1. GAAP is mandatory for publicly traded U.S. companies, ensuring transparency and consistency, which boosts investor confidence and stabilizes financial markets.

2. FASB sets GAAP standards, impacting over 300,000 companies in the U.S. by requiring uniform financial statements, aiding cross-company analysis and regulatory compliance.

3. GAAP compliance helps prevent fraud and misrepresentation, reducing audit errors by up to 50%, benefiting auditors, investors, and regulatory bodies.

4. Publicly traded companies spend an estimated 20-30% of their accounting resources on GAAP compliance, emphasizing its importance for maintaining trust with stakeholders.

Have you ever wondered what sets the foundation of transparency and reliability in companies’ financial reporting?

The answer is right in front of you – GAAP.

GAAP stands for ‘Generally Accepted Accounting Principles’, and it is an essential set of financial rules for regulators, investors, and several other stakeholders.

Why?

That is because this framework is the bedrock of financial reporting and is specifically made to ensure organizations represent their financial statements in a transparent, reliable, and consistent manner.

GAAP encompasses a broad range of accounting activities.

It covers the classification of items found on a balance sheet, the recognition of revenues, and even the measurement of financial performance and disclosure requirements.

GAAP has a set of ten fundamental principles that govern it.

In other words, these are the principles that aim to outline, standardize, and equally regulate the financial reporting processes associated with organizations. This is to help protect against minute to dire data manipulation or any unethical practices.

But, what are these ten principles? What do they even mean? Well, that’s what we are here to discuss.

What does GAAP Accounting Mean?

Generally Accepted Accounting Principles (GAAP) are basically the common set of accounting rules, standards, and even procedures that are issued and implemented by the Financial Accounting Standards Board (FASB) in the United States.

GAAP is a combination of authoritative standards, which are set by policy boards, and generally accepted ways of recording and reporting accounting information.

It has a major purpose of implementation. It ensures consistency, clarity, and compatibility in the financial statements of organizations.

What are the Principles of Accounting?

The one way to look at GAAP requirements is to closely examine and understand the nitty-gritty of accounting principles as a whole. These basic accounting principles were formulated by the American Institute of Accountants (AIA) in the wake of the Wall Street Crash of 1929.

The aim?

The primary goal of accounting standards was to guarantee that publicly-traded companies were actually abiding by consistent accounting methods. On top of that, it was also a way to help investors compare financial results year to year, and company to company – one of the testaments of financial benchmarking.

Here’s a list of all the accounting principles:

1. Economic Entity Principle: This concept is the foremost of all accounting principles and dictates that a business’s transactions must always be independent of the financial transactions or activities of owners.

2. Monetary Unit Principle: It is mandated that all transactions must be recorded in US dollars. Moreover, it is essential to note that accountants overlook the impact of inflation on recorded dollar amounts.

3. Time Period Principle: All business activities must be reported in concise, distinct time periods. It can be weeks, months, quarters, a whole calendar year, or a fiscal year. Moreover, it is important that the time periods are identified in the titles of the financial statements, including but not limited to the income statement, cash flow statement, and the stockholders’ equity statement.

4. Cost Principle: This principle strictly mandates the mention of an item’s historical cost. In simple words, this refers to the cash or cash equivalent that was paid during the purchase of that specific item in the past. While it is true that the value of an asset can climb or plummet with varying inflation rates, the historical cost is still to be reported on the financial statements.

5. Full Disclosure Principle: All relevant and important business information that a lender or investor would find worthwhile must be included in the company’s financial statements or in the notes to the statements. If you have noticed, this is one of the many reasons why footnotes are attached to financial statements.

Are you following all the relevant accounting principles?

Get a free audit done by our expert accountants!

6. Going Concern Principle: This refers to the belief that a company is going to carry on with its activities for the foreseeable future and does not plan to close or drastically scale down.

