1. Retained earnings represent a company’s cumulative net income minus dividends distributed, reflecting the portion of profits reinvested for growth or debt repayment.

2. The formula for retained earnings is: Beginning Retained Earnings + Net Income – Dividends Paid. It provides insights into financial stability and reinvestment capacity.

3. Positive retained earnings signal growth potential, while negative retained earnings (accumulated deficit) indicate past losses exceeding profits.

4. Retained earnings significantly impact financial strategies, including dividend policies, reinvestment plans, and funding for business expansion.

5. Accurate calculation avoids errors such as neglecting previous periods’ earnings or misclassifying dividend payouts, ensuring financial reporting precision.

If you’ve ever gone through a balance sheet, you would’ve come across the term ‘retained earnings’. This topic is of special interest to analysts, investors and management. This blog post is your one stop destination to understand all that is there to know about retained earnings. So without much ado, let’s begin.

Retained earnings, also known as retained profits or accumulated earnings, represent that portion of a company’s net income or profit which is retained or held back. This portion may then pumped back into the business rather than distributed among its shareholders as dividends. So you could say that retained earnings works as a turbocharger of your business engine!

Therefore, retained earnings are a key component of a company’s equity or shareholders’ equity on its balance sheet.

Retained Earnings Formula

Here’s how to find retained earnings over a time period:

Earlier Retained Earnings (REο) + Net Income(NI) – Dividends to shareholders(D) = Final Retained Earnings(RE)

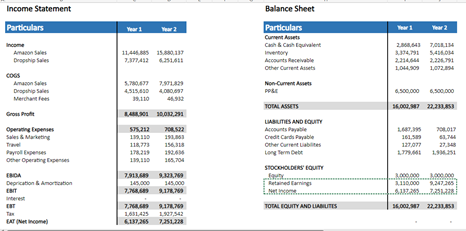

We will help you understand it better with the help of income statement and balance sheet of our client ABC Retail.

Thus, for year 1, retained earnings can be calculated as:

6137265 + 3110000 – 0 = 9247265

Hence, retained earnings for year 1 is 9,247,265.

This retained earning is now used as earlier retained earnings for year 2. And final retained earnings is calculated as:

9247265 + 7251228 – 0 = 16498492

Hence, retained earnings for year 2 is 16,498,492.

Notice here in the statement of retained earnings that the company is not paying any cash or stock dividends and is building its retained earnings.

Want to know more about the components of retained earnings? Find how to calculate retained earnings!

Retained earnings: Is it an asset to the business?

In the balance sheet of ABC Retail, you will observe that retained earnings are placed under the equity column. So, business owners can definitely use the retained earnings to buy assets, but as such, retained earnings is not an asset.

Net Income vs Retained Earnings: What’s the difference?

There is a very basic difference between net income and retained earnings. Net income refers to the profits over a specific time period such as quarterly, half yearly or yearly.

Whereas, retained earnings refer to the accumulation of all the profits the company has ever made starting from day 1 of its operations. This of course excludes any dividends paid to the shareholders as is evident in the retained earnings equation.

Is retained earnings debit or credit?

In the income statement of ABC Retail, you will notice that the company has made profit in both Year 1 and its net income has grown. As a result, its retained earnings account is credited with the net income for Year 2. Had there been loss in Year 1 with net income as negative, its retained earnings account would have been debited.

Why is retained earnings important?

As we said earlier, retained earnings is of special interest to analysts, investors and management. This is because it helps them assess the company’s financial standing and growth potential.

Not just that, it helps the management to make strategic decisions like expanding operations in new countries or into new sectors. Retained earnings uses could be:

- Capital reinvestment

Retained earnings represent the company’s accumulated profits that can be reinvested in the business. This can be used for research and development, debt reduction, expansion, and other investments to grow the company.

- Financial stability

Healthy retained earnings show that a company has a history of profitability and is financially stable, which can enhance its ability to attract investors and secure loans.

