Solutions

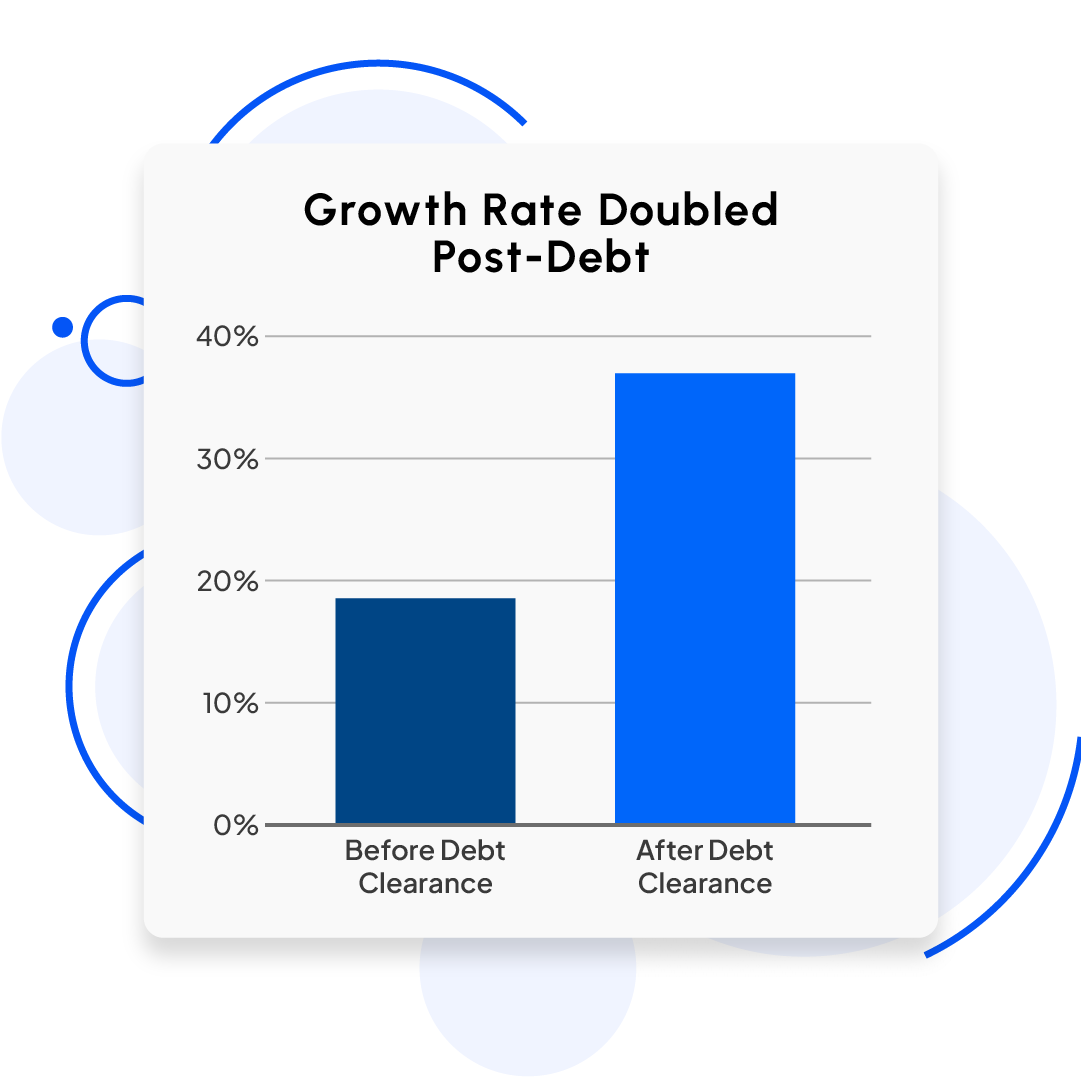

- Debt Restructuring: We analysed the debt portfolio and replaced high-interest loans with more affordable options, reducing the average interest rate from 18% to 8%.

