1. Financial audits ensure compliance with regulations, verify accuracy in financial reporting, and build trust among stakeholders by demonstrating financial integrity.

2. Internal, external, and forensic audits serve distinct purposes—ranging from compliance and fraud detection to evaluating operational efficiency.

3. Businesses are often required by law to conduct audits, especially public companies or those seeking loans, to ensure adherence to accounting standards.

4. Audits enhance decision-making by providing stakeholders with accurate financial data and highlight operational areas requiring improvement.

5. Effective audits require organized records, robust internal controls, and cooperation between management and auditors.

Every business you know has financial reports with them, like balance sheets and income statements.

They primarily enable companies to show their financial well-being to people like employees, investors, and analysts.

In order to check whether these reports are totally accurate, people get in close touch with auditors. But, what exactly are financial audits?

Well, a financial audit is basically an independent evaluation of a business’s financial reports and processes. Auditors usually closely examine the business’s financial transactions and overall operational improvement.

The role of the auditor (a skilled third party) is more than just verifying how accurate the financial statements are. They also help enhance the confidence of several stakeholders in the business’s financial operations and integrity.

But, even that’s not the full picture. What is a financial audit in depth and why is it even necessary? What’s, in fact, the purpose of it? Read this blog post about a financial audit checklist, and you will have all the answers to your lingering questions about a financial audit.

Importance of Financial Audits for Businesses

Financial audits are undeniably important for any form of business, big or small. Here are some reasons you need to be aware as to why they are important:

- Improved credibility: Audits do offer an independent verification, or just a perspective, into the company’s financial statements. This, in return, only makes the information for investors, analysts, lenders, and shareholders more credible.

- Regulatory compliance: Financial audits are a big help to ensure a business fully complies with all legal rules and accounting standards. This is one of the major ways through which businesses can avoid any future pitfalls or legal repercussions.

- Attracts funding and investors: Reliable financial audits and records often attract the investor’s eye, making it rather easier to secure loans. In other words, it gives a certain sea-level assurance to outsiders about how proper and accurate the financial data of a company is.

- Boosts financial management: Audits are one of the powerful ways to recognize potential weaknesses that can jeopardize the state of internal controls and financial reporting of a business. This is actually quite helpful to understand and improve the financial management of a company.

- Fraud prevention: Audited financials can be useful in identifying anomalies and ongoing frauds within the organization. Once you identify these risks early on, it becomes far too easy to take the right measures to prevent any significant financial losses or damage to your reputation.

8 Types of Financial Audits

Financial audits can be classified into many types, each with a distinct purpose. Here are the primary types of financial audits:

- External audit: This is a type of audit conducted by an independent or a third-party auditor. In fact, it is one of the most common ones as well. Largely, it focuses on the fairness of a business’s financial statements. Moreover, these are essential for external audits and are usually required for public companies.

- Internal audits: Internal audits are carried out by a company’s own staff, as opposed to external audits. This is more focused on reviewing the efficiency of internal controls.

- Statutory audit: This is basically a legally vital review to check how accurate a company’s financial records are. It aims to check out whether an organization exhibits a fair view of its financial performance, typically dictated by federal laws.

- Tax audit: This is the type of audit that mainly focuses on a company’s tax returns and compliance with tax regulations. In fact, these kinds of audits are carried out to make sure that a business’s tax payments and financial records are accurate and compliant with local tax regulations. Read more about Sales Tax Compliance outsourcing.

- Forensic audit: This is a type of audit that looks for proof of financial crimes like embezzlement, fraud, or other offenses by going through a company’s financial records. Furthermore, forensic audits are usually conducted in cases of any underlying suspicion of illegal financial activity.

- Compliance audit: This audit specifically looks at whether a company is actually adhering to the standards and regulatory policies. Compliance audits become vital for businesses that keep functioning in highly regulated sectors, like healthcare and finance.

- Information system audit: Otherwise called the IT audit, this is a type of audit that focuses mainly on the controls within a business’s IT infrastructure. It checks out answers for some regular questions that may come to mind. For example, is the system reliable and secure? Can it maintain data integrity?

- Operational audit: Operational audit primarily focuses on estimating the efficacy and efficiency of every part of an organization’s operational procedures and methods. Its scope is wider than that of other audit types.

Special offer unveiled - free business audit!

