diary so that your business runs smoothly.

Here are the top ten benefits of regular accounting and bookkeeping:

- Financial Analysis and Management

Regular bookkeeping helps businesses understand their financial position. This includes knowing what you’ve earned, what you owe, and where you spend money.

- Cashflow Management

Proper accounting provides visibility into a company’s cash flow statement, ensuring that there are sufficient funds to cover day-to-day expenses. This helps prevent potential liquidity crises.

- Budgeting and Planning

Accurate financial records allow businesses to create realistic budgets and financial projections. This assists in setting financial targets and making informed decisions.

- Tax Compliance

Accurate bookkeeping ensures that businesses are compliant with tax regulations. It simplifies tax preparation and ensures that the necessary documentation is available if audited.

- Business Growth

By highlighting profitable areas, losses, or trends over time, regular accounting can provide insights to guide business strategies. This can help ensure sustainable growth.

- Access to Financing

Accurate financial statements are crucial when seeking loans or investments. Lenders and investors require these to assess the financial health and viability of a business.

- Cost Management

Regular accounting helps identify areas of unnecessary spending. This allows businesses to reduce costs and increase profitability.

- Decision Making

With real-time financial data, business owners can make informed decisions quickly, be it about purchasing equipment, hiring staff, or launching a marketing campaign.

- Stakeholder Confidence

Regular and accurate financial reporting increases the confidence of stakeholders, including investors, creditors, suppliers, and employees. This ensures smoother business operations.

- Risk Management

Regular bookkeeping can alert businesses to potential fraud, discrepancies, or financial anomalies early on, allowing for timely corrective actions.

Next, let’s take a moment to clear up a common confusion in the financial world:

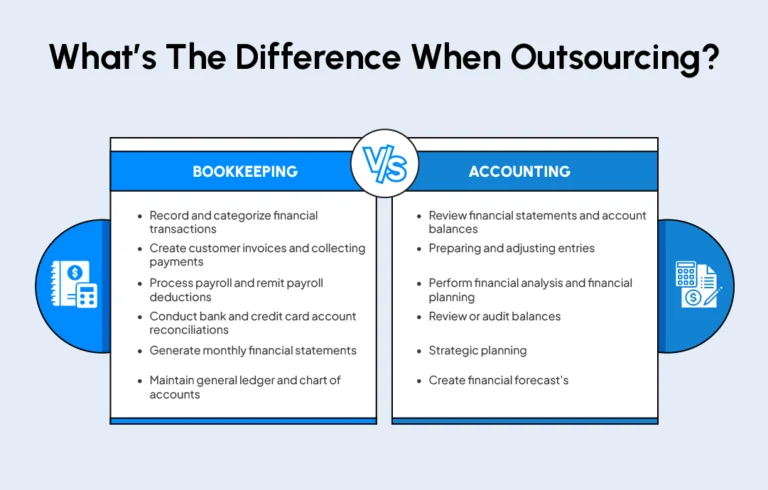

The Difference Between an Accountant and a Bookkeeper

A bookkeeper is like your reliable, everyday car. They help you keep track of where your money comes from and where it goes (your financial transactions). They’re the ones ensuring your financial engine runs smoothly day-to-day.

On the other hand, an accountant is like your trusty GPS. They use the information compiled by the bookkeeper to help guide your business decisions. They analyze your financial data, help you legally minimize your tax obligations, and provide strategic advice for your business growth.

In short, both are crucial for your business journey. A bookkeeper helps you keep track of your daily transactions. Meanwhile, an accountant uses that data to navigate your business toward greater success.

Bookkeeper Responsibilities

These are 13 key tasks that a bookkeeper typically does for a small business

- Record Daily Transactions: Just like keeping a diary, a bookkeeper records all the financial transactions of your business every day.

- Invoice Processing: They ensure all your invoices go out on time and track any incoming payments.

- Manage Accounts Receivable: They help you keep tabs on what customers owe you, making sure you get paid on time.

- Handle Accounts Payable: They keep track of what you owe to vendors and ensure these bills get paid.

- Payroll Administration: Your bookkeeper ensures your employees get paid accurately and on time.

- Bank Reconciliation: They match your bank statements with your business records to make sure everything adds up.

- Prepare Financial Statements: They compile data into understandable reports like balance sheets, profit and loss statements, and Cashflow Statements.

- Maintain General Ledger: The general ledger is like your business’s financial diary. Your bookkeeper keeps it tidy and up to date.

- Tax Preparation: They organize your financial data so it’s ready for tax season, saving you time and stress.

- Monitor Cash Flow: They keep an eye on your cash flow, helping you understand how money moves in and out of your business.

- Budgeting Assistance: They can help you create a realistic budget, guiding you towards your financial goals.

- Financial Analysis and Reports: They analyze your financial data and provide useful insights to help you make informed business decisions.

- Compliance Maintenance: They ensure your business follows all the necessary financial laws and regulations, keeping you in good standing.

Meanwhile, a good e-commerce accountant shall be able to help you with answering certain questions. Below are the most common questions small to midsized business owners typically ask:

- What is my correct Cost of Goods Sold?

- How much cash or working capital do I need to grow my business x times in the next x years?

- When can I hire my next employee?

- What is my business profitability? Am I actually profitable?

- Why are my bank balance and my net profit different?

- Despite rocketing sales, why am I always cash short?

- Why are my monthly profits varying dramatically?

- Shall I take a loan or equity?

- Shall I take Loan A or Loan B?

And many more…

So… What eCommerce Channels Can You Sell On?

To gain more orders, different ecommerce businesses create their presence on different online platforms. These could be:

- Search engines like Google,

- Social media platforms like Facebook or Instagram,

- Marketplaces like Amazon, Etsy, Walmart, or eBay,

- Platforms like Magento, Shopify, BigCommerce, WooCommerce, or even

- Email marketing campaigns.

This multichannel approach involves increasing orders and numerous activities. So, it becomes tough for eCommerce businesses to manage the bookkeeping and accounting for their ecommerce businesses.

This is where a streamlined approach to managing your books shall come in. The good part is there are so many accounting service providers who can do it for you. But before you hire someone, you should know what to expect and how to do things. This is where this guide will empower you to ask the right questions to your accountant or bookkeeper.

Cash or Accrual? The Two Accounting Methods You Can’t Afford to Ignore

There are two different approaches to accounting.

- Cash Basis

- Accrual Basis

Cash vs. Accrual Accounting: What’s the Difference?

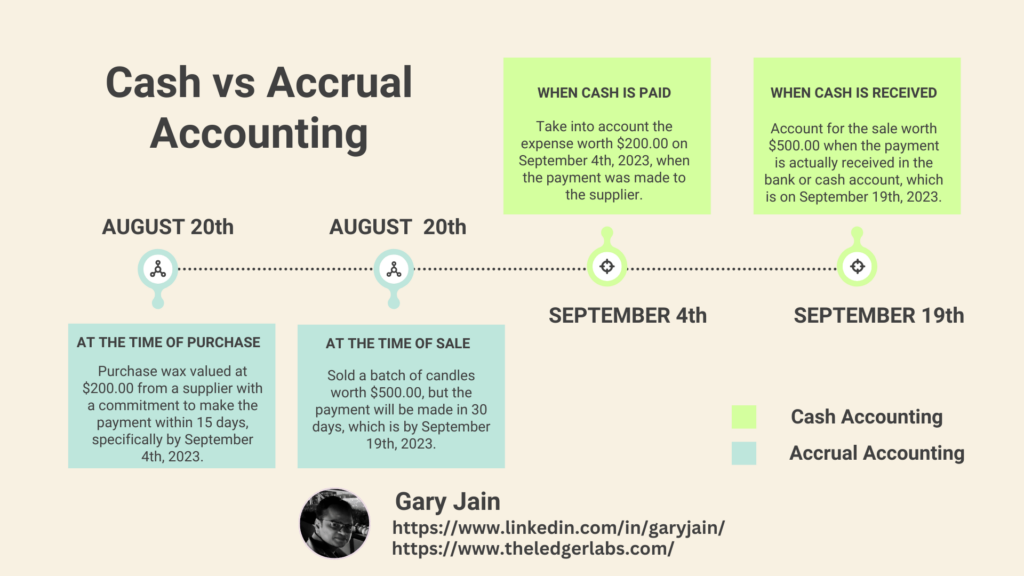

Suppose you’re running a business selling handmade candles. On August 20, 2023, you sold a batch of candles to a customer. It was worth $500, and they’ll pay you in 30 days, i.e., by September 19, 2023. On the same day, you also buy wax worth $200 from a supplier. You promised to pay them in 15 days, i.e., by September 4, 2023.

In the realm of the cash basis of accounting, it’s all about when cash changes hands. So, you record the $500 income on September 19, 2023, when you receive the payment. Similarly, you record the $200 expense on September 4, 2023, the date you pay the supplier. Your net profit for August is $0 (no income recorded yet), while for September, it’s $300 ($500 income – $200 expense).

Now, let’s hop over to accrual basis accounting. Here, you record transactions when they occur, regardless of when the cash exchange occurred. So, you record the $500 income and the $200 expense both on August 20, 2023. Your net profit for August, in this case, is $300 ($500 income – $200 expense), while for September, it’s $0 (no new transactions).

Here’s a quick recap in a tabular format:

In a nutshell, the cash basis of accounting is like a cash register, only ringing when money comes in or goes out. The accrual basis of accounting is like a diary, chronicling the story of each transaction from start to finish.

