Many individuals and businesses struggle with keeping their financial records accurate and up-to-date, particularly when it comes to reconciling their bank statements.

This can lead to confusion, errors, and even financial losses if not addressed properly. It’s essential to have a solid understanding of bank reconciliation in order to maintain the integrity of your financial records and ensure that you’re making informed decisions based on accurate information.

In this paragraph, we will explore the step-by-step process of how to do bank reconciliation, providing you with valuable insights and practical tips to streamline this important financial task. By following these guidelines, you’ll be able to reconcile your bank statements efficiently and effectively, giving you peace of mind and a clearer picture of your financial health.

1. Automating bank reconciliation in NetSuite can reduce reconciliation errors by up to 90%, significantly improving the accuracy of financial data.

2. Businesses using NetSuite report 30-50% faster month-end closures due to seamless integration between bank transactions and ledger entries.

3. NetSuite supports real-time reconciliation for multiple accounts, which can lower manual processing time by up to 75%, especially for businesses managing high transaction volumes.

4. Implementing reconciliation tools can increase visibility into cash flow, potentially enhancing decision-making speed by 25% compared to manual methods.

Why Is Bank Reconciliation Crucial for Businesses?

Maintaining Financial Accuracy

- Ensures Correct Financial Statements: Regular reconciliation checks prevent errors and inconsistencies, keeping the company’s financial records accurate.

- Facilitates Budgeting: With an accurate financial standing, businesses can budget and plan more effectively for the future.

Fraud Detection

- Identifies Unauthorized Transactions: Regularly reconciling bank statements can flag unauthorized or suspicious activity, serving as an early warning system against fraud.

- Enhances Internal Controls: It provides an additional layer of security and accountability within the financial department.

Cash Flow Management

- Tracks Inflows and Outflows: Knowing the exact state of your cash reserves helps in making informed operational decisions.

- Prevents Liquidity Issues: Timely reconciliation helps a business understand its actual available funds, preventing accidental overspending.

Compliance and Audit Preparedness

- Simplifies Audits: Accurate and up-to-date financial records make the audit process smoother and less time-consuming.

- Ensures Regulatory Compliance: Regular reconciliation aids in maintaining financial records in accordance with legal and tax obligations.

Vendor and Customer Relationships

- Prevents Payment Errors: Reconciliation can reveal duplicate payments or missed invoices, allowing for prompt resolution.

- Builds Trust: Accurate and timely financial transactions foster stronger relationships with both vendors and customers.

Who is Responsible for Conducting Bank Reconciliation?

The responsibility of conducting bank reconciliation typically falls on the company’s accountant or bookkeeper. They ensure accurate recording of financial transactions, comparing the company’s records with the bank statement using accounting software or spreadsheets. The accountant plays a crucial role in ensuring accurate financial reporting through bank reconciliation.

How Often Should You Reconcile Your Bank Account?

Regularly reconciling your bank account is crucial for accurate financial reporting. It is recommended to reconcile at least once a month to identify any discrepancies or errors, manage cash flow effectively, and detect potentially fraudulent activity. Timely reconciliation also helps in tracking outstanding checks and deposits, providing valuable insights into your business’s financial health.

Bank Reconciliation Terminology

Bank reconciliation involves understanding various terminologies.

Bank Statement: A monthly or quarterly document provided by the bank, summarizing all transactions in an account for a specific period.

Ledger Balance: The balance in a company’s accounting records, also known as the “book balance.”

Reconciling Items: Transactions that appear on either the bank statement or the ledger, but not both, requiring adjustment during reconciliation.

Outstanding Checks: Checks that have been written and recorded in the company’s ledger but have not yet been cleared by the bank.

Deposits in Transit: Deposits that have been recorded by the company but are not yet reflected in the bank statement.

Bank Charges and Credits: Fees or additional amounts added or deducted by the bank, such as service charges or interest income.

