Online businesses today are selling their products across multiple states and internationally. According to Department of Commerce data, U.S. e-commerce represented 22.0% of total retail sales in 2023. In fact, e-commerce sales witnessed 7.6% growth from $1.040 trillion in 2022 to $1.119 trillion in 2023.

As consumers depend more on internet purchases, state jurisdictions don’t want to miss out on significant taxable income. Earlier online sellers didn’t have to charge sales tax from customers and remit the same. Seeing how states missed out on about $33 billion of taxable income a year gave rise to ecommerce sales tax.

While it’s easier for online sellers to reach a vast majority of customers, navigating sales tax and different regulations can be complex. Worry not, this guide will help you understand small business sales tax and touch base on economic nexus.

- What are the unique sales tax challenges a small ecommerce business must be prepared for?

- The impact of U.S. Tax laws on small online sellers – a close look at the economic nexus regulations for tax collection.

- Steps small brands should take to prepare for the tax season.

- Which resources and automated technologies to consider to stay updated on information.

- Common mistakes made by business owners and how accountants help in tax filing.

Unique Sales Tax Concerns for Ecommerce Businesses

An online brand may face several complexities in grasping what sales tax for ecommerce is. It’s generally due to the global nature of online transactions. Plus, digital goods and services evolve rapidly compared to tangible products, leading to taxation challenges. Some of the tax concerns that internet sellers should be aware of:

- Struggle in Keeping Up with Varied Tax Landscapes: With new laws introduced and old laws changing an e-commerce business might inevitably miss a thing or two. For instance, with budget deficits caused by COVID-19, many states changed their sales tax legislation to tackle the situation. This ever-changing landscape is something every online seller must be aware of.

- Fluctuation in Tax Rates: Each state has its own way of operating sales tax collection from the e-commerce business. As they keep changing their tax rates, it becomes difficult for any online brand working in multiple jurisdictions to remit the appropriate amount to the government.

- Accuracy of E-commerce Tax Collection Across Multiple States: When businesses are unaware of the changes in laws and regulations in each jurisdiction, calculating correct sales taxes becomes a challenge. Especially when they don’t have the expertise or necessary resources.

Difference Between Tangible and Intangible Products: Both digital and physical goods have different sales tax rules. While the former is usually exempted from remitting tax, the latter is subjected to it. Therefore, it becomes a necessity for online sellers to understand different tax regulations for distinct products.

How Changes in U.S. Tax Laws Impact Online Sellers?

Did you know that 33 states reported $23 billion in revenue through remote sales tax in 2023 and is expected to grow more? Besides, about 95% of purchases will be done by the e-commerce platform by the end of 2040. This means online sellers can anticipate new sales tax laws on ecommerce in the coming years.

If we look at the records, the U.S. sales tax has evolved completely in the past few years. Both state and local governments are eager to collect more tax revenues from e-commerce businesses. On the contrary, companies are overburdened with changing tax rules, rates, and forms.

Since 2021, all states have adopted marketplace facilitator laws in addition to the economic nexus regulations for tax collection. This law originated from the concept that each state government could collect a significant amount of the required tax from a single entity rather than multiple small companies. Some legislation has also made it compulsory for market facilitators to undertake sales tax collection activities from online retailers.

What is the benefit of having this regulation, you ask? Well, for sellers, the burden has been reduced as the responsibility for certain sales tax payments has been shifted to the facilitators. That being said, one thing is certain – with more than 13,000 jurisdictions and 45 states having state-wide sales tax, an e-commerce business must monitor the regulations in all areas.

Preparation for Tax Season: How Far Ahead Should Small Ecommerce Businesses Start?

For many e-commerce businesses, tax season can be maddening full of form-filling, document-hunting, and excessive sweating. But, it doesn’t have to be if you start your tax planning well in advance to make your life free of stress. All you need to do is trust the following course of action:

Step 1: Get Your Bookkeeping in Order: Update your books to file the sales tax for e-commerce. For this, you have to:

- Record business transactions accurately

- Ensure your books are balanced

- Reconcile bank statements

Step 2: Understand Various Deductions and Organize Paperwork: Just in case you get audited by the IRS, having proof for all your deductions can save you from trouble. Once you complete step 1, you’ll get a clear idea of which receipts you need to hunt down.

Step 3: Keep Enough Tax Money Aside: Setting aside about 30% of the total sales is generally the rule of thumb if you aren’t sure how much you owe in federal taxes. You can use several saving methods to manage your funds like opening a separate bank account. Rest assured, this best practice will definitely reduce your stress during the tax season.

Step 4: Stay Informed About Tax Reforms: The latest tax laws are a boon for e-commerce businesses. Hence, you stay up-to-date with the changes to get the most benefits.