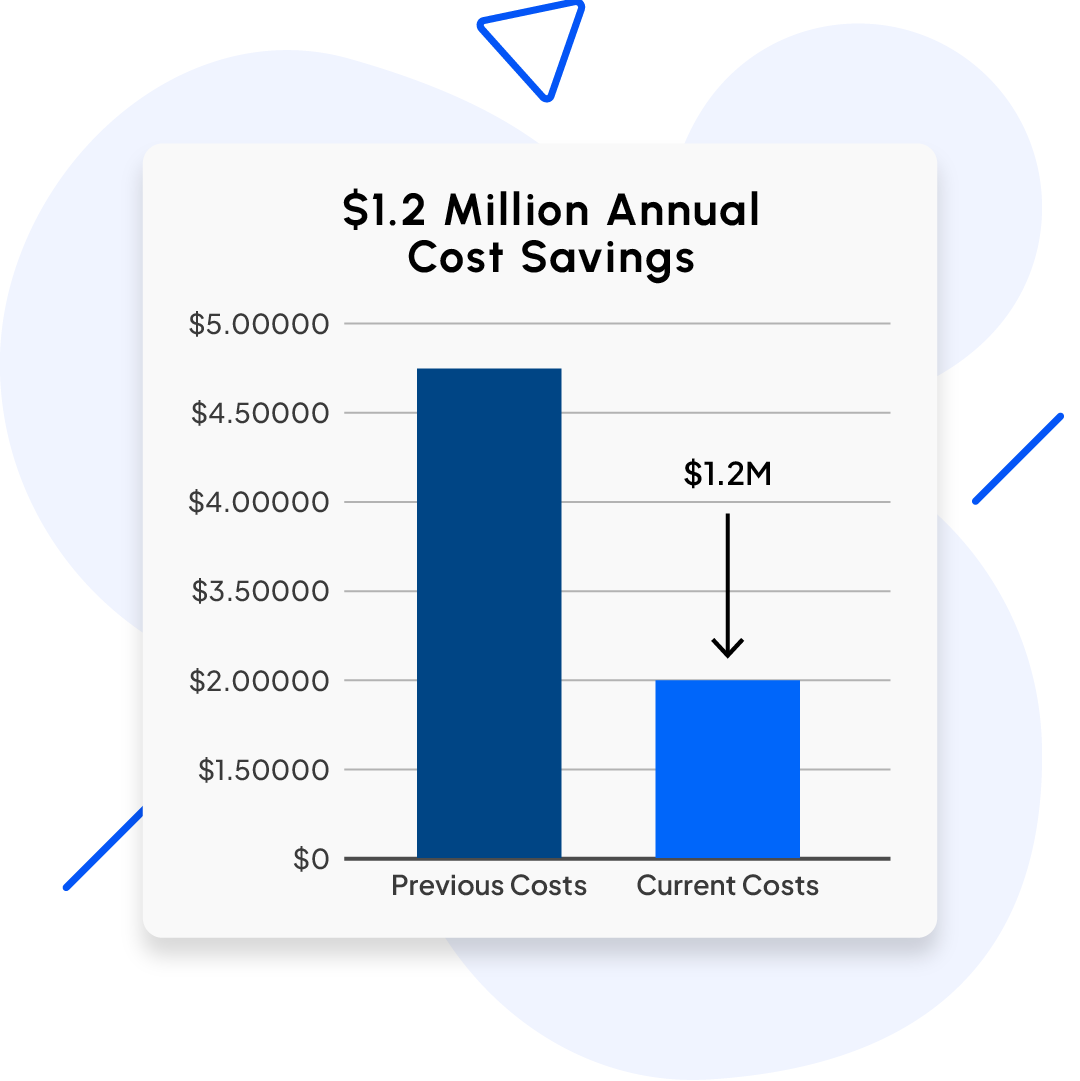

- Operational Cost Reduction: Targeted cost-cutting across non-essential areas helped reduce monthly operating expenses by 20% without affecting core operations.

- Vendor Negotiations: We renegotiated payment terms with major vendors, extending the payment cycle from 30 to 60 days to ease immediate cash flow pressure.