NSF (Non-Sufficient Funds): Checks or electronic debits that could not be processed due to insufficient funds in the account.

Cleared Items: Transactions that have been both recorded in the company’s ledger and processed by the bank, appearing on the bank statement.

Adjusted Balance: The ledger balance after accounting for all reconciling items, which should match the adjusted bank statement balance.

Bank Reconciliation Statement: A document that details the process and result of matching the bank statement with the company’s ledger, explaining any discrepancies.

Reconciliation is the process of comparing the book balance with the bank statement balance and identifying discrepancies. Understanding these terms is crucial for accurately reconciling your bank accounts.

Pre-Requisites for Bank Reconciliation in NetSuite

Before jumping into reconciliation, you’ll need:

User Permissions

First off, let’s talk about access. You need the right user permissions in NetSuite to mess around with bank reconciliation. So, check that you or your team have the clearance to get into the financial data.

Updated Financial Data

Your NetSuite should be up to date with all the financial transactions you’re going to reconcile. If you’re looking at last month’s bank statement, make sure all of last month’s transactions are in NetSuite too.

Bank Statements in Hand

You’re going to need the bank statement for the period you’re reconciling. Whether you’re a fan of digital copies or good old-fashioned paper, just make sure you have it ready to go.

Opening Balance

You can’t start a race without a starting line. Make sure the opening balance in your NetSuite account matches the opening balance in your bank statement. If not, you’ll be playing catch-up from the get-go.

Close Previous Periods

If you’re a regular at bank reconciliation, ensure that the previous periods are closed and reconciled in NetSuite. Think of it as sealing the last chapter before starting a new one.

Backup Data

You know how they say, “better safe than sorry”? Well, backup your NetSuite data. Trust me, it’s a lifesaver if things go south.

Reconciliation Period

Decide on the time frame you’re looking to reconcile. Are we talking daily, weekly, monthly? Knowing this helps you keep the scope manageable.

Audit Trail Enabled

NetSuite has this nifty feature that keeps track of changes made during reconciliation. Make sure this feature is enabled. It’s like your very own financial diary.

Currency Check

If you’re juggling multiple currencies, confirm that exchange rates are up-to-date in NetSuite. Currency misalignment can throw a wrench in your reconciliation game.

Steps to Perform Bank Reconciliation in NetSuite

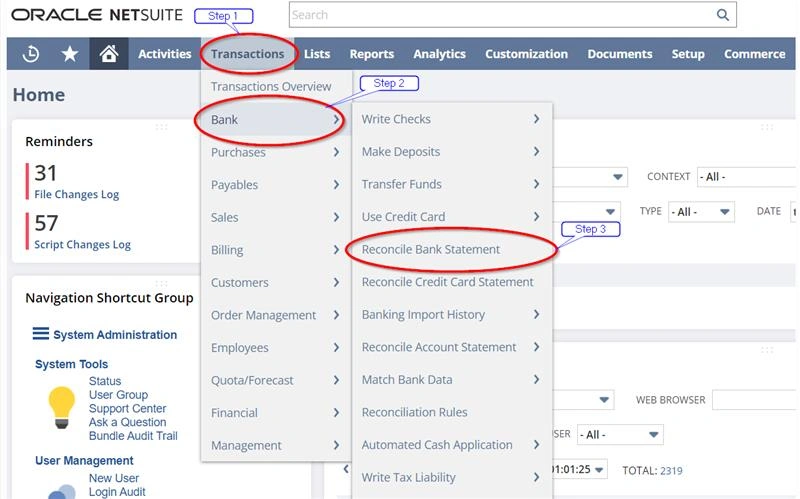

Step 1: Navigate to the Reconciliation Page

- Log in to your NetSuite account.

- Navigate to your dashboard.

- Go to Transactions -> Bank -> Reconcile Bank Statement.