- Dividend payments

Companies can use retained earnings to pay dividends to shareholders, although they are not obligated to do so. The decision to pay dividends is at the discretion of the company’s management and board of directors.

- Buffer for economic downturns

Retained earnings can serve as a financial cushion during economic downturns or unforeseen expenses. They can help a company weather financial challenges without having to borrow more or raise additional capital.

Thus, retained earnings are a critical component of a company’s financial health and sustainability.

Retained Earnings Case study

Example: Expansion of Tech Startup

In 2020, we were hired by a technology startup that had been in operation since early 2000’s. During its initial years, the company generated consistent profits, which were retained and reinvested in the business. Here’s how retained earnings were important in this scenario:

1. Funding Growth: The company used its retained earnings to fund research and development, hiring top talent, and expanding its product line. This allowed it to develop new software products and improve existing ones, staying competitive in the tech industry.

2. Market Expansion: As the company grew, it decided to enter new geographic markets. Expanding to international markets required a significant investment in infrastructure and marketing. Retained earnings again provided the necessary capital to support this expansion without taking on excessive debt or diluting ownership by issuing more shares.

Wondering how you can fund your Market Expansion?

Ask Gary our financial expert!

3. Acquisitions: Recognizing the need for diversification and innovation, the company decided to acquire a smaller tech startup that had developed cutting-edge technology. Retained earnings were used to fund the acquisition, providing the company with access to valuable intellectual property and talent.

4. R&D Investment: The tech industry is fast-paced, and innovation is crucial. The company allocated a substantial portion of its retained earnings to research and development, allowing it to create new, disruptive products that gained market share and drove revenue growth.

5. Weathering Economic Downturns: During a recession in the broader economy, the company’s industry experienced a slowdown. While revenues temporarily decreased, the company’s healthy reserve of retained earnings allowed it to maintain operations, retain employees, and continue investing in the business. This put the company in a stronger position to rebound when economic conditions improved.

In this example, retained earnings played a pivotal role in the company’s growth and resilience. They provided the necessary financial resources for expansion, innovation, and acquisitions.

Moreover, they ensured the company’s financial stability during economic downturns, all of which contributed to the company’s long-term success and value creation for its shareholders.

Click here to watch a video – How to Figure Out Retained Earnings?

Can retained earnings be negative?

Yes, retained earnings can be negative. This situation occurs when a company’s accumulated losses and dividend payments exceed its cumulative profits and other positive adjustments to retained earnings over time.

In other words, if a company has experienced consistent losses or has paid out more in dividends than it earned in profits, its retained earnings can turn negative.

There are several reasons why a company’s retained earnings might become negative. Some of them are:

- Sustained Losses

If a company incurs losses over multiple reporting periods, it subtracts these losses from its existing retained earnings. Over time, these accumulated losses can cause retained earnings to go negative.

- Large Dividend Payments

If a company pays out significant dividends to shareholders, it may distribute more cash than it has earned in profits, causing a negative impact on retained earnings.

- Accounting Adjustments

In some cases, accounting adjustments or revaluations, such as asset impairments or changes in accounting methods, can also reduce retained earnings.

A negative retained earnings balance is a sign that a company has not been profitable or has distributed more to shareholders than it has earned in profits. While negative retained earnings do not necessarily indicate financial distress on their own, they can be a cause for concern for investors and lenders.

Consequently, companies with negative retained earnings may face difficulties in attracting investors or obtaining credit because it suggests that the company has not been able to generate profits or has significant obligations to shareholders.

However, negative retained earnings are not necessarily a permanent issue. A company can work towards restoring positive retained earnings by generating profits in subsequent periods and potentially reducing dividend payments.

Further, negative retained earnings can also be projected to attract funding, if the company can convince investors about its expansion plans or launching new innovative products or services.

Whatever may be the case, it’s essential to assess the company’s financial situation and the reasons behind the negative retained earnings before making conclusions about its financial health.

Have questions about your business’s position on retained earnings? Don’t keep wondering. Connect with us and get them answered now by our professional accountants and bookkeepers with 12+ years of experience.