How to Migrate QuickBooks Desktop to Online Without Losing Data?

Migrating from QuickBooks Desktop to Online isn’t a simple export—it’s…

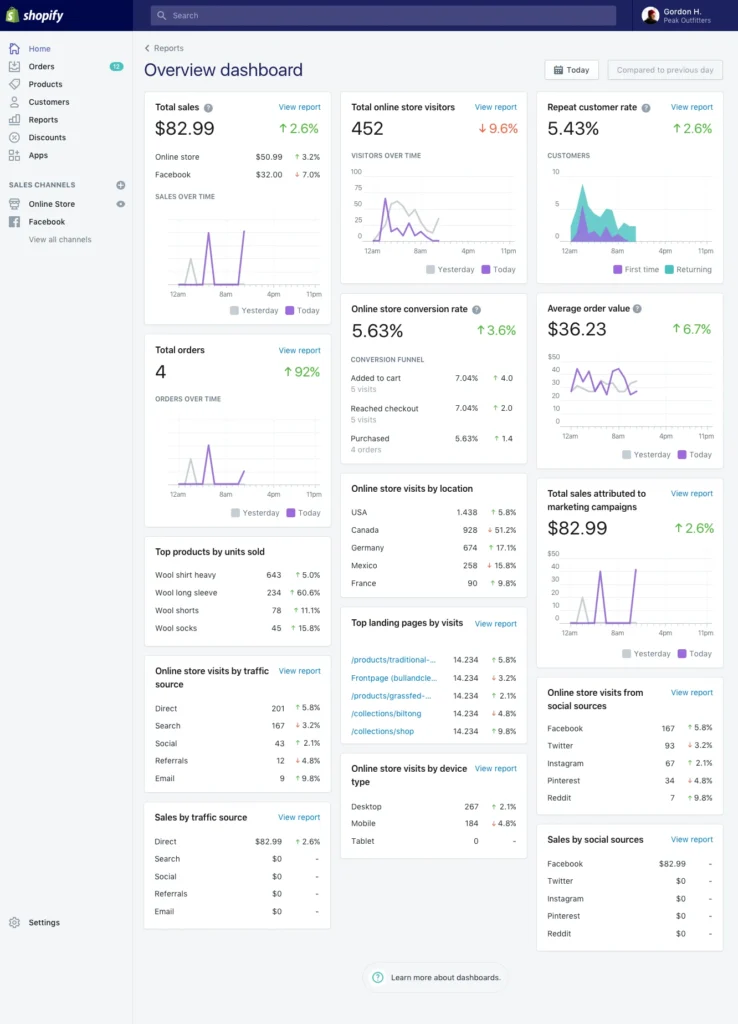

Nearly three million stores in the United States run on Shopify, yet most owners still wrestle with reconciliation gaps, gateway fees, and a patchwork of state tax rules.

Fall behind, and the penalty can wipe out ten to twenty-five percent of the tax owed.

We handle the numbers daily, tie every order to your bank feed, and file on schedule so your cash flow stays clear and predictable.

Happy Clients

Years in industry

Strong team

You plug in our connector once and forget about it. Each sale, refund, fee, and payout rolls into QuickBooks or Xero within a couple of hours. We reconcile deposits the same day, catch double postings early, and surface any missing transfer before your bank even clears it. The result is one clean journal entry per order and a daily batch that mirrors the bank feed. No spreadsheets, no midnight guesswork, just tidy books waiting for morning review.

Your ledger sits on a licensed US CPA’s second monitor, not a junior bookkeeper juggling cafés and dentists. This pro lives inside eCommerce ledgers all day, so a stray duty fee or chargeback pattern jumps out at them instantly. Shoot over a question before lunch and you’ll have a precise reply, complete with the right journal entry, by close of business. The same person signs off on month-end, which means no gaps and no surprises at tax time.

We tag every order by ship-to state, pull the current rate from certified databases, and prep returns for every jurisdiction where you cross a nexus line. Open a new warehouse or blow past an economic threshold and we flag it weeks before the filing deadline. Each return ships with a reconciliation sheet that ties back to the penny. Sleep comes easier when a state auditor’s spreadsheet looks identical to yours.

Gross sales data is worthless without knowing what each unit really costs. We import purchase orders, landed freight, and warehouse counts, then apply weighted-average or FIFO costing down to the SKU. When freight rates spike or a supplier slips a price increase into the next shipment, you see the margin hit before it drains cash. Pricing, promotions, and reorder decisions finally rest on fact, not instinct.

Growth dies when cash timing is off by even a few days. We build a rolling thirteen-week model that starts with Shopify payouts, layers in vendor terms, payroll runs, and tax drafts, then tells you exactly when cash will pinch. Every Friday the file updates so you start Monday with a clear “yes” or “no” on inventory buys or ad pushes. No crystal ball, just math that keeps the lights bright.