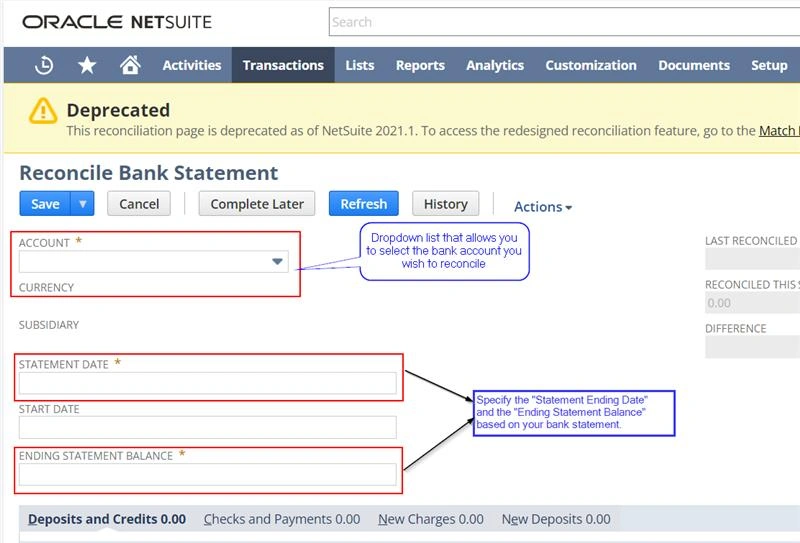

Step 2: Choose the Bank Account

- You’ll see a dropdown list that allows you to select the bank account you wish to reconcile.

- Specify the “Statement Ending Date” and the “Ending Statement Balance” based on your bank statement.

