While most beginner-stage businesses manage their finances during the initial stages, the need becomes increasingly obvious as the data becomes more complex.

You would really be taking a risk if you hire a generalist accountant instead of someone with specialized skills.

Here’s why you need an accountant for your e-commerce business, one capable of understanding the complicated e-commerce landscape.

- An e-commerce accountant helps businesses with sales tax compliance and other tax obligations.

- It’s time to hire an e-commerce accountant if your inventory has become too complex and you’re planning to expand your business.

- A general accountant has poor industry knowledge and is ill-equipped with inventory management.

Why an e-commerce accountant is the best choice for your business?

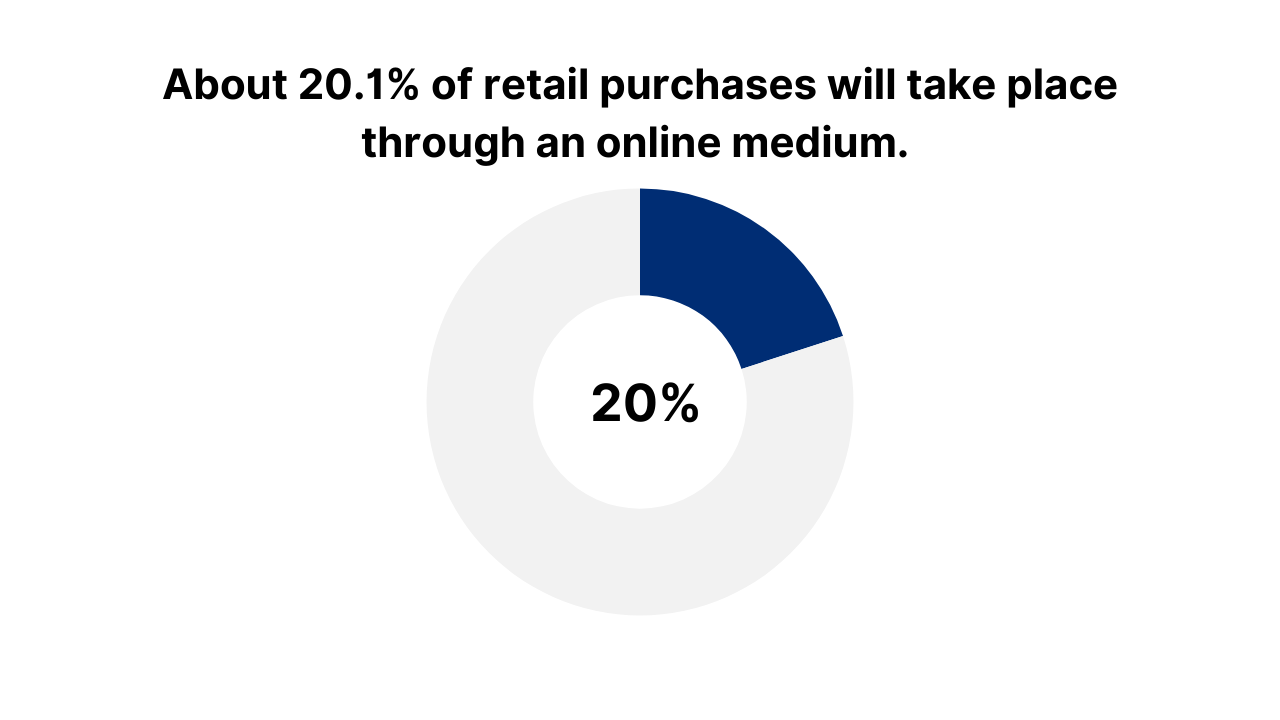

The global ecommerce sales are forecast to grow to $8.09 trillion by 2028.

And about 20.1% of retail purchases will take place through an online medium.

With the continuous growth in the e-commerce market, the need to hire a specialized accountant cannot be emphasized enough.

Businesses interested in gaining a competitive edge can achieve this by hiring an accountant with specialized skills in the e-commerce industry.

But before hiring one, you must know what to expect of them.

An e-commerce accountant is someone well-versed in online businesses. They focus on managing inventory, optimizing cash inflows and outflows, and handling complex sales tax regulations.

They have the skillset and education to handle challenges specific to the e-commerce industry as they constantly strive for operational efficiency, maximized profits, and tax compliance.

Key responsibilities of an e-commerce accountant

Businesses seek e-commerce accountants for bookkeeping, accounting, and other financial services.

They help in the preparation of financial statements, such as income statements and balance sheets.

Whether it is tax preparation or advice on cost reduction, an e-commerce accountant offers support in strategic financial planning. They have industry insights to help you forecast trends and develop budgets.

If you’re considering hiring an e-commerce accountant, here are some responsibilities you can expect them to handle for your business.

1. Cash flow optimization

Most businesses fail due to poor cash flow management. It is important to keep track of the daily transactions, and basically, monitor all the money that comes in and out of the business.

This way, you ensure that you have sufficient funds to continue regular operations without any hindrances.

Thus, an e-commerce accountant handles your cash flow, tracking and reconciling all the transactions. It helps improve your cash flow management and support growth initiatives.

2. Inventory management

An ideal accountant with e-commerce experience would help businesses track inventory levels and the cost of goods sold (COGS).

One key responsibility is inventory valuations. It helps ensure the regular maintenance of stock levels, resulting in significant cost savings as you don’t oversell or keep adding to your dead stock.

