1. ADP serves 900,000+ businesses across 140 countries, supporting a global workforce.

2. QuickBooks Payroll supports 1.4 million small businesses, primarily in the U.S.

3. ADP offers customer service 24/7; QuickBooks Payroll provides phone support on weekdays, 6 AM–6 PM PST.

4. ADP’s plans start around $79+ $4/employee/month; QuickBooks Payroll pricing starts at $45 + $5/employee/month.

Any business, big or small, needs a flexible payroll option.

However, choosing the right payroll software can get intimidating. QuickBooks and ADP are prominent names that have gained recognition over the past years.

The credit goes to their core features and reliability. But, which is the best fit for your business?

Let’s talk about that in detail.

Understanding ADP Payroll

Starting with ADP or Automatic Data Processing, a platform for managing payroll and HR services of businesses of varied sizes. It has two variants; one platform to serve large businesses, while its RUN service is designed for small businesses or start-ups having less than 50 employees. ADP RUN can offer you basic employee payroll and tax filing. However, it offers the flexibility to grow into enterprise plans available in the main platform.

The ADP payroll software is customizable and user-friendly. Their simple, automated solution makes it easy for businesses to process payroll and taxes in minutes from any device, anywhere. Most of its key functionalities are available as add-ons. Let’s discuss some of the important features of ADP Payroll:

- Time Tracking: One of the add-on attributes of ADP that you can purchase is time tracking and attendance. It helps in keeping a record of employees checking in and checking out directly through the platform.

- Benefits Management: Another add-on feature that is highly beneficial for employees is “Benefits Administration”. You have the option to choose a retirement plan, worker’s compensation, and employee’s health insurance.

- Compliance: ADP offers SmartCompliance as an additional feature that can help your business stay compliant with constant changes in payroll tax requirements and healthcare.

- Tax Support: One of the main benefits of ADP software is that it automatically files and pays payroll taxes for you and your employees. Aside from that, it can also file W-2s for an additional fee and can deliver copies to the employees.

- Onboarding: It is another ADP’s great feature that helps new hires fill out their onboarding paperwork online before their day of joining.

- Accessibility: Businesses can easily access ADP payroll features through the mobile app. You can run payroll, add employees, or see reports in its mobile version. While your employees can only gain access to their employee portal online.

ADP Payroll Pros

- HR and Payroll plans for multiple business sizes

- Dedicated HR portal

- Fully automated full-service payroll

- International solutions

- Comprehensive employer- and employee-facing payroll apps

- Good customer reviews

- 24/7 customer service (Phone Support: Monday – Friday)

- A wide variety of external integrations

ADP Payroll Cons

- Non-transparent pricing or plans

- Additional fees can add up quickly

- Doesn’t include accounting features

- Reports can be confusing, cumbersome, or clunky

- Requires integration for syncing accounts receivable and accounts payable

Exploring QuickBooks Payroll

Now, let’s dive into what QuickBooks Payroll has to offer. A well-known software for accounting purposes, QB is perfect for small to medium-sized businesses. Those who purchase QuickBooks Online Payroll or Intuit Online Payroll can access the software’s accounting and payroll features together.

Though you can integrate QuickBooks Payroll with QBO, you can use it as a standalone product. A business with less than 50 employees can find several core features in this software. Some of them include:

- Unlimited Payroll Runs: One of the attractive features of QuickBooks payroll is that businesses can process payroll as many times as they want. That too, without paying any additional fees.

- Reporting: The QuickBooks Payroll allows businesses to gain insights into their payroll data whenever they want.

- Benefits Administration: Another key feature is that you can set various employee benefit programs directly within the QuickBooks Payroll platform. Such as retirement plans, health insurance, etc.

- Automatic Tax Filing: One of the standout features of QuickBooks Payroll is its automatic tax filing functionality. The software can perform calculations and file taxes with ease on behalf of the company.

- Compliance: Like ADP, Quickbooks Payroll also helps organizations stay compliant with ongoing changes in tax regulations.

- Employees Self-Service Portal: An important attribute of QB Payroll is its self-service portal through which employees can access their payroll-related info like pay stubs, tax documents, etc.

QuickBooks Payroll Pros

- User-friendly interface

- Unlimited payroll runs anytime, anywhere

- Offers seamless integration with QB online

- Transparent pricing plans compared to ADP

- 24/7 customer service (Phone Support: Monday – Friday)

- 30-day free trial

QuickBooks Payroll Cons

- Integration only with other QuickBooks products

- No dedicated general HR portal

- Doesn’t have time-tracking tools

- Not compatible with businesses with large numbers of employees

Unsure which is the right payroll software for your business?