Step 5: Working with A Tax Professional: If you don’t have even a little hint of what to do, outsourcing an ecommerce and sales tax compliance professional is a smart idea.

The Role of Accounting Professionals in Keeping Ecommerce Businesses Informed

Though the finishing line of race is filing taxes, bookkeeping is the regular practice that gets you there. With professional bookkeeping experts, you have a team doing the leg work on your behalf. They can use robust software to automate your financial transactions by connecting credit cards, payments, and bank statements.

Furthermore, they can provide valuable advice that online guides cannot. If you’re unsure what credits you qualify for or didn’t know about the deductions or the best method to file your taxes, get their personalized services.

Reliable Sources for Staying Updated on Sales Tax Laws

How to keep up with US tax law changes is a question many e-commerce businesses ask. There are several effective strategies that they can use to keep them informed, including:

- Following IRS Announcements: Internal Revenue Service is the foremost authority in all matters of tax laws across the U.S.A. Keep an eye on their announcements to learn about any changes.

- Consulting Tax Professionals: CPAs and tax attorneys are professionals who stay up to date on tax law changes. They are the most qualified to offer you the best advice.

- Utilizing Tax Software: Many reputable sales tax software for ecommerce get updated regularly to reflect the changes in the latest tax law. Using these tools can help you stay compliant with tax regulations.

Role of Technology in Ecommerce Tax Compliance

Leveraging technology has become a requisite to simplify e-commerce sales tax processes. Automated tax software can help you calculate, collect, and remit the accurate tax amount across distinct jurisdictions, allowing your online store to stay compliant with the tax laws. Some of the best sales tax software for ecommerce are NetSuite ERP, Vertex, TaxCloud, QuickBooks, etc.

Beyond compliance with state tax regulations, technology can also help you to optimize strategies. Other aspects where tech software can prove beneficial for your e-commerce brand:

- Stay updated with the ever-changing tax rates and rules

- Accurate recording of all business transactions

- Submit and pay tax returns automatically

- Make cross-border transactions easier

- Identify discrepancies in sales data to avoid non-compliance with regulations

- Prevent fraudulent activities

Collaborating Effectively with Accounting Professionals for Sales Tax

Even though many ecommerce businesses understand sales tax and its regulations, many are unsure whether they’re filling and collecting taxes correctly. Hence, it becomes imperative to hire accounting professionals or bookkeepers who can make this process stress-free.

Why charge your customers the wrong sales tax on their purchases and let tax authorities catch that mistake when you aren’t even aware of it? Instead, work with a trusted team of accountants to help you with the know-how and manage ecommerce taxes. Your small business may benefit a great deal when working with experts in the following ways:

- Strategic financial planning for online store growth

- Streamlined ecommerce accounting

- Navigating e-commerce sales tax and compliance

- Proper inventory management

- Enhanced decision-making with financial analysis

- Integration of technology in accounting to further streamline the process

6 Common Sales Tax Preparation and Filing Mistakes

It’s easy to get tripped up while filling sales tax to the state no matter whether your business does it quarterly or monthly. That’s why, we bring some common pitfalls you need to avoid when filing a sales tax return:

- Late Filing: Delaying filing sales tax seems tempting but costly; postponing leads to penalties and late fees, hence it’s better to file on time.

- Not Filing A Return: Failing to file a return can result in penalties, even if your business owes no sales tax. For example, Florida imposes a penalty of 10% of the total taxed amount owed and might revoke your sales tax permit. In severe cases, you could face criminal charges, especially if you collect sales tax without permission.

- Incorrect Tax Collection Details: States require a detailed breakdown of sales tax collected by country, city, or district. Not doing so can lead to complications.

- Confusing Taxable Periods: States have different filing frequencies—annual, quarterly, or monthly. It’s easy to mix up these periods and file the wrong amount. So, ensure you file the correct amount for the specific period.

- Missing Information: A mistake as simple as a missing signature can lead to the rejection of the income tax return report. As each state’s form is different, make certain that you don’t overlook any detail.

- Computation Errors: These are the most common mistakes that online businesses make so best to avoid them using robust ecommerce sales tax software.