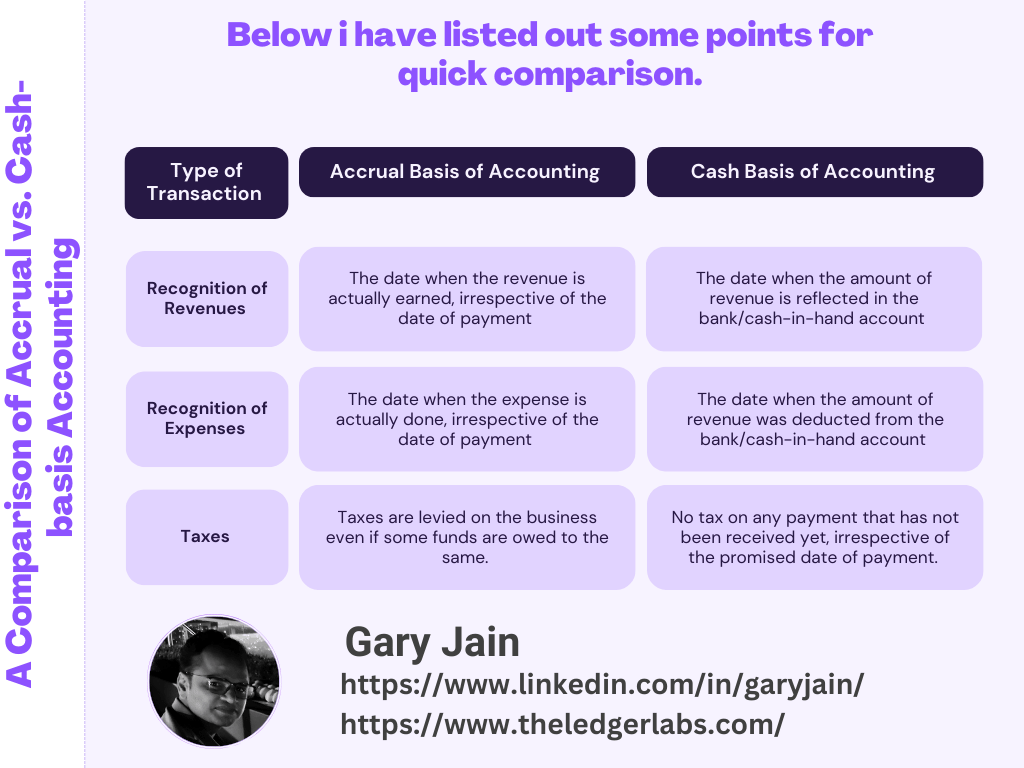

A Comparison of Accrual vs Cash-basis Accounting

Below I have listed out some points for quick comparison.

Now here is the question that I get asked most often:

Shall I Choose Accrual or Cash Basis Accounting for My Business?

You can refer to Cash vs. Accrual Accounting – Which one you should Choose here to help you decide.

Now comes the most important section you have been looking for.

The eCommerce Financial Checklist: 12 Must-Do Accounting and Tax Tasks

- Reconcile Sales, Returns, Shipping Income, and Chargebacks

- Reconcile COGS, Inventory & Inventory in Transit

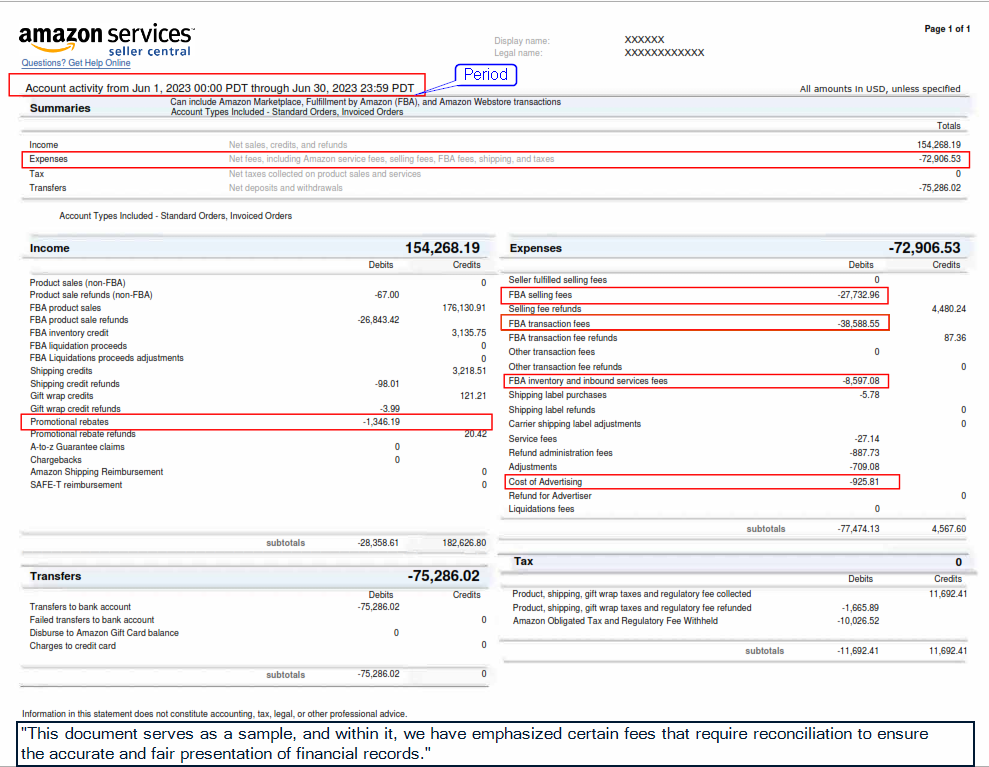

- Reconcile Channel Fees, Payment processing fees, promotions, etc.

- Reconcile Banks, Cards, Loans and Equity Accounts

- Prepare Financial Statements – Balance Sheet, Income Statement & Cashflow Statement

- Review the Numbers for accuracy

- Make meaningful sense out of Data

- Prepare Sales Tax Reports and file them as per your state guidelines. Quarterly or Monthly

- File Quarterly Estimated Taxes

- File Annual 1099s forms

- File Company Income Tax

- File Personal Income Tax

The tasks above are among the most relevant. This list is not exhaustive, but it includes the most essential ones to run your business successfully.

Let’s have a look at all these responsibilities individually.

1. Reconcile Sales, Returns, and Chargebacks

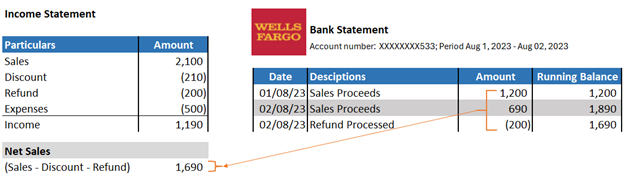

Let’s get back to the handmade candle store idea. You’ve had a great month with lots of sales. Fantastic job! But now, you have to make sure that all those sales on your seller portal match the money in your bank account. This is what we call ‘reconciling sales.’

This is how we do it, step by step:

- -Gather all your sales records for the month and add them up. Let’s say you sold 350 candles at $6 each. That’s $2100.

- -Next, check your bank account. The total amount deposited should match the sales you made. If it’s the same, great job! You’ve reconciled sales.

But what if the numbers don’t match?

Don’t panic! Look for any refunds or discounts you might have given. Maybe you had to refund a customer who received a broken candle, or you offered a 10% discount on a particular day. Subtract these amounts from your sales total, and it should then match your bank deposit.

To understand better how to reconcile ecommerce sales, you can refer to our guide here.

Now how can Uncle Sam remain quiet if you are making money? They need their share as well. It’s called Sales Tax. You should always be careful about sales tax calculations as they have many legal ramifications if done incorrectly. Let’s talk about how to reconcile sales tax.

How to Reconcile Sales Tax for eCommerce Sellers: A Quick 5-Step Guide

- The Sales tax collected is never an income, and you should never include it in your Income statement. You collected the sales tax from your customer on behalf of the state. After you collect it, you owe the money to its rightful owner, the state. Hence, you always reflect it on your balance sheet as a liability.

- Sales tax reconciliation is a match-making game between the sales tax you’ve collected from customers and the amount you owe to the tax authorities. It’s like making sure every dollar you’ve collected has a government-cut dollar that you pay out.

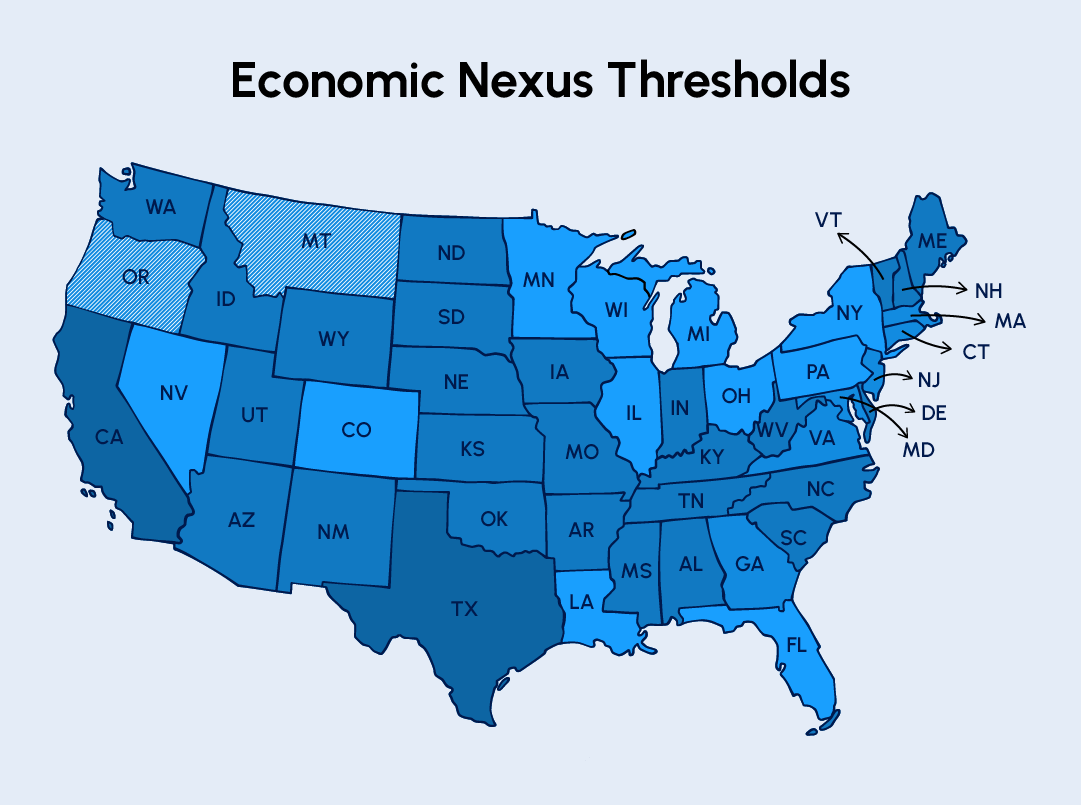

- Start by reviewing your total sales for a specific period, say a month or a quarter. Then, identify the portion of those sales that had sales tax applied. This will depend on your nexus (your physical presence or level of business activity) in different states. Let’s use an online bookstore as an example. If you have a nexus in New York and California, you’d separate your New York and California sales.

- Calculate the total sales tax you should have collected for these taxable sales. This involves applying the correct sales tax rate for each state. Remember, sales tax rates can vary. It’s important to get this right.