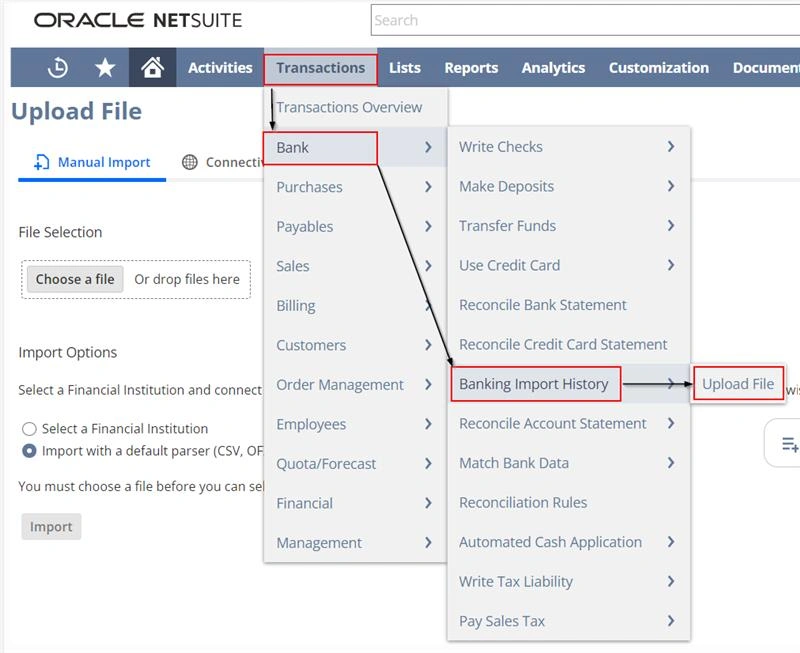

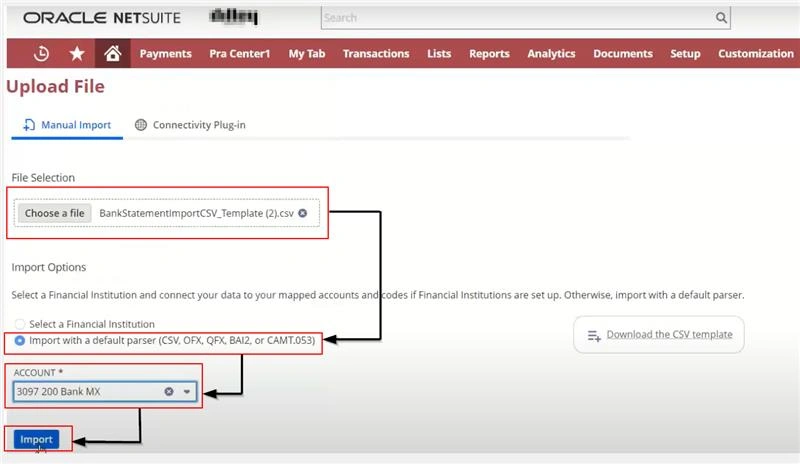

Step 3: Import Bank Statement (Optional)

- If your bank supports direct feeds, or if you have a downloadable statement in a supported format (like .CSV or .OFX), click the Import Statement button.

- Follow the prompts to upload your bank statement.

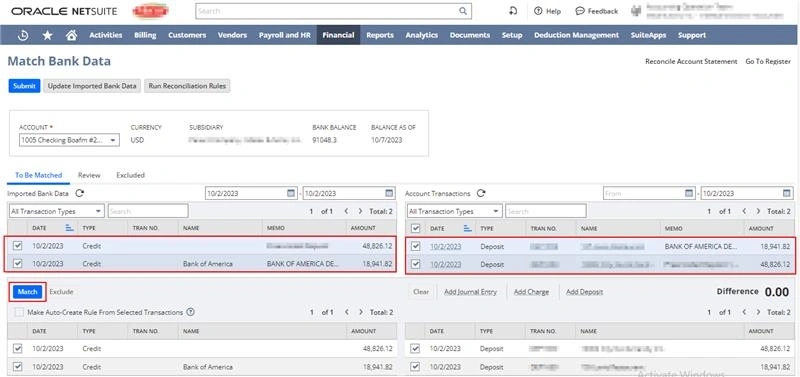

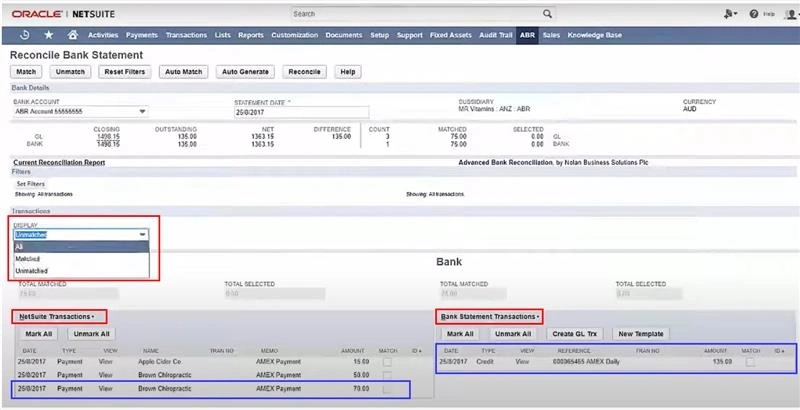

Step 4: Match Transactions

- NetSuite will automatically try to match the transactions listed in the bank statement with the ones recorded in your account.

- Verify these automatic matches to make sure they are accurate.

- Manually match any transactions that NetSuite couldn’t automatically reconcile.

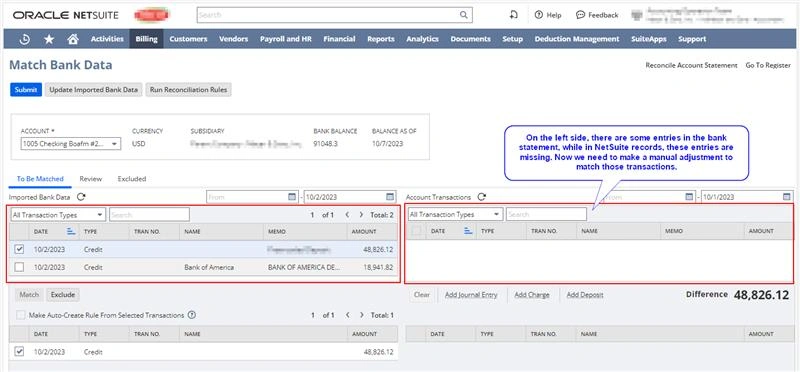

Step 5: Identify Discrepancies

- Should there be discrepancies between your bank statement and your NetSuite records, make a note of them.

