Ever wondered what exactly a financial statement is?

Many of us have.

Consider it your business’ report card, indicating all its financial progress.

These documents give a comprehensive rundown of how well your business is doing.

This is a detailed guide that will explain everything about financial statements.

Let’s get started.

What are Financial Statements?

Financial statements are documents that brief about the financial and accounting information of an organization.

In other words, they are basically statements of financial position of the organization.

This is a significant way businesses take a snapshot of their financial performance at a given time. Why is it essential, you may ask? It’s because it gives a detailed look about the economic status to stakeholders, including investors, tax authorities, and creditors.

Consider this: A local bakery needs to buy an oven to meet the rising demand for producing more sourdough. But, to get a loan for that same reason, it needs to show financial statements to the bank. This is where it discloses its financial situation.

1. The amount of dough it needs to produce.

2. How much does the baker owe?

3. How much cash will eventually track back in return?

With a financial statement that shows more assets than debts and equally enough cash flow, the bakery gets the green light. This proves why financial statements can help businesses step up their game.

4 Types of Financial Statements

Just the way correct implementation needs a precise plan, Financial Statements have four components that help keep their heads above water.

1. The Balance Sheet

Want to learn about your company’s financial stability? Learn how to read a balance sheet. Many aren’t sure what a balance sheet is or entails. But, here’s the good thing, with a little understanding, the haze will clear.

This financial snapshot outlines what a company owns (assets), owes (liabilities), and the value left over for the owners (shareholder’s equity) at a specific point in time.

Let’s talk about it differently.

Assets on one side must equal the sum of liabilities and owner’s equity on the other. Convinced?

This “equality” is where the name “balance sheet” comes from.

Further, when you study a balance sheet, it’s likely that you want to hunt down the company’s financial foundation. Here’s what we mean:

- Assets, like cash and inventory, are used to operate and grow a business.

- Liabilities are the obligations, including loans or bills, that must be paid.

Now, what’s left is the owner’s stake in the company. A robust balance sheet represents a healthy cushion of assets over liabilities. And what does that mean? It means good financial health for your business!

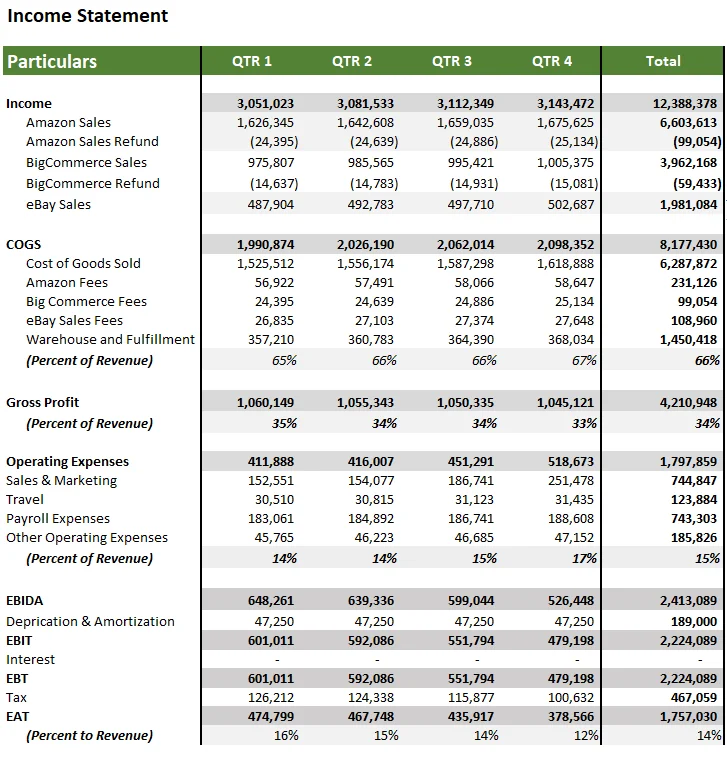

2. The Income Statement

If you want to track how much money a company makes, the Income Statement accounts are what you should look for.

This report shows the money the company earned (revenues) and spent (expenses) over the course of a month, quarter, or year.

This is to evaluate the net income or loss. Thus, an income statement gives a sneak peek at a company’s performance and profitability.

Starting with sales, it deducts goods sold and operating expenses, for example.

This means there are only two more factors to consider. It’s either profit or loss.

Let’s say the company has consistent losses over profits. You tell us, doesn’t it raise enough red flags for its future sustainability? For us, it sure does.