- Compare the sales tax you’ve collected with the amount you’ve calculated. If there’s a discrepancy, you’ll need to figure out why and how it happened and fix it. Perhaps you applied the wrong tax rate, or maybe there was a glitch in your ecommerce platform.Furthermore, I generally advise businesses on Making Provisions for Sales Returns and Chargebacks every month so as to get closer to the correct numbers.

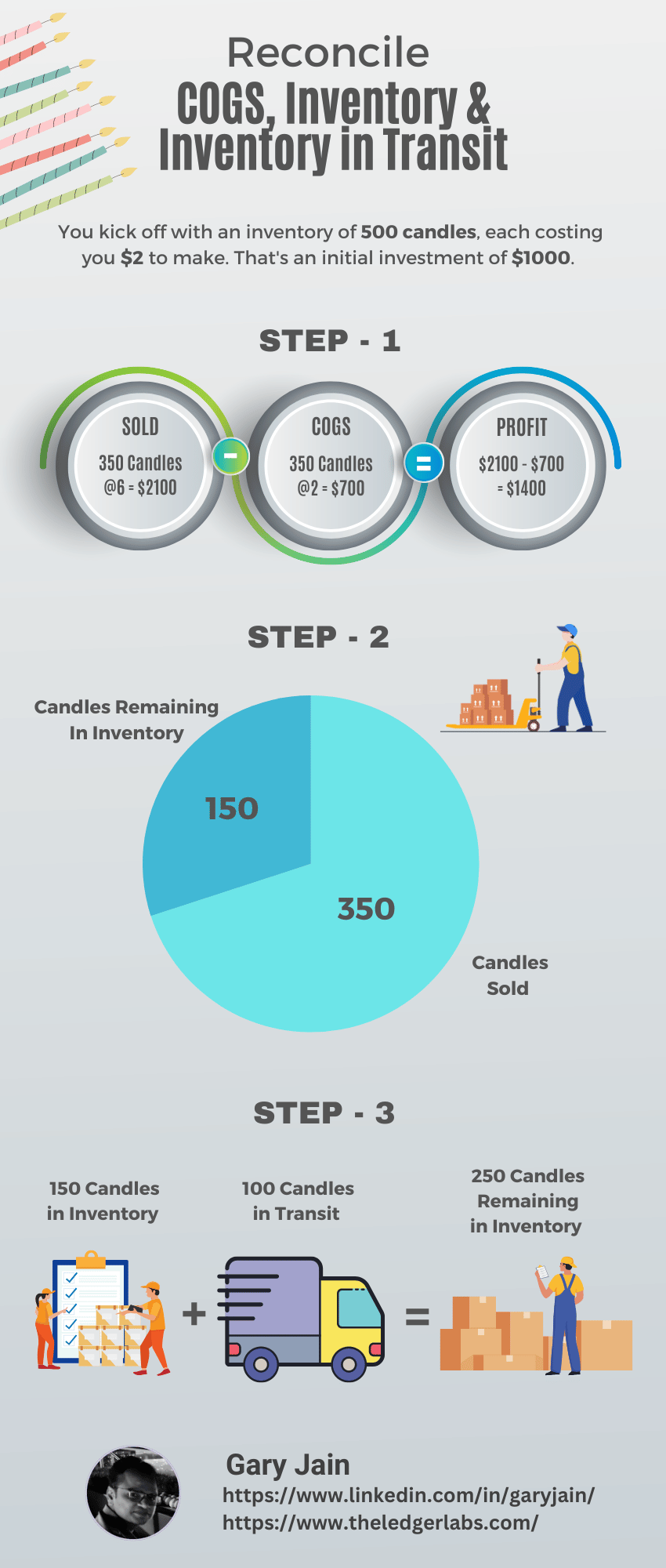

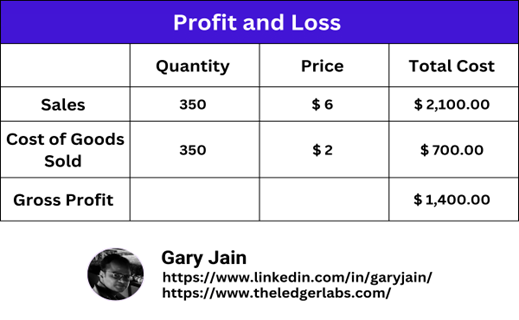

2. Reconcile COGS, Inventory & Inventory in Transit

Inventory and COGS are highly interrelated and very complex to calculate accurately. Below is a very simplified version of the relationship.

Let’s start with COGS. This might seem like just another acronym, but it’s actually a key player in your profitability game. It’s the total cost of producing the goods you’ve sold during a specific period. Understanding this helps you price your products effectively, ensuring you’re not just making sales but profitable sales!

Now, let’s demystify this with our favorite homemade candle example. You kick off with an inventory of 500 candles, each costing you $2 to make. That’s an initial investment of $1000.

Step One: Calculate Your Monthly COGS

By the end of the month, you sold 350 candles at $6 each- what a triumph! To calculate your COGS, multiply the number of candles sold by the cost per candle. So, 350 candles x $2 equals $700. This is your monthly COGS, giving you an insight into your direct production costs.

Step Two: Reconcile Your Remaining Inventory in Stock

You started with 500 candles and sold 350, leaving you with 150 candles. Do a physical count of your stock. If it matches up to 150, perfect! You’ve reconciled your Inventory in Stock.

If any numbers don’t match, perhaps due to damaged goods or giveaways, simply adjust these from your inventory count. Your figures should then align seamlessly.

Step Three: Consider Your Inventory in Transit

Suppose you have another batch of 100 candles that your vendor is shipping to you at the end of the month. Though they’re not yet in your physical stock, they are indeed a part of your inventory. So, your total inventory would be your Inventory in Stock (150 candles) plus your Inventory in Transit (100 candles), a total of 250 candles.

Don’t forget that the advance paid to your vendor for the Inventory in Transit plays a crucial role in your overall inventory costs. Say, you’ve paid an upfront cost of $200 for the 100 candles in transit. You need to factor into your inventory valuation.

Here is our advanced guide on How to Calculate the Cost of Goods Sold, which will help you understand this concept in much detail.

You can also refer to our other guide on How to Reconcile inventory for your ecommerce business. It will help you relate both these concepts.

By the way, you just calculated your Gross Profit Calculated from the example above.

But what if the numbers don’t match?

Don’t panic! Look for any refunds or discounts you might have given. Maybe you had to refund a customer who received a broken candle, or you offered a 10% discount on a particular day. Subtract these amounts from your sales total, and it should then match your bank deposit.

3. Reconcile Channel Fees, Payment Processing Fees, Promotions, and Similar

Let’s delve into some key costs you need to consider while running your ecommerce business:

- Channel Fees are costs associated with selling on specific platforms. For instance, if you’re selling on a marketplace like Amazon, you’ll pay a referral fee for each item sold. It’s crucial to understand these fees to price your products appropriately and maintain healthy profit margins.

- Payment Processing Fees are charges you incur while processing customer payments. These typically include a percentage of the transaction value plus a fixed amount per transaction. Shopify Payments, for example, charges between 2.4% to 2.9% of a purchase, plus a flat 30¢ transaction fee.

- Promotions are strategic discounts or special offers you provide to attract more customers. While they can boost sales, it’s important to calculate their impact on your overall profitability. You need to ensure that the increased volume of sales offsets the reduced profit margin per unit sold.

4. Reconcile Banks/ Cards/ Loans

Why should you reconcile, you ask? Well, think of it as a compass that always points to the truth. It helps you ensure that your financial records are accurate, spot any discrepancies, guard against potential fraud, and keep your cashflow healthy.

More importantly, it’s like a mirror that reflects your business’s financial health. It allows you to make informed and strategic decisions.

Now, let’s delve into some best practices for bank reconciliations:

- Regular Reconciliation: Make it a habit to reconcile your accounts on a regular basis. Whether it’s daily, weekly, or monthly, pick a timeline that suits your business operation. This practice will help you catch any discrepancies early and rectify them swiftly.

- Keep Records Updated: Ensure all records of your transactions are accurate in your books. Whether it’s a bank transfer, credit card payment, or loan repayment, each transaction should appear in your records.

- Double-Check: Compare your internal financial records with your external statements from your bank, credit card company, or loan provider. If there are any differences, identify, analyze, and rectify them promptly.

- Use Accounting Software: Leverage modern technology to streamline your reconciliation process. Several accounting tools can connect directly to your bank, card, and loan accounts, making reconciliation easier and more efficient.

How to Reconcile Your Bank Account?

Reconciling your bank account is an essential accounting task that helps you ensure that your business or personal records align with your bank statements. Doing so can help you catch any discrepancies or errors and get a clear understanding of your financial position. Here is a step-by-step guide on how to reconcile a bank account:

Step 1: Gather Your Documents

- Bank Statement: Obtain your latest bank statement. This might be a paper statement in the mail or an electronic statement you can download from your bank’s online portal.

- Accounting Records: Have your checkbook register, accounting software, or accounting ledgers handy.

Example: Suppose you run a small business called “Coffee Corner.” For reconciliation, you’ll first gather your bank statement for June 2023 and the record from your accounting software or ledger for the same month.

Step 2: Set a Time Frame

Decide the period for which you will reconcile your account. It could be a month, a quarter, or any other period as per your needs.

Example: You choose to reconcile your bank account for the month of June 2023.

Step 3: Compare Balances

Check if the closing balance from your last reconciliation matches the opening balance on your current bank statement.

Example: You find an opening balance of $5,000 on your June bank statement. This should match the closing balance of your last reconciliation in May.

Step 4: Match Transactions

Go through each transaction in your accounting records and match them with the transactions on your bank statement.

- -Mark off each matched transaction on both your statement and your records.

- -Take note of any transactions that appear in your records but not on the statement; these are your outstanding items.

Example: Your accounting record shows a bill payment of $600 to “Supplier A,” and you see this same payment on your bank statement.

- -Possible Error: A $600 payment to “Supplier B” instead of “Supplier A”.

- -How to Fix: Double-check both records and correct the entry in your accounting software to match the bank statement.

Step 5: Identify Discrepancies

Look for discrepancies like additional bank fees, charges, or any transaction amounts that don’t match.

Example: You find a bank fee of $20 that you didn’t account for.

- -How to Fix: Enter the bank fee as an expense in your accounting software.

Step 6: Adjust for Outstanding Items

Some items may not yet have cleared the bank. These could be:

Checks you’ve written but haven’t cashed.

Deposits made but not yet shown.

Example: An invoice of $1,000 to “Client X” shows as sent in your accounting software but doesn’t appear on your bank statement.

- -How to Fix: Keep this as an outstanding item. It’s likely that “Client X” hasn’t yet processed the payment.