Consult our expert accountants.

Comparing ADP vs. QuickBooks Payroll

When comparing QuickBooks vs ADP payroll, your business needs come into consideration. One of the major differences between the two payroll software is that ADP has more customizable options and functionalities than QuickBooks Online Payroll. On the other hand, QBO Payroll offers faster and unlimited payroll runs, along with the feasibility of complete integration with the Intuit Online software suite.

Let’s discuss the ADP vs QuickBooks payroll comparison in-depth based on various parameters.

1.QuickBooks Payroll Vs ADP Cost Compared

Intuit Online Payroll provides transparent pricing options, allowing small businesses to compare the costs of its three plans easily. These plans range of QuickBooks Payroll include:

- a) Starter Plan: Monthly: $45/month + $6/month per employee

- b) Advanced Plan: Monthly: $80/month + $8/month per employee

- c) Premium Plan: Monthly: $125/month + $10/month per employee

In contrast, ADP does not disclose its pricing information upfront. To obtain a quote, organizations must contact ADP’s sales team and provide them with the details about their business size and needs.

On ADP’s website, accessing pricing information for any of the ADP Run plans requires adding business details such as name, zip code, number of employees, and contact email.

2. QuickBooks Vs ADP Payroll Scalability and Customization Options Compared

When it comes to scalability or customization, ADP outshines QuickBooks Payroll. ADP offers tailored solutions for organizations of all sizes. So scaling up your business is made easy with ADP. In contrast, QuickBooks Payroll primarily aims to cater to smaller businesses with less than 50 employees.

As business needs become more complex with growth, ADP’s extensive features can appear invaluable. Features that make ADP a standout choice are:

- a) Various pay types

- b) Compliance with payment regulations

- c) Customizable reporting

- d) Seamless integrations

On the other hand, QuickBooks Payroll also provides basic payroll features and can integrate smoothly with accounting. It may fall short of meeting mid-sized businesses’ needs with more intricate payroll requirements. Additionally, Intuit Payroll lacks the specialized expertise to support HR management on an enterprise scale.