7. Matching Principle: Businesses must apply the accrual basis of accounting and match business income to business expenses within a specified time frame in order to comply with the matching principle. To understand this better, let’s brief you with an example. For instance, the sales commissions must be documented in the same accounting period as sales income (and not when they are paid). Read the difference between cash basis and accrual basis accounting.

8. Revenue Recognition Principle: As per this principle and under the accrual basis of accounting, revenue should always be reported on the income statement during the period it was earned. In other words, as soon as the product is sold, or a service has been provided, the organization immediately identifies revenue from the sale. This holds true whether or not the money is exchanged. Know more about revenue recognition.

9. Materiality Principle: According to the materiality principle, when an amount is small or immaterial, it is considered a misstatement in accounting records. The materiality principle dictates that amounts in financial statements are typically rounded to the nearest dollar.

10. Conservatism Principle: The principle of conservatism requires that potential costs and liabilities be recognized right away even if accountants are uncertain about how to report a particular item. In other words, it instructs the accountant to predict the losses and select the course of action that will decrease net income and/or asset value. Let’s see a brief example to understand this better. For instance, potential lawsuits can be considered as losses and are reported, while potential gains from other sources are not.

This leads us to the question: What does this have to do with GAAP’s accounting principles? Continue reading to find out.

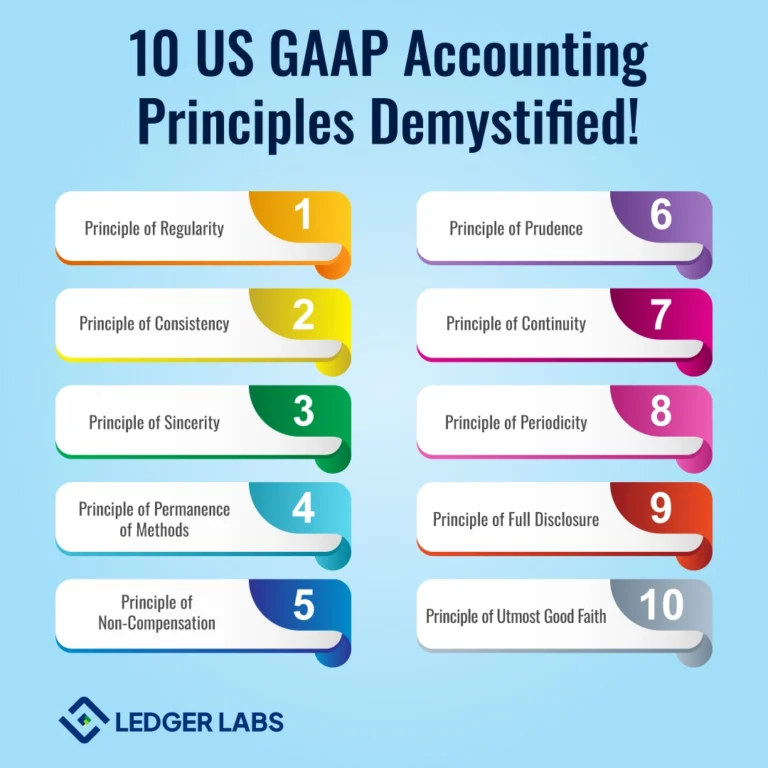

Understanding the 10 Principles of GAAP

While GAAP does include several official accounting rules and standards, there are a total of 10 principles that can clarify the primary mission of GAAP. Now, to be precise, these are mostly different from the ten accounting principles you saw right above.

However, because this portion stems from the above information, there can be a close overlap between the two. Let’s look at the 10 GAAP accounting principles in detail:

1. Principle of Regularity: This is the first principle of the list and necessitates accountants to adhere strictly to every established GAAP guideline. In other words, you simply don’t have the liberty to pick which GAAP rules to abide by.