Step 7: Make Necessary Adjustments in Your Records

Found discrepancies, such as bank fees or interest earned, that appear on the bank statement but not in your records? Make the appropriate entries in your accounting system.

Example: Your bank statement shows interest income of $25, which isn’t in your accounting records.

- -How to Fix: Record this as interest income in your accounting software.

Step 8: Calculate

After accounting for all transactions and adjustments:

- -Your adjusted bank statement balance should equal your adjusted accounting records balance.

Example: Your bank statement shows a closing balance of $5,405, and your accounting software shows $5,380.

- -How to Fix: The $25 discrepancy is due to the interest income. Once adjusted, both should match.

Step 9: Investigate Any Differences

If there are any differences between your adjusted accounting records and your adjusted bank statement, investigate. Check for:

- -Data entry errors.

- -Missed transactions.

- -Duplicate entries.

Example: Your accounting software shows an expense of $200 for office supplies, but your bank statement shows $220.

- -Possible Error: Maybe a $20 coupon that you thought you applied didn’t process.

- -How to Fix: Update your records to reflect the actual cost of $220.

Step 10: Finalize the Reconciliation

Once you’ve verified that your adjusted bank statement balance matches your adjusted accounting records, your reconciliation is complete.

- -Document the reconciliation, usually in the form of a bank reconciliation statement, and store it in your accounting records.

Example: Now that all transactions match and you’ve fixed all discrepancies, your reconciliation for June is complete.

Step 11: Review

Take a moment to review your reconciled records to gain insights into your financial status.

Step 12: Keep the Records

Retain all reconciliation documents, bank statements, and adjustment entries for future reference or auditing purposes.

Regularly reconciling your bank account helps maintain the integrity of your accounting information. Try to make it a routine financial practice.

5. Prepare Financial Statements: Balance Sheet, Income Statement, and Cashflow Statement

Financial statements are like the heartbeat of your business – they reveal its financial health and guide your decisions. And the big three statements are your keys to unlocking this treasure trove of insights:

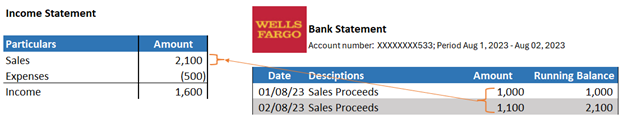

1. Income Statement

You can also refer to the income statement as the profit and loss statement. It provides an overview of a business’s revenues, expenses, and net income or loss over a specific period. It helps you to understand the profitability and performance of the business.

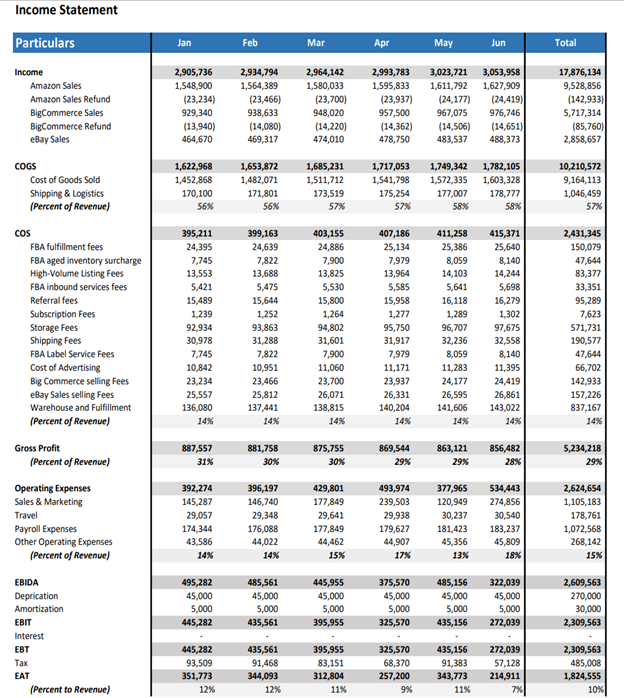

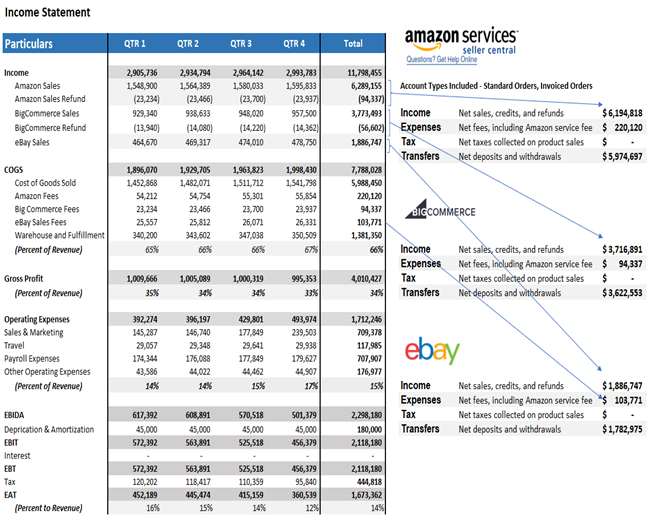

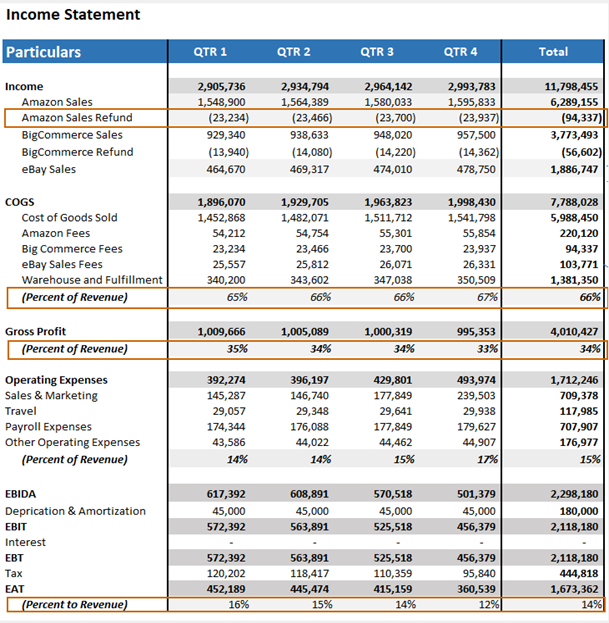

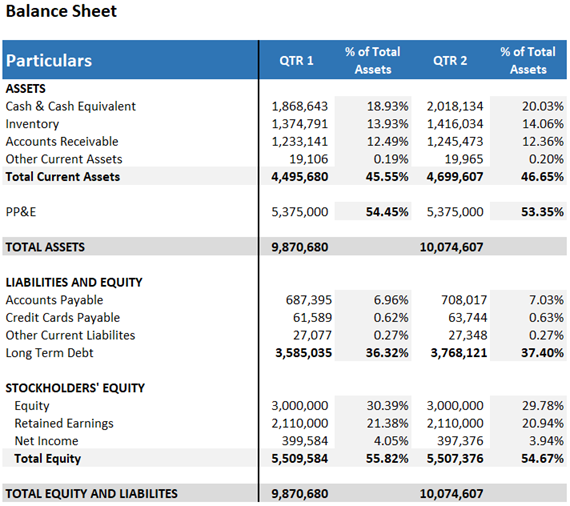

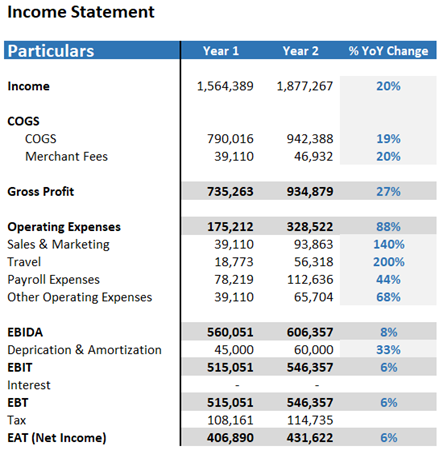

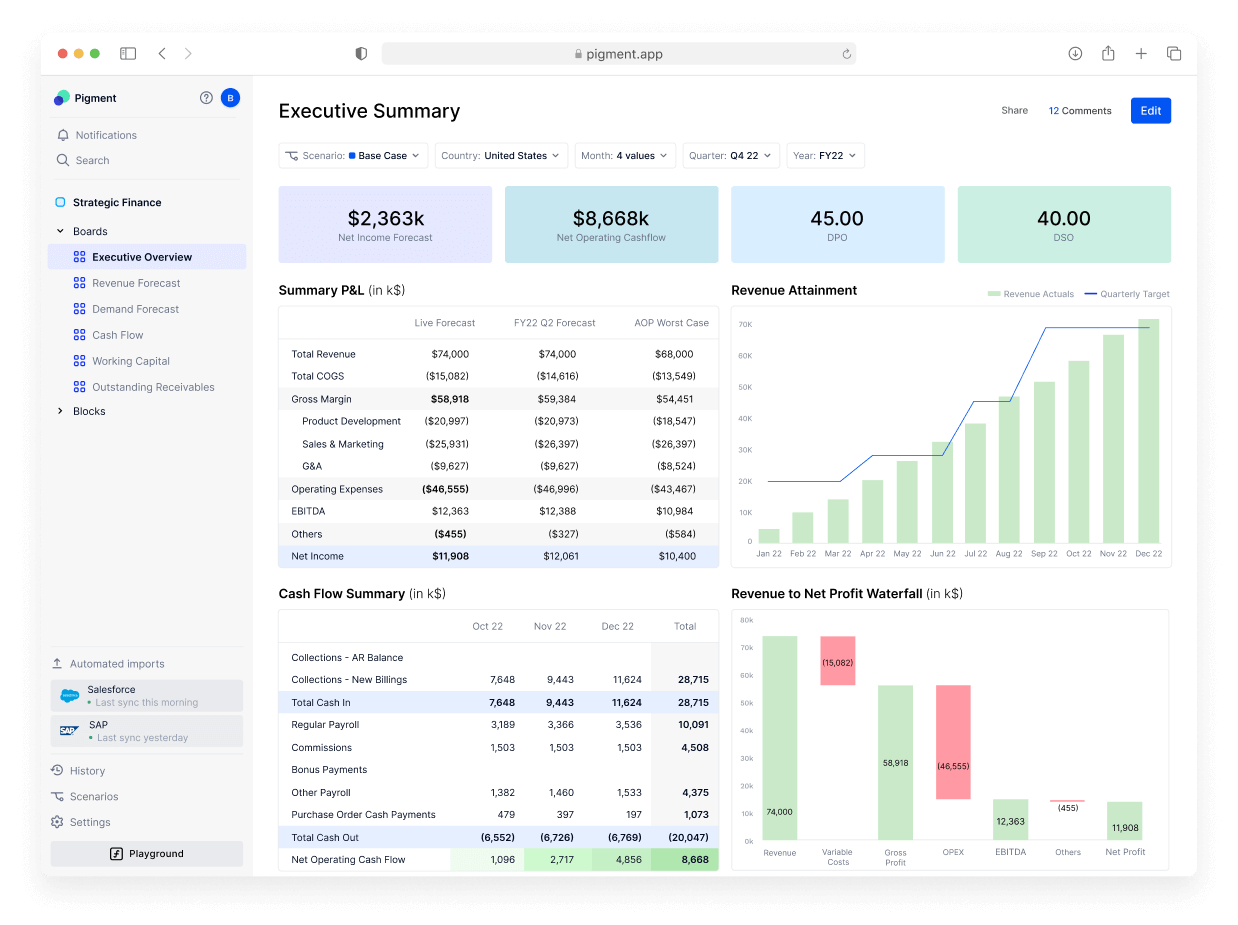

Here is the example income statement of an ecommerce seller client of mine. We’ve left out the name for data security purposes. You can refer to our detailed guide on how to read and review your income statement.

