Filing out a W-4 form, especially for the first time, may seem a little out of place and formidable.

For anyone, let alone beginners – it can be a bit scary to fill out, given the details, length, sections, and absolutely what not.

So, are you in a dilemma about how to start, what information you may need, or simply afraid of making mistakes that could cost you a substantial amount of money?

Then this guide is for you.

Introduction

But before that, let’s understand what this form is all about. The W-4 form, which is basically known as the Employee’s Withholding Certificate, is incredibly important to determine how much federal income tax has been withheld from your paycheck.

If you don’t want to overpay or underpay in any possible manner, then you need to get it right the very first time or end up in a massive mess later on.

Read More : What is Form 1120? Everything You Need to Know!

Understanding the W-4 form in Detail

The W-4 form, which is officially called the “Employee’s Withholding Certificate”, is an extremely important document that the U.S. tax system uses.

It can help you determine the amount of federal income tax withheld from your wage or salary throughout the year.

But how is this any helpful? Actually, it lowers the possibility of having a giant tax debt or getting a sizable refund.

In addition, you need to complete this form when you are newly employed or get to experience a major life update that can have a significant impact on your tax situation (for instance, let’s say you have just been married or had the birth of a child).

This form asks you for some major information, such as:

- Your filing status (are you single, married, or anything else?)

- The number of dependents

- If you have any extra income.

If you need help filling out the form, you can get advice from a tax expert or by visiting the IRS website itself.

What Information is Required on W-4 Form?

As mentioned earlier, you need to provide details like your current filing status, dependents, and extra income. But, let’s understand it in detail to help you stay ahead of the curve:

- Filing Status: This is a part of the form that showcases your current marital status. You can be married, single, or file jointly, for example. In the meantime, it goes to impact your standard deduction and tax bracket.

- Dependents: This is where it gets interesting. The total number of dependents that qualify for your claim can potentially lower your taxable income and simultaneously reduce your tax liability.

- Additional income: In case you have any other income sources that extend beyond your present job (let’s say, you have rental income or other investments in the pipeline), then you can take the chance to report them in order to adjust your withholding as per the need.

- Adjustments: In this part, you can claim the need to ask for additional tax to be withheld or lower the one currently ongoing based on certain circumstances. More often than not, it is relevant if you actually owe taxes from preceding years, have a massive medical expense, or claim specific tax credits.