Consult our accounting experts.

The Purpose of a Financial Audit

The primary goal of a financial statement audit is to be extra confident about your business’s financial standing. The result of the audit is also highly important for certain external bodies, including suppliers, creditors, investors, and sometimes, customers.

Here are some major purposes of a financial audit:

- Ensuring accuracy and reliability of financial statements: This can involve anything, including the verification of the information and making sure what it states is genuine.

- Assessing compliance with laws and regulations: Financial audits often help us examine whether a company has been abiding by all the related accounting regulations and laws.

- Detecting and preventing fraud: This is just one of the most known and influential areas of a financial audit. In other words, it helps in recognizing any fraudulent activities or certain gaps in the financial records. This is highly integral, as it saves businesses from the jeopardy of losses or malpractices.

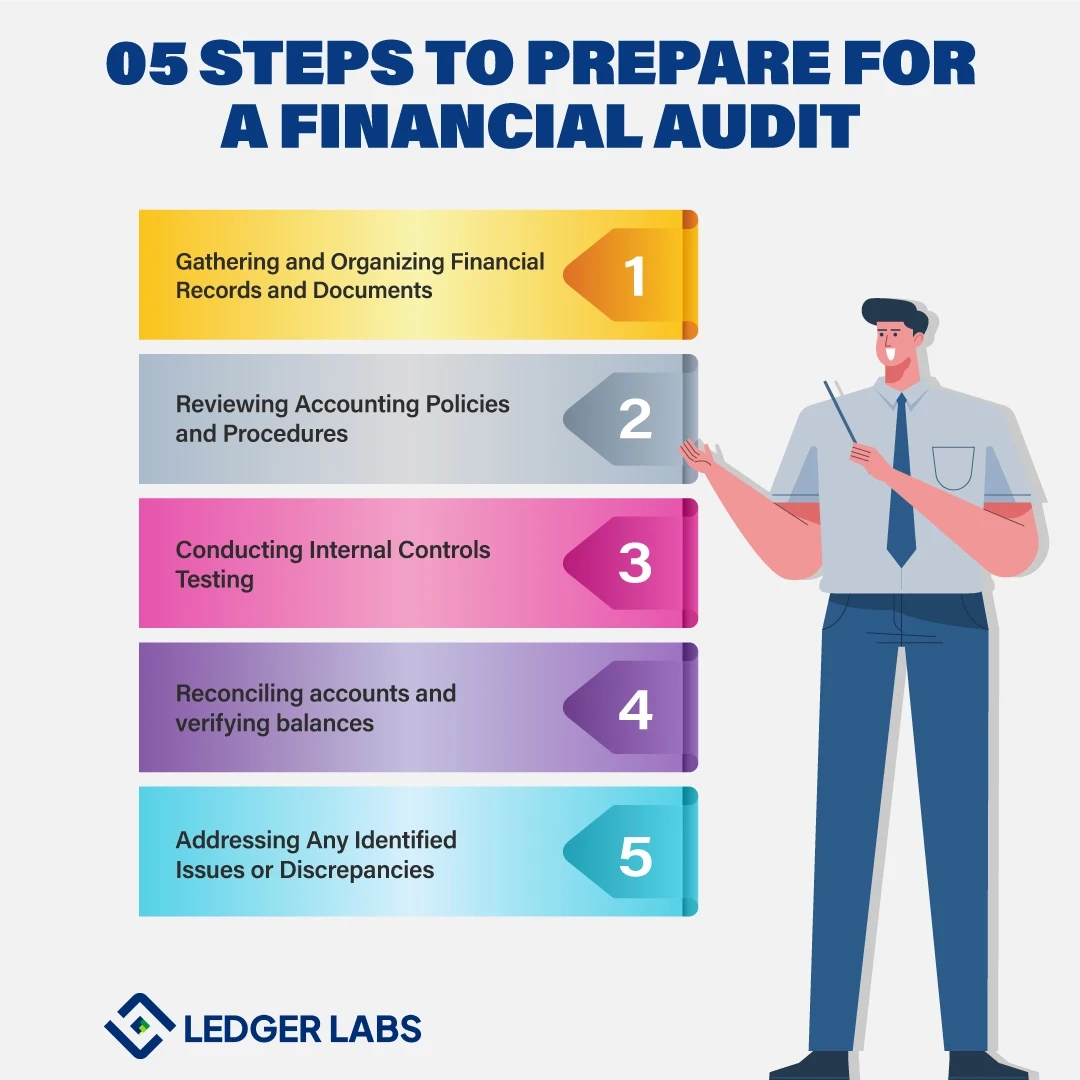

5 Steps to Prepare for a Financial Audit

Here are 5 key steps that you need to be aware of in case you want to prepare for a financial audit:

