1. 91% of companies believe benchmarking helps enhance their performance and competitiveness.

2. Businesses that benchmark against top industry performers improve efficiency by up to 69%.

3. 85% of top-performing companies regularly use financial benchmarking to identify growth opportunities.

Finance is one of the most crucial aspects of any business.

This subject matter alone can make or break the performance, profitability, and operations of your business.

This is the main reason why any business or businessman has always been found to be running after new and better ways to raise and manage finances.

A lot of businesses rely on financial benchmarks to know about their competitors’ performance and use the same for the profit of the business.

Financial Benchmarking is another widely used terminology in the corporate space. Using the techniques of benchmarking, different businesses try to analyze the performance of finance within the organization and to find the areas with scope for betterment.

Hence, you can easily understand how benchmarking in finance can help various businesses. However, for better and deeper insight, let’s know more about financial benchmarks and benchmarking.

What is Financial Benchmarking?

Benchmarking or a benchmark, in general, is known as a baseline or criterion that can help you compare one aspect with another, using the same benchmark as a level-playing field.

Benchmarking is a concept that concerns the analysis of financial and business practices undergone by any business in comparison to other businesses and their practices in the same field, industry, and domain.

With the help of this approach, one business can easily ascertain the incoming, outgoing, and management patterns of finance within the firm as used by another in the industry.

For the same, a financial benchmark is created and used as a baseline for the comparison of the finances of two or more companies.

Types of Financial Benchmarking

The definition of benchmarking in finance is self-explanatory in defining the purpose of the technique. However, it can not define its types. There are four types of financial benchmarks or benchmarking. Let’s know more about these using financial benchmarking examples:

1. Practice benchmarking

Under this form of benchmarking, businesses analyze the qualitative aspects of the finance used by competitors. This method is solely related to understanding the pace and performance of various processes and technologies used by any business.

2. Performance Benchmarking

Unlike, practice benchmarking, performance benchmarking uses quantitative or numbers-related financial benchmarks to understand performance. Using this technique, a business can easily mark out the KPIs, analyze its data, and, in turn, mold them in the favor of the business.

3. Internal Benchmarking

Just like the name, under internal benchmarking, you compare the performance of units, departments, and other factors present within the business. This is the first step that is used by a business to perform better than before and then devise a plan of action to beat the competitors.

4. External Benchmarking

Under external benchmarking, businesses compare the financial benchmarks of their organization against the competitors’. This technique is opposite to that used in internal benchmarking. Now that you know what is financial benchmarking and its types, let’s move on to understand how to set up the goals for effective and efficient benchmarking.

Related Articles:

- How to calculate retained earnings on a balance sheet?

- Post tax deductions simplified: What are they and how do they work?

- What is Financial Leverage Ratio and why is it important for small businesses?

- Catch Up Bookkeeping: A Comprehensive Guide!

- Strategic Planning KPIs: Who are the major players?

- Controller For Small Business – Who Are They & How They Work?

How to Ensure the Effectiveness and Efficiency of Benchmarking in Finance?

Financial Benchmarking is a very sensitive matter. Hence, while executing benchmarking or setting up financial benchmarks, you need to take into account some easily affecting factors:

- Determine and define the subject matter of benchmarking.

- Acknowledge the type of subject matter.

- Set benchmarking criterion.

- Set comparison parameters.

- Assemble the data related to the benchmarks.

- Run the comparison and pin out the KPIs and flaws.

- Ascertain how to fix the flaws.

- Determine a plan of action to fix the flaws.

- Execute the required operations to fix the flaws.

- Ascertain the performance after executing the operations.

- Analyze the results and modify the plan if necessary or go with the current plan.

Once you take care of all these factors, you can easily ensure that your financial benchmarking is viable and successful.

