Bookkeeping is simple but time-consuming.

It is one of the many tasks that small business owners do themselves, at least in the early stages of the business when cost-saving is necessary for survival.

However, as the business grows, so does the volume and complexity of data.

This is when the business owner must decide whether to continue spending valuable hours on the desk, tracking every transaction to the tee, or to delegate this responsibility to someone reliable, and instead, focus on core business activities and drive strategies.

While delegation is inevitable, you can also automate your bookkeeping using inexpensive bookkeeping or accounting software.

Let’s explore accounting software as an inexpensive bookkeeping alternative for small businesses.

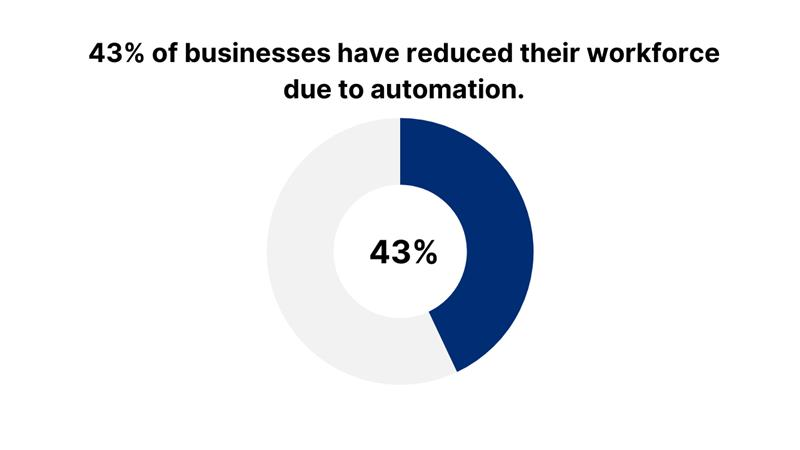

- 43% of companies have reduced manual workload through automation.

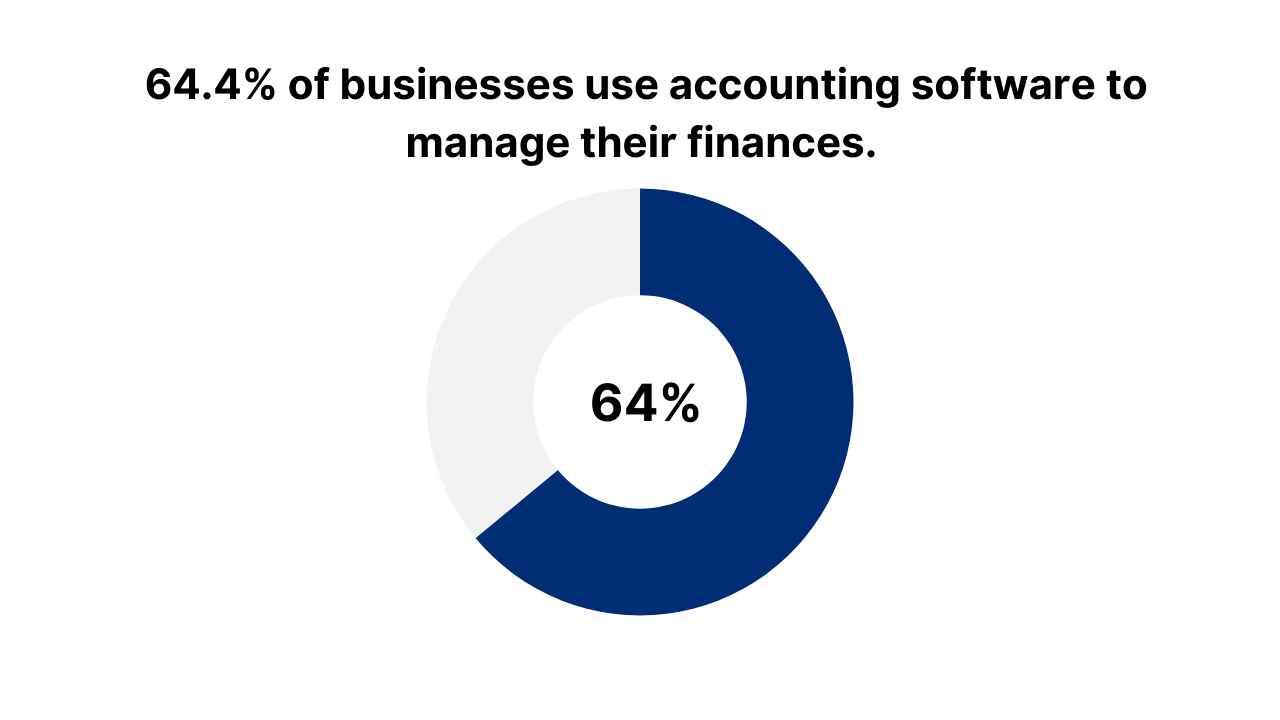

- 64% of businesses use accounting software to manage their finances.