- Gathering and Organizing Financial Records and Documents: This is the very first step. It is about drafting all the important financial records, including but not limited to balance sheets, income statements, and cash flow statements, among many more.

- Reviewing Accounting Policies and Procedures: In this step, you would actually want to review the company’s accounting practices and policies to make sure they have been complying with standing regulations and laws. Furthermore, this only consolidates the idea that you can make necessary adjustments in areas you find important to address.

- Conducting Internal Controls Testing: If you want to identify potential weaknesses that can impact the accuracy of financial reporting, start testing how efficient the internal controls are. This can be anything between examining the processes in line for authorizing transactions, protecting assets, and guaranteeing accurate financial reporting.

- Reconciling accounts and verifying balances: This step is vital because it helps to verify that all transactions are accurately documented and that account balances show the company’s financial situation fairly. Read more about balance sheet reconciliation.

- Addressing Any Identified Issues or Discrepancies: This is the last step you should be aware of. You need to make sure you are identifying any problems, underlying issues, errors, or gaps during the preparation process. In this case, you may need to make a few handful adjustments to financial records, enhance internal controls, or rectify the errors on financial statements. In essence, this just helps to exhibit the company’s appropriate financial position.

Importance of Maintaining Proper Documentation

Proper documentation is often the silver lining in many cases, starting from a mere internal audit to a big one. It helps you discover how transparent, clear, and accountable you are. Here is why maintaining proper documentation is incredibly important:

- Providing evidence to support financial transactions: Proper documentation is often a very straightforward and concrete method that helps support evidence for financial statements. Moreover, it can help you verify how genuine each transaction is. On top of that, it helps to know if all financial transactions are reasonably documented and traceable to their original source.

- Enhancing transparency and accountability: If you keep documentation, it just goes to enhancing the transparency of your business’s financial practices. Again, it guarantees that every financial transaction can be traced back. Thus, it helps to push the level of accountability within the walls of the company.

- Facilitating efficient audit processes: There is absolutely no doubt that well-maintained and structured documentation can streamline the audit process more. In this way, auditors can quickly access and analyze all integral documents, translating in a more fruitful and efficient audit in place. In addition, it simultaneously mitigates the likelihood of gaps, errors, and discrepancies since every piece of information is well-documented and easy to verify.

Want a quick assessment of your financial records from our accounting experts?

Collaboration with Auditors during the Audit

You need to understand that it is imperative to work together with auditors because it can substantially influence the efficiency of a financial audit. Here’s what’s needed from your end during the audit process:

Cooperating and facilitating auditor requests

A cooperative attitude toward the auditors is the first step towards effective collaboration. This can be anything between promptly responding to their requests for extra information, allowing access to different requests they put forward, and ensuring they have all the necessary information to conduct the audit effectively.

Addressing auditor inquiries and providing additional information when needed

Always keep an open line of communication with the auditors. In fact, it is highly important to respond to questions that come from auditors and provide them with all the information they need to understand the statements and records better.

Following up on audit findings and implementing necessary improvements

After the audit, take the time to follow up on the recommendations that the auditors make. When you enhance the organization’s financial health and integrity, it requires putting their feedback into practice and making vital improvements, adjustments, or corrections.

In Summing Up

If you want to keep your business financially healthy, you will have to look into precise financial reporting. However, if you want to stay totally accurate and avoid red flags, try having an independent review of your financial data to get the best results. This is basically what we call audited financial statements.

Contrary to common belief, audits are not always as harmful and problematic as people deem them to be. In many cases, it is just a health check-up of how your finances are doing. In fact, if you do a routine check, it just makes sure that the figures and procedures are in perfect shape.

Still not sure how to prepare for a financial audit? Let us help you. Our in-house accounting and bookkeeping experts have more than 12 years of experience solving problems around a financial audit. Get in touch now.