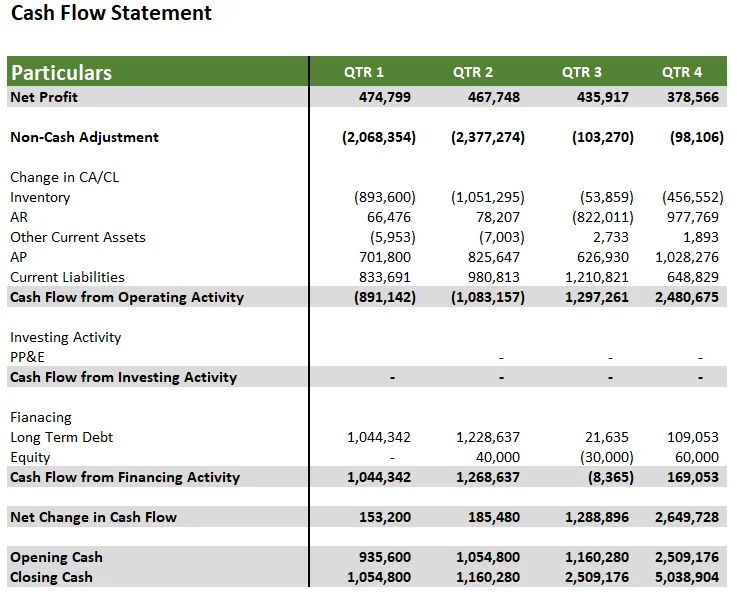

3. The Cash Flow Statement

Everyone needs to manage their cash. However, how many really know how to do that? Has it ever crossed your mind how an organization manages its cash? The answer is they do it through Cash Flow Management.

The cash flow statement shows the fundamental outline of the cash coming in and going out from operating, investing, and financing activities.

Unlike profits, which often times up in non-cash activities, this statement gives you a head start about the liquid cash the company has to work with.

So, this is basically the financial pulse of a business, showing its ability to pay a bill, repay a debt, and then invest for future development. Still confused?

Here’s an easy way to differentiate between Positive Cash flow and Negative cash flow.

Positive cash flow means more cash is coming in than leaving. This is a sign of financial strength. In contrast, negative cash flow could signal trouble ahead.

What’s your cash flow like?

Talk to Gary our expert CPA to get cash flow tips!

4. The Statement of Owner’s Equity

What happens to the owner’s share over the year? The owner’s equity statement, or the statement of owner’s equity, is where you know the secrets from.

It starts with the owner’s equity at the beginning of the period, deducts losses or money the owner has withdrawn. Finally, it adds profits from the income statement.

This statement gives a brief rundown of the owner’s transactions with the business. And what does it show in return? It shows the net change in ownership value across that fiscal year. Here’s a very simple way to understand it.

Increases in owner’s equity mean the company is growing its net worth. But what happens when it decreases? As harsh as it might sound, it probably means that the owner is withdrawing too much or that the company isn’t profitable. This is a resource we use to understand the owner’s financial relationship with their business.

Financial Statements Examples

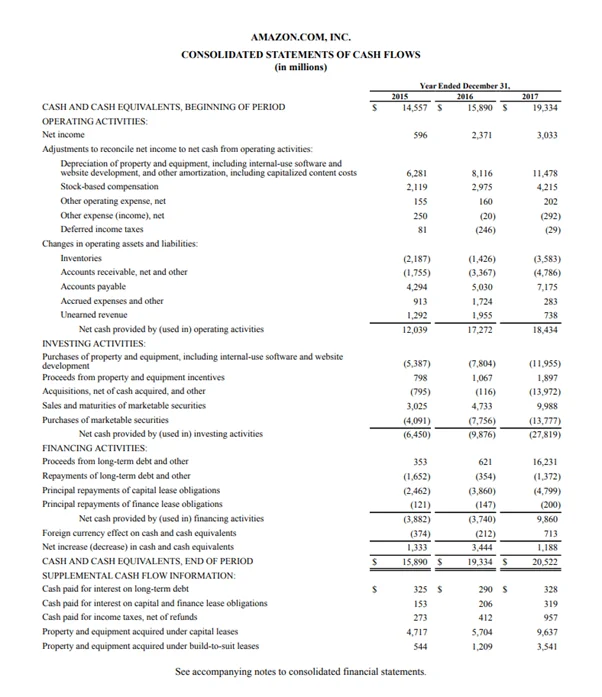

To help you understand the topic better, we decided to dig around a bit and came up with financial statements of amazon, the online retail giant. Let’s take a look at these!

The cash flow system, as per amazon financial statement, shows their cash position during a specific fiscal year. Notice how cash and cash equivalents at the end of year increases as compared to the beginning of the year indicating positive cashflows for all three years 2015, 2016 and 2017.

Similarly, refer to amazon income statement below. It reflects the company’s profitability and is usually the first place an analyst will look at. In the table we can see that how amazon sales are growing year on year along with its net income.