- Bookkeeping is a business function that helps track daily transactions for financial analysis.

- QuickBooks Online, Sage, FreshBooks, Wave, and Xero are inexpensive bookkeeping alternatives for small businesses.

Importance of bookkeeping for small businesses

Budget-based bookkeeping is as crucial for a business as breathing is for living.

By definition, bookkeeping is the act of monitoring and tracking every business transaction and categorizing it for financial analysis.

While most businesses start with manual bookkeeping, they gradually adopt more contemporary methods like accounting software.

It reduces manual effort and replaces it with automated accounting, saving you time and money.

It frees you up to focus your attention on growing your business.

Automation is necessary to thrive in this digital age.

43% of businesses have reduced their workforce due to automation. They have decreased business expenses by opting for technology, the most cost-effective alternative.

It has also helped businesses expand their specialized tasks.

Today, 64.4% of businesses use accounting software to manage their finances.

Accounting software gets an edge due to its ability to give you a holistic approach to managing finances.

It supports you with bookkeeping and accounting but also provides help with payroll management and other HR-related tasks.

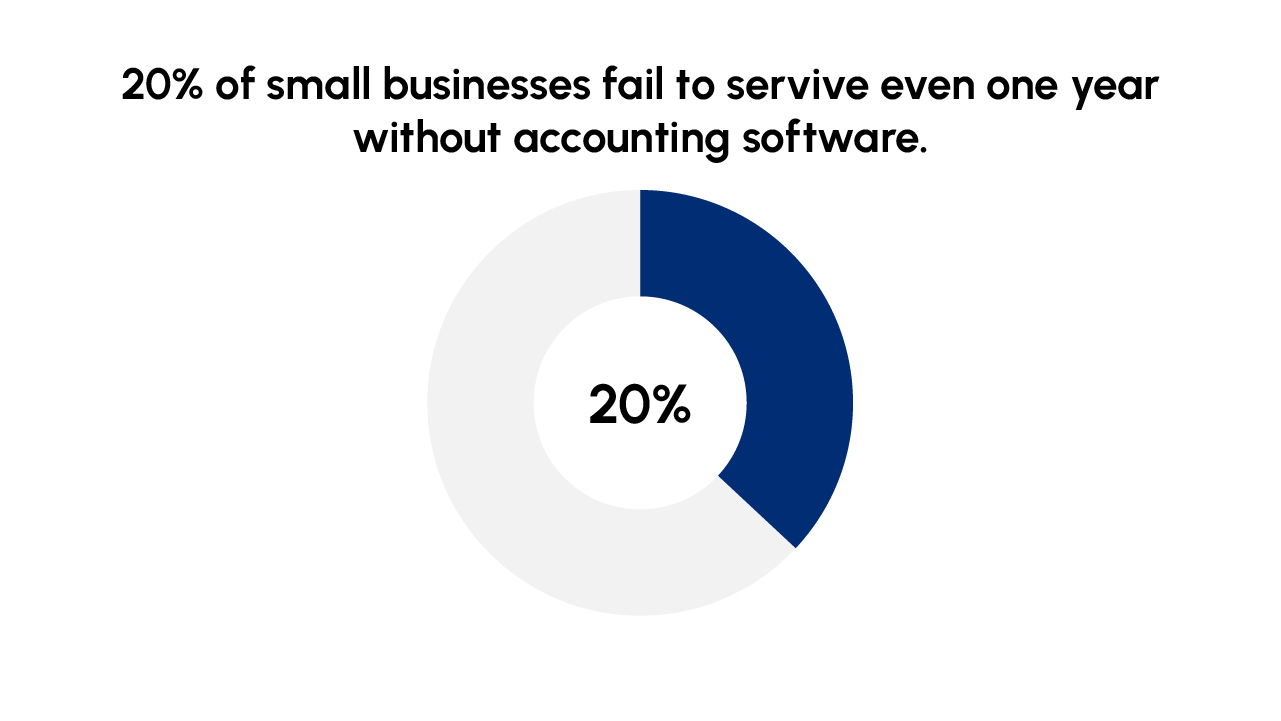

Using accounting software makes sense because 20% of small businesses fail to survive even one year without it.