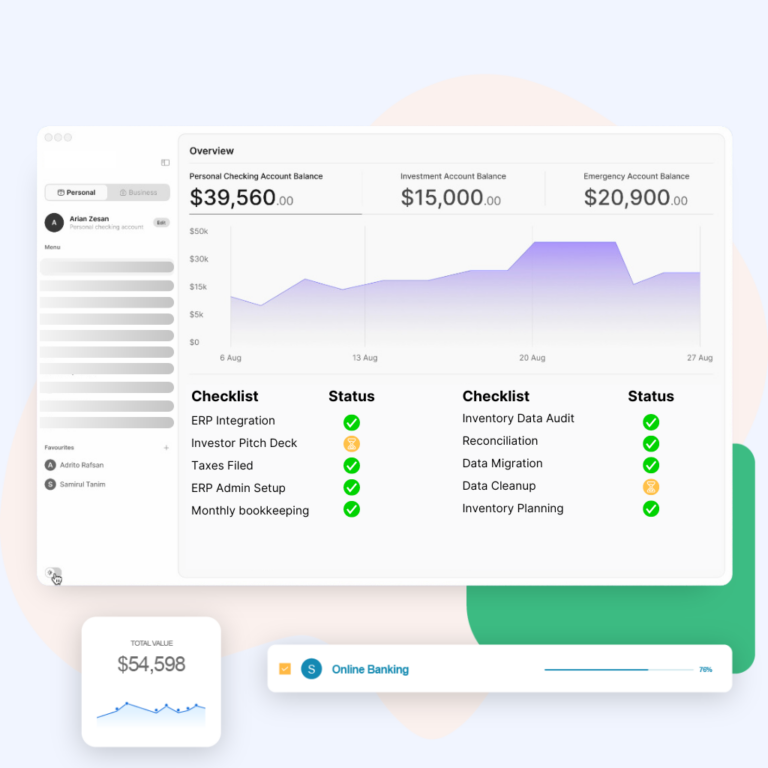

Types of Data Involved with Financial Benchmarking

It’s a misconception that benchmarking is only related to the data of numbers. This subject matter consists of both qualitative and quantitative data that includes:

- Profits (net and gross)

- Costs (production, operating, and otherwise)

- Trends (sales, profit, and all others)

- Revenues (per employee, per product, per unit, and more)

- Ratios (current, liquid, etc.)

- Other types of varied data, numbers, and information

What are the Benefits of Financial Benchmarking for a Business?

To summarize the importance of benchmarking in finance, the best thing to state would be:- Financial Benchmarking allows you to understand where your business stands. This benchmarking technique is the best way to ascertain the performance of your finance, business operations, executions, and every other aspect.

With the help of this technique, you can ascertain the KPIs and loopholes of your business. Once ascertained, you can devise a plan of action to improve the KPIs and fix the flaws.

Additionally, with the help of Benchmarking, you can compare both internal and external factors. The first thing you should do is beat your own business performance records before you move on to analyzing the competitors’. However, this is not a rule of thumb, but a mere suggestion.

If you are planning to grow, which is something that every organization wants, then with the help of financial benchmarks, you can compare your strategies with those used by the big league players and try to reach their levels.

Once you determine the strengths and weaknesses of your business, you can stand strong against the competition.

Related Articles:

- Heads-up Small Business Owners: 9 Accounting Trends to Watch Out for in 2024!How to calculate retained earnings on a balance sheet? Earnings?

- What is a financial audit and how to prepare for it?

- What is a GL code and how to automate it?

- What is bad debt expense and how to estimate it?

- What’s Cost Volume Profit Analysis? Assumptions, Examples, and Calculations

- Property Management Accounting: A Complete Starter Guide

Summing Up

If you are a business or an entrepreneur, then we suggest that you take the help of financial benchmarking. History has shown that numerous businesses, profitable or otherwise, have gained enormous advantages over their competitors, simply by taking the help of benchmarking in finance.

The functions undertaken by your organization can never be “too different” from that of a competitor. Hence, it’s better to get an edge over the competitors’ activities and work for the benefit of your business. With the help of financial benchmarking, you as a business can easily set up realistic, futuristic, and beneficial goals.

Whether it is short-term or long-term goals, benchmarking can help you with everything. Instead of following the ideology of going big or going home; follow the one stating going smart with benchmarking.

If you want affordable financing and accounting, the experts at The Ledger Labs are here for your ease. You can connect with the financial executives and get all the help required. Allow us to take care of all your benchmarking needs and instantly. Contact us today.