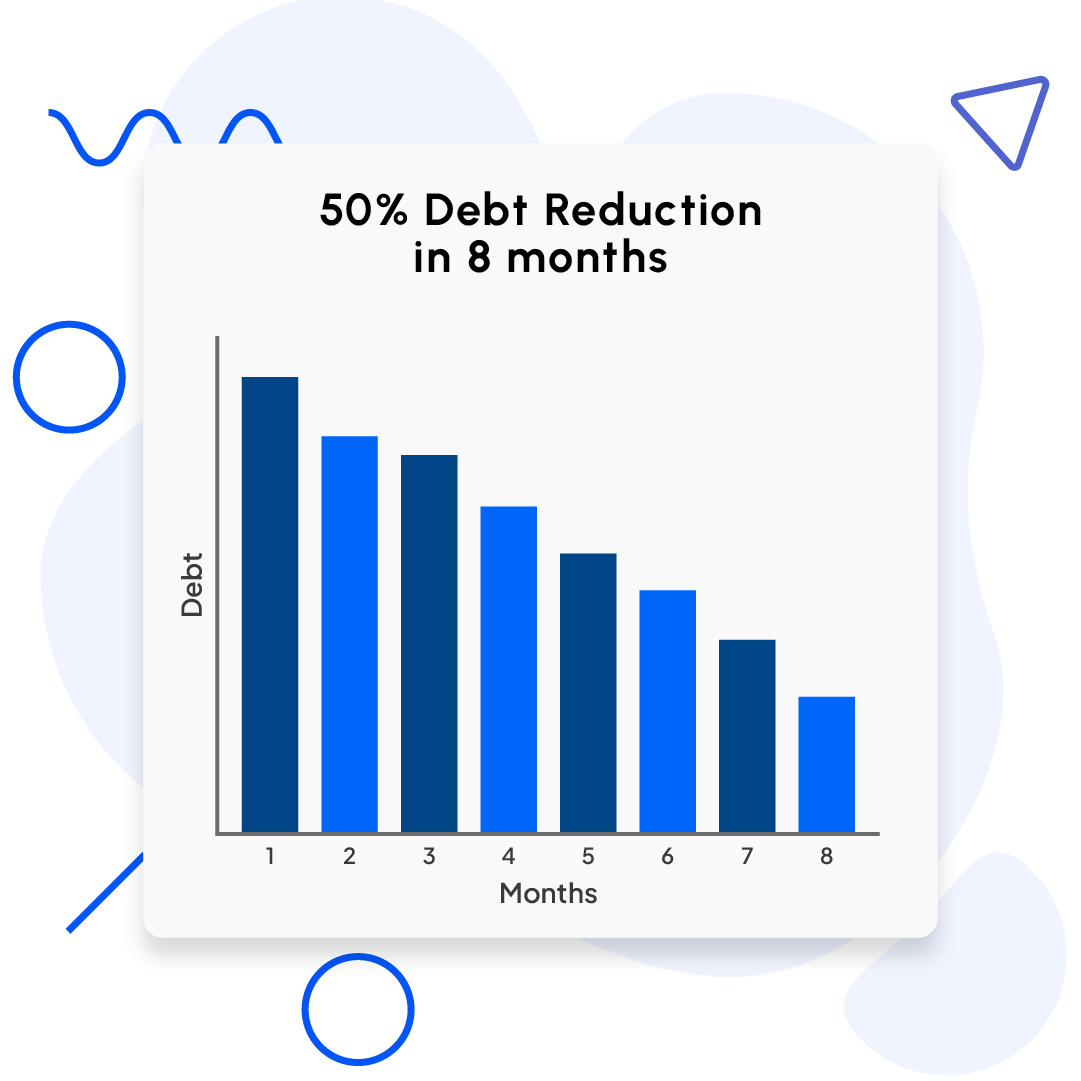

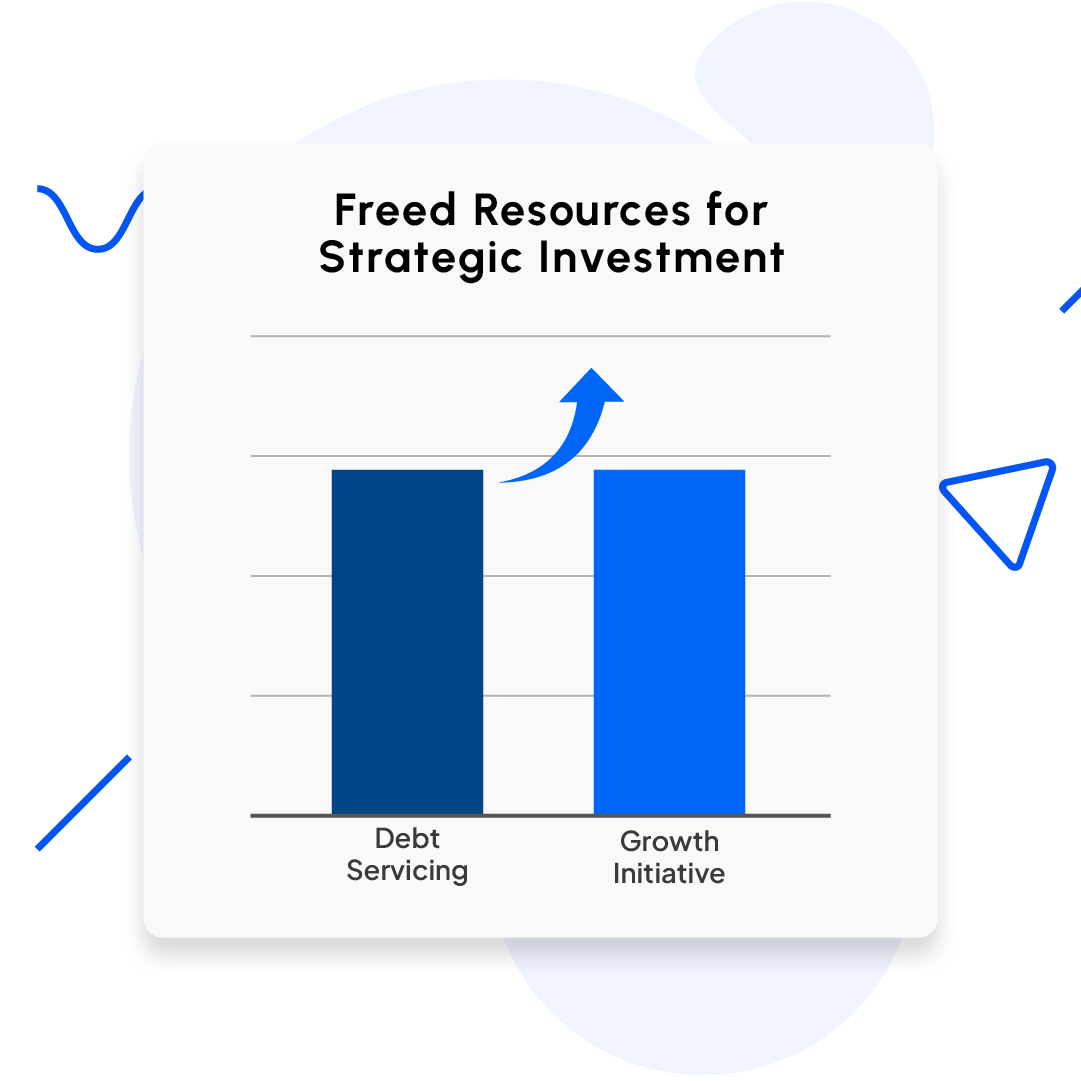

- Cash Flow Management: Implemented a strategic cash flow plan to prioritize debt repayment and allocate funds to high-ROI business areas.

- Commission Payment Automation: Calculated commissions were automatically posted as bills in QuickBooks, with detailed calculation sheets attached. These bills were then synced to Bill.com for controller approval.