2. Balance Sheet

It’s a financial statement that provides a snapshot of a business’s assets, liabilities, and shareholders’ equity at a specific point in time. It gives you a summary of what the business owns, what it owes, and the owners’ investment in the business. You can refer to our detailed guide on how to read and review your Balance Sheet.

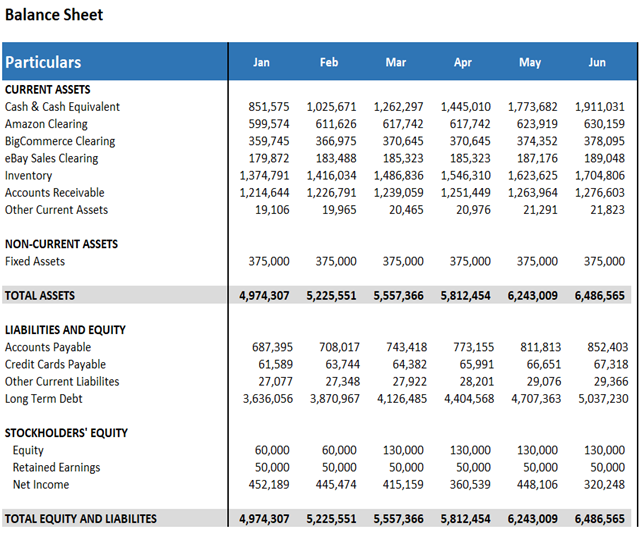

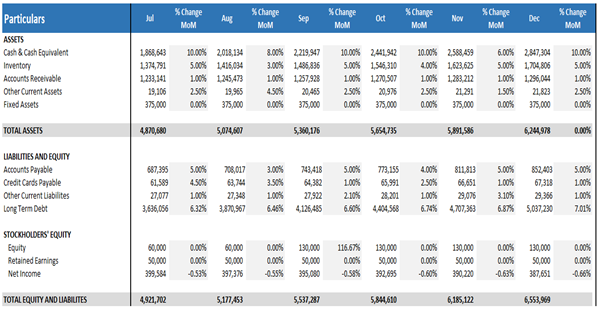

Here is an example of the balance sheet to show what it looks like.

3. Cashflow Statement

It provides information about the cash inflows (receipts) and cash outflows (payments) of a business during a specific period. It helps stakeholders understand how the company generates and uses cash.

I have already explained about covering the Income statement.

But the Cashflow Statement is a different game altogether. One interesting thing about cashflow is that your CPA will never ask for it for filing taxes. However, your investor, lender & any business consultant always will, which means that cashflow is a very crucial statement for indicating business health.

Why should you care about Cashflow Statements, you ask?

Well, they help you understand if your business is generating enough cash to stay robust and grow. They can even highlight potential issues before they become serious.

For example, your bookstore is selling a lot of novels, but your cashflow from operating activities is negative. This means that you might be selling on credit too often or not collecting payment swiftly enough. Spotting this early allows you to adjust your payment cycles and keep your business thriving!

Sections of the Cashflow Statement

Now, a Cashflow Statement consists of three sections, each telling a different part of your business’s financial story:

- Operating Activities: This is the heart of your business – where your main revenue-generating actions live. For instance, if you run a bakery, this would include the cash from selling bread and pastries, vendor payments, and utilities. Basically, it’s like a cash-based income statement.

- Investing Activities: This section is all about the long term. It tracks cash used for investments, like buying a new oven for your bakery, or cash received from your personal account. It’s like a cash-basis reconciliation of balance sheet items.

- Financing Activities: Here, we see how you fund your business and pay your debts. If you took out a loan to start your bakery, or if you’re paying it back, it shows up in this section. It’s like a cash basis for the reconciliation of balance sheet items.

You can think of a Cashflow Statement as a cash basis reconciliation with an amalgamation of a balance sheet and income statement. You can refer to our detailed guide on how to read and review your Cashflow Statement.

Different Methods of Calculating Cashflow Statements.

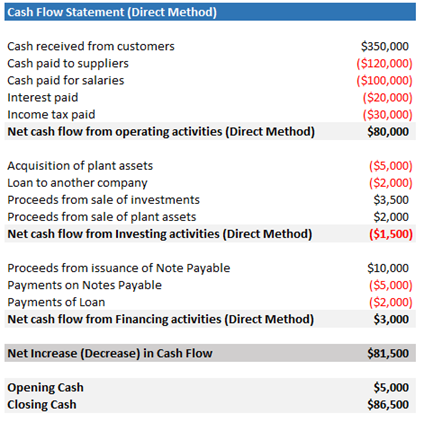

- Direct Method: This is like a detailed diary of your business’s cash transactions. It involves listing out all the individual instances where the cash came in and went out. So, if you run a coffee shop, you’d record the cash from every cappuccino sold and every bag of coffee beans purchased. While this method might require a bit more effort, it provides a clear and detailed picture of your cash flow.

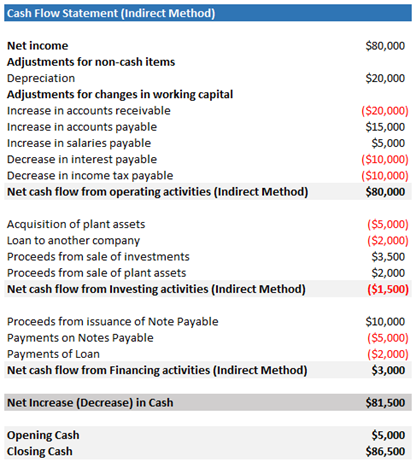

- Indirect Method: This is like a detective piecing together a case. You start with your net income (from your income statement). Then, add back or subtract non-cash items and changes in operational balances. For example, you’d add back depreciation (as it reduces net income but doesn’t involve actual cash). After that, subtract increases in accounts receivable (as this represents sales made but not yet paid for). This method is a bit quicker and easier to prepare. Though, it might not offer as much detail on your specific cash inflows and outflows. Personally, I have found my clients not understanding this approach at first glance. It takes me time to help them understand this, and is not my favorite for small businesses.

Each method has its advantages. The choice between them often depends on how much detail you want and how much time you’re willing to spend. Below is an example of using both methods using the same set of numbers. This shall help you understand them better.

Let’s assume we have the following set of numbers for a fictional company for a specific period:

Now, let’s prepare the Cashflow Statement using both the direct and indirect methods.

This demonstrates how the direct and indirect Cashflow Statement preparation methods result in the same net cashflow. Yet they present the operating activities information differently.

6. Review Financial Statements for Accuracy

Humans make mistakes but also correct them. Despite my years of experience in preparing the numbers, I still do not trust myself with 100% accuracy with multi-step processes as explained above. After finishing up the preparation, I do a review and make sure that all the statements tell me the parts of the same story. Numbers line up and match up to the facts.

Taking a Closer Look at Your Income Statement

Don’t worry, we’ll walk you through the different methods to make sense of this important financial snapshot of your business.

Make sure the sales on your portal match the sales in your income statement.

- The returns/refunds appear separately.

- The Merchant fees match the channel reports.

- COGS is consistent in terms of percentage of sales as compared to the last few months.

- The Operating expenses do not see a huge variation from past months.

- Always compare numbers month on month with the last 6 months or QoQ.

- Make sure that you use percentage increase or decrease in the MOM numbers or QoQ numbers. Any significant percentage increase shall be easy to catch.

Diving Deep Into Your Balance Sheet:

Let me guide you through various methods to understand your company’s financial position better.

- Make sure the closing balances of banks/cards match those in the books.

- Ensure the inventory values match the stock you have in the warehouse.

- Verify loan statements ending balance and ensure the ones in the books are a match.

- Sales Tax Liabilities shall match completely with the reports on your sales channels. Use the formula: the opening balance for the month/Quarter – Payments made + Sales tax collected that month/Quarter. Ideally, it should equal the Closing balance of Sales tax liability.

- Verify the equity section for all the investments put in by the owner or investor. All the owner draws should be genuinely owner draws.

- Always compare numbers month on month with the last 6 months.

- Make sure that you use percentage increase or decrease in the MoM numbers. Any significant percentage increase shall be easy to catch.

Taking a Closer Look at Your Cash Flow: Don’t worry, it’s simpler than it looks! Break it down piece by piece, where your money’s coming and going.

- Make sure to remove noncash transactions like depreciation, amortization, stock-based compensation, or exchange rate differences

- Make sure that cash balances at the beginning +/- Cash movements this period = Closing balance in the bank statements.

- Look for outliers like outstanding checks, deposits in transit, bank errors, or adjustments for reconciling items.

- Cashflow statement changes shall tie to balance sheet & income statement accounts like Accounts Receivable, Payables, Sales, Expenses, etc.

- Just check if the cashflow statement numbers line up with your business? Have you actually seen that type of cash movement?

- Look for any unusual or significant cash flows, such as large or frequent transactions, related party transactions, or transactions with tax implications, and obtain sufficient audit evidence and explanations for them.

Review Financial Statements

Reviewing is both an Art and a Science. This is the most interesting part I love about accounting. It may need some experience as well to find some hidden meanings in the data. Now the point is; what should you look for? The answer is it really depends on your business type, your most important performance indicators & your expectations.

