Reducing bookkeeping to a simple data entry task is a gross oversimplification.

While there are enough myths regarding bookkeeping, the value it adds to your business cannot be challenged.

Realizing the importance of bookkeeping is the first step to success while hiring an affordable bookkeeping service is the next.

However, since bookkeeping is time-consuming, demands attention to detail, and requires a high level of accuracy, it comes with a price.

The best way to find affordable bookkeeping is to look for services that offer both bookkeeping and accounting services under one roof.

And this guide will help you exactly with that.

- Bookkeeping has helped businesses increase their revenue by 15%

- Outsource bookkeeping to a service provider that understands what your business currently needs.

- Bookkeeping gives you peace of mind and makes your financial audits faster and simpler.

- Bookkeeping makes financial management easy and more efficient.

Why do businesses need (better) bookkeeping services in the first place?

While avoiding outsourcing bookkeeping during the initial stages of your business seems justified, every business owner experiences that one pivoting shift where this step becomes necessary.

In the early stages of your business, you put on as many hats as you possibly can because the resources are so limited.

From being the creative force to the salesperson to the account manager, you are anything and everything you need to be to get your business running.

But as you progress through, the amount of data increases, occupying more time and energy.

And any sane entrepreneur would advise against doing your own bookkeeping once the wheels start moving.

Yet, 34% of business owners are doing their own bookkeeping – a major obstacle that is stopping them from taking their small business to the next level.

How would you even get the opportunity to think about scaling when you’re spending hours of your day tracking cash inflows and outflows, instead of strategizing and overlooking core business operations?

And we all know the significance of cash flow management.

82% of businesses fail due to poor cash flow management. So, nobody is discarding the role of bookkeeping.

All I’m saying is that this responsibility needs to be outsourced at some point.

Many businesses believe that bookkeeping is expensive. But that’s where they go wrong.

Instead of thinking of bookkeeping as an investment, they look at it as an additional cost.

But did you know that about 15% of businesses have witnessed growth in revenue after outsourcing their bookkeeping to cloud service providers?

There are different types of bookkeeping so choose the one that is most suitable for your business objectives.

- In-house bookkeeping

- DIY bookkeeping

- Bookkeeping agency

But how do you find the right bookkeeping services?

Key points to consider when finding affordable bookkeeping

- Find a bookkeeping service that aligns with your business goals while understanding your current bookkeeping needs.

- Choose a service that is open to innovation, like NetSuite CRM integration, to automate and improve your financial management.

- Look for a bookkeeping service that also provides accounting and CFO services as the entire package would be more feasible compared to only bookkeeping.

4 ways bookkeeping benefits businesses

Bookkeeping is predicted to see a job growth of 5% in the next couple of years.

Recognizing the role of bookkeeping will only take your business forward, helping you scale and avoid as many costly blunders as possible.

Here are the top reasons to hire a bookkeeper for your business.

Efficiency in cash flow management

Bookkeeping helps your business become more efficient.

You make your financial health more visible by automating every financial transaction.

Track every revenue and expense, for both record-keeping and to make data-driven decisions. Tracking every cash flow helps you become more organized, allowing you to take proactive measures to avoid failures.

They help you identify investment opportunities and reduce accounting costs. Another aspect of bookkeeping is that it helps you make timely payments.

It helps you recognize the payments you’ve yet to make and yet to receive.

You can also manage financial fluctuations and allocate budgets more effectively.

Cost saving and financial clarity

One of the main reasons why businesses should hire bookkeeping services is to gain financial clarity – a product of effective financial management.

Here’s how you can manage your finances more efficiently:

- Track and record every financial transaction, including income and expense

- Monitor and analyze the financial performance to identify repeating patterns

- Use financial records to make business decisions

- Create accurate financial reports with real-time data updates

- Allocate your budget by analyzing your financial health

When you have access to accurate financial information, you can strategically set business goals, helping you manage expectations.

Having your financial data at your fingertips helps you invest and identify growth opportunities.

Imagine creating budgets for your next marketing campaign without really knowing your spending capability. That sounds disastrous.

Ultimately, a proactive approach to financial management helps you get control of your finances.

And, it eventually helps you save more money.

Tax compliance

Most business owners dread the tax season as the entire preparation process seems too intimidating with incomplete books and poor financial management.

tax preparation becomes quick, simple, and easy When you regularly update your books.

Hiring a bookkeeper would ensure your financial records are accurate and up-to-date. Having organized records helps you minimize errors.

Also, with their expertise, you can identify tax deductions to reduce your costs.

You need to be proactive in your approach to make the most of every tax benefit.

Compliance is an important part of any business as it helps them stay in the good books of the IRS.

Hence, establish transparency to stay tax compliant and maximize profits.

Data accuracy and informed decision-making

Your business is as good as your next financial decision.

Informed decision-making is necessary to sustain a business and stay relevant in this competitive landscape.

And for that, you have to keep your financial records straight.