- You’ll need to resolve these discrepancies to reconcile your accounts accurately.

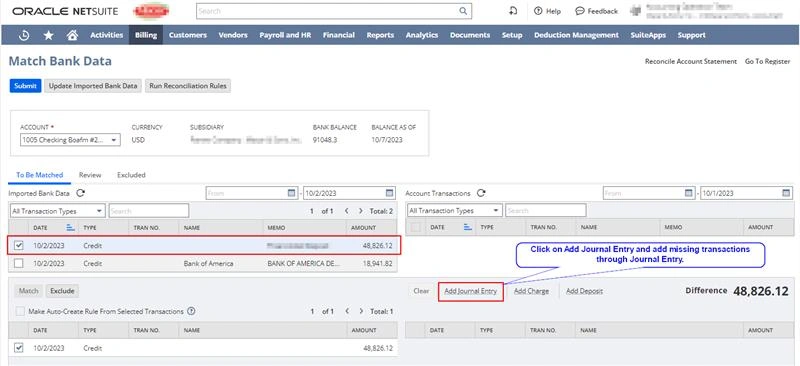

Step 6: Make Adjustments

- Click on Add Adjustment or navigate to the adjustment option.

- Add missing transactions or remove duplicate entries.

- Correct any errors in the data.

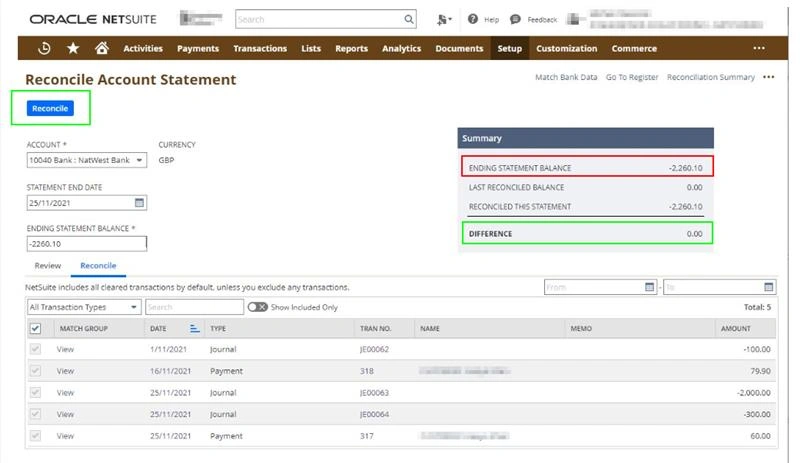

Step 7: Verify and Complete Reconciliation

- Once all transactions have been matched and all discrepancies have been adjusted, verify that your ending balance in NetSuite matches the ending balance on your bank statement.

- Click Finish or Complete Reconciliation to finalize the process.

Common Challenges Encountered During Bank Reconciliation

Here’s the lowdown on some common challenges you might bump into, along with their real-world examples and step-by-step solutions. Let’s break it down!

Challenge 1: Unmatched Transactions

The feeling when you can’t find that one matching transaction is like searching for a needle in a haystack.

Example: You recorded a $75 payment in NetSuite, but it’s not showing up on your bank statement.

Step-by-Step Solution:

- Verify Timing: Sometimes the transaction may not have cleared the bank yet. Check if it’s a timing issue.

- Search Manually: Go through your bank statement line by line to see if it’s labeled differently.