3. QuickBooks Payroll Vs ADP User Interface and Ease of Use Compared

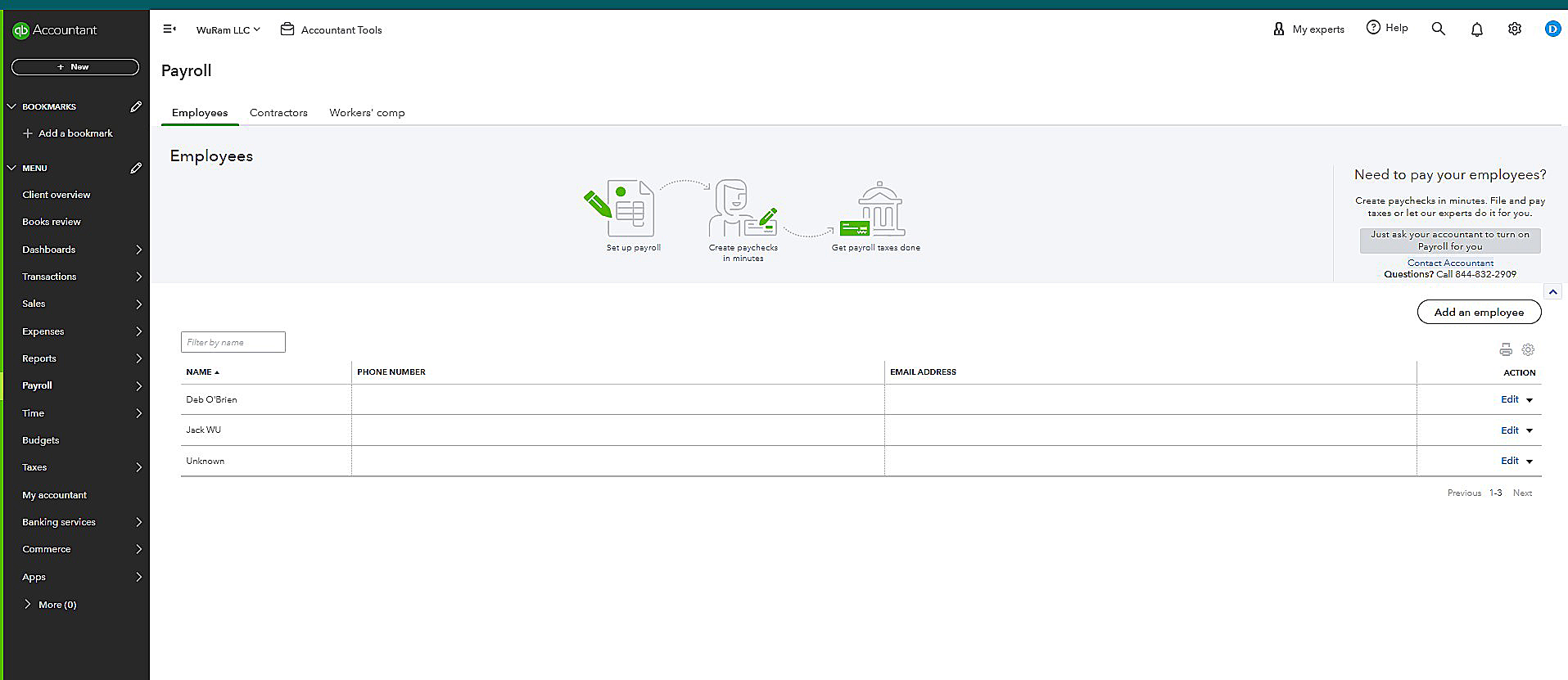

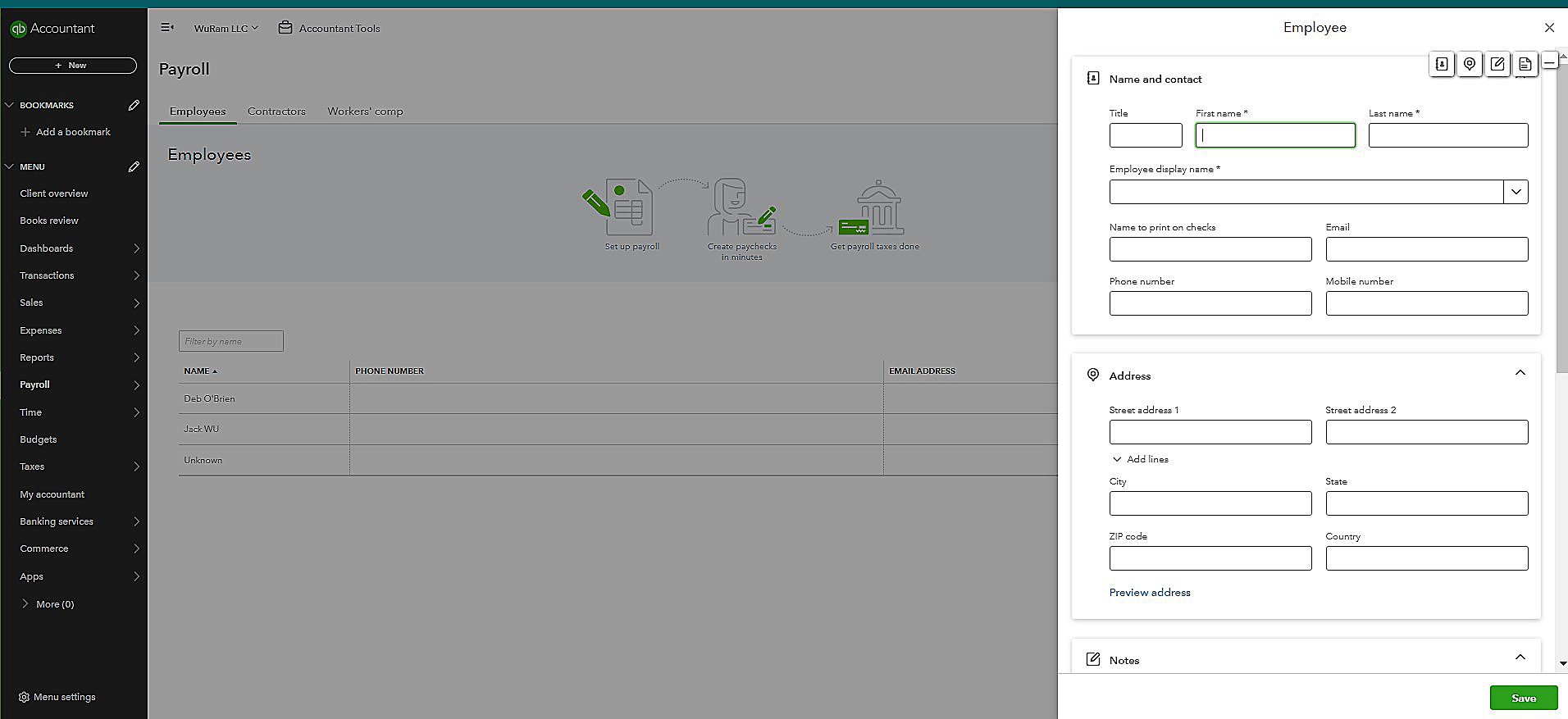

In terms of ease of use, QuickBooks Payroll emerges as the winner. Its interface is simpler and more intuitive. Accessing its dashboard makes it easier for first-time users to grasp and start using the features quickly.