All you have to do is choose a software with features that align with your business needs.

Top 5 accounting software for bookkeeping

QuickBooks Online is the most popular tool in every small business owner’s accounting kit.

The highly functional features are easily customizable, giving you several add-on options.

Other accounting software fails in comparison to its user-friendly interface which works even better on mobile devices.

While it may be slightly on the higher end for a startup, it wouldn’t be a problem if you have a budget for technology.

Let’s explore its pros and cons to help you evaluate QuickBooks Online even more thoroughly.

1.QuickBooks Online for small businesses

QuickBooks Online is the most popular tool in every small business owner’s accounting kit.

The highly functional features are easily customizable, giving you several add-on options.

Other accounting software fails in comparison to its user-friendly interface which works even better on mobile devices.

While it may be slightly on the higher end for a startup, it wouldn’t be a problem if you have a budget for technology.

Let’s explore its pros and cons to help you evaluate QuickBooks Online even more thoroughly.

| Pros | Cons |

|---|---|

| Cloud-based technology: It is a cloud-based technology that allows quick and easy access to financial data from anywhere. It only requires an internet connection. | It’s a learning curve: It is a learning curve for startup businesses, making the process of setting it up slightly more time-consuming in the early stages. |

| Free trial: QuickBooks offers a free trial period so you can test and get hands-on experience before making a full commitment. | Lacks industry-specific features: While QuickBooks offers a wide range of features, it does have its shortcomings. For example, it doesn’t have payroll. Thus, make sure you check industry-specific features before subscribing. It also doesn’t offer barcode scanning and other e-commerce integrations. |

| Wide range of features: It offers a wide range of accounting features, like accountable payables, account receivables inventory management, invoice generation, bank reconciliation, expense tracking, etc. | Lacks comprehensive financial reports: QuickBooks does offer financial reporting features but they are quite simple. If you prefer comprehensive reports for higher transparency and in-depth analysis, QuickBooks may not suffice. |

| Online payments and invoices: Clients and vendors can easily view invoices and make payments online. It makes communication and payments seamless. | Lack of support: You might struggle as it lacks customer support. If you need support with third-party integration, you’d have to involve the third party and not QuickBooks for direction or support. |

2. Freshbooks for micro businesses

FreshBooks is a simpler version of QuickBooks and can be a great starting point for any small business.

Despite being user-friendly and simple, it manages to offer a wide range of features, like double-entry accounting.

While it is perfect for businesses with one or two users, it can work just fine with more.

It is ideal for micro businesses for basic bookkeeping, like monitoring bank accounts, accepting payments, and tracking expenses.

It also offers complex and industry-specific features like mileage and time tracking.

Here is the list of its pros and cons.

| Pros | Cons |

|---|---|

| User-friendly: FreshBooks is simple and easy to use making it an ideal choice if you function intuitively. | Additional user cost: While it is extremely affordable for a single user, it does increase in price should you add additional team members. |

| Affordable: FreshBooks is extremely affordable, especially its lower-tier plans. | Less customizable: While accounting software is supposed to be a tailored business solution, FreshBooks is not. This causes a major hindrance for large businesses. |

| Complex features: It easily handles complex features, such as double-entry for comprehensive financial reporting. | Not for larger businesses: This accounting software isn’t suitable for businesses with more than two users. |

| Ideal for entrepreneurs: If you are running the business solo, FreshBooks will be your ideal accounting partner. |

3. Sage for tracking inventory

Sage accounting is for businesses requiring solid inventory management functionality.

It is ideal for companies looking for high-end customizability and data capacity.

It is the most comprehensive accounting system that allows you to go one step further, helping your growing initiatives.

It has built-in connections that provide remote support.

While it’s dated in the way that it doesn’t provide mobile support, you can use it only via desktop or laptop, it is still a powerful accounting software.

Let’s look at its pros and cons.

| Pros | Cons |

|---|---|

| Free trial: Sage provides a free trial to explore its features and get a first-hand experience before you fully commit to either of its plans. You can evaluate whether or not it has the features to suit your business needs. | Complex: Setting up Sage can be complex. It is time-consuming and requires professional support. Therefore, its implementation phase is longer than most. |

| In-depth reporting: Sage offers comprehensive reporting features that help you analyze your business finances. You can use it to generate balance sheets and monthly, quarterly, and annual income reports. It is ideal for determining cash flow problems. | Potential workflow inefficiency: While Age has a wide range of features, they are often complex, causing hindrance in your workflow efficiency. Users take time to understand the system, a problem that can make you lose interest in the software pretty easily. |

| Robust inventory support: It offers strong inventory tracking features that allow you to manage your inventory to avoid dead stock and make informed buying decisions. | Busy interface: Sage has a cluttered homepage – there’s simply too much going on. You can easily get intimidated just by looking at the features and their complex usage. |

4.Wave for invoice generation

Wave is ideal for freelancers and sole proprietors.

