Starting a business is both exciting and nerve-racking.

While running your own business allows you to control your professional life, it can quickly feel too overwhelming, causing you to lose control over your finances and other aspects of your business.

This usually happens when you don’t know enough about tax preparation and filing.

You may be passionate about your business because you love your product and understand its value in the marketplace.

But administrative responsibilities can easily take a toll on you.

And that is exactly why you have accountants and accounting tools to help you.

Contrary to popular belief, you don’t need to spend millions of dollars on it.

Let’s explore inexpensive tax filing solutions for your small business.

- Tax filing is an exhausting process that can be easy once you know your business entity and the form you must use to file your tax return.

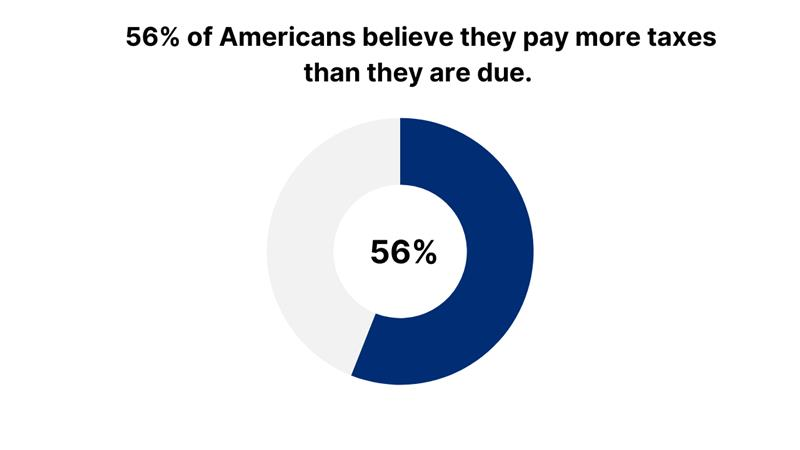

- 56% of Americans pay more taxes than they are due.

- Prioritize your bookkeeping and daily accounting to ensure accurate tax filing.

A quick guide to small business taxes

- 56% of Americans believe they pay more taxes than they are due.

- 34% believe they pay the exact amount.

- 8% claim they pay less than their fair share.

By evaluating the numbers, you can see that most business owners don’t know what they are doing—a risky situation to work in.

The IRS can knock on your door at any time and demand an audit.

You don’t want to make careless mistakes and get a hefty fine because you didn’t know enough about tax filing.

Tax compliance is the one aspect of your business where you shouldn’t hesitate to seek help.

You can outsource your tax preparation to a reliable service provider or simply opt for an inexpensive route and invest in tax filing software.

In addition, you must learn the basics yourself. For example, what is your business entity type?

It helps you determine the tax form you have to use to file your tax return.

It also reminds you of the deadline and financial requirements you need to submit.

Types of business entities

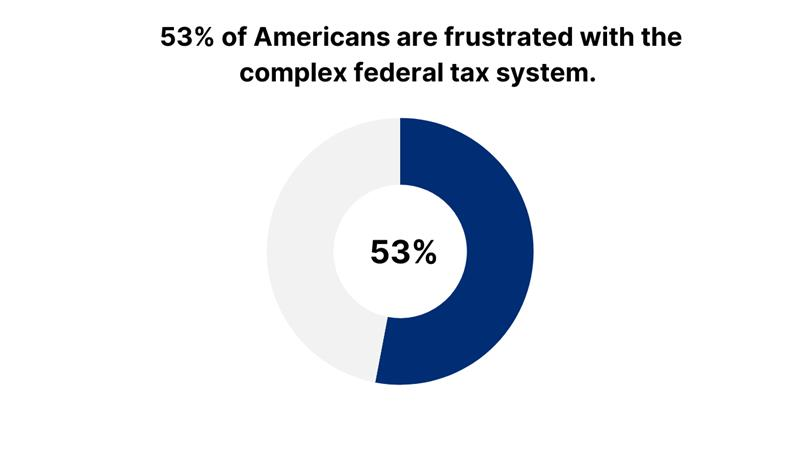

Approximately 53% of Americans are frustrated with the complex federal tax system.