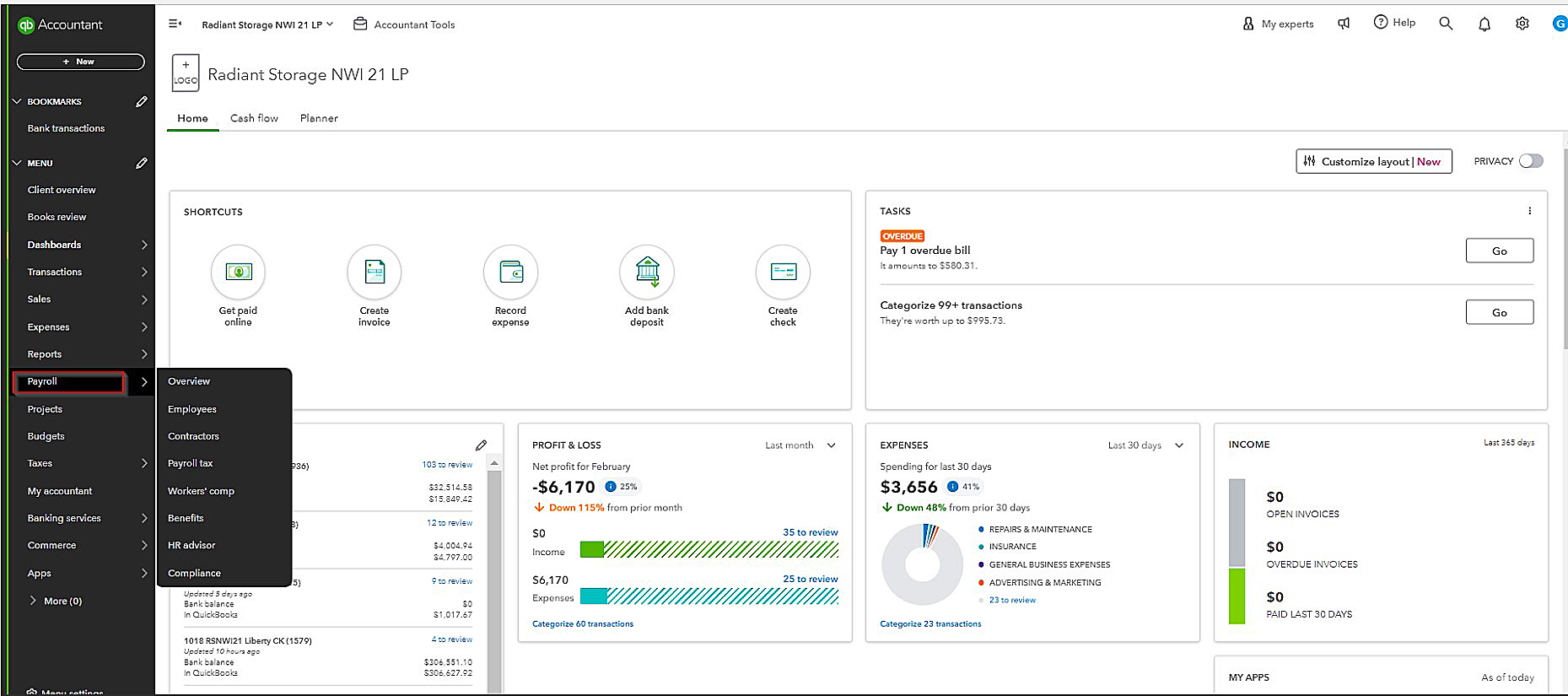

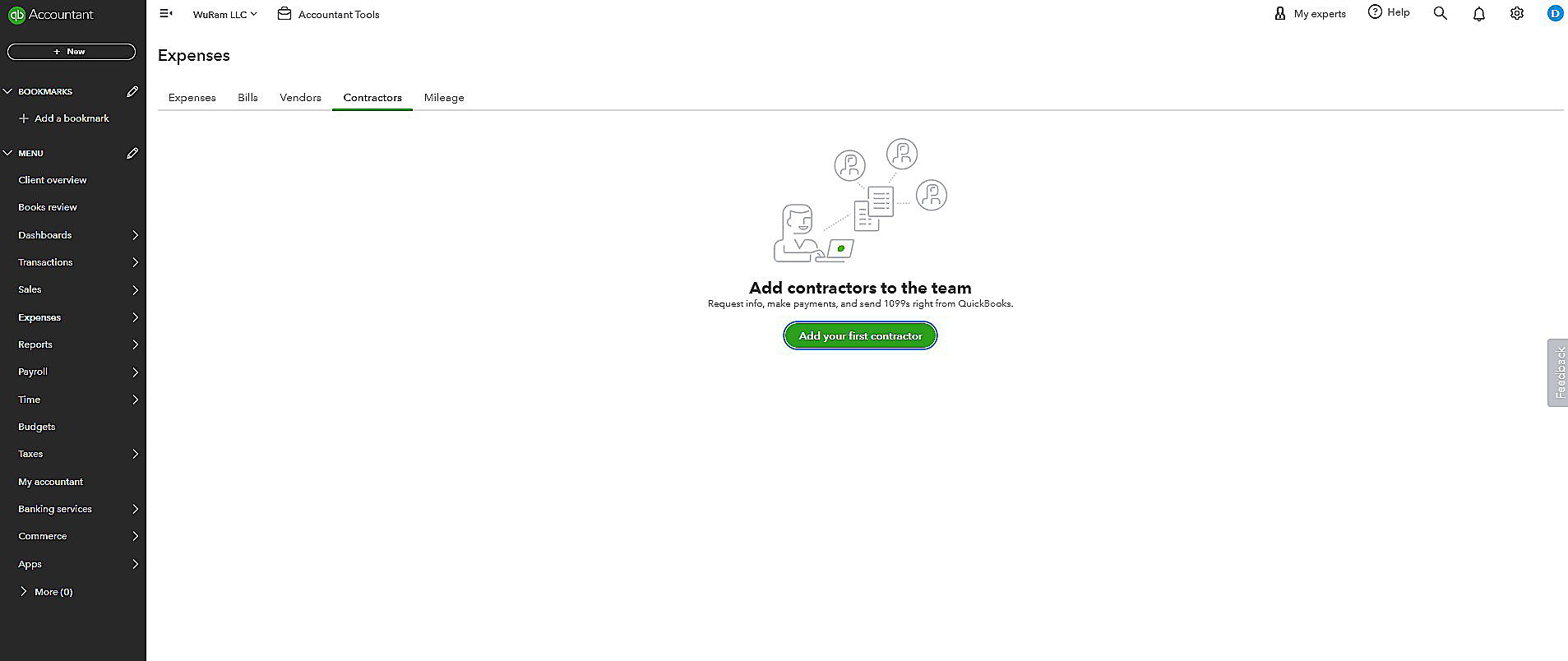

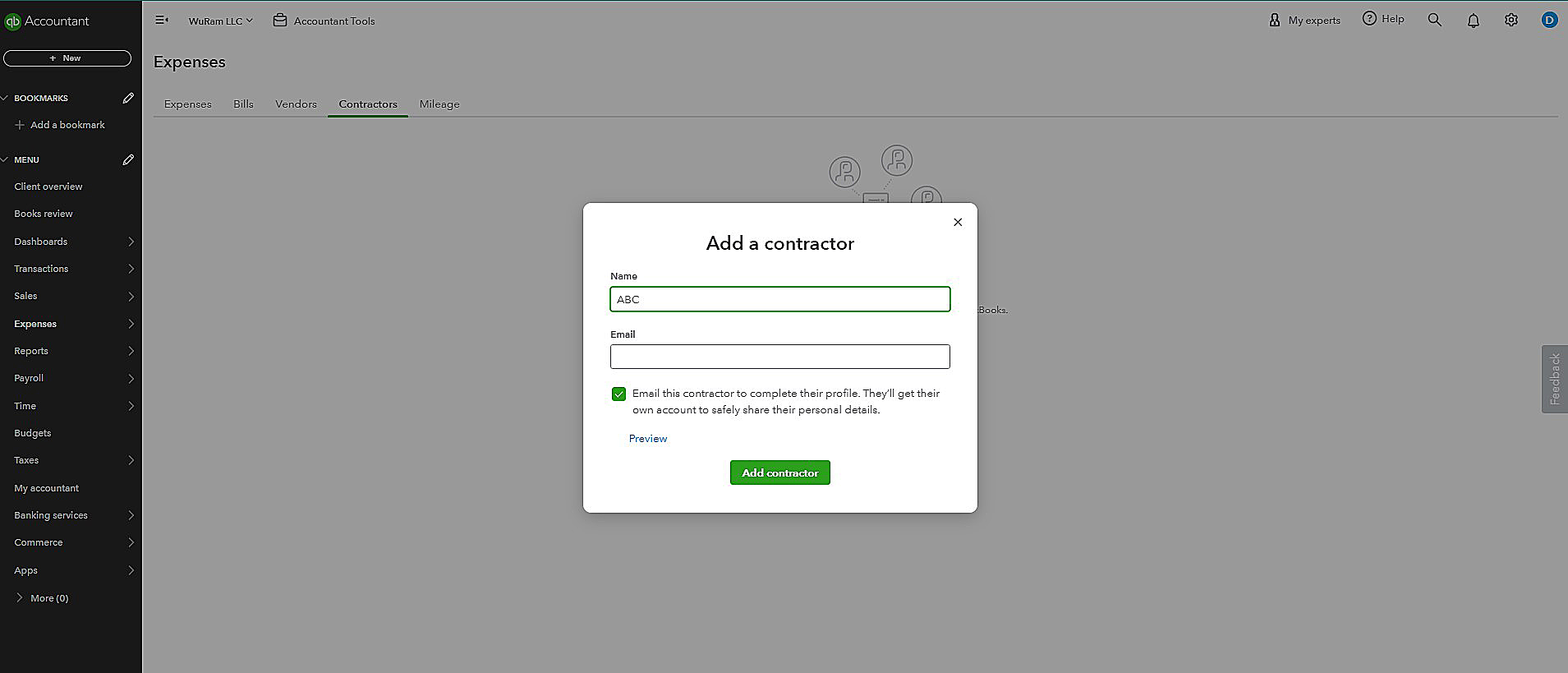

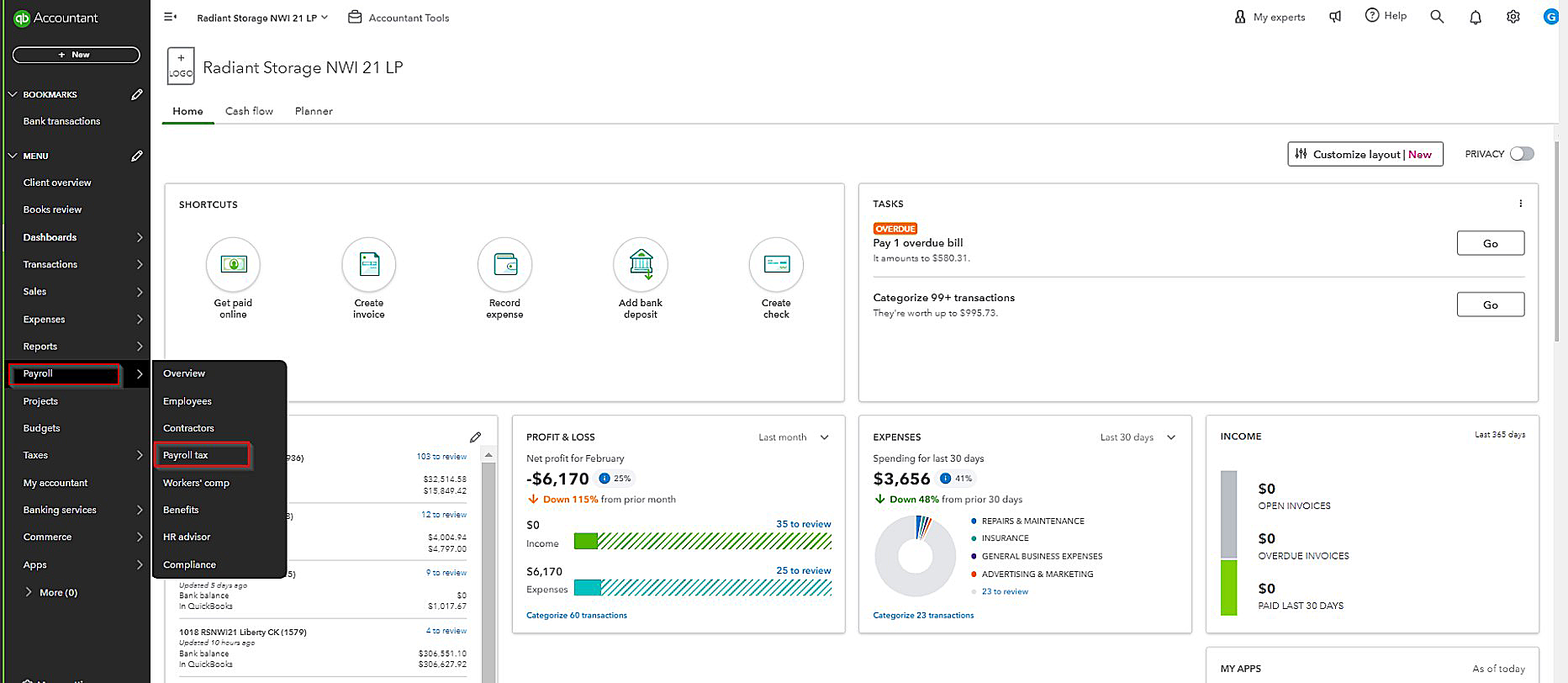

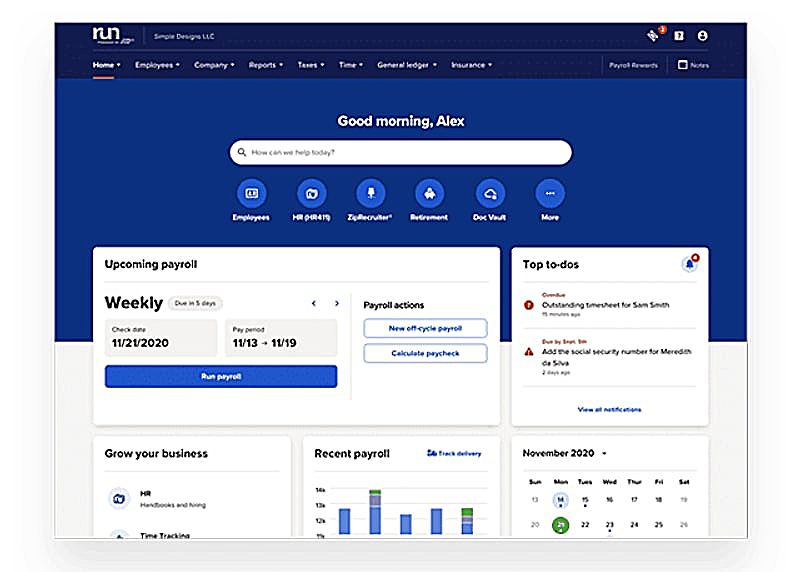

a) Navigating to QuickBooks Payroll

b) Employee dashboard

c) Adding a new employee

d) Contractors Dashboard

e) Adding a new contractor

f) Accessing QBO Payroll Tax

ADP, on the other hand, has a more intricate interface equipped with advanced features and customization options. Indeed, this level of customization is beneficial for businesses with complex payroll needs. It can overwhelm users new to payroll processing and simply need to run basic payroll tasks.

QuickBooks Payroll provides a straightforward dashboard focused on core payroll functions such as calculating paychecks, filing tax