For example – If you are in the business of selling Services, then your profitability shall be higher as compared to selling products. Your Fixed assets will be relatively lower as compared to a manufacturing business.

Your KPI will not be the return on assets, but it will be the return on employees you have used to deliver the services.

Let’s Talk About These 5 Financial Analysis Techniques

There are many types of Financial statement analysis techniques, but I will be discussing the most often used and practical for small to mid-sized businesses.

- Vertical Analysis

With vertical analysis, every item in your financial statement is presented as a percentage of a base figure. This makes it easy to compare and evaluate your company’s key metrics. For example, in your income statement, each item is expressed as a percentage of gross sales. Similarly, in your balance sheet, each item is stated as a percentage of total assets.

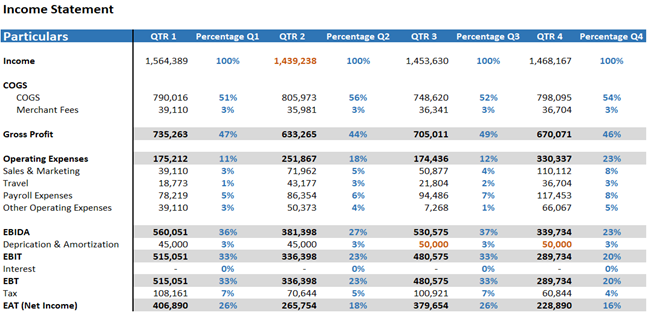

Let’s dive into an illuminating example of vertical analysis.

In the above income statement, you can quickly see that while total sales decreased in Q2 and then increased in Q3 and Q4, the company’s gross and net profit percentages have also changed, respectively. While you would likely expect the cost of goods sold to increase as the total sales amount increases, using the vertical analysis method reveals that the costs didn’t increase proportionately to the increase in sales and vice versa.

In the first quarter, the cost of goods sold was 54% of the company’s overall total sales, but in Q2, the sales were reduced by 5%, but the COGS only changed by 1%. This may mean the company stopped selling those units whose margin was comparably lower than others OR this may also mean that the company purchase costs have increased which the company may have passed to the consumers and due to very elastic demand, the sales fell drastically.

Furthermore, as the company’s revenue started growing, other related costs like sales and marketing and payroll expenses also started increasing.

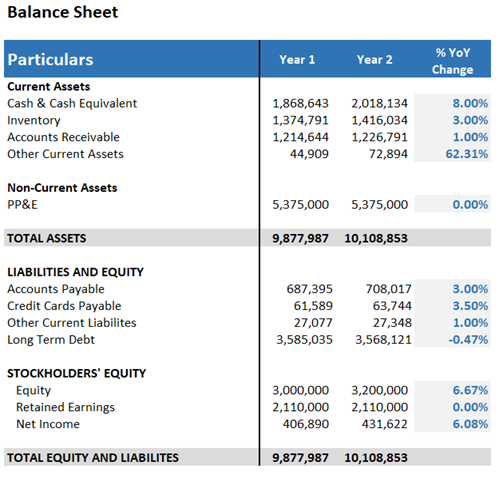

In the analysis above, by using vertical analysis, you gain a clear understanding of net profit and easily compare performance over time. Ready to maximize the benefits of vertical analysis? Let’s Calculate the Vertical Analysis of the Balance Sheet with a practical example.

Vertical Analysis Formula: Individual Item / Total Assets (Liabilities) * 100

Let us now calculate the Vertical Analysis of the Balance Sheet with the help of another example.

The process is virtually identical to our common size income statement; however, the base figure is “Total Assets” as opposed to “Revenue”.

Once we divide each balance sheet item by the “Total Assets” of $9,870,680. The assets section is informative with regard to understanding which assets belonging to the company constitute the greatest percentage.

In our case, half of the company’s asset base comprises PP&E, with the rest coming from its current assets. The sum of the current assets equals 45.55%, confirming our calculations thus far are correct. On the liabilities and shareholders’ equity side, we’ve chosen the base figure to be total assets.

To reiterate from earlier, dividing by total assets is akin to dividing by the sum of liabilities and equity. Since liabilities and equity represent a company’s funding sources – i.e., how the company obtained the funds to purchase its assets – this part of the analysis can be insightful for understanding where the company’s financing stems from.

As an illustration, our company’s long-term debt accounts for 36.32% of total assets, quantified as the “debt to asset ratio.” This ratio gauges solvency risk and debt versus equity funding.

We can assess short-term liability coverage through the current ratio; for instance, Q1’s ratio of 5.80 signifies strong payment capacity.

Working capital measures short-term health; Q1’s positive $3.7 million suggests operational funding and future investments.

However, excessive working capital prompts questions:

- Are resources underutilized due to excess inventory or missed debt opportunities?

- In Q2, cash rose by 8%, and loans by 5%. Is expanded cash balance linked to increased borrowing?

2. Horizontal Analysis

Wouldn’t it be great if you could effortlessly analyze financial statements and identify trends over multiple accounting periods? Well, with horizontal analysis, you can do just that!

Horizontal analysis examines changes in financial statements and calculates the percentage change in specific line items between the current and previous accounting periods. It helps find trends and make comparisons.

It has helped me in financial modeling, forecasting, and identifying Year over Year (YoY) or Quarter over Quarter (QoQ) changes. With this information, you can also make accurate predictions about future trends.

A horizontal income statement analysis can be used to determine the YoY growth rate in the above case. Furthermore, it assists us in identifying possible areas of growth and concerns.

For example, while revenues increased by 20%, depreciation expenses increased by 33%. Why has the rate of depreciation increased? Additionally, selling and administrative expenses have increased by 140%. What variables could have influenced this increase? We can successfully target areas that require additional investigation and attention by precisely recognizing trends.

As we can see, we can appropriately detect trends and develop relevant areas to target for further analysis.

In the example above, we can identify the YoY growth rate using a horizontal income statement analysis. In addition, it helps us identify potential areas of growth and concerns.

For example, For instance, though revenues surged by 20%, long-term debt only saw a slight 0.47% reduction. This may mean that business is profitable enough to fuel its growth (can be verified by income statement) OR it may also mean that partners have invested money in the business themselves. You can also check whether any fixed asset or current asset was used to fund the growth. By accurately identifying trends, we can effectively target areas that require further analysis and attention.

As we see, we can correctly identify the trends and develop relevant areas to target for further analysis.

3. Ratio Analysis

Ratio analysis is all about relationships – comparing different numbers from your balance sheet, income statement, and cash flow statement to each other to get a clearer picture of your business’s health.

One major advantage of ratio analysis is its ability to simplify complex financial data into understandable metrics. Think of it as translating the language of accounting into plain English (or whichever language you prefer).

Another benefit is its versatility. There’s a ratio for nearly every aspect of your business you might want to investigate, from liquidity (can you cover your short-term debts?) to profitability (how much are you earning relative to your costs?), efficiency (how well are you using your assets?), and solvency (can you survive in the long term).

Finally, ratio analysis allows for easy comparisons. Whether you’re looking at different periods in your own company’s history or benchmarking against other businesses in your industry, ratios provide a standard unit of measure. This can help you spot trends, identify strengths and weaknesses, and make informed decisions.

Below is a breakdown of some of the most common ratio metrics:

Balance sheet:

It gauges stability and risk, influencing decision-making for investments, loans, and financial strategies.

- Return on Asset Turnover – measures a company’s efficiency in generating revenue from its total assets.

- Quick ratio – measures a company’s ability to meet its short-term financial obligations using its most liquid assets.

- Receivables turnover – measures how many times a company collects its average accounts receivable during a specific period, indicating the efficiency of its credit and collection processes.

- Days to sales – Days to sales ratio measures the average time it takes to convert inventory into sale.

- Debt to assets – measures the proportion of a company’s debt relative to its total assets, indicating its financial leverage.

- Debt to equity – measures a company’s financial leverage by comparing its total debt to shareholders’ equity.

Income statement:

A statement that summarizes a business’s revenues, expenses, and profits over a period.

- Gross profit margin – measures profitability after subtracting production costs.

- Operating profit margin – measures a company’s profitability after operational expenses.

- Net profit margin – measures profitability as a percentage of revenue.

- Interest coverage – Earnings sufficient to cover interest payments on debt obligations.

To analyze your cash flow and minimize financial risks, use these key performance indicators.

- Operating cash flow – Cash generated from core business operations, excluding financing activities.

- Free cash flow – Company’s available cash after expenses.

- Free cash flow yield – Return on investment from free cash flow.

- Cash conversion cycle – It measures how long it takes to turn investments in inventory into cash from sales.

- Net debt to free cash flow – It shows how much a company owes compared to its money left after expenses. Lower is better for financial health.

Comprehensive:

This includes return on assets (ROA) and return on equity (ROE), along with DuPont analysis. With the help of the comprehensive ratios, you can ascertain a comprehensive view of the finances and operations of the business.

Here is a quick Cheat sheet for the Ratio analysis. You can print and keep it on your desk while reviewing the statements.

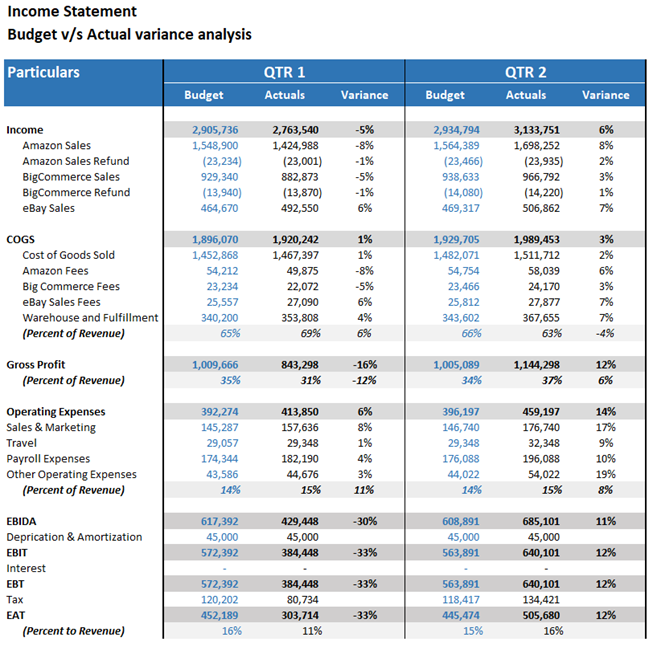

Budget vs. Actuals – Variance Analysis

Imagine planning a road trip and then comparing your actual journey with the plan. Did you take a few detours? Did you arrive on time? The same principle applies to your business budget. You map out your financial journey for the year (your budget), and then compare it with what actually happens (your actuals).