- Update NetSuite: If it was recorded incorrectly, make the necessary adjustments in NetSuite.

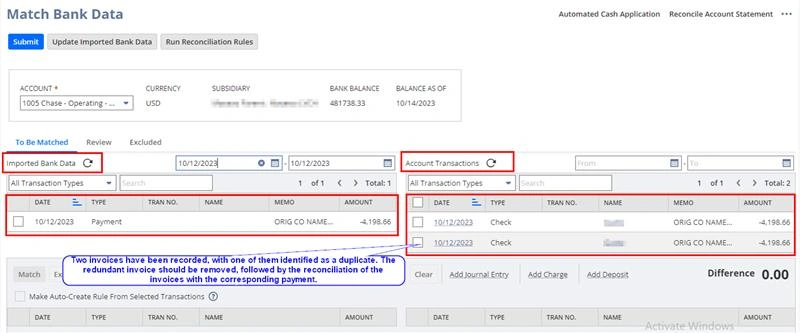

Challenge 2: Duplicated Entries

This is like seeing double when you’re not wearing your glasses.

Example: You notice a $4198.56 expense payment recorded twice in NetSuite but only once in your bank statement.

Step-by-Step Solution:

- Identify Duplicates: Confirm that the transaction is indeed duplicated and not two separate but similar transactions.

- Delete or Void: In NetSuite, either delete one of the duplicates or mark it void.

- Re-run Reconciliation: Go through the reconciliation process again to ensure it matches.

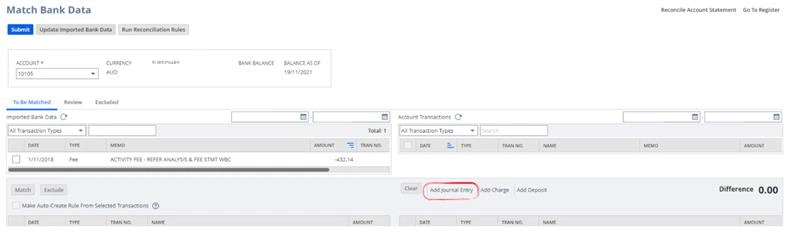

Challenge 3: Missing Bank Fees or Charges

Often overlooked, and they creep up like weeds in your financial garden.

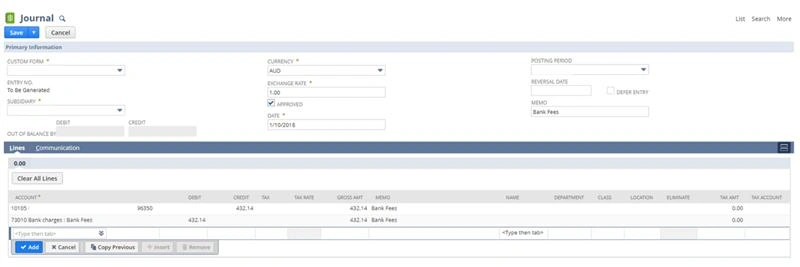

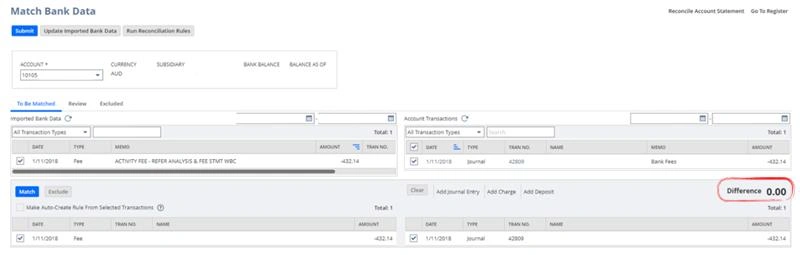

Example: Your bank charges a $432.14 monthly service fee that isn’t recorded in NetSuite.

Step-by-Step Solution:

- Identify the Charge: Confirm the fee on your bank statement.