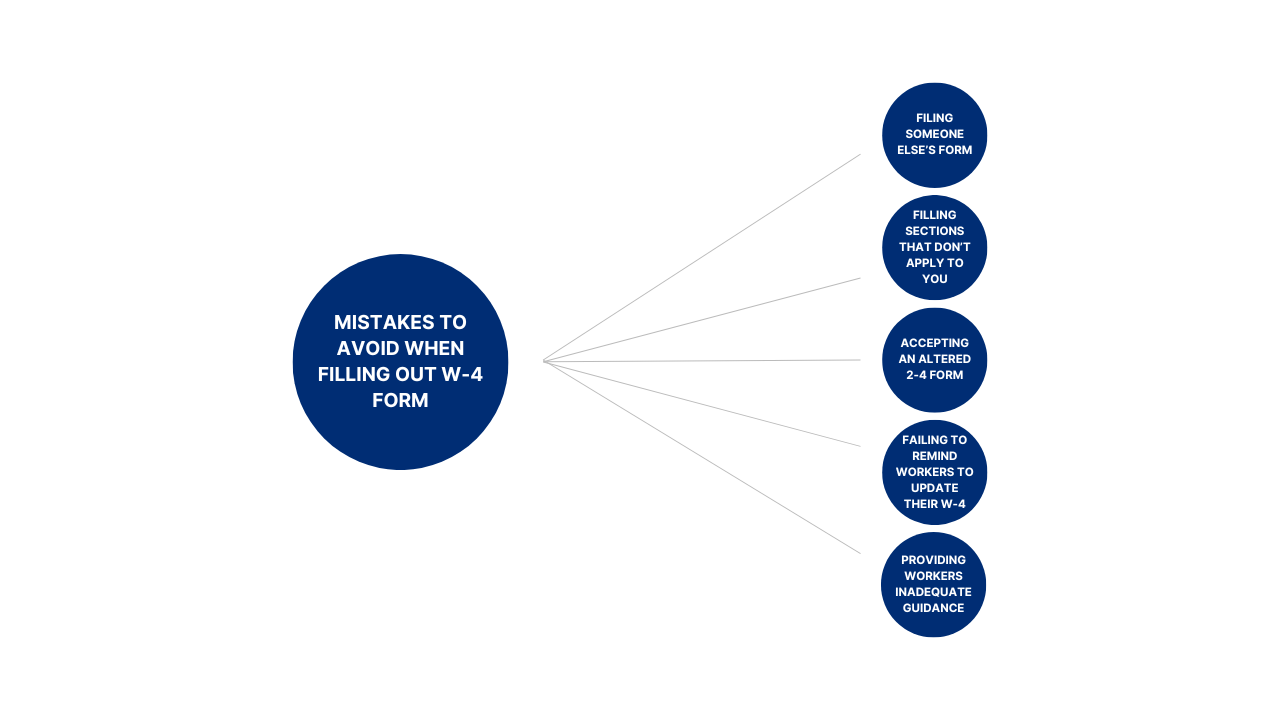

Common Mistakes to Avoid when Filling out W-4 Form

As you may already know, a W-4 form can become a futile piece of paper if it is anyhow altered without authorization or has any wrong information.

Just like e-commerce accounting mistakes, aim to avoid these common mistakes at all costs:

- Filing someone else’s form: By the name of it, you can guess how grievous the crime may be. It is literally against the law for employers to fill the form W-4 form on behalf of an employee.

- Filling out the sections that do not apply to you: The only sections that are compulsory to fill up include section one (which is for personal information) and section five (which is reserved for the employee’s signature) are called “compulsory”. Nonetheless, sections two through four can only be important if you are going to claim dependents, have more than one job, or need to make a few tweaks and adjustments.

- Accepting a W-4 form that is altered: There is absolutely no doubt that employers need to confirm that no unauthorized changes have been made to the W-4 form. On any day, if the employee decides to modify the structure, format, or wording of the form, then the employer has the legal right to completely reject it.

- Failing to remind workers to update their W-4: Employers need to remind their employees to update their W-4 forms by December 1st of every year.

- Providing workers any inappropriate guidance: In any case, employers should refrain from suggesting certain entries to the form. In that way, they can avoid the conflict that arises later on. Instead, they should direct staff members to the IRS’s tools, the form’s instructions, and any relevant worksheets.

Changes to the W-4 form in 2025

The W-4 for the year 2025 is now here. Now, while it has not gone through any revolutionary and trailblazing changes that we all saw in 2020, it is actually still important for you to know.

Note that you do not need to send the W-4 form directly to the IRS but it is still what builds the foundation of your payroll. Why is it important? Well, it is important because it tells the employer the exact amount of federal income tax to withhold from your paycheck.

So, let’s understand the details of the 2025 W-4 form to catch you up on the minor adjustments and speed up your understanding.

So, what’s basically in it for the W-4 2025 form? To be honest, not much of it has changed this year. However, here are a few things that have been tweaked:

- The IRS (Internal Revenue Service) now goes to offer a tax withholding estimator that is designed for individuals who have self-employment income, or for people who are married to those with self-employment income.

- The figures found on the Deduction Worksheet are now adjusted for 2025.

Quite frankly, this is everything there is to know about Form W-4 updates in 2025.

Related Articles:

- How to calculate retained earnings on a balance sheet?

- Post tax deductions simplified: What are they and how do they work?

- What is Financial Leverage Ratio and why is it important for small businesses?

- Catch Up Bookkeeping: A Comprehensive Guide!

- Strategic Planning KPIs: Who are the major players?

- Controller For Small Business – Who Are They & How They Work?

How to fill out the W-4 form in 2025?

It is true that employers really rely on the data you write down on the W-4 form to help them understand the amount of payroll taxes to withhold. After they have withheld it, they later forward it to the IRS (plus, the state and local tax authorities, if applicable).

Depending on how you complete the W-4, you may find yourself with a tax refund or with unpaid taxes at the end of the year. So, that brings us to the question, how do we fill out the W-4 form in 2025? Let’s understand in detail.

Step 1: Jot down the personal details

This is where you need to write your full name, tax filing status, address, and Social Security number. Moreover, please note that your filing status determines whether you qualify for certain tax credits and deductions.

Step 2: Adjust for more than one job

Let’s say you work more than one job or file jointly with your spouse, who works too. In that case, you need to follow the specific instructions for accurate tax withholding. Let us be clearer here.

Fill out sections 2 through 4(b) on the W-4 form for the highest-paying job. For the other ones, leave out the sections blank.