Let’s make it simple by understanding the common types of business entities.

It will help you determine which tax form you need to file.

Sole proprietorship

The sole proprietorship is subjected to individual income tax and self-employment tax. This is also applicable to businesses running on partnerships.

S Corporation

S corporations fill out Form 1120-S as the shareholders are paid dividends acting as their salary.

C Corporation

C corporations are taxed on a corporate level, which makes every shareholder an employee. Here, payroll taxes are applicable to individual salaries. You will be using Form 1120.

The 4-step guide to filing taxes

Tax filing is complicated, making it impossible for a new business owner to get a hang of things with the word go.

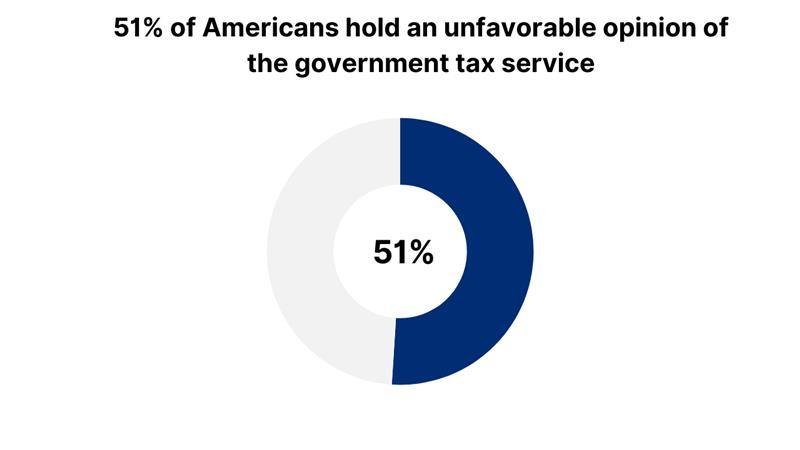

About 51% of Americans hold an unfavorable opinion of the government tax service as they believe the system is unnecessarily complex.

We have explained the process in four steps to make it simpler to understand.

Step 1: Gather financial records

You have to collect all your financial records beforehand to simplify your tax filing process.

Here’s the list of all the financial data you need:

- Business expenses: showing cash outflows

- Income: indicating cash inflows

- Profit and loss: A simple record of all your earnings and any loss that you incurred

- Salaries: All the salaries you credited in your employee’s bank accounts or checks you’ve generated.

Basically, you need to have all the receipts, deposit slips, bank statements, and invoices as proof. They will be compiled and submitted along with your tax report.

Step 2: Find the applicable form

Here’s when it gets complicated.

Tax preparation in the US involves filing different types of IRS forms. The one you have to fill out depends on your business entity and the number of employees you have or don’t.

Here are some of the common forms:

| Tax Forms | Purpose |

|---|---|

| Schedule C with Form 1040 | Sole proprietorship or single-person LLC |

| Schedule SE with Form 1040 | Self-employed individuals |

| Form 1120 | C or S corporations |

| Form 1065 | Partnerships |

| Form 940 | Federal unemployment tax |

| Form 941 | Social Security and Medicare |

Step 3: Know your deadlines

It is important to file your tax returns on time. You can risk hefty penalties that can eat up your entire profit by missing the deadline.

The deadlines are both quarterly and annual. Here are some important dates to remember.

| Dates | Who Should File the Forms? |

|---|---|

| January 31st | All employers to submit Form 940 |

| March 15th | All partnership-based businesses to submit Form 1065 |

| April 15th | Annual filers to submit their forms, including corporations by filing Form 1120 and Form 1040 |

Step 4: File your taxes

Now file your tax returns and avoid the risk of hefty penalties.

The IRS demands 5% of the unpaid taxes every month should you delay your payment or miss the deadline.

Top 4 tax filing software for small businesses

Here is the list of the top 4 tax filing software for small businesses.