The real magic comes from understanding the differences, or variances, between these two. Did you spend more than planned? Did you earn less? Recognizing these deviations is like having a friendly heads-up that allows you to adjust your course as needed, ensuring you stay on the road to profitability.

Our guide to budget vs. actual variance analysis and reporting covers how to calculate it, visualize it, and, most importantly, interpret it. Follow along using our budget vs. the actual Excel template. Download it for free and replace the sample data with your own to make the model outputs more relatable.

Calculating and comparing budget vs. actuals of expense items starts with creating “Actual” financial statements & then comparing pre forecasted “budgets” to “actuals”.

Our example below is integrating the actuals with the budget. The budget is compared directly to the actuals for expense and revenue categories pulled from the actuals sheets into the column adjacent to the budget. This approach follows best practice when comparing data by putting side by side the values of budgets, forecasts, and actuals in a horizontal layout.

Finance team members should ask questions like:

- Did the variance in income occur due to a change in quantity sold or a change in price?

- Did the variance in COGS occur due to change in price of inventory?

- Is any variance is due to timing difference and will reverse?

- What are the reasons behind the negative variance in overall Income Statement?

- What methodology was followed for the budgeting for income and expenses?

The answers to these questions are good starting points to identify key drivers in revenue or spending variance.

5. Future Forecasting

Most common forecasting techniques often used by me and requested by my clients as well are:

Income Forecasting

Forecasting an income statement involves predicting your business’s future revenues, expenses, and ultimately, net income. It’s like gazing into a crystal ball for your business’s financial future. But fret not, you won’t need any magical powers – just some good old-fashioned number crunching and strategic thinking.

- Firstly, start with your revenues. Look at your past sales trends and growth rates. If you run a bakery and your sales have been growing by 10% each quarter, that’s a good starting point for your forecast. But also consider any upcoming changes. Are you planning to launch a new line of gluten-free pastries? Factor that into your forecast.

- Next, move on to your expenses. Again, past trends are helpful. If your flour costs have been rising by 2% each quarter, include that in your forecast. But don’t forget about any planned changes. Are you going to hire a new baker? Add their salary to your future expenses.

- Finally, subtract your forecasted expenses from your forecasted revenues to estimate your net income. This will give you a glimpse into your future profits.

Remember, forecasting your income statement isn’t just about predicting numbers. It’s about visualizing your business’s financial future and using that vision to make strategic decisions today.

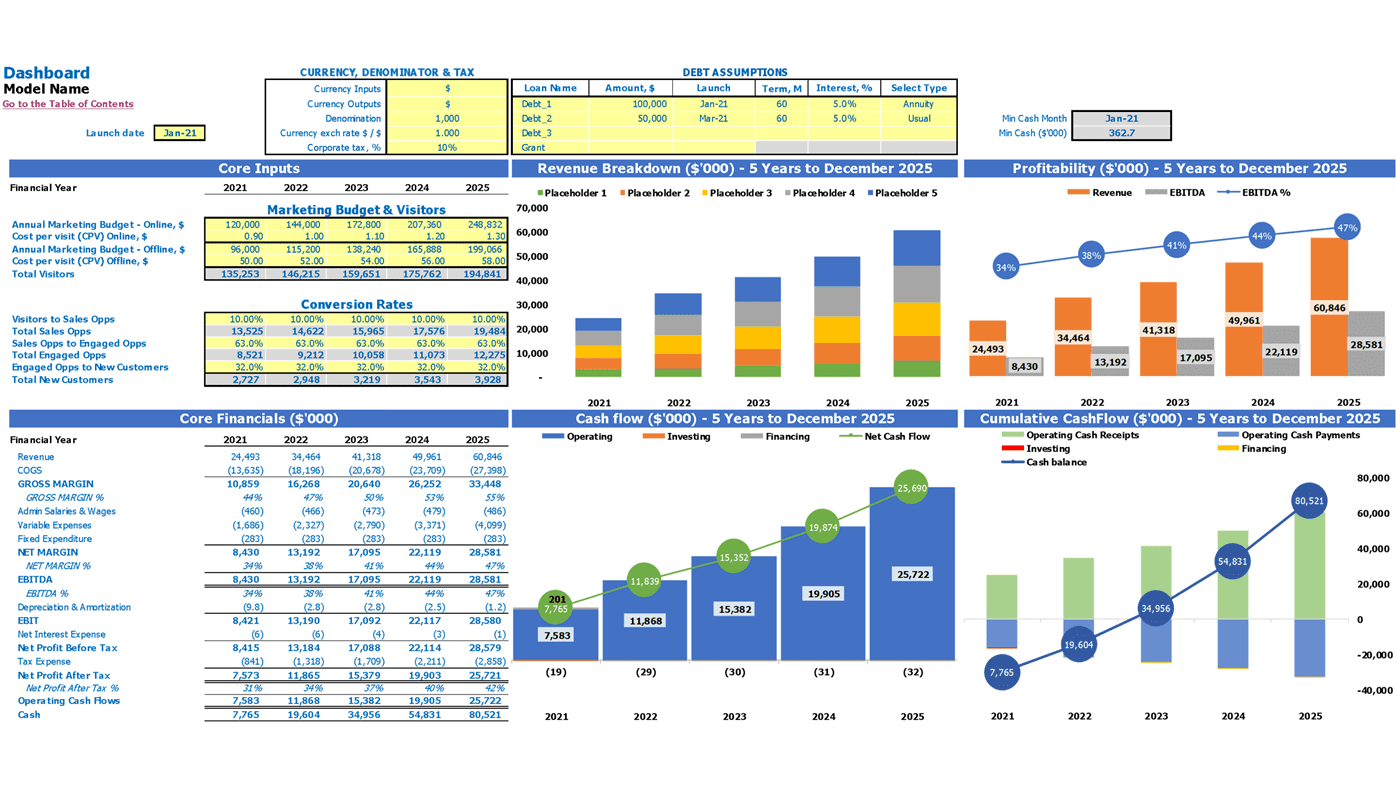

Below is an example of a Income statement forecasting we did for one of our client.

Cashflow Forecasting

Forecasting a cash flow statement involves projecting your future cash inflows and outflows from three main activities: operating, investing, and financing. It’s like being a weather forecaster for your business’s financial climate. But don’t worry – you won’t need a weather balloon or radar, just some strategic analysis and careful planning.

- Let’s start with Operating Activities. These are your business’s everyday operations, like selling products or paying salaries. To forecast these cash flows, look at your income statement forecast and adjust it for non-cash items like depreciation. For instance, if you run a coffee shop and expect to earn $50,000 in net income next year and have $5000 in depreciation, your cash flow from operating activities would be $55,000.

- Next up are Investing Activities. These relate to the purchase and sale of long-term assets, such as property or equipment. If you plan to buy a new espresso machine for $10,000 next year, that’s an outflow in your investing activities.

- Finally, we have Financing Activities. These involve raising money (inflows) and repaying it (outflows). If you’re planning to take a $20,000 loan next year but will also repay $5,000 of an old loan, your net cash flow from financing activities would be $15,000.

So, add up all these cash flows, and voila! You’ve forecasted your cash flow statement.

Below is an example of a Cashflow statement forecasting we did for one of our client.

Prepare and File Sales Tax

Sales tax reporting is essentially about telling the tax authorities how much sales tax you’ve collected from your customers. It’s like presenting a detailed account of your tax collection activities. But don’t worry – you won’t need an accounting degree or a fancy calculator, just some organized records and careful calculations.

- Start by gathering your sales data for the reporting period, which could be a month, a quarter, or a year. This should include each sale’s invoice number, the amount charged, the date sold, and taxes collected.

- Next, separate out the sales that were subject to sales tax. This will depend on your nexus (your physical presence or significant business activity) in different states. If you run an online clothing store and have nexus in Texas and Florida, you’d separate out your Texas and Florida sales for reporting.

- Then, calculate the total sales tax you’ve collected for these taxable sales. This involves adding up the sales tax from all relevant invoices. Remember, accuracy is key here, so take your time and double-check your work.

- Then, Fill out your state’s sales tax return form and submit it by the due date. Each state has its own form and submission process, so make sure to check your state’s Department of Revenue website for specific instructions.

Tips:

- Filing Frequency: The frequency at which you need to file your tax returns is determined by the taxing authority and is provided to businesses during the registration process. This frequency can change based on factors like your annual revenue. You may need to submit tax returns monthly, annually, or at another designated frequency.

- Zero Returns: Even if you didn’t collect any tax in a specific area during a reporting period, you may still need to file a tax return. It’s important to be prepared to submit tax returns by the due date for each reporting period, regardless of your sales. If you consistently file zero returns, you may receive notification from the taxing authority that you no longer need to file a return. However, until you receive this notice, it’s important to stick to your regular filing schedule.

- Exemptions: When filing your sales tax, it’s important to consider deductions and exemptions. These can vary depending on your location. Some common types of deductions include resale exemptions, tax-exempt products, sales where taxes were collected by marketplace facilitators, and sales to exempt organizations. Not every sale requires you to collect tax from the customer, but it’s important to be aware of these exemptions before submitting your sales tax returns.

Finally, it’s time to pay the state its money. Just as each tax authority has its own procedure and schedule for filing, the method and timeframe for remittance also differ based on sales volume in a particular location. For instance, in Connecticut, remittance can be on a monthly, quarterly, or yearly basis, determined by the overall tax liability. Except for a few special cases, taxes are typically due at the time of filing.

Due Dates: To prevent incurring penalties and interest, always ensure your tax payments are made by the deadline.

Payment Methods: Some tax authorities exclusively accept digital payment methods, such as ACH, EFT, or payments via credit and debit cards.

Extensions and Relief Measures: During events like the pandemic, numerous states offered tax relief measures, allowing businesses extended periods to file and transfer sales tax. In situations like natural disasters or significant disturbances, such relief measures are common, with specifics provided by the state tax authority.

We have often fought with the authorities on reliefs due to various reasons. Sometimes they just send a letter on the basis of their estimation of your sales. We have to substantiate that the case is otherwise and get relief.

Remember, preparing and filing your sales tax reports isn’t just a legal obligation. It’s also a way to demonstrate your business’s integrity and commitment to playing by the rules.

Quarterly Estimated Taxes

Quarterly estimated Taxes are essentially prepayments of your annual tax liability, broken down into four payments throughout the year. Think of it like having a meal plan at your favorite restaurant – instead of paying for a big feast at the end of the year, you pay for smaller meals throughout the year. But don’t worry – you won’t need any culinary skills, just some careful calculations and timely payments.