Card processors and wallets shave pennies that turn into five-figure losses over a year. Each month we compare every deduction against your contracted rate, bundle the evidence, and press the claim until the refund lands. Last year we clawed back more than seven thousand dollars for a single niche apparel brand, money that fell straight to net profit without anyone lifting a finger.

Shopify founders usually reach us after months of chasing numbers that refuse to line up. Payouts drop from three gateways on different calendars while the dashboard lumps yesterday’s orders into one gross figure that never matches the bank statement.

Refunds, chargebacks, and gift-card redemptions sit in limbo, skewing revenue and masking real margin. State tax rules shift mid-year; a threshold is crossed, and the first notice arrives before anyone on the team knows the rule existed.

Inventory costing drifts because freight surcharges, duties, and supplier price bumps collect in a miscellaneous account instead of the SKU ledger. Promotions drive volume but crush cash because the company has no rolling forecast that ties the marketing calendar to vendor terms and payroll.

Processor fees bleed thousands in quiet overcharges. Month-end closes drag on for three weeks, so decisions rely on stale data. When funding talks start, investors spot gaps in cost of goods and sales tax accruals that stall the deal. We step in, rebuild the ledger from order level up, tighten reconciliations to daily, file every tax return on time, and put a thirteen-week cash view in the founder’s inbox each Friday, so numbers guide growth instead of guesswork.

Auditors arrive, find clean trails, and leave without asking for extensions later.

Hiring a Shopify-focused accounting team is less about paperwork and more about keeping your margin intact, your cash steady, and your credibility high.

sAds, inventory turns, and fulfillment already eat your day; tacking on gateway reconciliations and multistate tax filings drags focus from growth.

A crew that speaks Shopify fluently catches red flags early, ties every order to the penny, and hands you numbers you can act on—before the week even starts.

You reclaim hours, avoid nasty surprises, and regain room to maneuver. Multistate returns, landed-cost tracking, and true net revenue per SKU all roll into one clean ledger. Get it wrong and the ripple drains capital. Get it right and you walk into board meetings with real-time facts, clean trails, and a calmer pulse.

Every shipment is tagged by destination, checked against current rates, and rolled into ready-to-file returns for every jurisdiction you touch. Cross a nexus threshold or open a new warehouse, and you know before the next filing date. Notices, penalties, and audit panic disappear because the numbers an inspector sees are the numbers already in your books.

Every order, refund, and fee lands in your books within hours, matched to bank deposits so the dashboard and the bank agree. We tag each shipment, monitor nexus thresholds, and file on time in every state you reach, stopping penalties before they start.

Each sale, refund, and fee feeds straight from Shopify into QuickBooks or Xero within hours. We match deposits the same day, trace every penny of gateway deductions, and flag duplicates before they pollute your general ledger. The store dashboard, bank feed, and financials line up perfectly, so you stop guessing and start deciding.

Ledger Labs goes way beyond basic accounting consultation and service. We’re a service designed to help you manage cash flow, reduce unnecessary expenses, and develop financial strategies that keep your business profitable and compliant with U.S. tax laws. Instead of just recording past transactions, we provide insights that drive smarter financial decisions for the future.

We begin by thoroughly assessing your financial records, identifying inefficiencies, and pinpointing areas for cost optimization. This allows us to recognize the areas of improvement and help you put together a robust accounting strategy. We dig into your books to find what’s missing, broken, or holding you back. Then, we lay out exactly what needs fixing — so you’re no longer guessing and finally have a clear path to clean, accurate finances.

As soon as we finalize a comprehensive plan of action for your books, the next step is to deploy this plan. We do this by ensuring we have proper internal and external control of data. Internally, we ensure that financial records are organized, reconciled, and regularly monitored. Externally, we implement secure data-sharing protocols and compliance measures to safeguard financial information.

Accounting is an evolving process, and we continuously refine financial strategies to enhance profitability. We ensure full compliance with tax regulations, conduct regular audits, and provide proactive recommendations to keep your business on the right track. And one of the best ways for us to do this is by building custom apps and workflows for your business - all powered by AI.

Our system provides up-to-date financial reports, allowing you to track performance, monitor key metrics, and make data-driven decisions. With detailed reports and regular insights, you gain complete control over your business finances and witness the financial health of your company improve. Our reporting system helps you identify trends, address potential issues proactively, and optimize cash flow management.

Keeping the books for a young Shopify store looks simple on day one.

One payment gateway, a handful of domestic orders, and a single tax rate in play. You post numbers on Sunday evening and start Monday with clean figures.

Growth changes that picture fast. More orders, new channels, and a patchwork of state rules pile up until you spend whole weekends chasing a single missing dollar.