- TaxSlayer for startups :- TaxSlayer is a cheaper option on this list offering one-on-one support through its “Ask a Tax Pro” feature. It allows you to speak to a tax expert who can offer extensive tax advice.

There is a 100% accuracy in tax filing reports. Should there be any defaults, the software is ready to reimburse you with penalties or interest.

In addition, you get a refund guarantee.

You can avail of audit support services if there is a case of an IRS inquiry.

Make sure you use the discount code to leverage the low-tier plans.

- H&R Block for basic tax filing :- With H&R Block you get a step-by-step tax filing guide that is simple and easy to follow.

You can demand video support and get assistance with online plans.

In addition, you can speak to a tax expert with a minimum of 10 years experience. However, you’d have to pay an additional fee for it.

What gives this software an edge is that it allows you to meet up with a tax expert in person.

You get a maximum refund along with audit support and help to deal with an IRS notification.

- TurboTax premium for filing complicated tax returns:- Turbotax is a user-friendly tax filing solution that offers step-by-step guidance in a Q&A format. This makes it simple and easy to follow.

You can demand a final review of your tax report before submitting it.

It offers support from tax experts for tax preparation. You can sign and file your returns rest assured it is accurate and consistent.

You can even avail of audit support should you receive an IRS notification.

While it is relatively expensive due to costly plans and additional costs, it is your all-rounder solution to tax filing.

- FreeTaxUSA for free tax filing:- If you opt for federal income tax filing, this software offers the service free of cost.

You can opt for the Deluxe Edition to get audit defense support. It gives you a representative to help you with IRS audits on your federal tax return.

You can benefit from a refund guarantee should there be any miscalculation or problems with your tax return.

It guarantees 100% accuracy and in case of failure, you will get full reimbursement for the penalty.

It does have a fair share of problems like you can’t import your W-2 form automatically. You must do it manually.

Also, state-level tax filing is not free; you’ll have to pay $14.99 for the support.

The live chat version is only available on the Deluxe Edition.

3 best practices for accurate tax filing

Here are the three best practices for accurate tax filing.

- Prioritize bookkeeping:- Budget bookkeeping helps you track and monitor your finances. This is why you must make it a daily practice.

Regular bookkeeping helps you avoid mistakes; integrate an automated system to reduce the chances of errors.

Human error is responsible for 41% of mistakes in financial reporting.

With accounting software in place, you don’t have to spend hours on your desk, filing spreadsheets and getting exhausted.

Instead, you avoid manual errors by automating the entire bookkeeping process. - Understand sales tax requirements:- Sales tax requirements are complex. This is especially true if you run an online business.

I’d highly recommend you get help from an accountant and learn about your sales tax liability.

Here’s what you should know about sales tax – it depends entirely on a rule known as nexus.

Nexus means that your business is attached to the state. So, you will collect sales tax from there.

Now, here’s where things get complicated.

Your business might operate in more than one state, indicating more than one nexus.

Let’s simplify.

You have an office, its employees, a warehouse, and probably a shop where you showcase your products. You might also have a storage inventory.

You will collect sales tax from locations your business operates from.

Tax laws are different in every state, so be sure to seek professional tax advice.

They can give you an in-depth explanation of how to file your sales tax returns. - Find the right accountant for your business:- You must hire an accountant that understands your business.

It is best to outsource your accounting needs to someone with experience in the same industry.

It will be even better if you hire someone who has worked for the same business entity as you.

They can guide you through the various tax preparatory steps for accurate tax filing.

The bottom line

Tax filing is serious business.

File accurate tax returns by gathering all financial records and filing the correct tax forms before the deadline.

The process becomes easy when you know which tax form to file your tax return. Make sure you know your business entity and structure to find the right form.

Tax filing becomes inexpensive when you use tax filing software like TaxSlayer and TurboTax.

You can also outsource your tax filing needs to Ledger Labs.

We have 12+ years of experience in the field, helping businesses file their tax returns.

Book a consultation appointment with us to find out more.