returns, and generating reports. This simplicity reduces the learning curve for small business owners who want to manage their payroll.

Moreover, you can integrate QuickBooks Payroll seamlessly with QuickBooks’ accounting and bookkeeping platforms. This integration consolidates all financial tasks into one platform. Thus, it eliminates the need to toggle between different modules and dashboards. Know more about other benefits of QuickBooks.

4. ADP Vs QuickBooks Payroll Customer Support and Reliability Compared

If you wish to differentiate ADP vs QuickBooks for payroll in terms of customer support, many parameters come into play. Both software offers comprehensive customer support, including phone, email, and chat assistance. However, the option to get personalized support is available with ADP.

In terms of reliability, since ADP is more focused on providing payroll and HR solutions to businesses of all sizes, many users rely on this software for critical payroll functions. On the other hand, QuickBooks Payroll is deemed reliable to some extent, especially for businesses already using QuickBooks accounting software.

5. QuickBooks Vs ADP Payroll Comparison Based On Integration Capabilities

When it comes to the integration features of QuickBooks Payroll and ADP, the best choice depends on what your business needs. Let’s break down what the software has to offer in terms of integration:

QuickBooks Payroll:

- Integrates smoothly with QuickBooks Online

- Provides robust payroll reporting

- Mostly limited to integration with QuickBooks Online, which works well for small businesses already using QuickBooks for accounting

ADP Payroll:

- Offers integration with various popular business software, including:

- a) ERPs like Workday, accounting systems, etc.

- b) CRMs such as Microsoft Teams, Oracle, and SAP

- Provides scalable plans that can handle businesses with up to 1,000 employees

- Offers more customization and a wider selection of integrations, suitable for complex business needs

Need help with QuickBooks integration?

Ask our expert consultants.

If you consider these factors, ADP aces in this field. It is a preferred choice for businesses with complex needs, larger employee counts, and a desire for more scalability.

Whereas QuickBooks Payroll is a better option for small businesses already using Intuit accounting software. However, if a company plans to expand, choosing ADP would be a more suitable option.