- To start, estimate your total income, deductions, and credits for the year. You can use last year’s figures as a starting point, but adjust for any significant changes. For instance, if you run a consulting business and expect to earn 20% more this year, factor that into your estimate.

- Next, calculate your estimated tax liability using IRS Form 1040-ES or a similar state form. This will give you your “meal plan” for the year. Remember, accuracy is key here, so take your time and double-check your work.

- Then, divide this total by four to get your quarterly payments. These are due on the 15th of April, June, September, and January.

- Finally, submit your payments online, by phone, or by mail, depending on your state’s guidelines.

Filing 1099s at Year-End

The 1099 form is essentially a report card that you, as a business owner, send to the IRS to tell them about certain types of payments you’ve made during the year. Imagine it like sending a postcard to the tax authorities about your business adventures. But don’t worry – you won’t need to be a tax expert or have fancy software, just some organized records and careful attention to deadlines. You can also refer to my in-depth guide on filing 1099s.

However, if you have some doubts related to Filing 1099s, refer to the next sections.

Who needs to file the 1099 form?

If your business employed a third-party contractor(s) during the previous year and paid over $600* to them for the services, then you need to file the 1099 form and issue a 1099-NEC to the said party(s). This includes partnerships as well. If the accumulated payment is less than $600, then 1099-NEC is not required (for the business).

However, if you are a contractor instead, you need to and should report all types of earnings. This includes all types of incomes summing more than or less than $600.

There are some exceptions to this rule. There are certain parties and situations that exempt you from filing the 1099. Let’s have a look at the same below.

No Need to File 1099 For Corporations (C and S)

If the contractor is registered as an S corporation or C corporation, then you do not have to file Form 1099. To know whether your contractor is a C corporation or an S corporation based or not, you can refer to the details provided in Form W-9 of the contractor. You can also look for the suffix inc. in the name of the contractor for clarity.

No Need to File 1099 For Employees

The IRS has clearly distinguished between employees and independent contractors. However, there are certain parties who present themselves as independent contractors, but are actually employees. The IRS is always on the lookout for such individuals.

If you have hired and paid an employee for a service, then you need to reflect all types of compensation to the employee in Form W-9. In such a case, you don’t need to file Form 1099. So, clarify whether the hired person is an employee or an independent contractor.

No Need to File 1099 For Individuals Hired from Freelance Marketplaces

If you hired the contractor from freelance marketplaces like Fiverr and Upwork, then you don’t have to file Form 1099. However, the freelancer needs to file Form 1099-K if his/her total earnings sum up to $20,000+, from at least 200 transactions.

How to File Form 1099?

- Firstly, calculate the total amount paid to the contractor(s) in the previous year.

- Secondly, collect the information for each contractor, including names, addresses, Social Security Numbers and/or Employer Identification Numbers, etc.. (Ask for Form W-9 for the same.)

- File Form 1099 for every contractor, individually, by entering the required details.

- Lastly, issue copies of the 1099 form(s) to the recipient(s), and the IRS, and don’t forget to retain a copy for your reference as well.

Tips:

- -Remember, the deadline for filing almost all 1099s is January 31.

- -If any payment is settled using PayPal or a credit card, then you don’t need to file Form 1099 for the same. Instead, the contractor will file Form 1099-K.

File Corporate Taxes

What do you need to give to your accountant to file Taxes?

Here is a checklist for preparing the documents for your tax filing. Tax Filing services are available as well to make it smoother for you. It’s advisable to use them in order to save money in future penalties.

List of Documents

- Yearly Financial Business Reports

- Financial records

- Financial records relating to deductions

- Asset records

- All the required Business Tax Forms

- Business Loan Information

- Identification and Personal Information

- Income and Expense Records

- Stock & Bond Information

- Business’s Payroll Data

- Opening & Ending Inventory Total

- Form 1098 for mortgage interest and property taxes

Fill out your corporate tax return form. If you’re a C corporation, you’ll use Form 1120. If you’re an S corporation, you’ll use Form 1120-S. It’s like choosing the right format for your presentation.

File Personal Taxes

What do you need to give to your accountant to file Taxes? Answer is below:

- Social Security documents

- Income statements such as W-2s and MISC-1099s

- Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations

- Tax deduction records

- Expense receipts

Filing your personal taxes is like giving an annual account of your financial story to the IRS. But don’t worry – you won’t need a degree in tax law or complex accounting software, just some organized documents and a bit of time.

Let’s start with gathering your financial records for the year, including W-2s, 1099s, and receipts for deductible expenses. Next, determine your filing status and exemptions. This gives the IRS a snapshot of your household situation.

Here is a checklist for preparing the documents for your tax filing. Tax Filing services are available as well to make it smoother for you. It’s advisable to use them in order to save $$$ in future penalties.

As I Talked a lot about accounting & bookkeeping, let me discuss some accounting & bookkeeping tools for small businesses.

Accounting & Bookkeeping Tools for Small Businesses.

Here are several notable tools you can use for bookkeeping.

- Owned by Oracle, NetSuite is a comprehensive cloud-based ERP solution that provides accounting, CRM, and e-commerce capabilities.

- It’s suitable for a range of business sizes, from startups to large enterprises.

- Features real-time metrics, financial planning, and advanced revenue management.

- A favorite among small businesses, it offers features like invoicing, expense tracking, payroll processing, and reporting.

- Allows integration with numerous e-commerce platforms, POS systems, and payment gateways.

- With its user-friendly interface, Xero offers functionalities such as invoicing, inventory management, and payroll.

- It integrates seamlessly with a variety of third-party apps.

- Tailored primarily for freelancers and service-based businesses, FreshBooks shines in areas like time tracking, project management, and invoicing.

- It also offers expense tracking and customizable reports.

- This free software is great for very small businesses and freelancers.

- With invoicing, expense tracking, and basic reporting, it provides the essentials.

- They charge for payment processing and payroll services.

- A component of the Zoho suite, it provides comprehensive accounting solutions such as inventory management, time tracking for projects, and automated workflows.

- Can be integrated with other Zoho products and several third-party applications.

Sage Business Cloud Accounting:

- Known for features like invoicing, forecasting cash flow, and tax management.

- Suitable for businesses that require software that can scale with their growth.

The table below shares the features of different eCommerce Accounting and Bookkeeping tools. Each eCommerce accounting software includes those features that are listed under the product itself and that of the product on the farther left.)

As you can see, different eCommerce accounting software offer different features to the business. This difference makes it tough for eCommerce businesses to choose the most accurate platform for their business.

eCommerce Accounting Best Practices

- Embrace Automation: Harness the power of technology to automate your e-commerce accounting processes. It’s like having a co-pilot who manages the controls while you navigate your business towards success.

- Choose the Right Software: Invest in robust e-commerce accounting software tailored to your specific needs. Think of it as choosing the right tool for the job – it can make all the difference.

- Regular Reconciliation: Make it a habit to regularly reconcile your accounts to ensure accuracy. It’s like doing regular tune-ups for your car to keep it running smoothly.

- Track Inventory Accurately: Keep a close eye on your inventory levels and costs for precise profit calculations. Consider it as keeping the pulse of your business health.

- Understand Sales Tax Laws: Stay informed about the sales tax laws applicable to your business. It’s like knowing the rules of the game, so you can play it well.

- Separate Personal and Business Finances: Keep your personal and business finances separate to avoid confusion. Imagine it as keeping your work life and personal life distinct for better balance.

- Maintain Proper Records: Keep detailed records of all financial transactions for future reference and audit readiness. It’s like keeping a diary of your business journey.

- Plan for Major Expenses: Anticipate and budget for major expenses to avoid financial surprises. Think of it as planning your route ahead of a road trip.

- Stay Compliant: Ensure your business complies with all financial regulations and standards. It’s like following traffic rules to reach your destination safely.

- Seek Professional Help: Don’t hesitate to seek help from accounting professionals when needed. Consider it as asking for directions when you’re unsure of the way. Remember, we’re here to guide and support you on your e-commerce accounting journey.

e-Commerce Accounting: The Key to Success

No business has ever achieved success without discipline. eCommerce accounting allows you to gain this discipline. With the help of accounting, you can get a deeper insight into the present and the future.

You can easily evaluate the reliance on the present tactics used by your business and the scope for improvement.

This may seem like an easy and not-so-important task but the reality is quite the opposite.

Every successful e-commerce business, to date, has taken the support of well-established accounting principles and practices, not only to record and control the books of accounts but to figure out the best possible ways to stimulate growth.

Being operational on multiple channels for sales, you can not indulge in traditional accounting tactics. It’s time to mend the advanced eCommerce accounting practices in your favor and grow beyond your competition.

Frequently Asked Questions

To set up QuickBooks, you need to follow the below steps:

1. Firstly download and link your business bank accounts

2. Set up the accounting payment gateways like Stripe, Shopify, etc.

3. Set the invoicing as required by the business. Also, mark all the charts for the business that deems fit to your requirements.

4. Offer the user access to all the necessary personnel.

After the setup is complete, you will find there are multiple options and functionalities on the tool that offer deeper insight in the business operations and transactions.

The process to record transactions in an ecommerce business is quite similar to that with any other business. For the same, the bookkeeper needs to record details like the date of the transactions, the total amount, the payer and payee, etc. You can take the help of an accounting software for feasibility and automation of data entry.For this purpose, recording the transactions is not enough. You need to set up various payment gateways, manage the inventory, manage the returns, chargebacks, and various other aspects.

The manual procedure to manage the eCommerce P&L is a bit complicated. As long as you take the help of an automated e-commerce accounting tool, you will not face any problem.

For any eCommerce business, transactions related to purchase and sales are the most common. Other transactions include payments related to shipping and delivering goods. The cost of managing the eCommerce business domain and marketplace account are also there.

There are five business revenue methods that any eCommerce business can get involved into. These include:

Out of the most common e-commerce model, wholesale business model is the most profitable one.

The success rate of eCommerce business ranges between 10%-20%. Apart from these ones, other businesses tend to fail within the first 5 years of incorporation.

For any small business, the best accounting method is the cash-based accounting practices.

Financial accounting helps in making the important decisions related to marketing like what’s the budget for marketing, which modes of marketing should be used, evaluating multiple marketing alternatives, etc.

Bookkeeping is the core or base of accounting. Without effective bookkeeping, you can never get effective accounting. Bookkeeping allows the business to record the transactions related to operations accurately and timely. The data so collected and recorded can be later used to undergo accounting practices accurately and effectively.