3. Tax Compliance

Tax compliance in the e-commerce industry can be tricky, especially if you’re unable to keep up with the changing sales tax laws and regulations.

An e-commerce accountant has the knowledge and experience to help you stay compliant and avoid hefty fines and penalties that can take a huge bite out of your profit.

They understand tax obligations in different states and countries if your business is global.

4. Cost management

E-commerce accountants are trained to identify room for improvement.

Thus, they find ways to reduce your costs and increase profitability.

An e-commerce accountant analyzes all business processes, finding ways to make them more efficient. It helps to implement cost-saving solutions to maximize profit returns.

5. Financial analysis and reporting

The purpose of tracking daily cash flow is to maintain financial records.

An e-commerce accountant provides comprehensive financial reports and in-depth analysis.

This gives you insight into how well your business is performing.

Real-time reporting makes finance management more efficient, speeding up the informed decision-making process.

Reasons why a generalist accountant is costing your business more

While a general accountant can help manage your accounts, you need an e-commerce accountant to help you gain a competitive advantage with their industry-specific knowledge and experience.

Here are some reasons why a general accountant costs you more.

1. Lack of industry knowledge

An accountant without e-commerce experience might be excellent with basic bookkeeping and accounting but their lack of industry knowledge often leads to missed opportunities.

They might not be well-versed in handling multiple payment gateways and the nuance of tax preparation.

A general accountant could undermine the expense related to digital marketing, leading to poor online sales performance.

E-commerce businesses require accountants who understand inventory management and its related issues.

They should not only cater to physical transactions but also monitor online transactions and sales tax obligations.

2. Complex sales tax compliance

While a general accountant can help you with basic tax preparation, an e-commerce accountant can help with sales tax compliance.

An accountant with industry insights is up-to-date with the changes in tax regulations, helping you avoid risks and other pitfalls.

Staying compliant can be challenging because every state and country has different tax laws and obligations.

An e-commerce accountant carefully helps you mitigate tax penalties to maintain smooth operations.

3. Inadequate financial reporting

You need accurate and up-to-date information to make business decisions.

A general accountant has information but it’s not as detailed as it needs to be for e-commerce businesses.

This results in poor decision-making, higher costs, and missed opportunities.

An e-commerce accountant has the expertise to highlight the red flags in financial reports that directly or indirectly affect your business.

They provide detailed financial reports, including customer acquisition costs, long-term customer value, and other channel-specific metrics.

This level of detail helps in planning and taking risks. You can use it to navigate the complex e-commerce industry.

4. Ill-equipped with inventory management

Inventory is the biggest aspect of e-commerce business.

It has to be managed efficiently as slight errors of judgment or miscalculations can lead to customer dissatisfaction and overstocking.

Miscommunication or ill-informed decisions can cost you hundreds of dollars.

A general accountant is not equipped with knowledge of inventory tracking, inventory valuation, and COGS.

They struggle with managing multiple sales channels which disturbs your order fulfillment cycle.

Signs you need to hire an e-commerce accountant

Let’s look at the 3 signs that your business needs an e-commerce accountant.

1. Your business is scaling

If you are planning to expand your business or the complexity of your data has rapidly increased, it’s time to consider hiring an e-commerce accountant.

They have the skill set to handle extensive data with efficiency.

An accountant can make sure you have the infrastructure ready to take on the increased amount of data with the same efficiency as it was managed in the earlier stages.

Whether it is data accuracy, it’s consistency across channels or the efficiency of reporting, this accountant will handle all financial aspects.

An accountant with experience in the e-commerce industry can identify trends in your sales and provide cost-saving solutions.

They can even give you a heads-up when you’re moving in the wrong direction, for example, making a big investment when you’re low on cash flow.

To boil it down for you, when there are increased volumes of transactions and other financial data, an accountant prepares the business for scaling, giving the business the infrastructure it needs to grow.

2.You are entering a new market

Imagine your business is entering a new market and expecting new tax regulations to stay compliant and avoid penalties.

While you might take it leniently, the tax landscape is quite complicated. A small mistake could end you in legal trouble with the IRS.

And because you are making huge strides and not leaving any stone unturned, it would only make sense to get an e-commerce accountant on board.

They will handle the complex tax obligations, meeting tax compliance requirements of the new market. This step will ensure smooth sailing.

3.Your inventory is complex

Do you have an accountant on board who is unable to manage your inventory effectively? It’s time to find someone with the right skill set.

E-commerce accountants have industry knowledge and hands-on experience with inventory management. Integrations like WooCommerce with NetSuite can enhance your inventory management and provide adequate insights into how your business is performing.

These kinds of integrations allow seamless data synchronization between the inventory levels, online store, and centralized database.

It reduces the need to manually update your inventory every time an order is placed on your website.

This gives you real-time visibility and updates on your stock. You have all the important numbers at your fingertips, whether it is the turnover rate or the cost of goods sold.

The bottom line

An e-commerce company cannot depend on a general accountant for too long as it’s too big a risk.

Your business requires a specialized skill set that only an e-commerce accountant can offer.

An e-commerce accountant can evaluate your business and provide tailored solutions, whether it is unique financial strategies or leveraging advanced e-commerce tools.

Ledger Labs has 12+ years of experience offering e-commerce businesses accounting and bookkeeping solutions.

We also help with integrations, such as NetSuite integration with Stripe or Salesforce.

Book a consultation appointment with us today to find out more.