- Add to NetSuite: Record the fee as an expense in NetSuite.

- Reconcile Again: Refresh your reconciliation page and match the new transaction.

Enter all the necessary information, such as date, account, amount, and memo. Click Save.

Challenge 4: Currency Conversion Issues

When you’re juggling multiple currencies, things can get tangled like a ball of yarn.

Example: You received a payment in euros, but your bank account is in dollars. The conversion rate used by the bank differs from what’s in NetSuite.

Step-by-Step Solution:

- Check Rates: Confirm the exchange rate used by the bank on the transaction date.

- Update NetSuite: Modify the currency exchange rate for that specific transaction in NetSuite.

- Reconcile: Match the transactions again and proceed.

Challenge 5: Credit Card Processing Fees

Ah, the good old fees that siphon off a little bit of every transaction.

Example: A $100 sale paid via credit card nets you $97 because of a $3 processing fee, but you recorded the full $100 in NetSuite.

Step-by-Step Solution:

- Identify Fee: Note the $3 processing fee on your bank statement.

- Record in NetSuite: Create an additional transaction in NetSuite to account for the $3 fee as an expense.

- Re-run Reconciliation: Now with the additional entry, reconcile the amounts to match.

Illustrating Bank Reconciliation with a Practical Example

To illustrate bank reconciliation with a practical example, start by using a spreadsheet or accounting software to list all transactions. Compare each transaction on the bank statement to the corresponding entry in your accounting records. Make note of any discrepancies and investigate the cause. Adjust your accounting records to match the bank statement. Finally, prepare a bank reconciliation statement to clearly illustrate the reconciliation process. This practical example allows you to visually see the steps involved in bank reconciliation and ensures your records are accurate. By following these steps, you can confidently reconcile your bank accounts and maintain accurate financial records.

Red Flags in Bank Reconciliation and How to Address Them

So let’s break down some common red flags you might encounter while reconciling bank accounts in NetSuite and how to deal with them.

Red Flag 1: Long-Outstanding Checks

If checks are outstanding for an unusually long period, it’s a warning sign that needs attention.

How to Address:

- Review the Outstanding List: Check who these checks are made out to and the date they were issued.

- Follow-up: Contact the recipients to confirm if they received and deposited the checks.

- Consider Stop Payment: If a check is lost, you may want to consider placing a stop payment through your bank and reissuing it.

Red Flag 2: Inconsistent Opening Balances

When the opening balance in NetSuite doesn’t match the one on your bank statement, something’s off.

How to Address:

- Check Previous Reconciliation: Ensure that the last reconciliation was finalized correctly.

- Review Transactions: Double-check for any transactions that might have been recorded incorrectly or not at all.

- Update Records: Correct any discrepancies before moving forward with the new reconciliation period.

Red Flag 3: Repeated Adjustments for Discrepancies

If you’re consistently having to make adjustments for the same types of discrepancies, that’s a pattern you can’t ignore.

How to Address:

- Identify the Source: Try to pinpoint why these adjustments are consistently needed. Is it a data entry issue? A procedural glitch?

- Amend the Process: Once identified, update your procedures or training to prevent these discrepancies from reoccurring.

Red Flag 4: Unexplained Gaps in Check or Transaction Numbers

Missing check numbers or gaps in transaction sequences can signal fraudulent activity or a serious accounting error.

How to Address:

- Audit the Gap: Determine what should be in that gap. Was a check issued? Was a transaction recorded?

- Consult Team: Confirm with your team whether this is a clerical error or something more suspicious.

- Strengthen Controls: Implement internal controls to prevent unauthorized transactions or issue pre-numbered checks to keep better track.

Red Flag 5: Transactions That Never Clear

Transactions that appear in NetSuite but never clear on the bank side can be troubling.

How to Address:

- Verify Validity: Make sure these transactions are legitimate.

- Review Timing: Some transactions take time to clear; confirm that it’s not a timing issue.