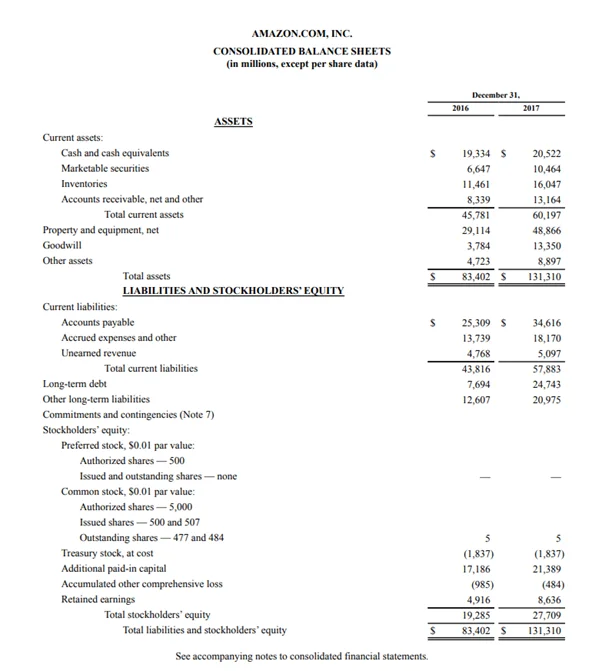

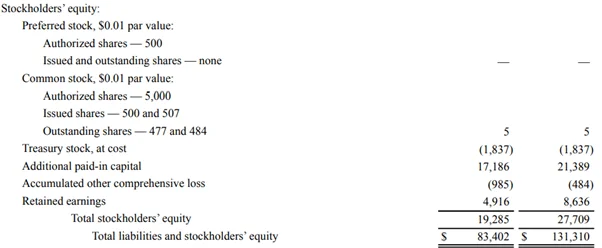

Now, take a look at amazon balance sheet. It tells us what the company owns and what it owes. Further, it reflects the company’s assets, liabilities, and stakeholder’s equity in 2016- 2017.

Lastly, is owners’ equity or stockholder’s equity.

This gives us the residual interest in the assets of a company after deducting liabilities.

You can think of it as the net value or net worth of a company from the perspective of the owners or shareholders. Considering the company liquidated every asset to pay off all debts, whatever leftovers you see would go straight to the stakeholder’s equity.

Notice how the total stockholders’ equity has grown from 19,285M in the year 2016 to 27,709M USD in the year 2017 indicating an increase in wealth.

How to Prepare Financial Statements?

Now that we’ve got some idea of the components of financial statements. Let’s understand how to prepare them.

Financial statements are typically prepared in the following order:

Step 1: Verify Receipt (Supplier Invoice)

This is where you compare the receiving log to accounts payable to ensure all supplier invoices are received.

Step 2: Verify Issuance (Customer Invoice)

You should compare the shipping log to accounts receivable to ensure all customer invoices are issued.

Step 3: Pile Up Unpaid Wages

You must accrue an expense for wages that are earned but are yet to be paid at the close of the reporting period.

Step 4: Evaluate Depreciation

In the accounting records, you need to estimate the depreciation and amortization expenses for fixed assets.

Step 5: Value Inventory

This is where you conduct an ending physical inventory count or use a different process to evaluate the ending inventory balance. This is the type of information that helps derive the cost of goods sold, noting it down in the accounting records.

Step 6: Bank Account Reconciliation

This is where you conduct a bank reconciliation. Not only that, this is where you create journal entries to record adjustments required to know whether the accounting records match the bank statement.

Step 7: Post Account Balances

We’re almost reaching the end line because this is where you post all subsidiary ledger balances to the general ledger.

Step 8: Review Accounts

It’s time to review. Start reviewing the balance sheet accounts and fine-tune them with journal entries to adjust as per the account balances. This is to ensure they’re balanced.

Step 9: Financial Review

Get yourself a preliminary version of the financial statements and go through it. Who knows whether there are hidden errors inside? You don’t want surprises now, do you? There might be several errors, so create journal entries to rectify them. After everything looks fine, print it again. Repeat the process until all errors are gone.

Step 10: Accrue Income Taxes

Got the corrected income statement? It is time to accrue an income tax expense.

Step 11: Account Closure

It’s almost time to tie up the loose ends of the period’s financial narrative. This means you should close all subsidiary ledgers for the period and open them for the next reporting period.

Step 12: Issue Financial Statements

Print a final copy of the financial statements. Based on the information you get, make footnotes. Eventually, prepare a cover letter which briefs about the critical points in the financial statements. Assemble the information, and you are ready to distribute it to the recipients.

Get downloadable and ready-to-use templates of Financial Statements.

How to read Financial Statements?