Common signs you are ready to pass the ledger to specialists:

Any one of these warns that error risk now outweighs the comfort of doing it yourself. Miss a state filing by a day, and the penalty can wipe out a week of net profit. A single gateway mismatch can leave investors doubting your revenue numbers. Outsourcing shifts that burden to a team working inside the e-commerce ledgers every hour.

What you gain when that shift happens:

Outsourcing costs money, but so does every hour spent on tasks that do not grow sales. The break-even arrives sooner than most founders expect once the store clears mid-five figures in monthly revenue.

A good service walks you through the switch in phases, starts with the current month, then rebuilds past records only where gaps matter, keeping the bill under control. Within a quarter the close cycle often drops from three weeks to three days. Move early, before mistakes settle into the books.

Clean, current numbers let you buy inventory with confidence, raise capital on solid ground, and sleep on Sunday night.

| Feature | Ledger Labs' Shopify Accounting Services | Other Services |

|---|---|---|

| Real Time Order and Payout Reconciliation | Our connector posts every Shopify order, refund, and fee into QuickBooks within hours and matches each deposit to the bank feed. Numbers stay aligned daily, leaving no space for guesswork. | Manual CSV exports once a week with missed fees and duplicate orders that leave ledgers out of balance. |

| Multi Channel Sales Integration | Data from Amazon, point-of-sale, and extra storefronts flows into one chart of accounts with consistent SKU codes and payout schedules. | Each channel sits in a separate file, forcing time-consuming consolidation and frequent data loss. |

| Sales Tax Nexus Monitoring and Filing | Every shipment is tagged by state, current rates applied, and returns filed on schedule. Notices are handled before they escalate. | Threshold alerts ignored, filings late, and penalties stack up. |

| SKU Level Inventory Cost Tracking | Freight, duty, and supplier price bumps land in the correct SKU cost so margin reports show true profit on each sale. | Costs sit in suspense accounts, margins look better than reality, leading to poor pricing calls. |

| Gateway Fee Variance Audit | Monthly variance checks flag overcharges, file claims, and book refunds straight back to your ledger. | Processor fees are assumed correct, cash leaks stay hidden for years. |

| Rolling Thirteen Week Cash Forecast | A forecast updates each Friday, showing clear cash gaps before they hit so you can plan inventory and ad spend with confidence. | Cash projections built monthly on stale data. Surprises hit payables and payroll without warning. |

| CPA Led Support and Same Day Response | A US-licensed CPA reviews books and answers urgent questions the same business day, delivering depth and clarity. | Junior staff rotate across unrelated industries, replies take days, depth is limited. |

| Flat Predictable Monthly Pricing | A single monthly figure covers bookkeeping, tax filings, and inbox support. No hidden bills, ever. | Hourly billing piles up without warning, forcing founders to ration questions. |

Find out what our customers are saying about our products.

Since working with Ledger labs, our bookkeeping and Controller processes have been streamlined. The routine accounting tasks are managed on a predictable schedule, and checklists are used to ensure that all required documents are processed within the proper deadlines. We have improved the accuracy and timeliness of our financial statements and other crucial

Patrik Nichols CFOWe have a unique business, and almost all the accounting firms we have engaged so far have been unable to get a hold of our business. But Ledger Labs really took the bull by its horn. They understood our business better than us & created a very customized process & systems to streamline our accounting department. We now have detailed step-by-step process documentation, checklists & schedule of reports.

Amanda Fludd CEOLedger Labs found $18K in missed deductions that our old accountant completely missed—same books, same receipts, totally different results. That’s when I knew we were finally working with pros. Since then, they’ve helped us restructure expenses and make tax planning part of the daily flow, not just something we scramble on last minute.

Michael Smith CFOGary—yes, the founder—took the time to really understand our business and where we were struggling. Within a few weeks, our books were clean, our cash flow was clear, and we were spending way less time managing it all. You can tell he genuinely cares, and that energy runs through the whole team

Nicole Allen Founder & CEOOur multidimensional experience and wide exposure have been channelized beautifully in these articles!

Migrating from QuickBooks Desktop to Online isn’t a simple export—it’s…

Manual invoicing can take 15–20 minutes per document. This guide…

Hiring a cheap bookkeeper doesn’t have to mean settling for…

From saving thousands to scaling fast — these stories highlight how we help businesses grow smarter with real financial strategy and execution.

| Thank you for Signing Up |

My main problem always has been to know my accurate profits & this is precisely what Ledger Labs helped me with. They went through my entire supply chain costs, my monthly operational expenses, and COGS and got me the correct costing of my goods and the cost of running the business. Now I know how much I need to sell & at what price I should sell it to be profitable.

Ariel Robinson CEO & Founder