- Investigate: If they still don’t clear, it may be necessary to delve deeper to rule out fraud or errors.

Red Flag 6: Variances in Recurring Payments

If your recurring payments like rent, utilities, or subscriptions are fluctuating unexpectedly, it’s a red flag.

How to Address:

- Check Rates and Terms: Make sure there hasn’t been a rate change or additional charges you weren’t aware of.

- Contact Vendor: Reach out to the service provider to clarify any unexpected changes.

- Update NetSuite: Adjust your recurring payments setup in NetSuite as needed.

FAQs on Bank Reconciliation:

Commonly asked questions about bank reconciliation include the three methods of preparation, the process for preparing a bank reconciliation statement, the importance of bank reconciliation in financial management, common discrepancies to look out for, and the recommended frequency for performing bank reconciliation. The three methods of preparing bank reconciliation involve comparing the bank statement and cash account, comparing individual transactions, and using the accrual method of accounting. To prepare a bank reconciliation statement, gather bank records and business records, identify discrepancies, and make necessary corrections. Bank reconciliation is essential for accurate financial management and helps detect errors, ensure sufficient funds, and maintain accurate business records. Regular reconciliation should be performed to prevent issues and discrepancies from accumulating.

What are the three methods of preparing bank reconciliation?

The three methods of preparing bank reconciliation include the deposit method, balance method, and combination method. The deposit method compares deposits in transit on the bank statement to recorded deposits. The balance method compares ending balances on the statement and in the company’s books. The combination method uses both approaches to reconcile discrepancies.

How do you prepare a bank reconciliation statement?

To prepare a bank reconciliation statement, gather your bank statement, check register, and financial records. Compare the ending balance on your bank statement to the one in your check register. Adjust the register for any discrepancies and reconcile outstanding deposits or withdrawals that haven’t cleared.

Where Do Non-Sufficient Funds (NSF) Checks Go on a Bank Reconciliation?

Non-Sufficient Funds (NSF) checks are included in the “Outstanding Checks” section of a bank reconciliation. The amount of the NSF check is subtracted from the bank statement balance. Additionally, the NSF check should be recorded as a debit in the company’s accounting records. It is crucial to follow up with the customer who wrote the NSF check to resolve the issue.

Do I need to reconcile all of my bank accounts?

It is crucial to reconcile all of your bank accounts regularly, even if you have multiple accounts. Reconciling each account individually helps spot errors and prevent fraud, allowing you to manage your cash flow effectively.

What is the difference between a bank statement and a general ledger balance?

A bank statement serves as a record of all transactions made through a bank account, while a general ledger balance represents the total amount of money in a company’s accounts recorded in its accounting system. Reconciling these balances helps identify discrepancies and errors.

What is the main purpose of reconciliation?

The main purpose of reconciliation is to ensure that your bank account balance matches your financial records accurately. It helps identify errors, discrepancies, and missing transactions. Regular reconciliation prevents overdrafts, minimizes fraud risk, and provides a clear picture of available funds for budgeting and cash flow management.

Why doesn't my bank reconciliation balance?

There could be various reasons why your bank reconciliation doesn’t balance. One possibility is the presence of missing or duplicate transactions in your accounting records. Another factor could be errors in data entry or discrepancies in the bank statement information. Thoroughly reviewing and reconciling all transactions is crucial for identifying and correcting any discrepancies.

Conclusion

Mastering bank reconciliation is essential for maintaining accurate financial records and ensuring the financial health of your business. By regularly reconciling your bank accounts, you can identify any discrepancies or errors, detect fraudulent activity, and improve overall financial efficiency. It is important to understand the terminology and steps involved in the bank reconciliation process, as well as the common challenges that may arise. Automating the bank reconciliation process can simplify and streamline the process, saving you time and effort. If you need further assistance or guidance in mastering bank reconciliation, don’t hesitate to get in touch with our experts.