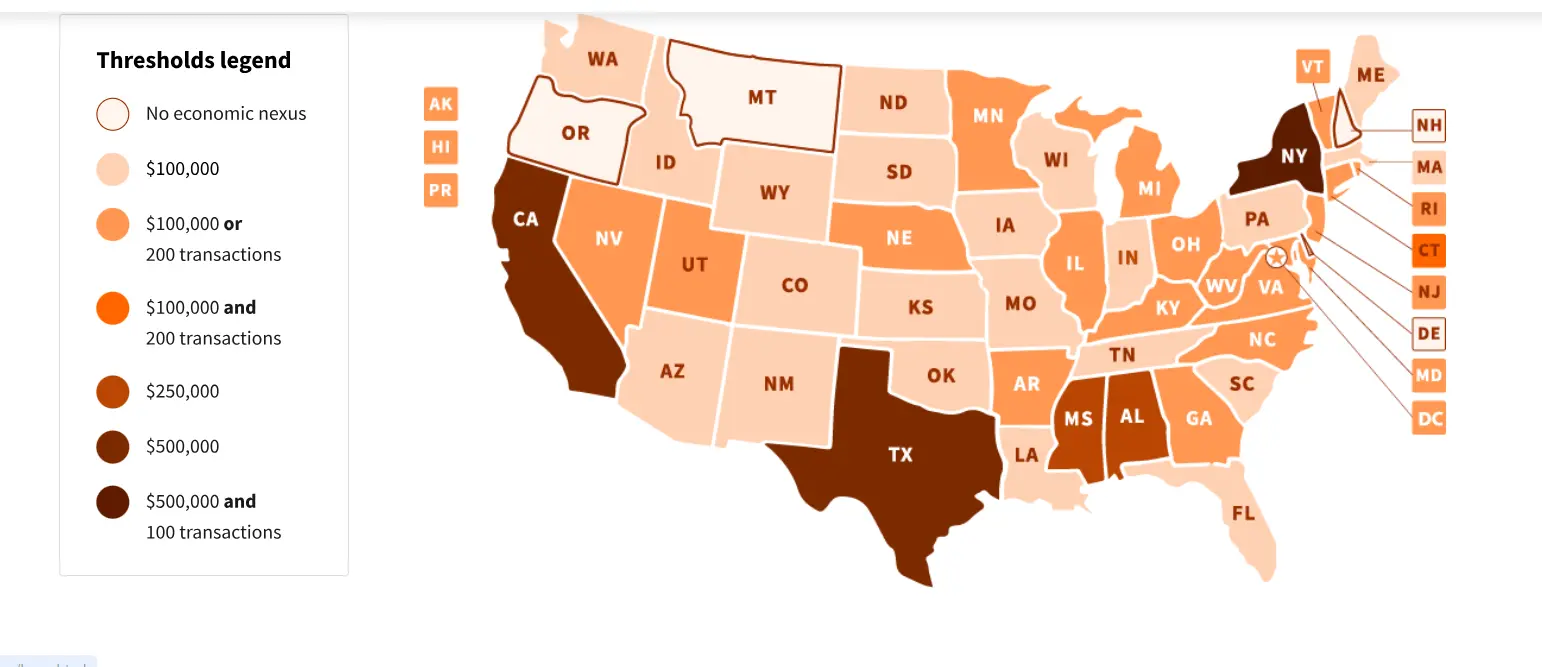

Minimum Internet Sales Thresholds for Charging Sales Taxes

Whether in New York, Nevada, California, or Alaska, ecommerce state sales tax breakdown and code differs. And your business needs to follow what is mentioned by each jurisdiction. The minimum threshold accepted by maximum states is 200 transactions or $100,000 in gross annual sales in the last four quarters. Nonetheless, it varies from state to state. Let’s look at a few of them:

- Threshold of $500,000 in California, New York, Massachusetts, and Texas

- Online sellers making $100,000 in annual revenue pay sales tax in North Dakota, Idaho, Tennessee, and Iowa

- Lower or no thresholds like Oklahoma require e-commerce stores to pay tax at $10,000 sales

Economic Nexus and When Sales Tax Collection Begins

An economic nexus is established when an out-of-state seller becomes liable to pay sales tax as it exceeds the state’s sales threshold. Or when the set level of transactions is met. E-commerce businesses must then register for a sales tax permit and start collecting it from their customers.

As ecommerce sales tax by state difference, online sellers should understand each state’s laws and regulations. Moreover, they need to make themselves aware of the consequences of not paying sales tax on time.

Preparation Steps for Economic Nexus Thresholds

Complying with your sales tax nexus threshold is a multipart process. Factors like customers, base location, products one sells, and sales volume play a big role in the taxation of ecommerce. To stay prepared for the future once you cross the threshold revenue, perform the following steps:

- Research State Laws: As an online seller, you must figure out the nexus laws of each state, where you make sales.

- Monitor Sales: The economic nexus is actuated by achieving a specific threshold (say $100,000 annually) and/or a certain number of transactions (200). So, you must calculate your sales throughout the country to determine if you’ve exceeded a state’s economic threshold.

- Register for Permits: Once you’ve achieved the threshold, register for sales tax permits in the relevant states.

- Update Systems: Adjust your accounting systems to collect and report sales tax accurately for those states.

- File Sales Tax: After you’ve arranged everything properly, file your sales tax before the due date.

What to Look for When Hiring Accounting Professionals?