It performs several accounting functions, like invoice generation.

You can use this software should you have a few employees working under you.

It comes with integrated payroll and double-entry tools, making it ideal for industry-specific operations.

Although it is mostly free, it has recently introduced $8 charges per month for accessing additional features, like scanning expense receipts.

What gives Wave an edge is its ability to support multiple currencies.

What makes it slightly disappointing is the fact that it doesn’t offer time-tracking tools or mobile access.

Let’s explore its pros and cons.

| Pros | Cons |

|---|---|

| Simple: Wave is a simple accounting solution for small businesses and freelancers. | No third-party integrations: It is a simple accounting software that offers zero third-party integrations or advanced accounting tools, like mileage and time tracking. |

| Free plan: While it has recently launched an $8 plan, it does offer a free plan with limited features, like invoicing and customizable payment templates. | No live support: Its free plan doesn’t offer any live support. |

| Mobile app: It has a dedicated invoicing application for smartphones. | No audits: Audits are necessary for financial management. This accounting tool cannot offer financial audits. |

5. Xero for small businesses with multiple services

Xero offers a wide range of financial features and integrative functionality.

It allows you to track your sales revenue, expenses, bills, and inventory. It offers payroll support and allows you to generate and analyze financial reports.

Xero supports artificial intelligence, helping you automate different accounting tasks.

It is ideal for small businesses looking for integrated features, like reporting tools.

You can use it to track your fixed assets.

While it isn’t suitable for sole proprietors, it is ideal for growing companies with limited budgets.

Let’s look at some of its pros and cons.

| Pros | Cons |

|---|---|

| Real-time reconciliations: Xero is simple, automatic, and provides real-time bank reconciliation. It simplifies the process, allowing you to synchronize financial data in real-time. It reduces manual entry and saves you tons of time. | Lacks advanced features: Xero lacks advanced inventory tracking features, failing to support businesses with complex inventory needs. |

| Invoicing: You can use Xero to quote, calculate, and process orders. It integrates easily with accounts receivables and improves your financial workflow. | Limited support for different currencies: Xero doesn’t provide extensive support handling multi-currencies. It may even restrict access to certain features with lower-tier plans. |

| Scalability: Xero offers a bunch of features that help you scale with time. It accommodates according to your accounting needs, ensuring efficiency every step of the way. | Lacks built-in debtor chasing: A built-in debtor chasing is a feature that helps businesses follow up on unpaid invoices. This may look like an additional administrative budget. |

3 tips for choosing the right accounting software

Understanding why you need an accounting software is important.

With so many options available, why should you opt for Xero, QuickBooks Online, or any other software?

It all bottles down to your business needs.

But apart from your core business needs, there are a few considerations that you can’t overlook.

Here are three essential tips for choosing the right accounting software for your small business.

1. Scalability

You have to evaluate whether or not the accounting software you choose has the ability to handle large amounts of data.

Some accounting tools have limited capacity and can cause problems with complex financial data.

You want accounting software that works well in both scenarios.

It should have features that support your growing business needs.

Today, you might have to pay ten vendors but tomorrow that number could go up to 100.

So make sure you choose software that is flexible and ready to grow with you.

2.Budget

Of course, the main reason you opted for this alternative is to save cost while also getting your work done.

It is important to select software that offers features to meet your bookkeeping needs but also doesn’t cost you an arm.

If you like the features of any accounting software, look at its different subscription plans.

Ideally, it’s best to opt for the annual subscription plan as it saves you more money.

3. Security

No matter how appealing software may look to you, never compromise the security of your data.

Most cheap accounting software isn’t secure.

Thus, be mindful and look for online reviews before subscribing to any bookkeeping service or choosing an accounting tool.

The bottom line

Bookkeeping is an essential part of accounting for small businesses.

While it may seem like an additional cost to some, there are inexpensive bookkeeping alternatives available.

QuickBooks online is an ideal option for small businesses with a learning curve, FreshBooks is ideal for sole proprietors.

Xero is great for businesses in their growing phase, Sage handles inventory management.

With so many cost-effective solutions, it is important to analyze your business needs budget to make the right decision.

You can also outsource your accounting to Ledger Labs.

We have 12+ years of experience helping businesses across industries and catering to different business needs.

Book a consultation appointment with us to get to know more.