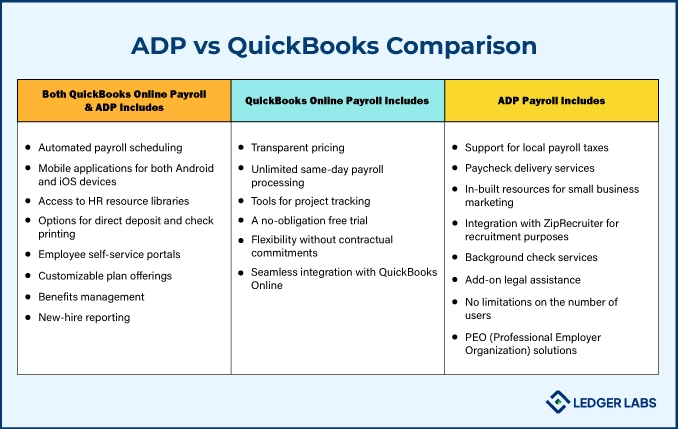

ADP vs. QuickBooks Comparison: At A Glance

Though we’ve differentiated Quickbooks vs ADP payroll on the various aspects above, let’s cover the key points in brief.

Both QuickBooks Online Payroll and ADP Payroll Provides:

- Automated payroll scheduling

- Mobile applications for both Android and iOS devices

- Access to HR resource libraries

- Options for direct deposit and check printing

- Employee self-service portals

- Customizable plan offerings

- Benefits management

- New-hire reporting

Only QuickBooks Online Payroll Includes:

- Transparent pricing

- Unlimited same-day payroll processing

- Tools for project tracking

- A no-obligation free trial

- Flexibility without contractual commitments

- Seamless integration with QuickBooks Online

Only ADP Payroll Includes:

- Support for local payroll taxes

- Paycheck delivery services

- In-built resources for small business marketing

- Integration with ZipRecruiter for recruitment purposes

- Background check services

- Add-on legal assistance

- No limitations on the number of users

- PEO (Professional Employer Organization) solutions

Case Studies and User Experiences

Till now we’ve made an in-depth comparison of QuickBooks Payroll vs ADP Payroll. Let’s look at some real-life examples to understand how they have helped businesses address their payroll needs. These insights can provide valuable information about the usability, effectiveness, and overall satisfaction with the software.

Real-world examples of businesses using ADP Payroll

These days, many business organizations use ADP payroll to manage their administrative operations. According to the statistics by G2, about 32% of enterprises, 39% of mid-market companies, and 28% of small businesses use ADP Payroll services. Although ADP offers services to extensive industries, the software is highly preferred by organizations in areas like:

- Manufacturing

- Hospital & Healthcare

- Professional Services

Some of the well-known US-based companies using ADP Payroll since its inception are T-Mobile, John Deere, etc.

Real-world examples of businesses using QuickBooks Payroll

In 2021, one digital marketing startup company was facing issues in managing its payroll needs. With a small team of employees, they required a solution that focuses on easy accessibility. To address this challenge, the QuickBooks experts at The Ledger Labs stepped in.

Our company recommended QuickBooks Payroll as the ideal solution. They guided the organization’s staff through the setup process and provided training on how to effectively utilize its features. Moreover, we also helped them integrate QuickBooks Payroll with other features of QBO. This initiative aided them to get effortless data synchronization between the two platforms.

In this way, our organization helped the startup focus more on their core business functions, leaving the administrative tasks to QuickBooks Payroll.

QuickBooks Vs ADP Payroll Comparison: Final Thought

The right payroll software for your company depends on its unique needs and priorities. Yet, we hope our full comparison of ADP Vs QuickBooks Payroll has made deciding between the two software a little easier. When you’re choosing the best fit for you, keep in mind to look for key features like budget, scalability, ease of use, and customer support.

Nonetheless, after comparing the overall capabilities of QuickBooks Payroll and ADP, we realized the latter emerges as the leading platform. The reason is ADP has the feasibility for unmatched customization, advanced functionality, and enterprise-level support. That doesn’t mean QuickBooks Payroll lags in any parameters. It’s just more suitable for small businesses and doesn’t have extensive features for business scalability.

So if you need to handle complex payroll processing, choose ADP.

Otherwise, QuickBooks Payroll is easy to use for businesses with 50 or fewer employees.

If you’re struggling with setting up your accounting software, connect with our accounting and bookkeeping experts.

Still, finding difficulty in your payroll processes? No worries! Get in touch with our QuickBooks experts today and they will solve your query immediately.