Here’s what you should do:

- Track your expenses and income

- Analyze your financial data

- Identify growth opportunities

- Use integrative technology to maintain transparency and accuracy of data across the organization

- Use these insights to make data-driven decisions

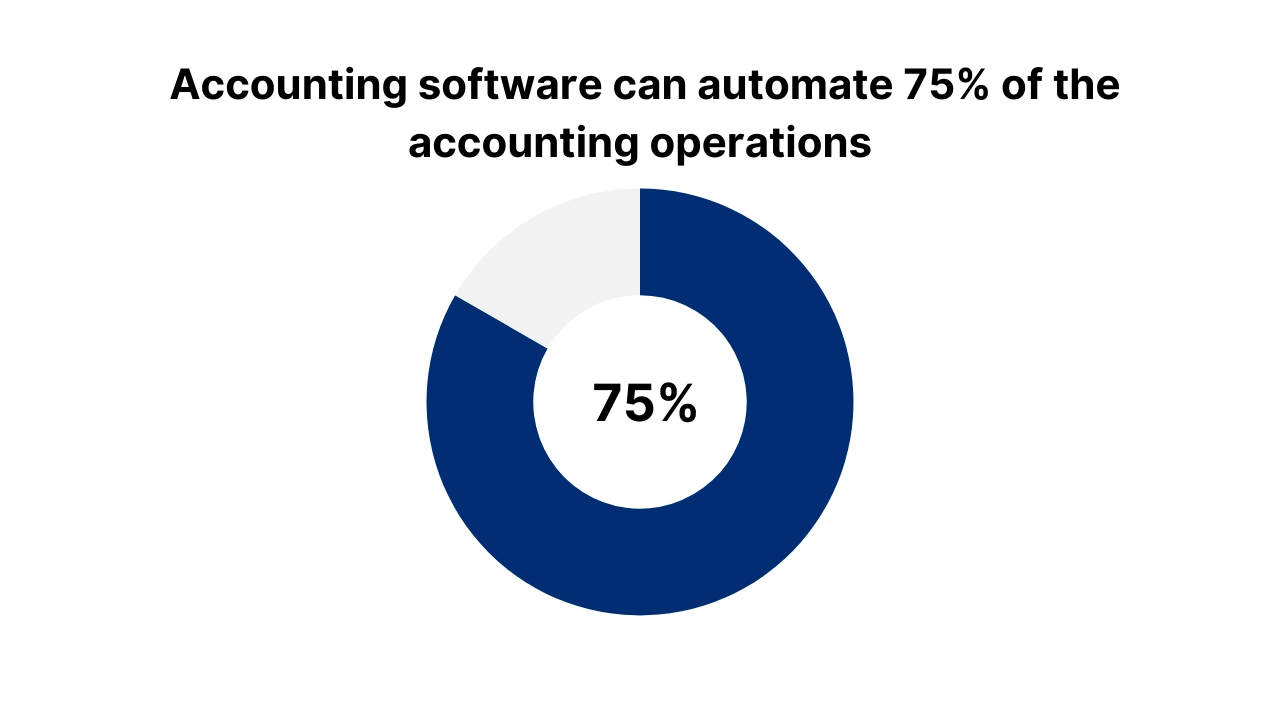

Discounting the role of accounting software seems conservative knowing that 75% of the accounting operations can be automated.

With so much on your plate already, you need to have a growth mindset to put on-the-desk tasks on autopilot.

You can implement NetSuite to manage your inventory and sales data to identify areas for cost reduction and create a sense of stability across channels.

The more organized and up-to-date your data is, the more empowered you are to make decisions.

3 things to expect after hiring a bookkeeper

Now that you’ve decided to outsource your bookkeeping, here’s what you should expect.

1. Faster audits

The IRS is pretty strict with compliance and regulatory issues.

Bookkeeping helps you keep your financial records organized, reducing the tax preparation process quicker.

It makes financial audits faster and simpler.

Therefore, you can expect your business to stay compliant, avoiding penalties and unnecessary legal fees.

Outsourcing your bookkeeping will support your plans for cost savings.

2. Business growth

Bookkeeping helps you keep your financial transactions organized and up-to-date.

When you outsource your bookkeeping, you can rest assured that this task will be automated, reducing manual input and increasing the accuracy of data.

You can also generate your income statement and balance sheet using real-time data.

This will allow you to strategize your business finances more efficiently.

Also, such transparency will give you clarity on how well your business is performing and whether any issue could possibly damage your finances.

3. Peace of mind

Nobody can challenge the peace that comes with updated books.

When you have so much going on, knowing that your books are regularly updated, and supporting informed decision-making, keeps you at ease.

The Bottom Line

Bookkeeping is necessary to maintain financial control and transparency.

Outsource your bookkeeping to an affordable bookkeeping service that understands your business needs and future objectives.

It can help you stay tax-compliant, increase data accuracy, and manage your finances more efficiently.

This is where Ledger Labs can help you.

With 12+ years of experience, we have helped businesses of all sizes and industries.

We have access to the right tools and understanding of the latest tax developments.

Our bookkeeping and accounting services have helped businesses maximize their profits and gain control of their finances.

Book an appointment with us today to find out more about our services.