2. Principle of Consistency: Accountants must consistently use the same techniques for transactions and financial reporting to preserve accuracy and avoid inconsistencies or discrepancies. This principle is highly important to maintain continuity and comparability of the financial records of a company over time. Should there be a shift in technique or a new accountant introduces another approach, then these changes should be documented in the footnotes of financial statements.

3. Principle of Sincerity: As per this principle, it is important for accountants to represent a precise and transparent reflection of the organization’s financial well-being. Accountants are required to accurately report a company’s current financial situation, even in cases where it may be in financial distress and may jeopardize its continued existence.

4. Principle of Permanence of Methods: The principle of Permanence of Methods was developed to highlight the necessity of long-term consistency or uniformity in financial reporting practices. Similar to the second gaap accounting principle, but focused specifically on financial reports, it makes sure that reports from different companies can be readily compared.

5. Principle of Non-Compensation: The Principle of Non-Compensation emphasizes the full disclosure of all financial information, including positive and negative, without balancing debts against assets or income against outlays. This helps to guarantee an accurate and transparent portrayal of a business’s financial situation, without avoiding any positive or negative value whatsoever.

Ensure that your business follows all the necessary GAAP accounting principles.

Get in touch with our accountants.

6. Principle of Prudence: This principle insists and mandates that financial information is to be presented on the basis of factual (real) figures and not any speculation or future expectations. Accountants are advised to avoid speculation and to stay rooted in reality, particularly when it comes to the company’s future. Although companies are allowed to forecast, speculative data of this kind cannot be included in the official financial statements.

7. Principle of Continuity: Forming the foundation of this principle, it is assumed that the business is going to continue to function indefinitely. This principle basically applies regardless of the current status of the company. Put simply, this indicates that an analyst can declare with confidence that their actions will not interfere with the business’s regular operations. Consequently, regular business processes should not be hampered by the gathering of financial data and the valuation of assets.

8. Principle of Periodicity: As per this gaap accounting principle, it is important that all accounting records should be organized and bifurcated into accurate timelines. For example, yearly, quarterly, or monthly.

Accounting records should be organized into appropriate time frames, such as quarterly or yearly. For example, revenue reported for a quarter can only relate to that quarter; this eliminates the possibility of financial data being manipulated over multiple periods to conceal performance fluctuations.

9. Principle of Full Disclosure: It is the responsibility of accountants to make sure that financial reports fully disclose all pertinent and relevant information that influences the reader’s comprehension of the financial statements. This disclosure is important to ensure full financial transparency and accountability. Moreover, this can help analysts and investors stay informed about the decisions they make on the basis of these documents.

10. Principle of Utmost Good Faith: According to this GAAP accounting principle, everyone who engages in financial reporting must conduct with full integrity and honesty, with no exceptions as such. More essentially, this extends far beyond compliance, as it also embodies a commitment to ethical conduct towards involved stakeholders.

In case of small businesses, they may have certain exemptions or simplified reporting requirements compared to larger entities, they are generally still expected to follow Generally Accepted Accounting Principles (GAAP) in their financial reporting. The extent to which small businesses must adhere to GAAP can vary depending on factors such as their legal structure, industry, size, and regulatory requirements.

Unsure which GAAP principles are important for your business?

Talk to our accounting experts.

In Summing Up

The 10 US GAAP accounting principles offer us a strong framework that guarantees uniformity, reliability, and comparability of financial reporting across different business areas. Why are they so important to businesses?

Well, it is a reflection of maintaining a high standard of financial integrity and transparency. In fact, this was one of the primary reasons why the ten principles were given rise to.

They provide an accurate and impartial picture of a company’s financial standing, assisting stakeholders in making wise and sound decisions in the long term. While they may seem tricky and often stringent at times, these principles are the bedrock that helps to preserve the integrity of financial data in the marketplace.

Have questions? We are ready to answer for you. Get in touch with our in-house accounting and bookkeeping experts who have more than 12 years of experience. Let us be your solution to all the unanswered questions you have ever had.