When preparing and filing sales tax or understanding the economic nexus for each state starts to take a toll on you, it’s time to get professionals’ help. Here are some important things you need to consider when hiring one:

- Set Your Expectations Straight: Find out what tasks you need help with. Is it for e-commerce sales tax compliance or do you only need assistance with administrative tasks? This will help you choose the right partner.

- Level of Expertise: Progress can seem a far-fetched dream if you hire someone who doesn’t understand your industry. So, do check their expertise in different niches. Also, look for their credentials and certificates.

- Communication: Improper communication can lead to the risk of financial trouble. The accounting professionals you choose must easily dictate complicated manners and shouldn’t enforce their opinions onto you without listening to your ideas first.

- Technological Knowledge: This one matters the most in e-commerce tax management. Your online store’s transaction data should be accurately stored in a system and must process orders seamlessly. Hence, the experts you hire should possess knowledge of effective technologies to manage your finances.

If you’re considering partnering with a professional with expertise in ecommerce and taxes, they must know various aspects of this field. We’ll discuss each of them in the next few sections:

Handling Drop Shipments and Multi-State Sales Tax Collection

When e-commerce businesses ship products directly to their customer, they may need to manage sales tax for both the states where the customer resides and the company’s location. An expert can ensure compliance by understanding each state’s rules and obtaining the needed permits.

Using automated tools, tracking where you’ve nexus, and collecting sales tax from customers accordingly are some ways to stay compliant with different state’s rules and regulations.

Tracking Nexus Triggers Across Multiple Marketplaces

An ecommerce business must keep track of its sales volume and transaction count across all the sales channels, be it Shopify, Amazon, eBay, or its own website. With the help of an accounting professional, you can regularly review each state’s economic nexus thresholds. Plus, they can compare them against your sales data to identify where you might establish a nexus.

Liabilities and Filing Requirements Upon Crossing Economic Thresholds

One of the tasks that requires a high level of expertise is once your e-commerce business crosses the economic threshold of any state. This is where the assistance of accounting professionals matters the most. They can help prepare a reliable ecommerce sales tax solution by:

- Registering for a sales tax permit for that state promptly, as soon as you exceed a state’s economic nexus threshold

- Establishing the procedure of collecting sales tax from customers in that state immediately after registration

- Filing sales tax returns as regulated by the state, typically monthly, quarterly, or annually

Dealing With Over-Collection of Sales Tax

Many reasons can lead to over-collection of sales tax, including:

- Outdated information

- Misunderstanding complex state, county, and city tax rates

- Charging tax on items that are actually tax-exempt

- Misapplying tax where the business doesn’t have a nexus

- Incorrect tax calculations due to software or manual errors

However, a strategic advisor can help minimize or eliminate these issues. One of the major tasks of an accounting professional is to ensure sales tax software for ecommerce and systems are regularly updated with the latest rates. Furthermore, they conduct a detailed analysis of nexus to determine where the business has a tax obligation.

Last but not least, they identify instances of over-collection of sales tax and facilitate issuing refunds or credits to customers.

Responding To Sales Tax Audits: Initial Steps and Considerations

Who can help you prepare for the sales tax audits if your e-commerce business has received a notice for one? Ideally, you should do your homework beforehand and make sure your processes comply with the jurisdictions where you have a nexus. If not done, stay calm and accept that audits are a normal part of business operations.

Seek professional help immediately if you can’t fathom what’s happening. An expert will follow a certain procedure to respond to ecommerce tax audits:

- Gather all relevant documentation, including sales records, tax returns, receipts, and correspondence

- Double-check records for accuracy

- Conduct an internal review to identify potential issues or discrepancies before the auditor finds them

- Resolve the issues that may arise during internal review

- Arrange meetings or calls with the auditor to discuss the audit process

- Provide resolution options in case of potential outcomes of the audit like penalties

Addressing Taxation for Interstate Orders

As we’ve mentioned already the ecommerce sales tax nexus changes from state to state, so it’s essential to oversee taxation for all your inter-state orders. Doing so can avoid discrepancies in your data and penalties during tax audits. Accounting professionals can help you identify where to register and collect taxes. Using appropriate software, they can also simplify tax filing and remitting tasks.

Final Thought

Ecommerce sales tax compliance requires navigating a minefield of regulations, rules, and deadlines, which vary widely between jurisdictions.

Luckily, accounting software includes built-in features to automatically track tax rates and collect the correct amount from the customers.

Nonetheless, it’s still paramount to understand general state tax rules, apply for a permit in applicable nexus states, and submit your tax return before the deadlines.

If you’re struggling to do so, seek help from a dependable accounting partner like The Ledgers Labs. We have been in this game for a long time and understand the nitty-gritty of small business sales tax compliance. Moreover, our team can help with tax preparation and planning to streamline the entire process. Contact us today to get our immediate assistance.