Reading financial statements is more like studying the scoreboard of a business. Here’s how you should do it:

- Begin with the balance sheet

The balance sheet talks about the “book value” of your organization. It allows you to see the resources available and how they were financed on a particular date.

Let’s make it simpler. Look at the assets because it should be equal to the sum of liabilities and owner’s equity. After that, review company cash and cash equivalents because they show you the liquid money your company has on hand. Usually, people use the accounting equation:

Assets = Liabilities + Owner’s Equity.

Recheck the liabilities to understand what the company owes and when it’s due. Did you check? Now that you’re done, evaluate the owner’s equity to see what stakeholders own.

2. Let’s move to the income

Here the first thing to look at is the top line (revenue) and trace down to the bottom line (net income). Gradually move on to the next part, i.e., the cost of goods sold (COGS). Take note of it and the operating expenses to see where the company spent money. This is where you understand the company’s profitability by looking at its operating income and net income.

3. Let’s analyze cash flow statements

You can break down cash flow statements into three sections: Cash flow from operating activities, investing activities, and financing activities.

Review the cash flow from operating activities to have a clear image of the cash generated from the company’s core business. Move on and look at the investing activities to get detailed insights about the company’s growth.

Further, examine the financing activities to evaluate how the company is funding its growth and operations, whether through debt or issuing equity.

4. Review the statement of owner’s equity

Lastly, you need to understand all changes in the owner’s or shareholder’s equity over time. This is where you need to be updated with new stock issuance, dividends paid, or retained profits in the business.

“Why shareholder’s equity is an important number to us, is that it allows us to calculate the return on shareholders’ equity which is one of the ways we determine whether or not the company in question has the long-term competitive advantage working in its favor.”

Warren Buffet and the Interpretation of Financial Statements

Analysis of Financial Statements

Don’t leave just yet. Analyzing financial statements is important too. When you have available financial statements, you examine and interpret the financial data of the business to find out how well it is performing now and whether it has a good financial standpoint.

Here’s how we conduct a thorough analysis:

Horizontal Analysis

In horizontal analysis, we compare the financial data over different periods. Further, we take a closer look at the trends in growth or the depreciation in revenue, expenses, or profits.

Vertical Analysis

In vertical analysis, we examine every item on a single financial statement as a percentage of a total. You have absolutely no idea the amount of details this can produce! This can disclose the structure and proportional size of accounts. For example, you get a clear picture of how much assets are in cash.

Ratio Analysis

Financial ratios help us evaluate liquidity (can the organization meet all short-term obligations?), solvency (is it possible for the organization to sustain long-term operations?), profitability (is the organization generating profits?)

Liquidity Ratios

These consist of current ratio and quick ratio:

- Current Ratio is current assets divided by current liabilities

- Quick Ratio is current inventory assets divided by current liabilities

Solvency Ratio

Here we should take into account debt to equity and interest coverage ratios.

- Debt to Equity where total debt is divided by the total equity

- Interest Coverage Ratio where earnings before interest and taxes [EBIT] are divided by the interest expense.

Profitability Ratios

- Net Profit Margin

- Return on Assets

- Return on Equity

Cash Flow Analysis

We have already covered cash flow earlier in the article. Recall that this is where you review operations, investing and financing to examine the company’s cash-production abilities.

Common Size Analysis

We do this by converting items present on the income statement into sales percentage for making a comparison between organizations of different sizes.

Benchmarking

This is where we compare the financial matrix of the business to the industry standards to have a better understanding of how it is performing.

Looking for downloadable Financial Statements ready to use with just one click?

Summing up

Financial statements are the cornerstone of decision-making in small businesses. But, no single statement can give you a complete picture of how your company is doing. You need everything: balance sheets, income and cash flow statements and more.

When you combine all of them together, a robust picture materializes. Are you taking good care of your business? Dust up, because your statements can reveal a lot of details.

Frequently Asked Questions

1. How often should a small business prepare financial statements?

The answer is annually. However, many find it beneficial to prepare financial statements quarterly or, sometimes, monthly. Your preparation frequency is proportional to monitoring the company’s financial health and making informed business decisions over a specific timeline.

2. Where is depreciation on financial statements?

You can find depreciation on both income statement and balance sheet. Depreciation expense is reported on the income statement whereas the accumulated depreciation is found on the balance sheet.

3. What are pro forma financial statements?

Pro forma financial statements are projections of future expenses and revenues. These are made on the basis of previous years’ data. They are a part of financial forecasting.

4. What are interim financial statements?

Interim financial statements are those financial reports of the organization that typically cover a short period of time, usually less than a year.

5. Where can I find financial statement templates?

We offer you ready-to-use, fully downloadable templates you can get started with now. Just fill the form alongside and put ‘request financial statement templates’ in the message field.