In case you (or simply you and your spouse, both) have a total of two jobs and bring home almost the same amount, then you can mark box 2(c) in order to showcase the same. The catch here? Well, you need to do it in both the form W-4s.

Now, let’s say you do not want to disclose to your employer that you have another job or that you do have an income source from another non-job source, then here are a few things that you can do:

- You can ask your employer to withhold an additional amount of tax from your salary on line 4(c).

- Consequently, you may just choose not to factor the additional income into the W-4. Instead of that, you can send “estimated tax payments” to the IRS yourself.

Step 3: Account for Dependents

You need to list down your dependents, such as children, and apply the suitable credit amounts if your income is anything less than $200,000 (or $400,000 if filing jointly). You can opt not to claim dependents in order to have a higher amount of tax withheld, which may lower your final tax payment.

Step 4: Fine-tune Your Withholdings

Indicate on your tax return whether you want more tax withheld or if you plan to claim deductions over and above the standard deduction.

Step 5: Conclude the Form

Are you done with the form? Filled out all necessary sections? Now it is time to sign and date it prior to submitting it to the payroll or HR department of your employer. Not to mention, some employers can help you submit the form online through their already existing payroll systems.

So, that’s it. This is all you need to do if you want to know how to fill out a W4 form for dummies (or for experts, too).

In Wrapping up

As you know already from the above discussions, filling out this form is as important as understanding your tax brackets.

Now, it is very normal to feel a little intimidated and uncertain about the whole procedure.

But, here’s the thing, you can always take help from an expert W4 consultant in order to understand what fits your situation and how to address it.

Since this is a crucial part of the process, we would recommend never making a mistake while filing it out.

Why?

Because nobody wants to underpay or overpay their taxes since that can be strenuous, repetitive, and resource-incentive.

Moreover, the constant back-and-forth with the IRS can be quite a hassle. So, whether you are just starting a new job role, undergoing a major life event, or simply adjusting your withholding – take the extra time to fill out the W-4 accurately because who doesn’t like waking up on the right side of the bed?

Need help filing your W-4 form? We house the right experts who can help do that for you, while you take the back seat and watch as everything is done seamlessly. Get in touch with specialists who have more than 12 years of experience in the field and file your W-4 perfectly, with zero errors!

Related Articles:

- Heads-up Small Business Owners: 9 Accounting Trends to Watch Out for in 2025! How to calculate retained earnings on a balance sheet? Earnings?

- What is a financial audit and how to prepare for it?

- What is a GL code and how to automate it?

- What is bad debt expense and how to estimate it?

- What’s Cost Volume Profit Analysis? Assumptions, Examples, and Calculations

- Property Management Accounting: A Complete Starter Guide

Frequently Asked Questions about the W-4 form

Q-1. How do I find the 2025 W-4 form?

You can get hold of the latest version of form W-4 on the official website of the IRS. In fact, the IRS also offers several versions of the form in many languages. That means, you can avail of it in Korean, Spanish, Chinese, and more. In addition, you may be able to electronically amend your W-4 form through the payroll system of your employer.

Q-2. What happens if I begin a job in the middle of the year?

In case your job starts in the middle of the year and you have not worked more than 245 days, then ask your employer to utilize the part-year method to evaluate your tax withholding. If you didn’t know, the standard withholding calculation is actually considered on the basis of the entire year’s employment, which could potentially lead to excessive withholding. In fact, you can totally avoid the over taxation. and the need to wait until tax season for your refund by employing the part-year method.

Q-3. What is the difference between a W-2 from a W-4?

Ans. If you ask what is a W4 vs W2, let us clarify. In simple words, a W-4 helps employers understand the amount of tax that needs to be withheld from an employee’s paycheck. On the other hand, a W-2 form is responsible for reporting the annual earnings of an employee to the IRS.

Q-4. Do I have to update my W-4 every year?

Ans. Actually, no. You do not need to update your W-4 form every coming year. However, it is still extremely important that you review and monitor your withholding at least once per year in case there is a major life event, a change in your financial circumstances, or any particular change in your filing status. This can help you ensure that the withholding amount is always right throughout the year. In this way, you can avoid owing a gigantic sum during tax season or receiving a significant amount of refund.

Q-5. Do all the employees have to fill out a new form every year?

Ans. The good news is no. An employee must only fill out the 2025 form W-4 if they:

- Are recently employed.

- Have decided to change their withholding.